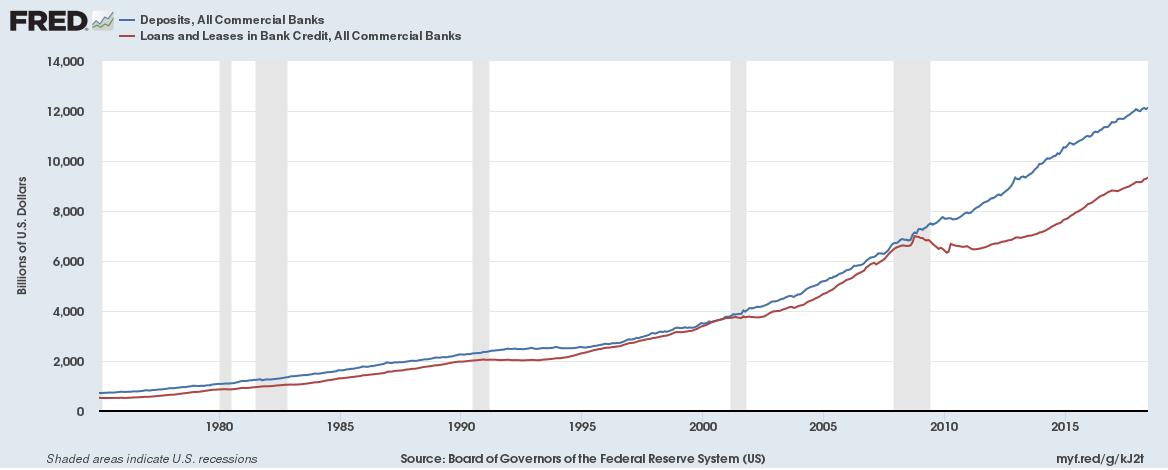

Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way, graph below,

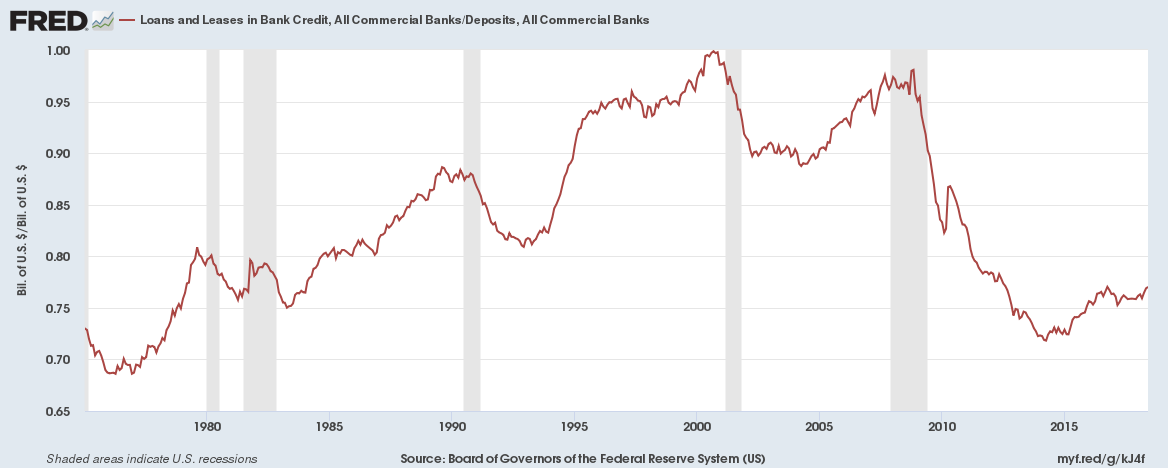

The loans to deposits ratio has fallen to a low of 0.77

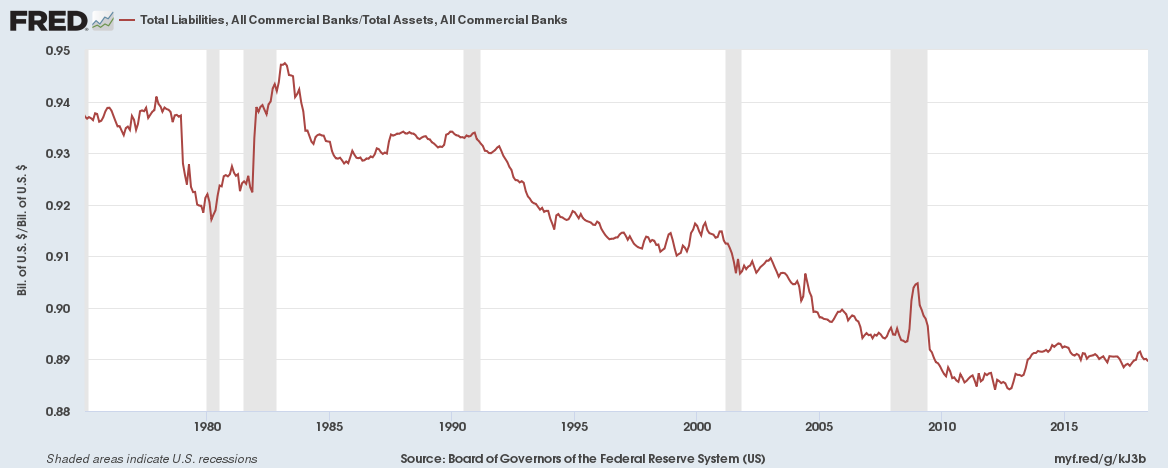

