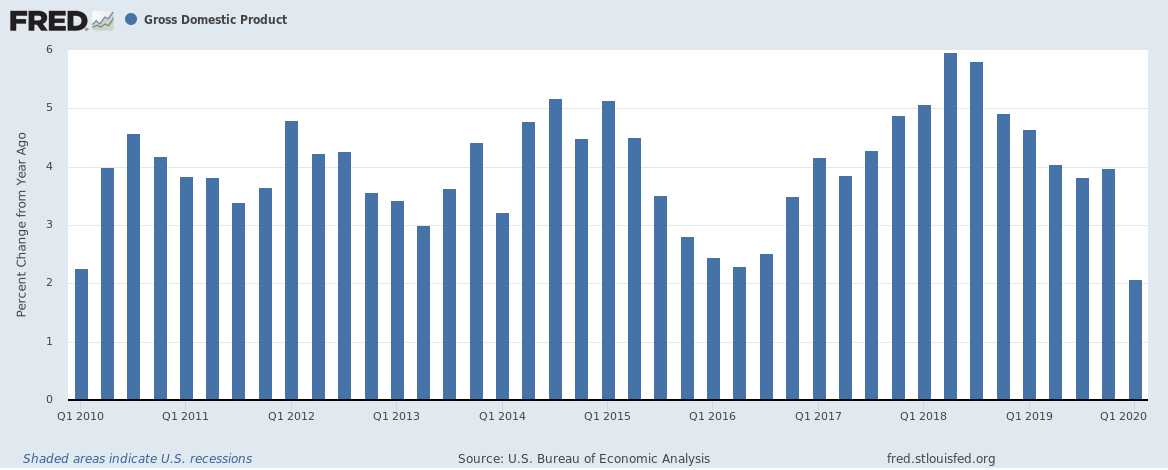

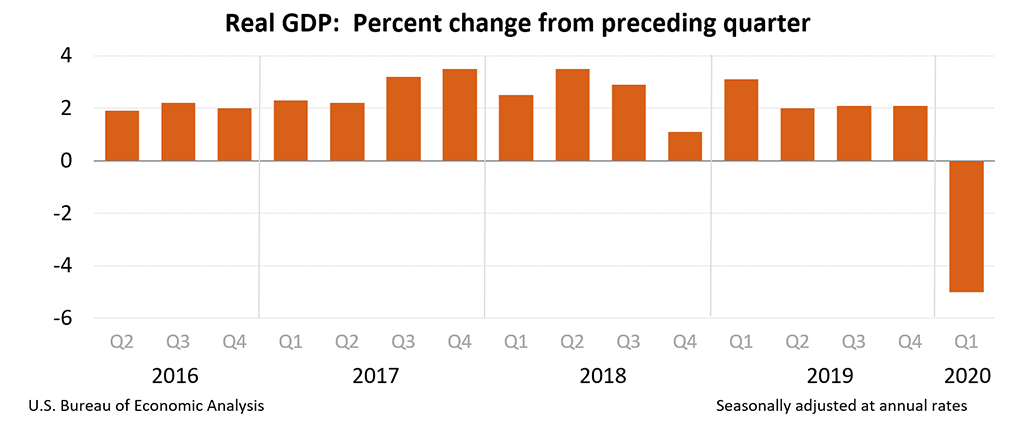

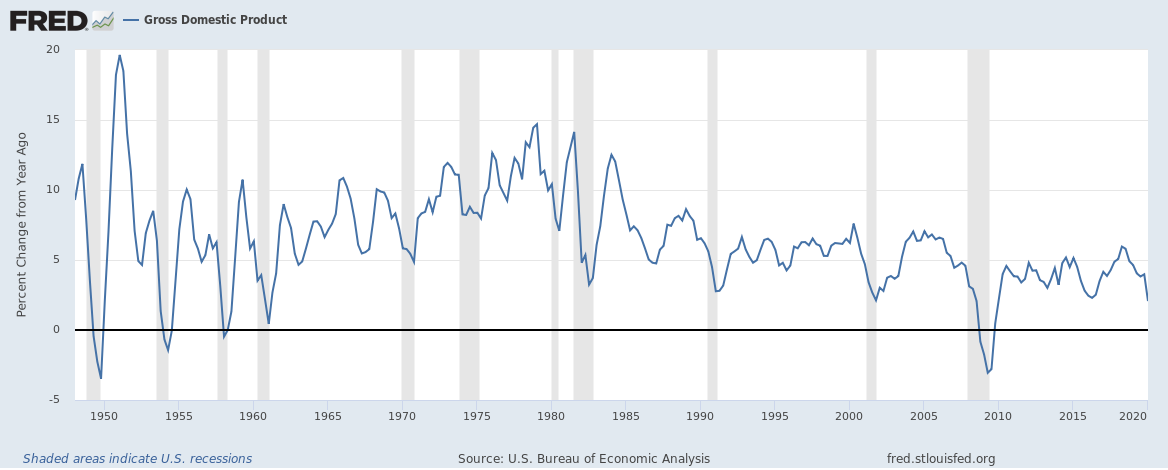

U.S. gross domestic product (GDP) contracted 5% in Quarter 1 (Q1) 2020 (vs Q4 2019) but grew 2.1% (vs Q1 2019) on back of economic activity being hit due to the spread of COVID-19. On a long-term average, the numbers aren’t really that bad but Q2 2020 will be far worse …

