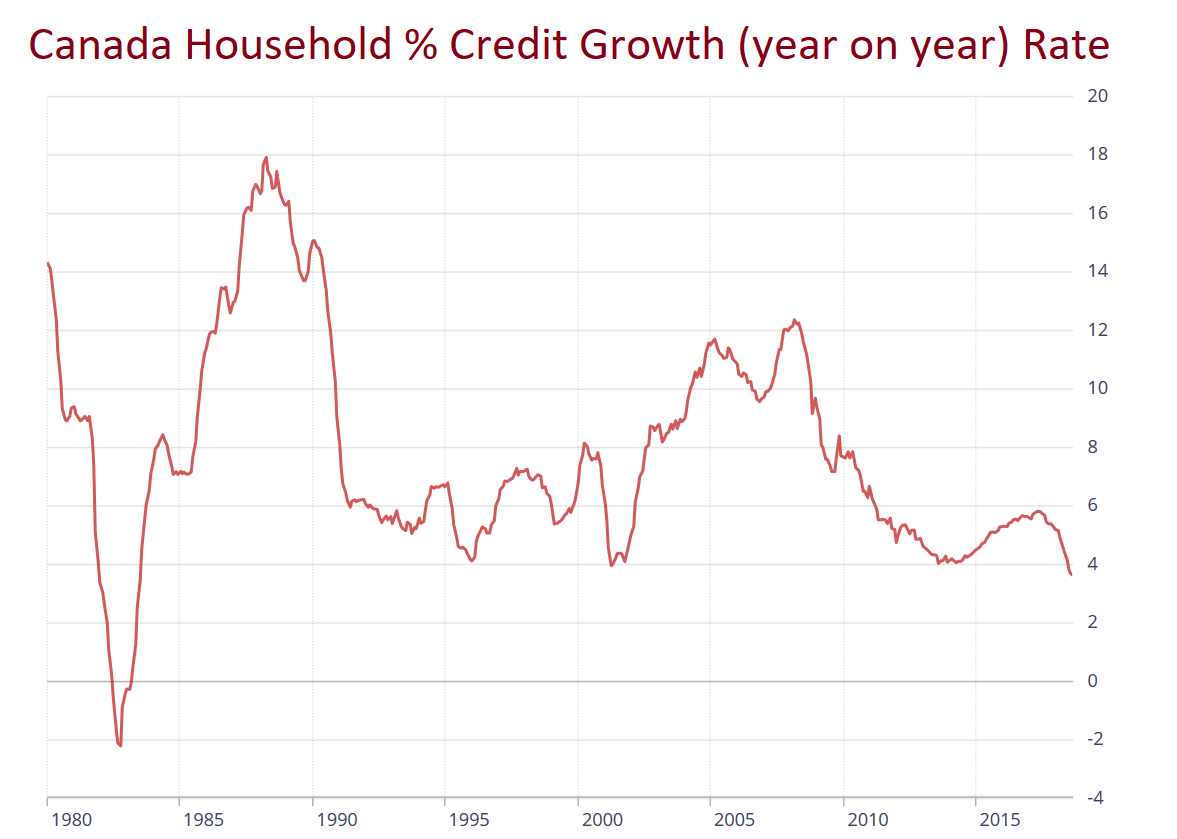

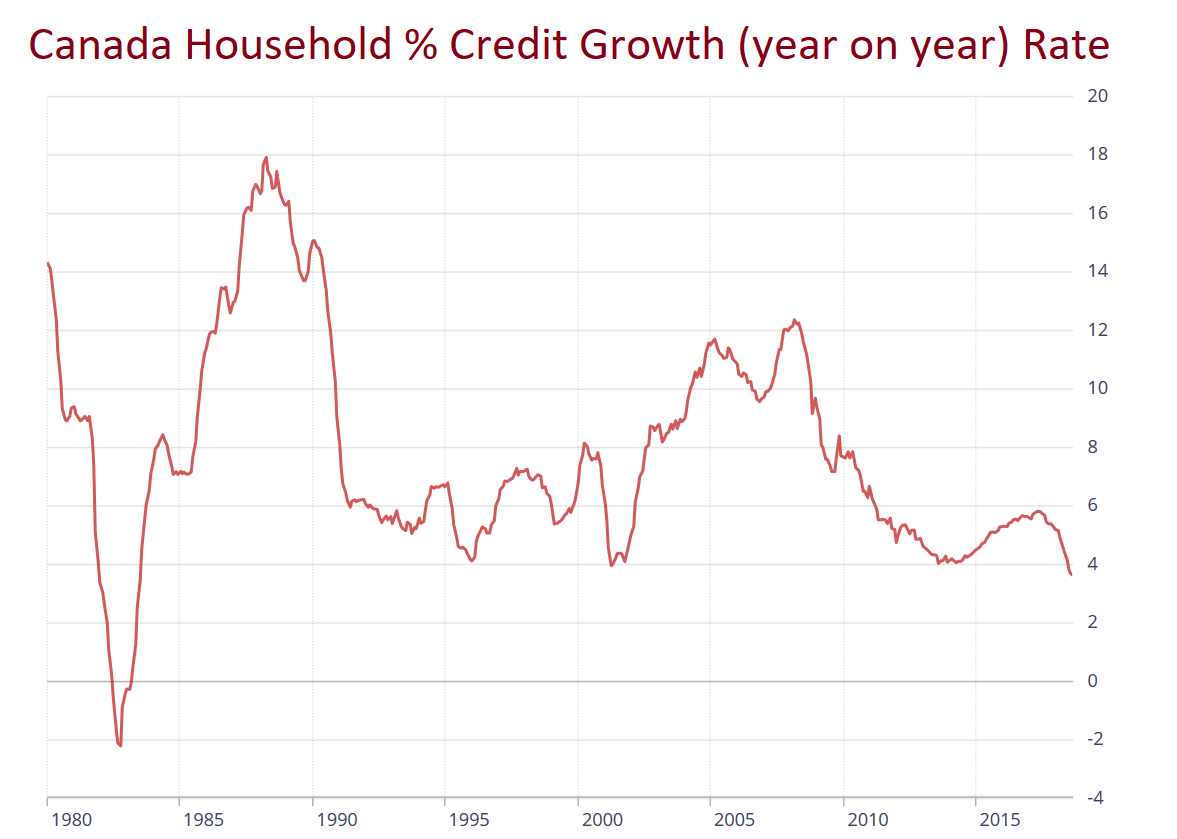

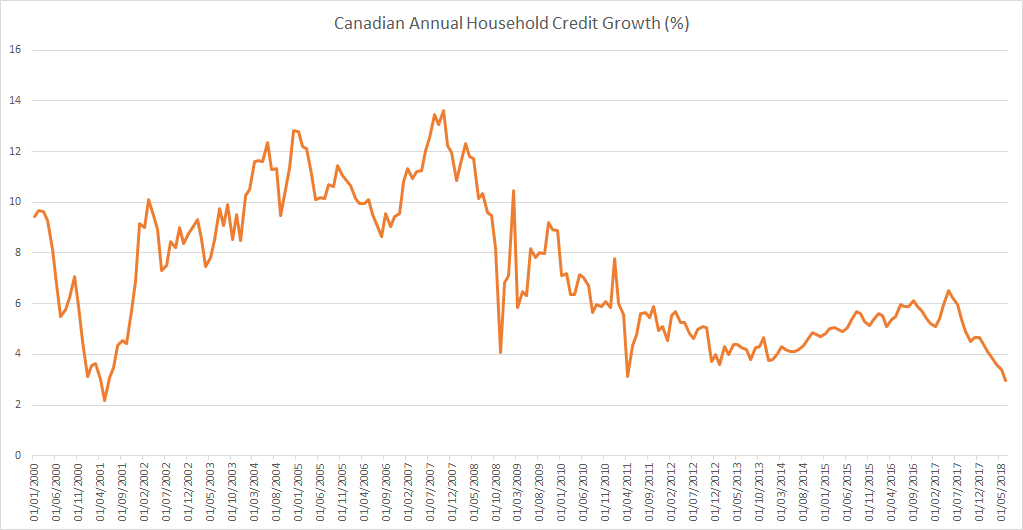

Households in Canada are accumulating debt at the slowest pace in 35 years as interest rates continue to rise. Household credit growth has slowed to 3.5%, the slowest since 1983.