And the liabilities to assets is close to a record low at 0.89

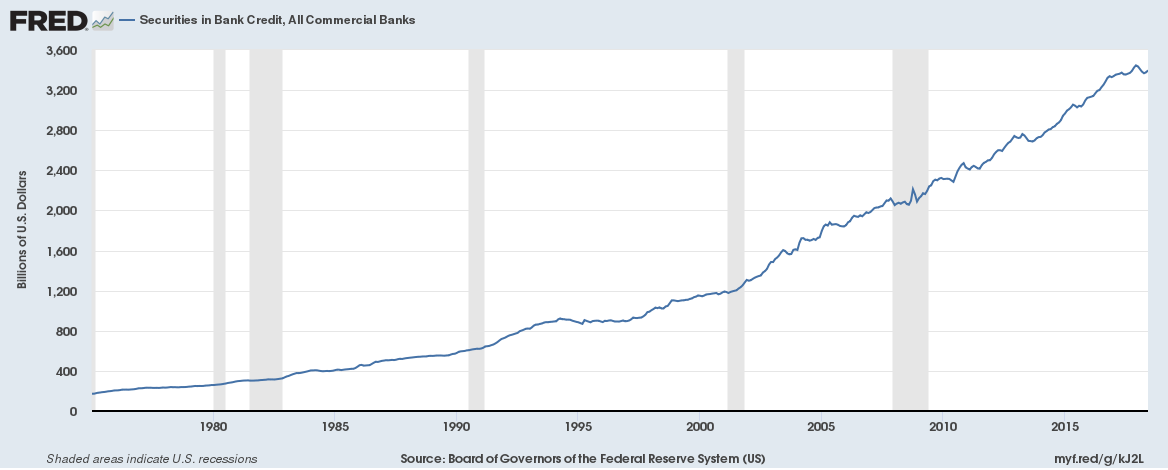

As securities holdings as part of holdings as soared to $3.5 trillion (mainly held as mortgage backed securities)

