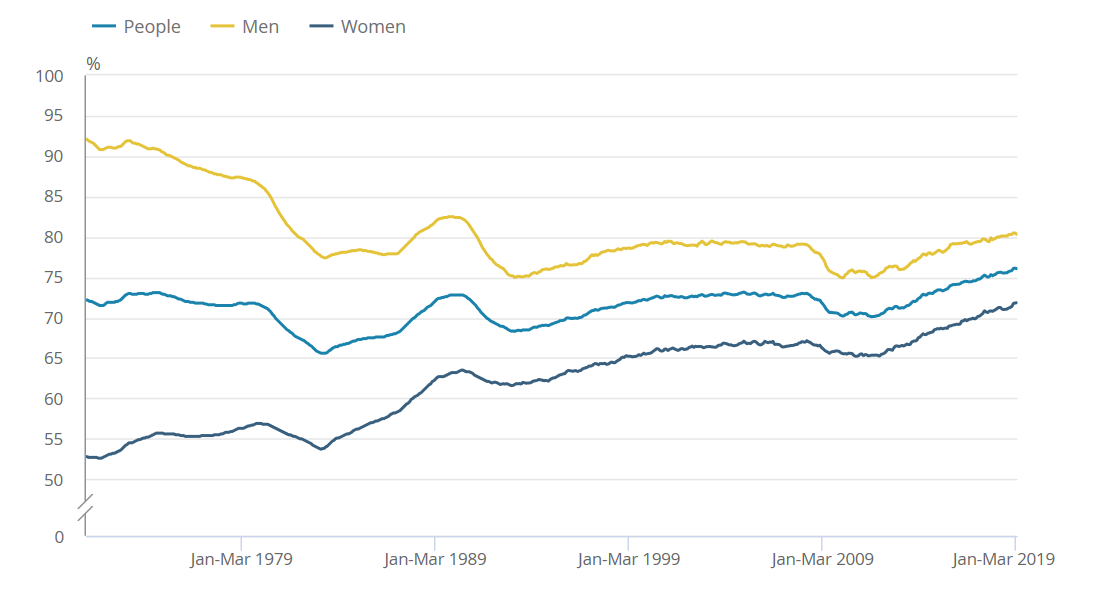

At the end of March 2019, the employment rate for the United Kingdom was estimated at 76.1%, the joint- highest figure on record. The UK economic inactivity rate was estimated at 20.8%, again close to a record low.

Why wouldn’t it be?

At the end of March 2019, the employment rate for the United Kingdom was estimated at 76.1%, the joint- highest figure on record. The UK economic inactivity rate was estimated at 20.8%, again close to a record low.