Why wouldn’t it be?

Households in Canada are accumulating debt at the slowest pace in 35 years as interest rates continue to rise. Household credit growth has slowed to 3.5%, the slowest since 1983.

The Euro Area, China, Canada, Mexico and Japan together account for over 70% of U.S. trade. Have these countries (including the Euro Area group of countries) manipulated their currencies to boost exports? In this century (2000 onwards) the Chinese Yuan, the Canadian Dollar and the Euro have appreciated against the dollar. The Japanese Yen has been largely unchanged against the U.S. dollar since the start of this century and only the Mexican Peso has weakened against the dollar.

U.S. trade with the world has grown despite tariffs and tariffs rhetoric in the first half (January to June) of 2018. There is one point of view that trade grew to avoid tariffs before they were implemented which might be partially true. Here are the key takeaways and the dataset,

Canadian household credit growth is slowest since 2001 with Household credit (Annualized 3-month growth rate) growing at 2.98% and Household Mortgage credit (Annualized 3-month growth rate) growing at 2.85%.

1. The U.S. has the 13th lowest average tariffs in the world as per the World Trade Organisation

We wrote about average import tariffs or custom duties per country, the United States has the 13th lowest tariffs in the world (out of the 165 members of the World Trade Organization) at only 3.48%.

2. … but the U.S. only charged 1.65% in tariffs in 2017

The WTO number is averaged across all products; the actual tariffs could be different based on the product mix of imports as well as any special trade deals the country may be part of.

In the case of the U.S., the actual import tariff or custom duty was just $38.49 billion or 1.65% of the value of $2.34 trillion in imports in 2017.

3. The U.S. did have a Trade deficit with Canada in 2017

Canada was the largest export market with exports of $282.47 billion in 2017. Canada was also the third largest market for imports behind only China and Mexico with total imports of $299.98 billion and a trade deficit of $17.5 billion. The trade deficit itself with Canada was the 12th largest for the U.S. in 2017.

4. All constituent countries taken together, the European Union was the largest export market for the U.S. in 2017

The U.S. had exports worth $284 billion to the 28 European Union Countries in 2017, beating Canada with $282.5 billion of exports in 2017. Continue reading “14 things about U.S. trade and trade tariffs”

Where is the biggest property bubble?

Here’s how much the total residential mortgage debt outstanding has grown since 2008 for Australia, Canada, the UK and the US,

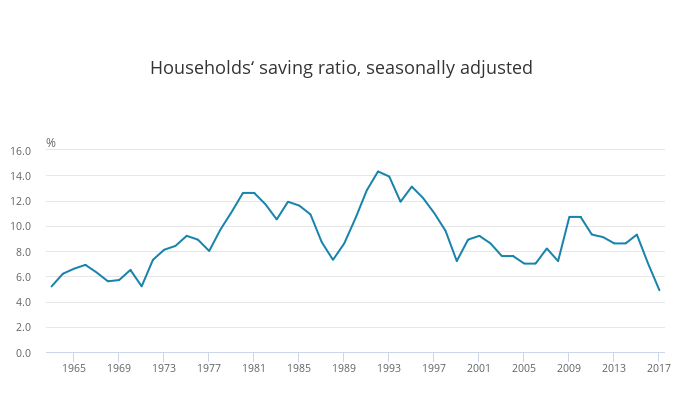

We recently wrote about the UK household savings ratio falling to a record low of 4.9% in 2017 (since comparable records began in 1963) as growth in households’ spending exceeded the growth of households’ income. (Read more here).

We also wrote about the household savings rate in the US falling to a multi-year low of 3.1% as household expenditure grew quicker than income (Read more here). Continue reading “Household saving rates are falling globally”

The European Central Bank (ECB) has asked Deutsche Bank to estimate the costs of winding down its trading operations. Apparently Deutsche Bank is the first bank that has been asked to run this exercise, but others may follow.

How complex is Deutsche Bank? Continue reading “ECB asks Deutsche Bank to estimate the cost of winding down its investment bank; Spain’s sovereign debt upgrade; Canadian bond yields rising most amongst the G20”

What a difference a year makes, these are the current 10 year government bond yields, Continue reading “Impact of interest rates in the US and the UK heading higher”