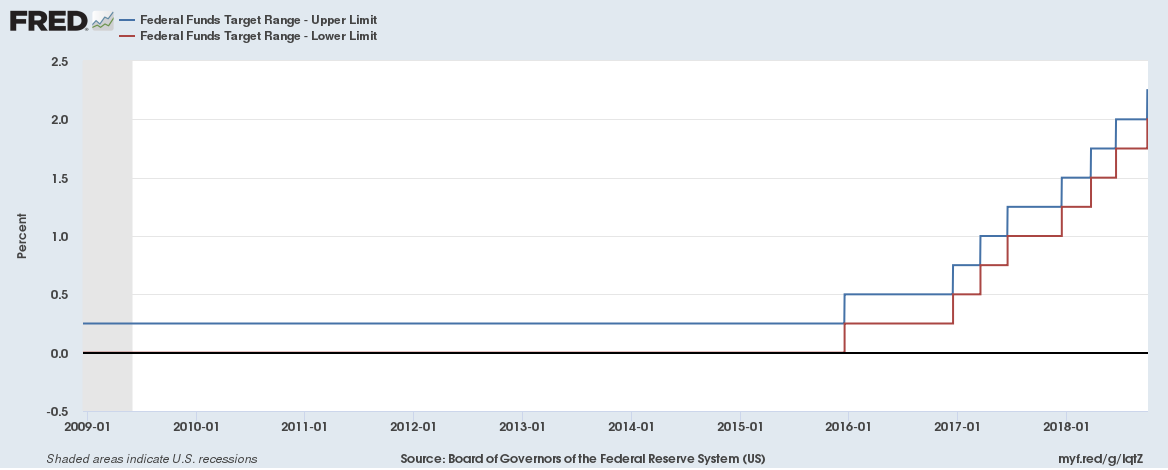

The Federal Reserve increased the target for the bank’s benchmark rate by 0.25% (to a range of 2% to 2.25%) last week, the eighth rate rise since 2015. Are rising interest rates really having any impact on mortgage or saving rates?

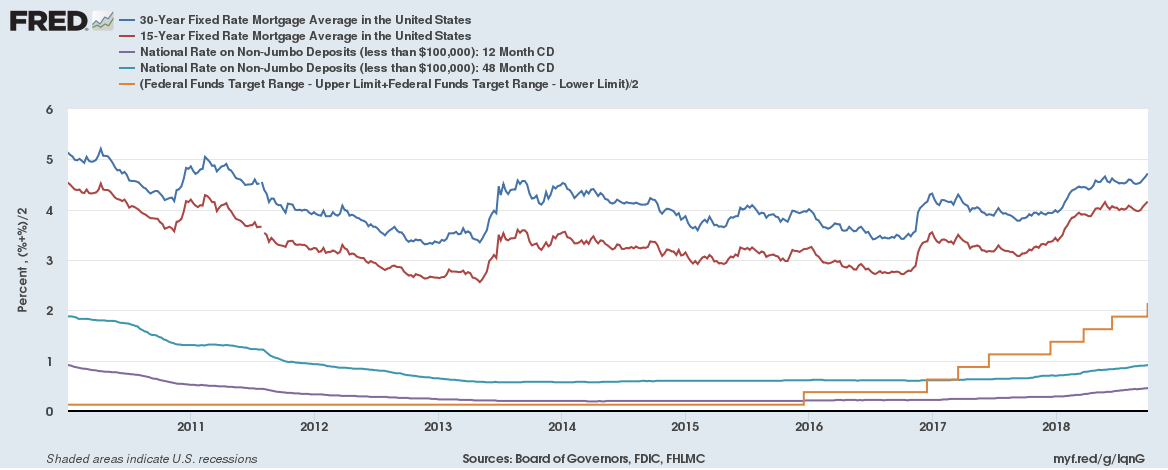

Just two charts give an answer to that, firstly actual fixed interest rates on mortgages, interest rates on savings and an average of the Federal Target rate,

