The Euro Area, China, Canada, Mexico and Japan together account for over 70% of U.S. trade. Have these countries (including the Euro Area group of countries) manipulated their currencies to boost exports? In this century (2000 onwards) the Chinese Yuan, the Canadian Dollar and the Euro have appreciated against the dollar. The Japanese Yen has been largely unchanged against the U.S. dollar since the start of this century and only the Mexican Peso has weakened against the dollar.

U.S. Trade Statistics for January to June 2018 – exports up 9.67% as imports up 8.66%, EU largest trade partner, China replaces Canada as second largest trade partner

U.S. trade with the world has grown despite tariffs and tariffs rhetoric in the first half (January to June) of 2018. There is one point of view that trade grew to avoid tariffs before they were implemented which might be partially true. Here are the key takeaways and the dataset,

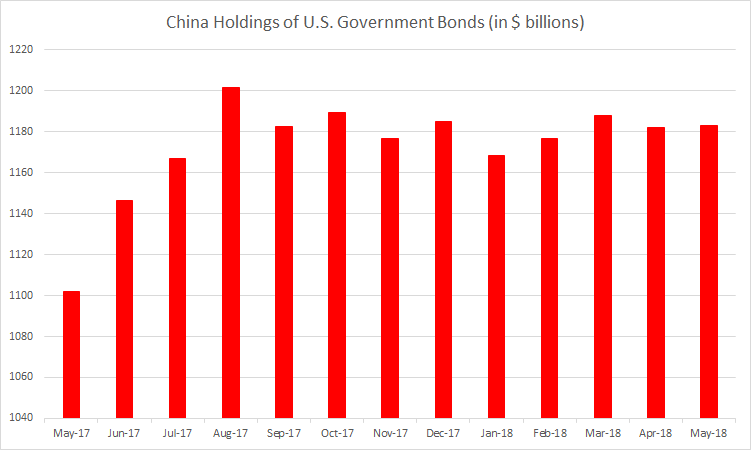

China hasn’t been selling U.S. Government Bonds despite trade tensions

Is China selling U.S Government Bonds (Treasury Bills, T-Bonds and Notes) given the trade war tensions between China and the United States? The simple answer to that is no. Actually, no major foreign country holder of bonds is really selling.

But you might wonder what is going on if you make a chart look like this,

Continue reading “China hasn’t been selling U.S. Government Bonds despite trade tensions”

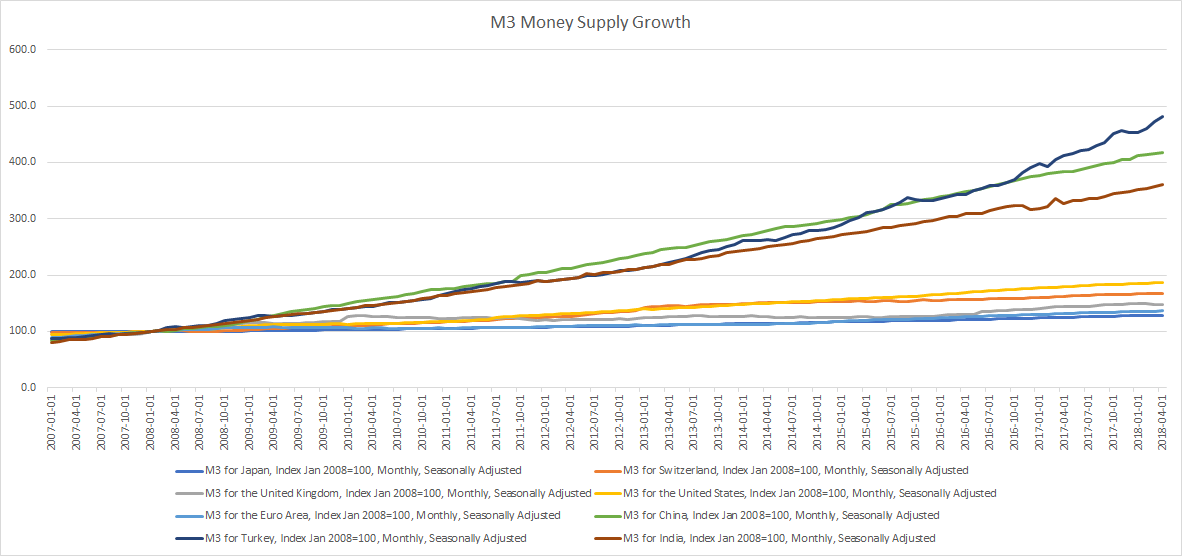

Here’s how much money supply has grown for major economies in the past decade (2008 to 2018)

Broad Money M3

Broad money (M3) includes currency, deposits with an agreed maturity of up to two years, deposits redeemable at notice of up to three months and repurchase agreements, money market fund shares/units and debt securities up to two years.

14 things about U.S. trade and trade tariffs

1. The U.S. has the 13th lowest average tariffs in the world as per the World Trade Organisation

We wrote about average import tariffs or custom duties per country, the United States has the 13th lowest tariffs in the world (out of the 165 members of the World Trade Organization) at only 3.48%.

