The Office for National Statistics (ONS) and the Bank of England (BoE) both released UK data on March 29 and the data doesn’t look good. Key highlights include:

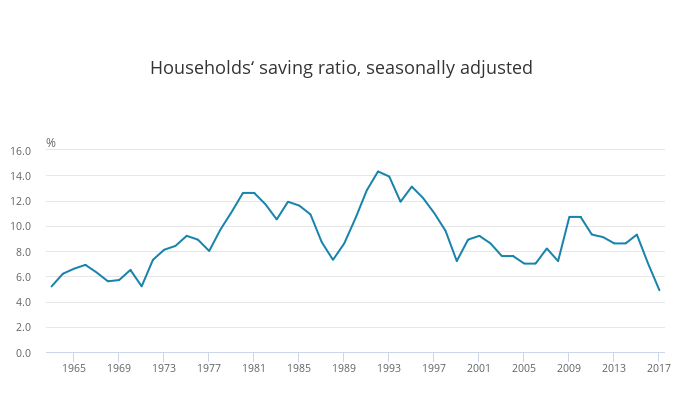

- The households’ saving ratio fell to an annual record low of 4.9% in 2017 (since comparable records began in 1963) as growth in households’ spending exceeded the growth of households’ income.

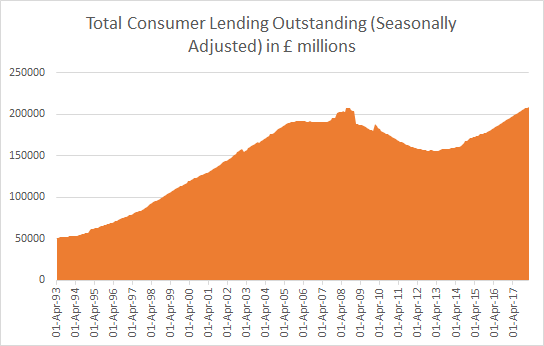

- Consumer Lending Outstanding (seasonally adjusted) excluding student loans hit a new record high £209.45 billion, higher than even before the financial crisis.

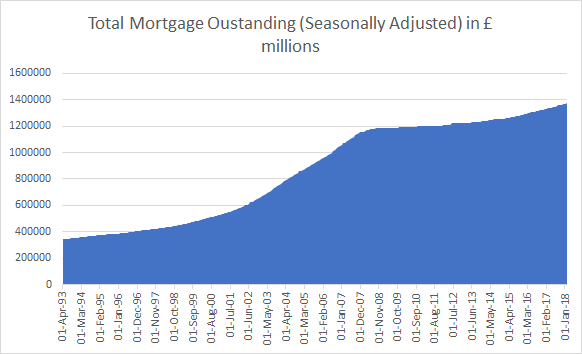

- Total Mortgage Outstanding (seasonally adjusted) hit a new record high of £1.38 trillion.

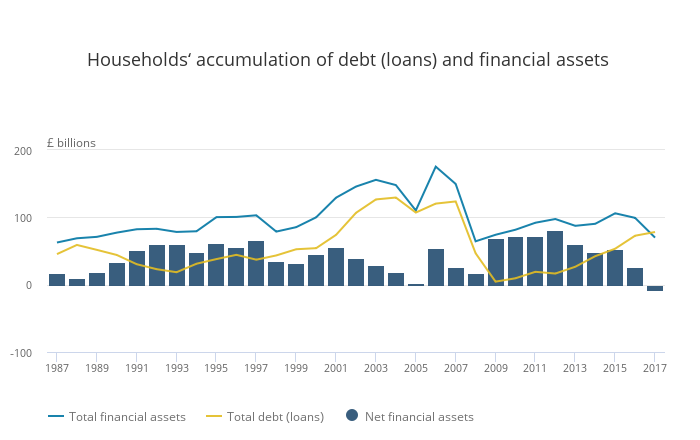

- Households accumulated slightly more debt in the form of loans in 2017 than they did financial assets for the first time since records began in 1987.

The fall in the saving ratio in 2017 was mainly due to household spending rising at a faster pace than income, as was the case in the previous year when the saving ratio also fell.

As per the ONS, in 2017, households’ expenditure rose by £46.7 billion and contributed negatively to the saving ratio, while gross disposable household income increased by only £29.3 billion.

Gross disposable household income growth was boosted by the largest increase in wages and salaries since 2007 (£28.7 billion) as the amount of people in work reached record highs. However, this growth was partially dampened as outgoings on taxes on income and wealth also reached their highest year-on-year increase (£11.3 billion) since the same year, 2007. The rise in household expenditure was driven mainly by expenditure on housing (£10.5 billion) and spending on restaurants and hotels (£6.2 billion). Compared with the previous year, household expenditure rose by 3.8% in 2017 while gross disposable household income increased by 2.3%.

A fall of £8.5 billion in the adjustment for pension entitlements, which represents deferred savings related to pensions, further contributed to the fall in the saving ratio in 2017. As a result, gross savings (a measure that indicates the amount households have available to save or invest) fell by £25.9 billion year-on-year.

The accumulation of debt (measured by the amount of short-term and long-term loans households took out) in 2017 outstripped the amount of total financial assets they accumulated in the same period. This was the first time this happened since records began in 1987.

The fall in the accumulation of financial assets is due mainly to households depositing much less into UK monetary financial institutions (such as banks). In 2017, households deposited only £36.5 billion. This was the lowest since 2011, following the largest amount deposited in a single year by households in 2016 when it was £70.4 billion.

Amounts deposited into UK banks began declining from Quarter 3 (July to Sept) 2016 and remained low throughout 2017. This may reflect the fall in the return on savings as the Bank of England dropped the base interest rate to a record low of 0.25% in August 2016.

Another reason that could explain this sudden drop in deposits was the growing expectation of an interest rate rise. As inflation intensified in 2017, there was much talk of the Bank of England increasing the base rate for the first time in a decade. This expectation may have led many households to borrow and spend now while the cost of borrowing remained low and put off saving until a (near) future date when interest rates and the return on savings increase.

In Quarter 4 (Oct to Dec) 2017, households have continued to accumulate more loans secured on dwellings (that is, mortgages) than unsecured loans (for example, credit card loans). In annual terms, the accumulation of unsecured loans and secured loans were similar between 2010 and 2015. Despite the rise in unsecured loans, the accumulation of loans secured on dwellings has begun increasing at a faster rate than unsecured loans in the last couple of years, as was the case before 2009.

Meanwhile, the Bank of England reported record highs for both mortgage outstanding and consumer loans.

Consumer Lending Outstanding (seasonally adjusted) excluding student loans hit a new record high £209.45 billion, higher than even before the financial crisis.

Total Mortgage Outstanding (seasonally adjusted) hit a new record high of £1.38 trillion.