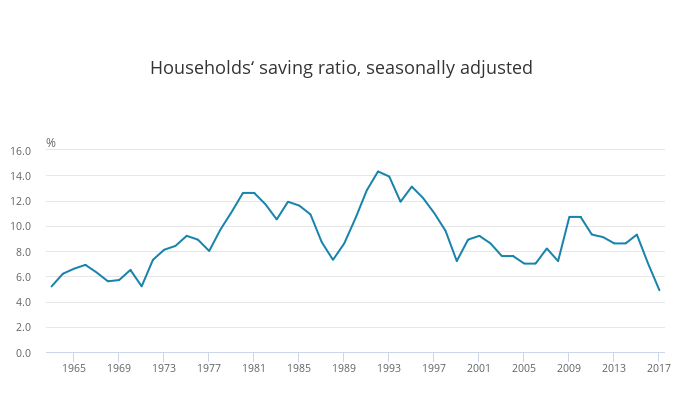

We recently wrote about the UK household savings ratio falling to a record low of 4.9% in 2017 (since comparable records began in 1963) as growth in households’ spending exceeded the growth of households’ income. (Read more here).

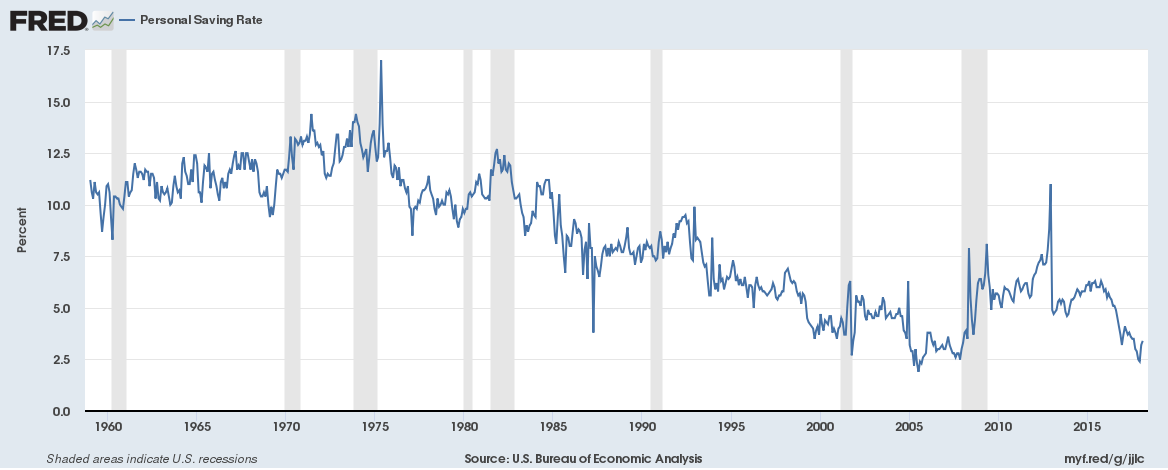

We also wrote about the household savings rate in the US falling to a multi-year low of 3.1% as household expenditure grew quicker than income (Read more here).

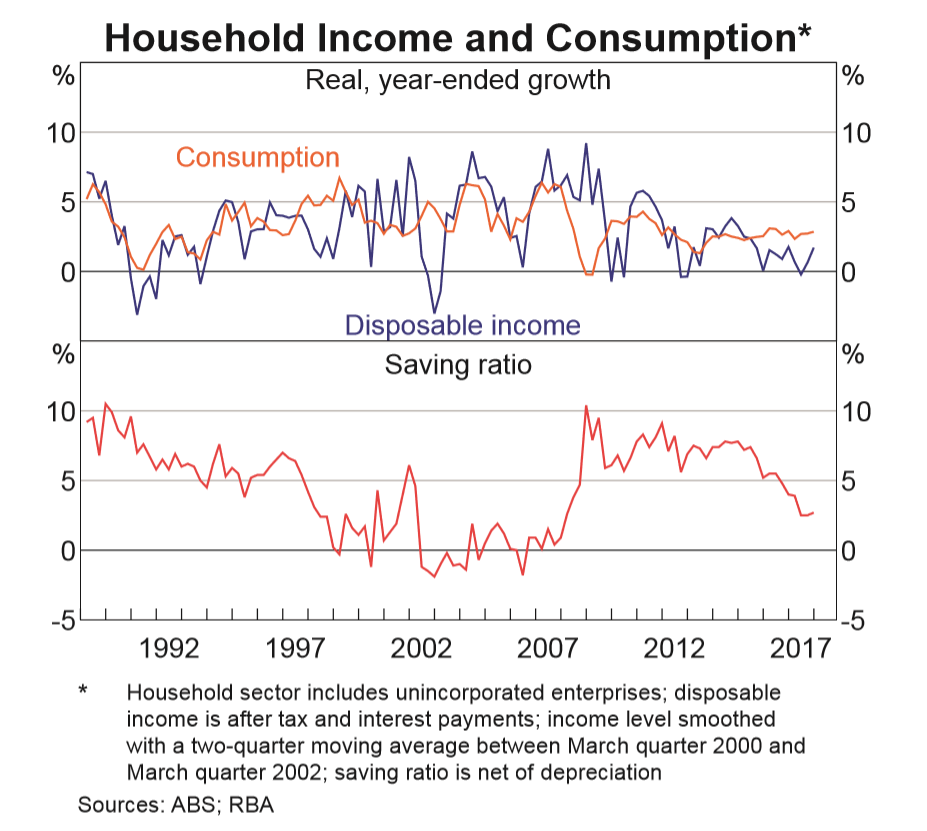

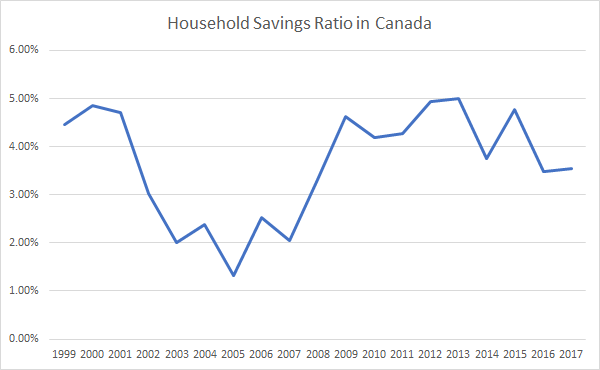

And it appears the same is happening in Australia and Canada as well.

Spending is outpacing income, household debt is at an all time high and interest rates are at an all-time low. What would happen if interest rates were to rise significantly or if the economic conditions like record unemployment to reverse?