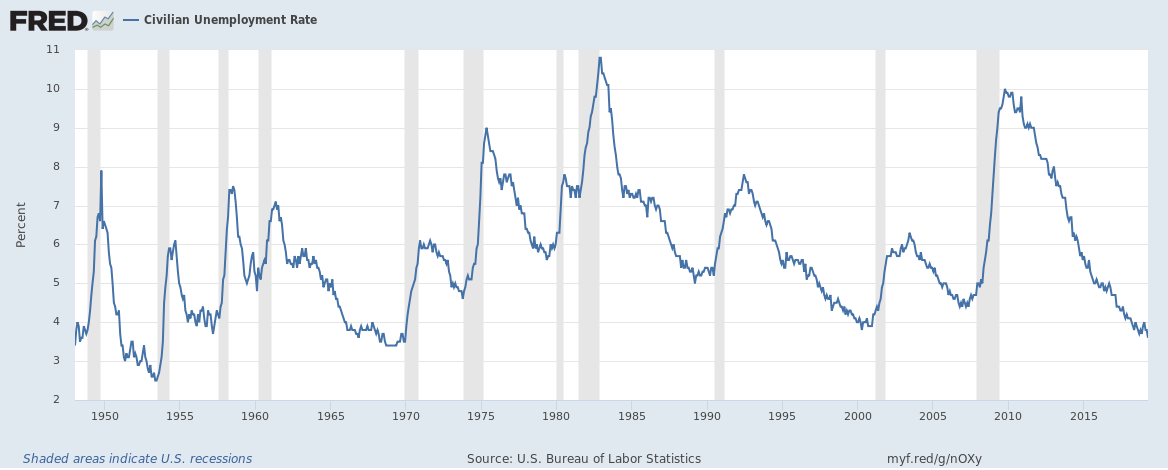

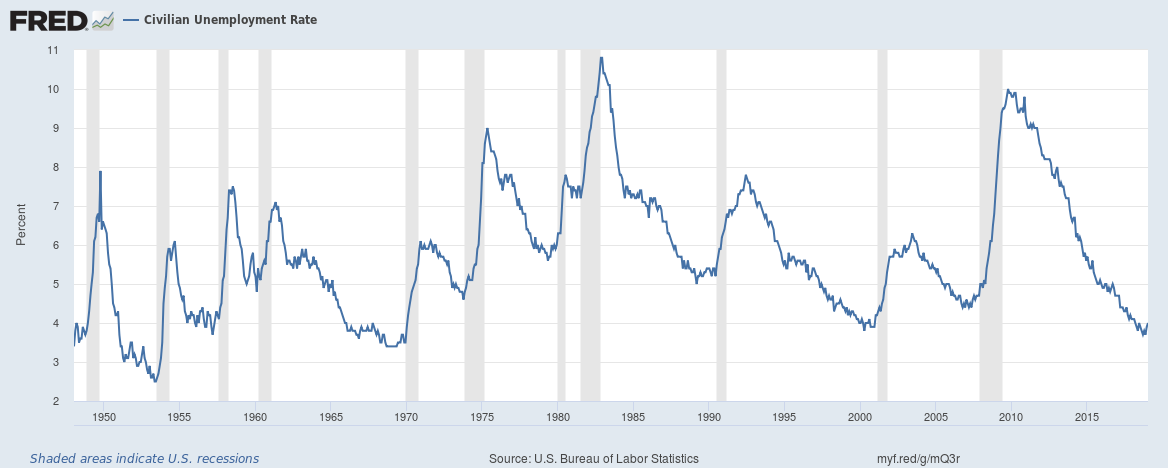

The U.S. unemployment rate hit 3.6% in April 2019, its lowest level since December 1969.

This is an interesting one, one of our three U.S. recession indicators is the U.S. unemployment rate.

The U.S. Bureau of Labor Statistics data reveals that the U.S. unemployment rate has hit a new multi-year low four to eight months before the start of every recession since the 1940s. In other words, the economy hits full employment four to eight months before the start of a recession.

The unemployment rate goes up at least 1% and then doesn’t go back down without a recession occurring.

22 out of the 28 Member States of the European Union (EU) currently have national minimum wages. The 6 countries in the EU that do not currently have any minimum wage level set are Denmark, Italy, Cyprus, Austria, Finland and Sweden.

Continue reading “Here are the minimum wage levels across the European Union”

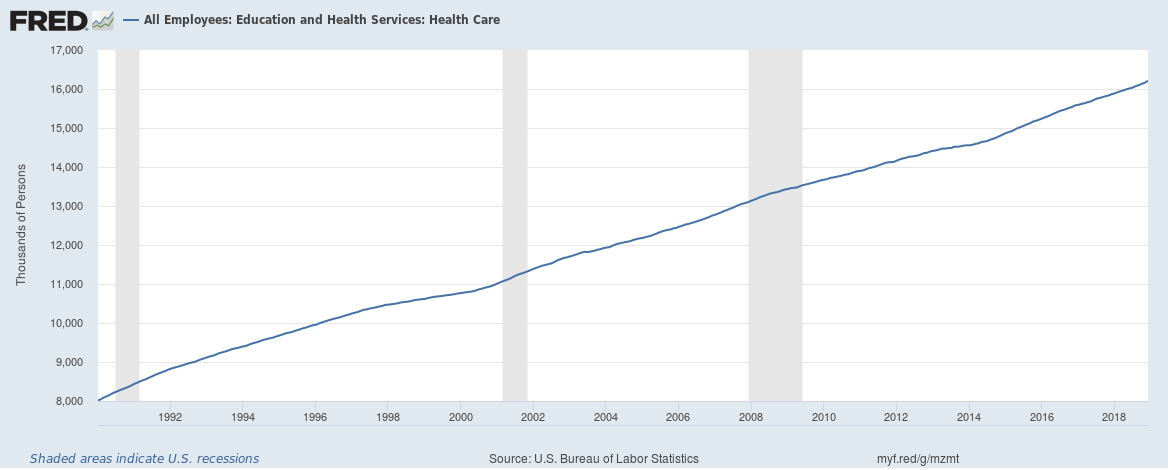

Some 16.2 million people now work in the Healthcare sector in the United States. Healthcare has displaced Retail as the largest employer in the United States and has been the biggest job creator since the 1990s. 10.8% of all nonfarm jobs are now in healthcare. Here’s a graph of the growth of healthcare jobs,