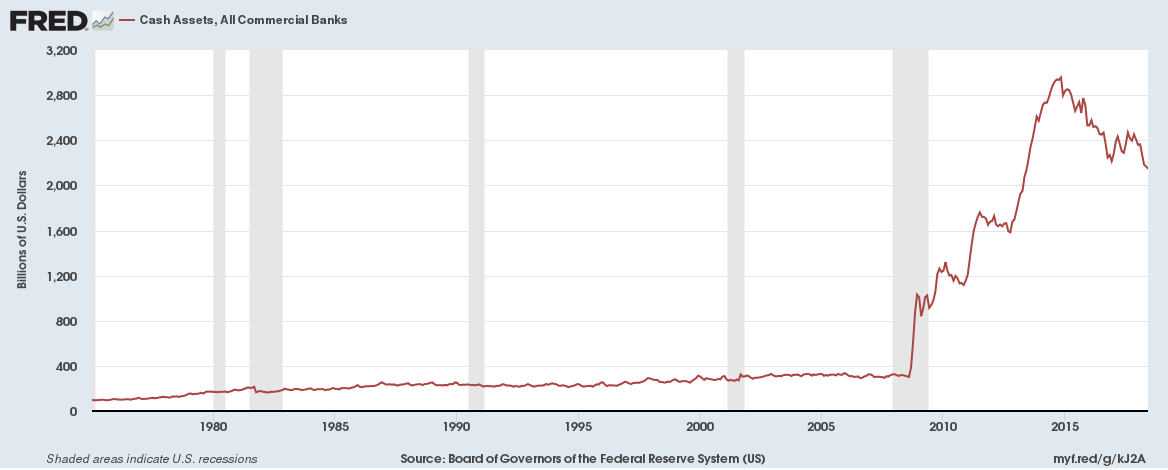

And cash holdings have soared to $2.2 trillion

… but banks are lending risk free to the Federal Reserve

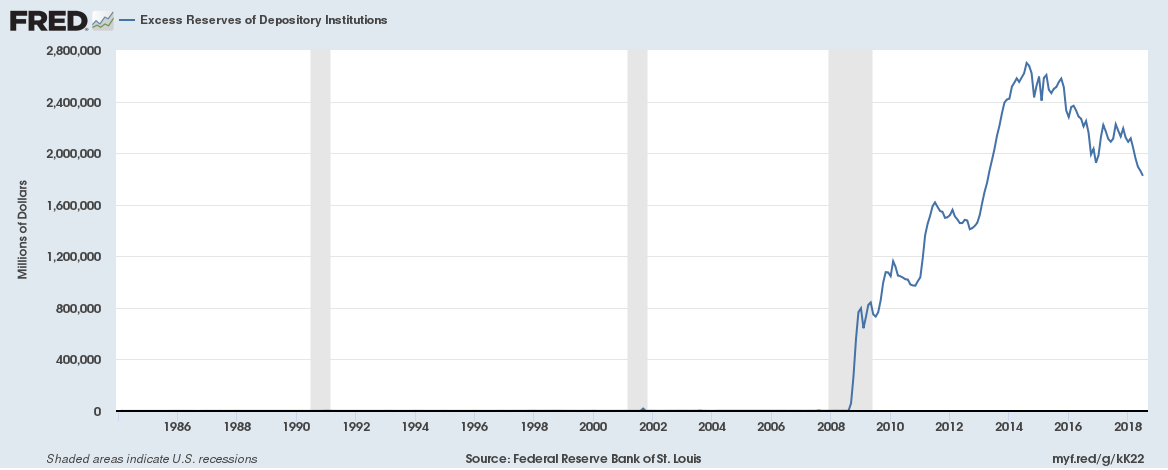

Banks in the US can hold excess reserves with the Federal Reserve. In 2008, as part of the Emergency Economic Stabilization Act of 2008 it was mandated that interest would be paid on reserve balances held with the Federal Reserve.

Excess reserves cash funds held by banks over and above the required reserves have grown significantly since the financial crisis. During the crisis banks borrowed money from the Federal Reserve but that has reversed. Banks currently hold over $2 trillion in excess reserves with the Federal Reserve.

Holding excess reserves is a risk-free way to earn a great return. In 2017, the Federal Reserve paid over $25 billion as interest to banks in the US on reserves. Given that interest rates are expected to rise several times this year that number could very well double. Obviously, the Federal Reserve is expected to slowing wind down QE and in principle excess reserves could shrink but that is likely to be a very slow process. In the meanwhile, banks in the US should enjoy a windfall in the form of risk-free return.

