UK interest rate hike expectations

The Monetary Policy Committee of the Bank of England meets on Thursday, May 10 to decide the direction of interest rates.

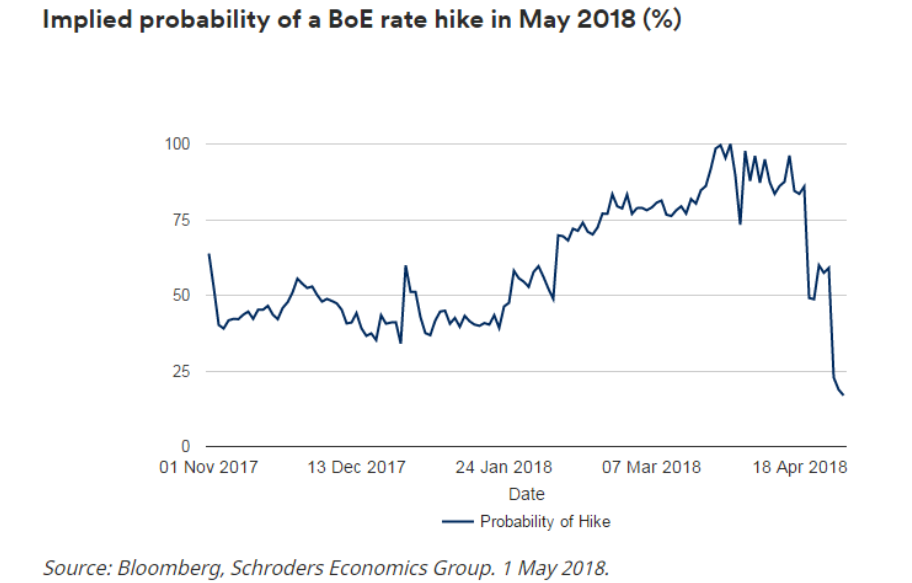

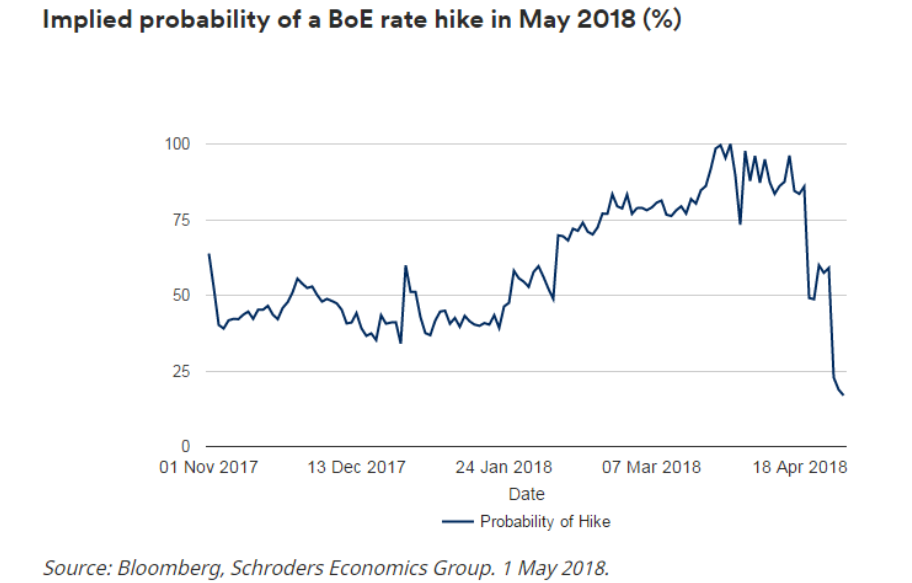

Following a weak UK Q1 2018 GDP growth of only 0.1%, the slowest since Q4 2012 (read here) and inflation falling from 2.7% in February to 2.5% in March (against a Bank of England target of 2%), the market is now pricing in a 17% of a rate rise in May. The market had factored in a 100% chance of a hike just a few weeks ago.

UK 10-year bond yields fell 5bps during the week. The 10-year bond now yields 1.4% (up 0.32% over the past year)

Continue reading “Weekly Overview: UK interest rate hike expectations; Argentina hikes interest rate to 40%; LIBOR OIS; US Money Supply growth accelerating again; Bank of Canada and Bank of England speeches”