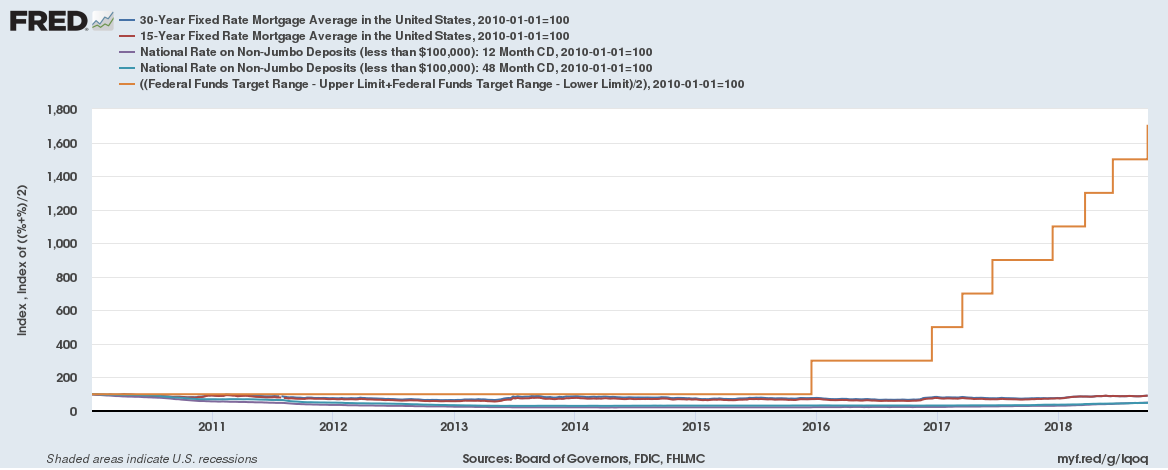

And the chart indexed to January 1st, 2010 = 100, see how detached the average benchmark target rate is,