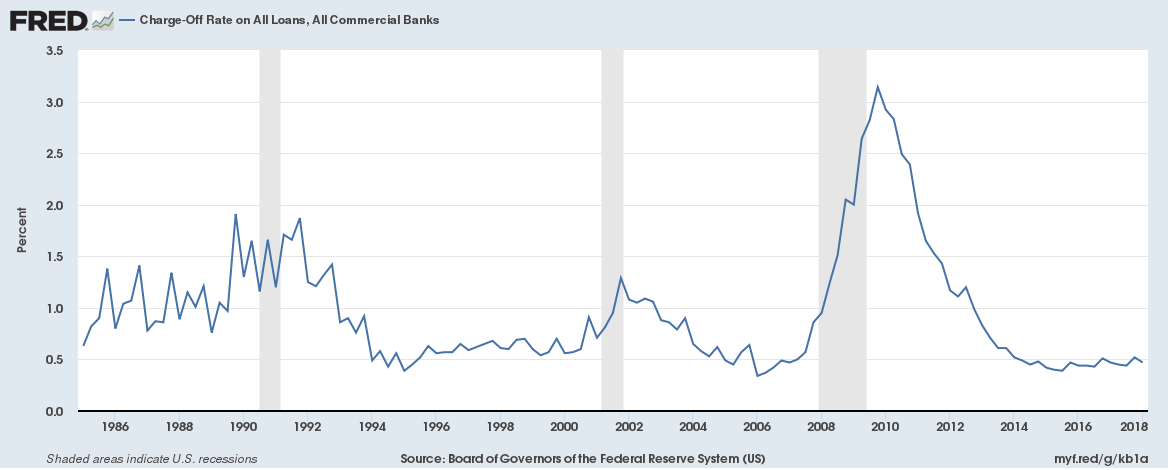

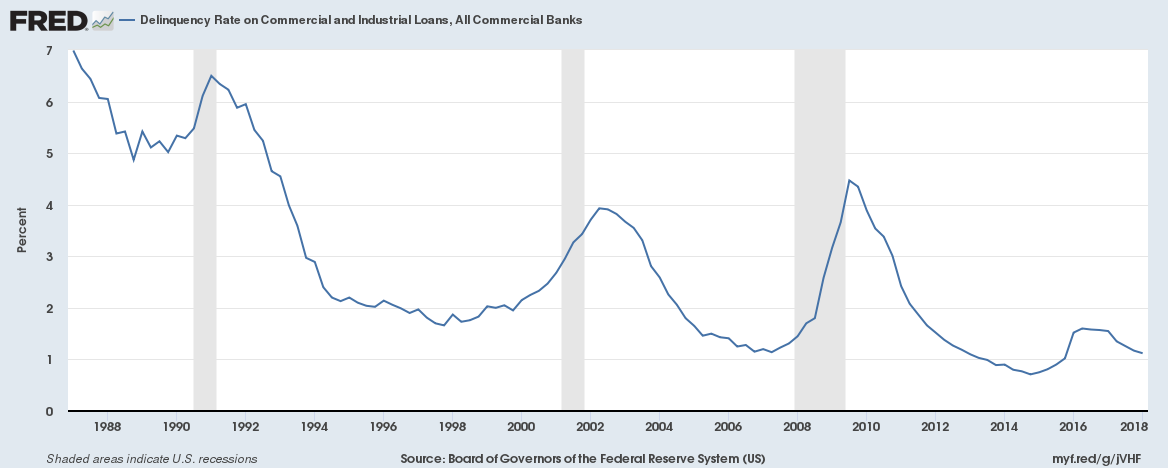

Being conservative in lending means charge-off and delinquency rates remain close to record low levels

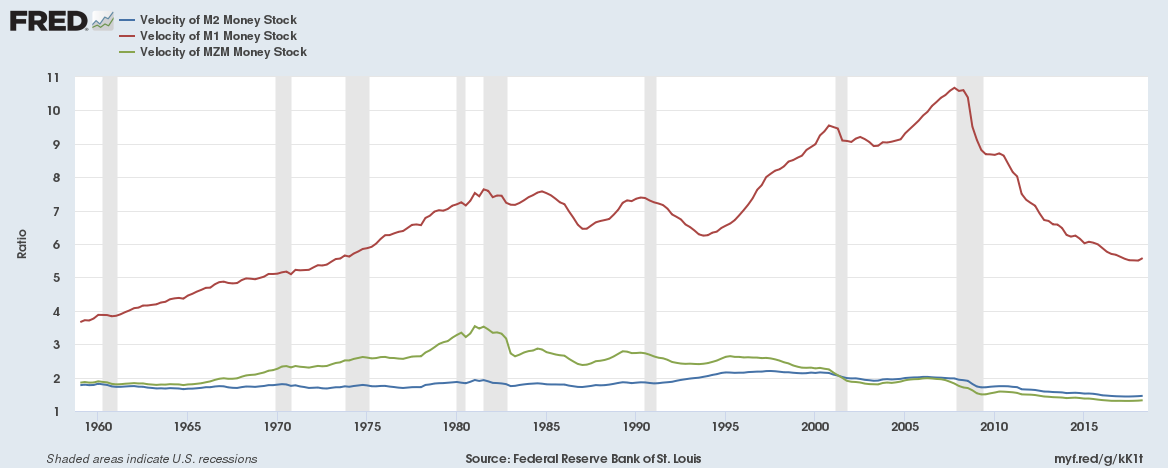

And money velocity is at record lows

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest.

Money velocity in the United States at almost the lowest level ever, graph below,

Read more: The curious case of low U.S. money velocity