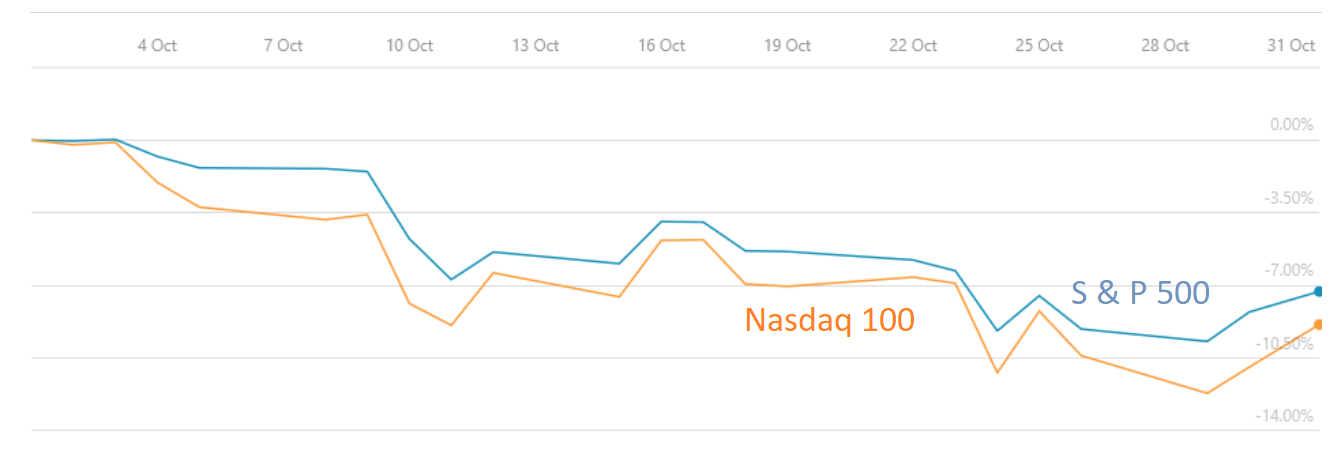

What a month October 2018 has been for the global equity markets. The U.S. Equity market had its worst month since the financial crisis, with the S & P 500 falling most in a single month since February 2009 and the Nasdaq 100 falling most in a single month since October 2008.

Elsewhere, in Europe the FTSE, CAC and DAX and in Asia, the Shanghai Composite all had the worst month since January 2016. Facebook, Netflix and Amazon had their worst single month of stock price falls ever.

We haven’t really written much on the Equities market in October but will write about it shortly.

We wrote about a couple of things in October 2018, here are some highlights,

Are rising benchmark interest rates in the United States having any impact on mortgage or saving interest rates? They aren’t really but here’s why the Federal Reserve increasing interest rates could be a problem.

Meanwhile, as Dollar LIBOR hits 10-Year High, are Federal Funds rate outlook or Credit Risk to blame?

We asked some food for thought questions in a post titled ‘Too much of Analysis causes Paralysis’

The Bank of England Balance sheet has been expanding rather quickly recently, perhaps due to Brexit? We wrote about The Real Economics of Brexit as latest numbers show that Germany accounts for almost all the intra European Union current account surplus plus the European Union posts a record external current account surplus with the U.S.

Q3 2018 GDP numbers were out during the month, U.S. Q3 2018 GDP estimated at 3.5% as consumer spending boosts growth but business spending stalls; and Eurozone Q3 2018 GDP up by 0.2% and European Union Q3 2018 GDP up by 0.3%, both lowest since 2013; Italy grew 0%; Eurozone economic sentiment falls for the 10th consecutive month

Other posts during the month:

Don’t rule out high or hyper-inflation in the road ahead

Sovereign Credit Ratings for each Country

Here’s how Australian Money Velocity has changed over the years