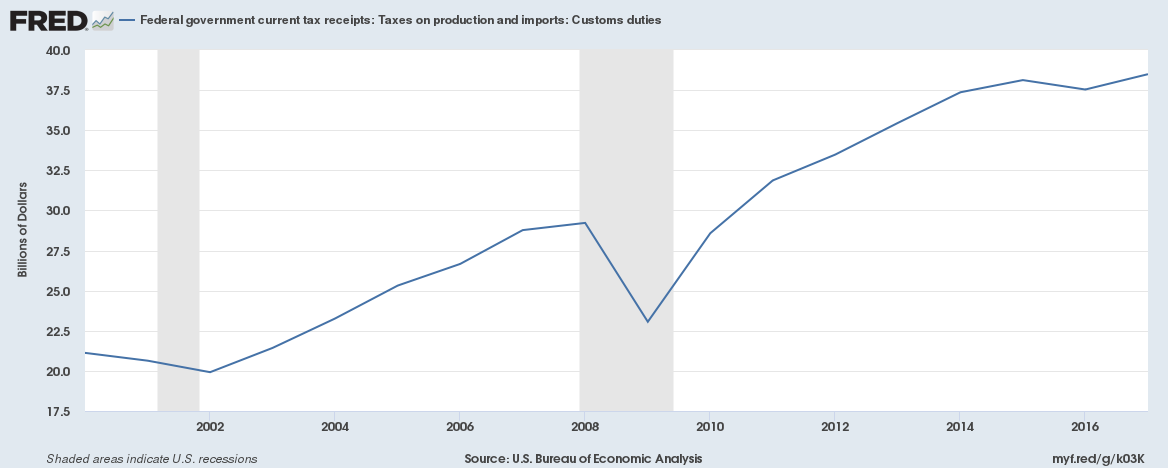

2. … but the U.S. only charged 1.65% in tariffs in 2017

The WTO number is averaged across all products; the actual tariffs could be different based on the product mix of imports as well as any special trade deals the country may be part of.

In the case of the U.S., the actual import tariff or custom duty was just $38.49 billion or 1.65% of the value of $2.34 trillion in imports in 2017.

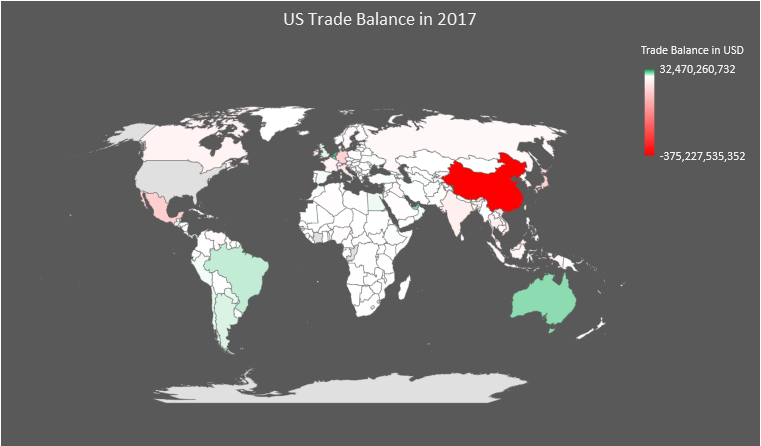

3. The U.S. did have a Trade deficit with Canada in 2017

Canada was the largest export market with exports of $282.47 billion in 2017. Canada was also the third largest market for imports behind only China and Mexico with total imports of $299.98 billion and a trade deficit of $17.5 billion. The trade deficit itself with Canada was the 12th largest for the U.S. in 2017.

4. All constituent countries taken together, the European Union was the largest export market for the U.S. in 2017

The U.S. had exports worth $284 billion to the 28 European Union Countries in 2017, beating Canada with $282.5 billion of exports in 2017. Continue reading “14 things about U.S. trade and trade tariffs”

The U.S. only charged 1.65% in import tariffs in 2017

We wrote about the average import tariffs or custom duties per country recently. That data set was sourced from the World Trade Organization (WTO) and it showed that the average import tariff or custom duty for the United States is currently 3.48%. We did mention that the WTO number is averaged across all products; the actual tariffs could be different based on the product mix of imports as well as any special trade deals the country may be part of.

In the case of the U.S., the actual import tariff or custom duty was just $38.49 billion or 1.65% of the value of $2.34 trillion in imports in 2017.

Continue reading “The U.S. only charged 1.65% in import tariffs in 2017”

All you wanted to know about US trade in 2017 and why China matters so much

Here are all trade datasets (by country and product category) for the US for 2017 (data aggregated from trade.gov – US Department of Commerce and export.gov),

US Trade in 2017 by Country

Continue reading “All you wanted to know about US trade in 2017 and why China matters so much”

Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

But is also claimed that there are days when the 2-year bonds aren’t traded. That is interesting because the Bank of Japan only holds a small proportion of 2-year bonds. How to traders keep their jobs then? They trade bond futures instead. Continue reading “Apparently, there are days when no one trades some Japanese government bonds; Could China devalue their currency or sell US Treasurys?”

US 10-year bond yield hits a 4-year high, is the US now an exception?

Greece (Moody’s Credit Rating: Caa2) is now paying 83 bps lower interest on 2-year bonds than the US (Moody’s Credit Rating: Aaa). Is the US now truly the exception? Continue reading “US 10-year bond yield hits a 4-year high, is the US now an exception?”