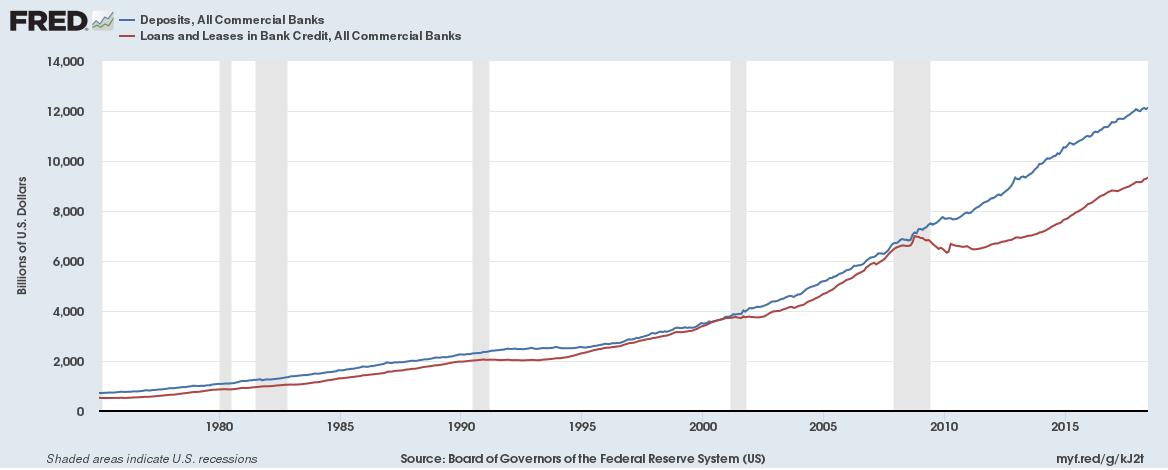

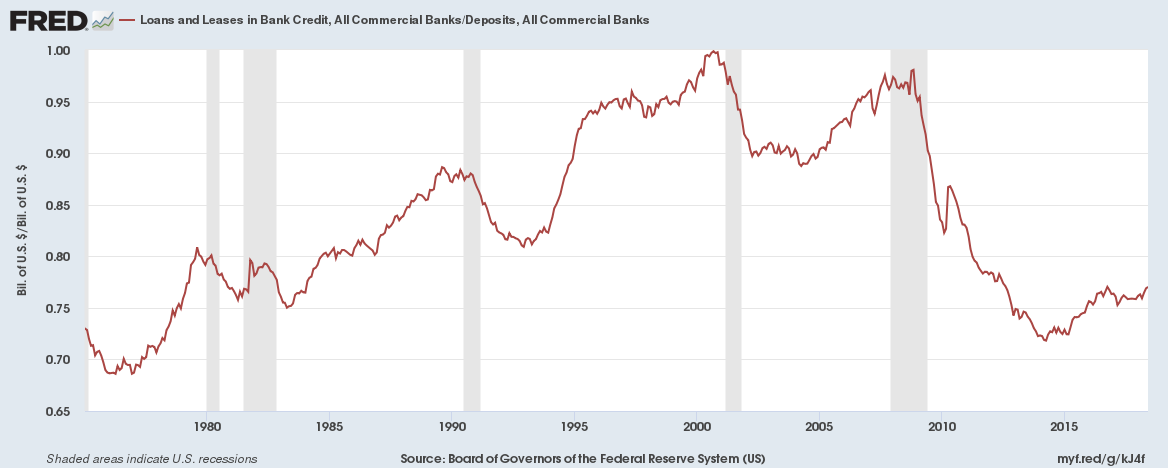

Mortgage, Loans and Savings interest rates are completely detached from the Federal Reserve’s benchmark rate. This isn’t entirely surprising given ample liquidity in the financial system. Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way, graph below,

The loans to deposits ratio has fallen to a low of 0.77,

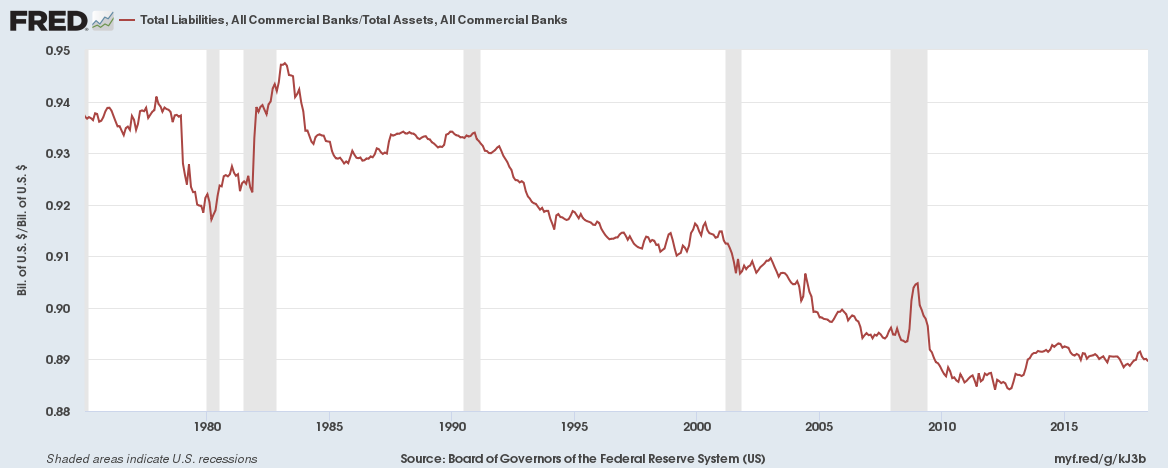

And the liabilities to assets ratio is close to a record low at 0.89,

Banks don’t need the savings and can’t find enough customers to lend money. Don’t expect better returns on savings, which would only mean the flight of money to riskier assets could continue.

Related:

Banks in the United States have a problem – they can’t find enough customers to lend money to