Continue reading “Healthcare has displaced Retail as the largest employer in the United States”

Continue reading “Healthcare has displaced Retail as the largest employer in the United States”

We wrote about three slightly different U.S. recession indicators that have been predictive of the past few recessions and have been tracking how near or far are those from being invoked, here’s where we are at the end of 2018,

We wrote about three slightly different U.S. recession indicators that have been predictive of the past few recessions and have been tracking how near or far are those from being invoked, here’s where we are in September 2018,

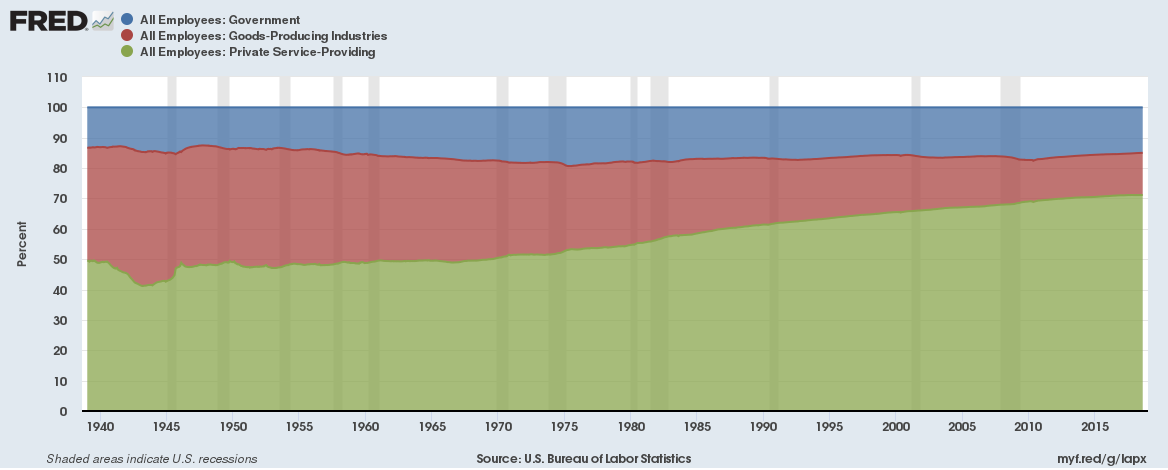

The private service sector in the United States now accounts for over 71% of all jobs given the growth in entertainment, tourism, healthcare and educational services. The exponential growth of the internet and people buying more experiences (like travelling or eating out) rather than buying goods means the goods-producing industries (like construction, manufacturing and mining) have seen a decline in jobs and now contribute less than 14% of all jobs. Government jobs have contributed around 15% consistently to the overall labour market over the past 50 years.

Continue reading “The Service sector increasingly dominates the U.S. labour market”

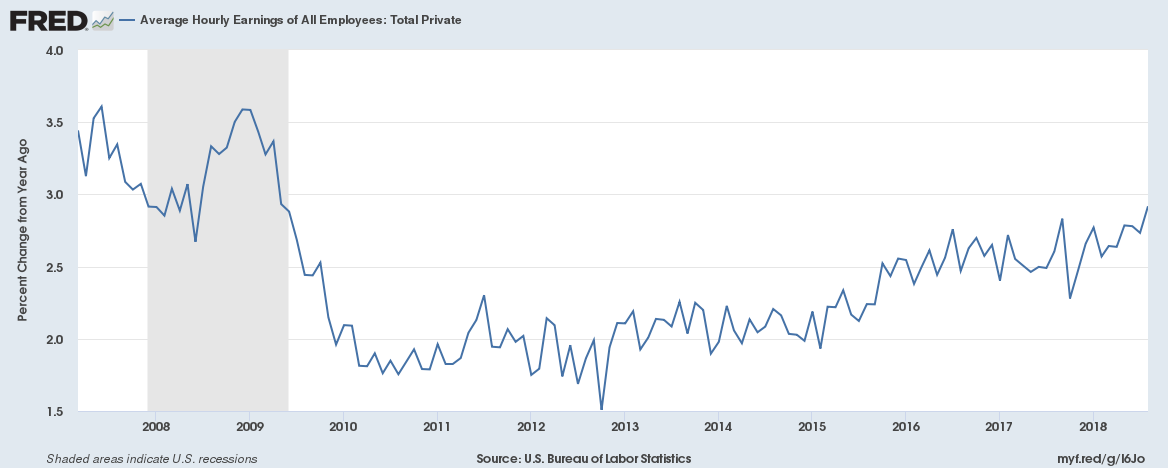

Both the United Kingdom and the United States currently have record multi-year high levels of employment, yet wages haven’t kept up with inflation for the vast majority of people causing a real income squeeze. Although the U.S. recently reported the highest wage growth since the last recession most people don’t feel their wages are keeping up with rising prices. What is going on?

