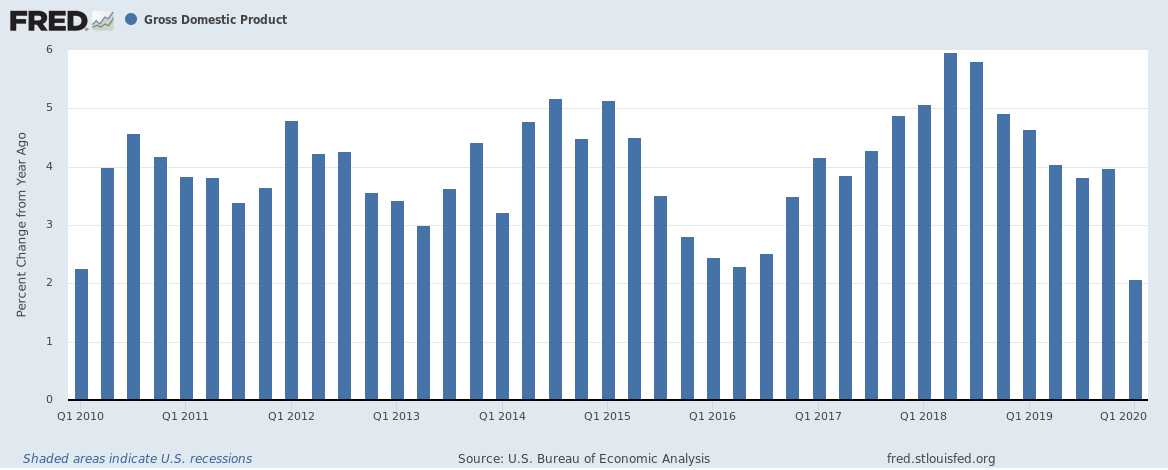

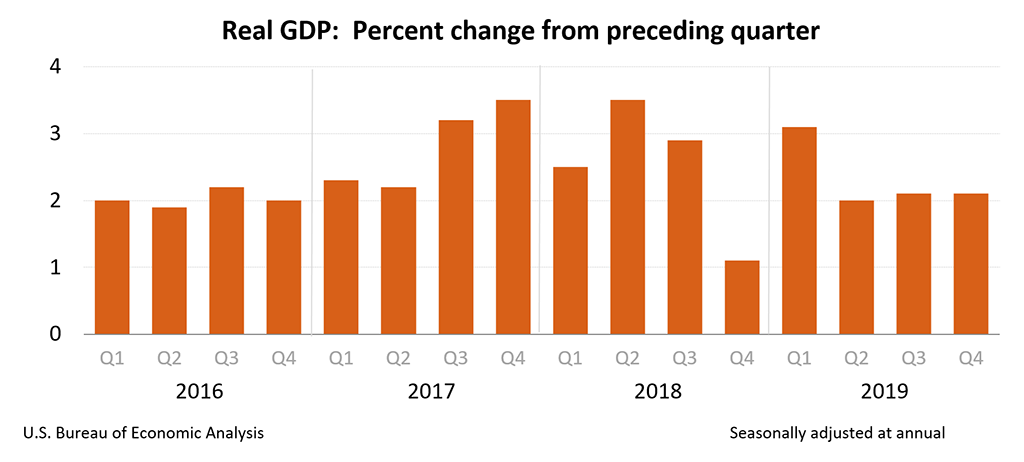

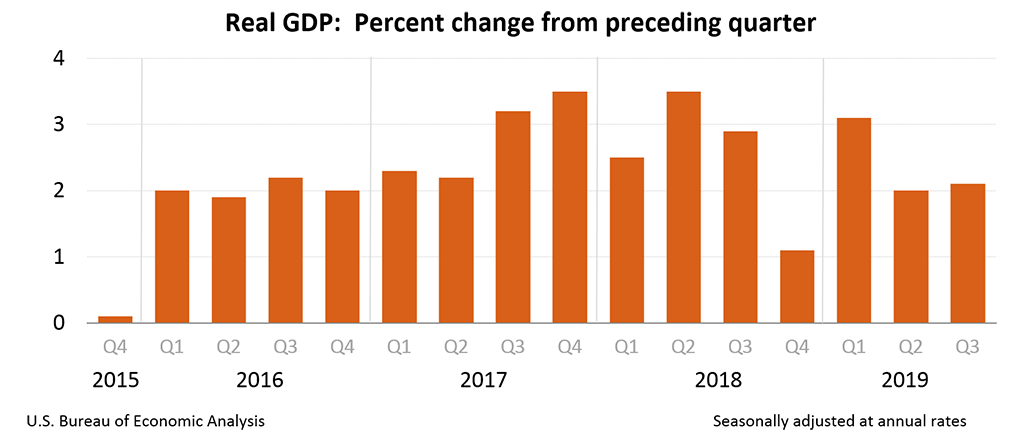

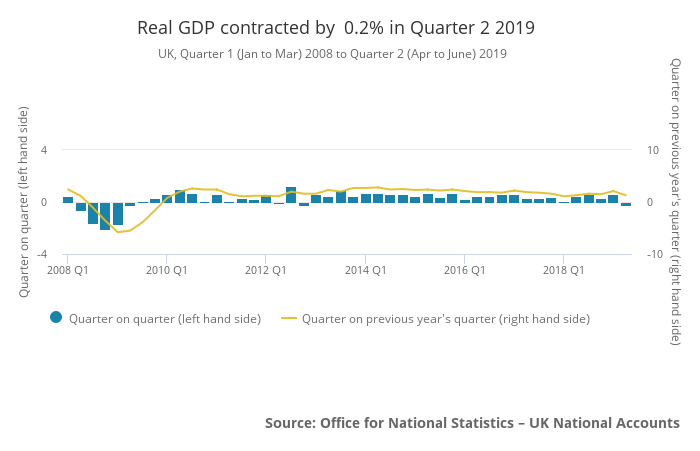

U.S. gross domestic product (GDP) contracted 5% in Quarter 1 (Q1) 2020 (vs Q4 2019) but grew 2.1% (vs Q1 2019) on back of economic activity being hit due to the spread of COVID-19. On a long-term average, the numbers aren’t really that bad but Q2 2020 will be far worse …