Continue reading “Here’s why wages aren’t rising despite record employment and labour shortages”

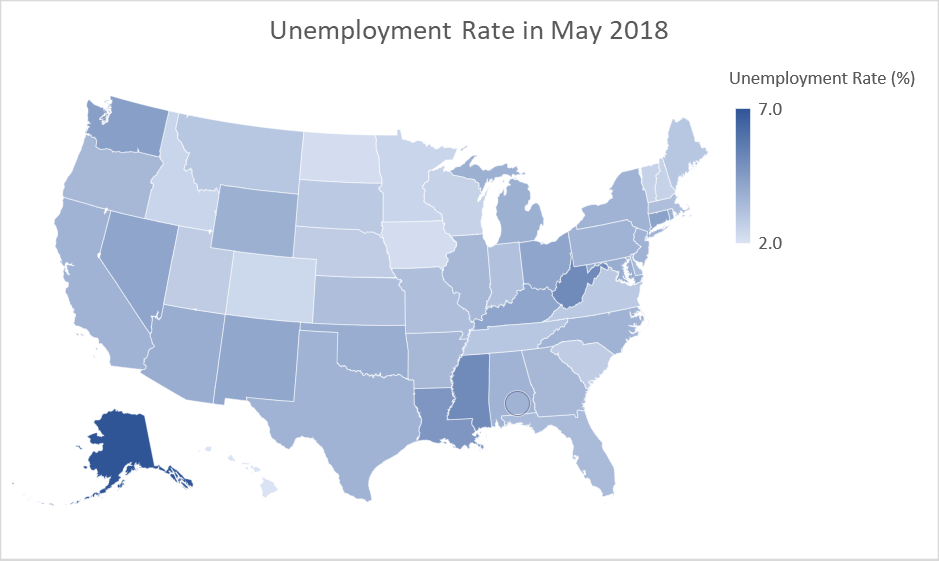

Some states in the United States have done exceptionally well over the past decade creating massive number of new jobs and reporting record low unemployment. There are reports of major labour shortages in at least some states currently.

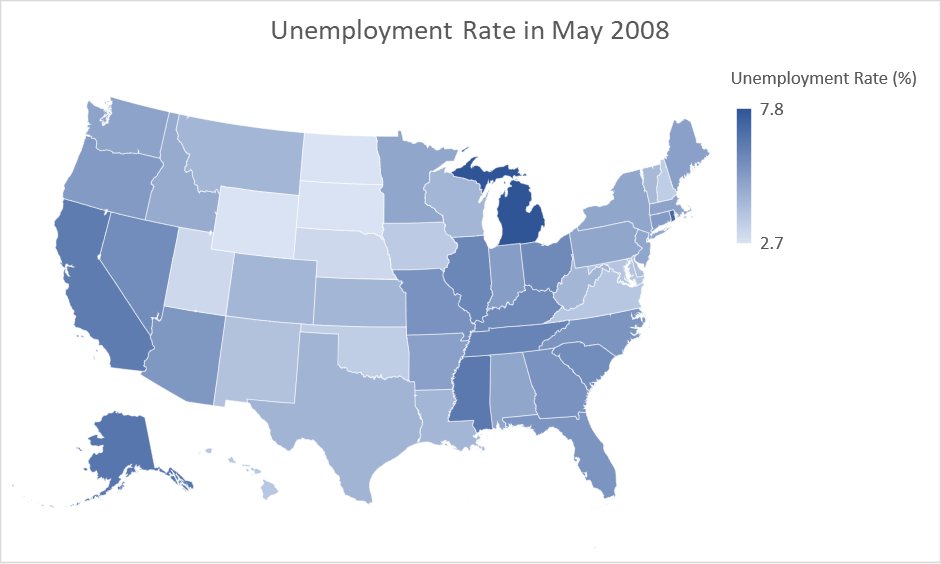

Here are maps of the unemployment rate in each state in May 2008 and May 2018,