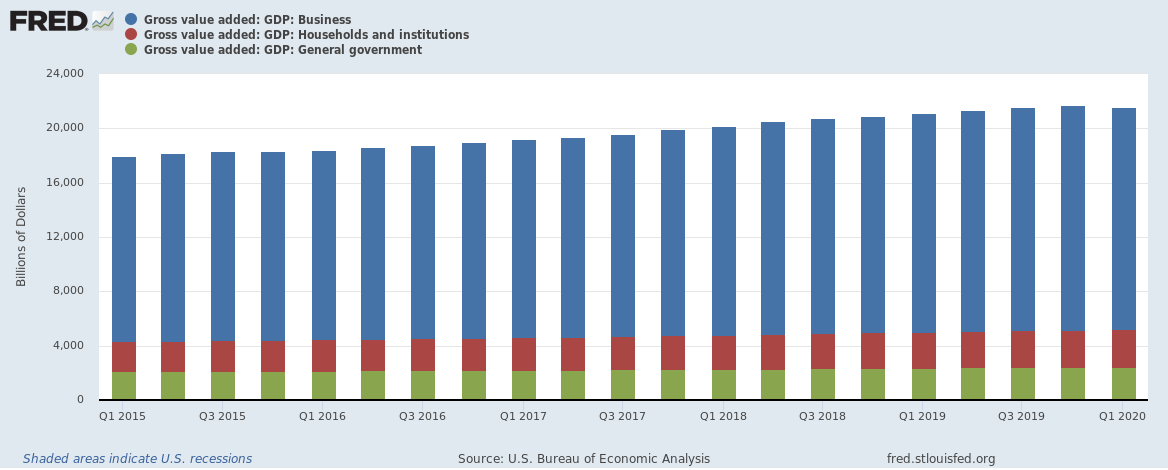

Current‑dollar GDP decreased 3.5%, or $191.6 billion, in the first quarter to a level of $21.54 trillion. The decrease in real GDP in the Q1 2020 reflected negative contributions from personal consumption expenditures (PCE), private inventory investment, non-residential fixed investment, and exports that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased. The month of March unsurprisingly saw the biggest falls in output.

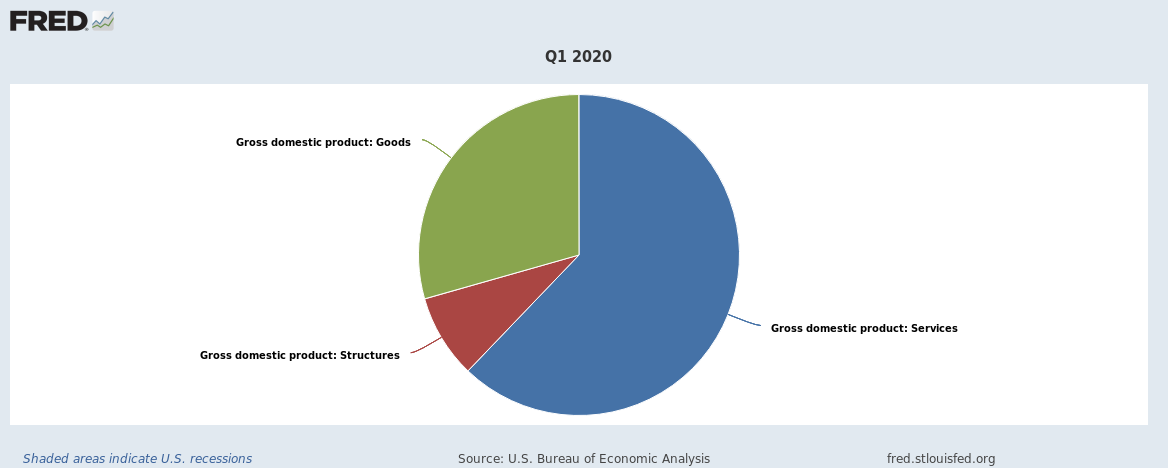

Services contract

As COVID-19 began hitting economic activity, contribution of both services and goods to GDP fell. The decrease in PCE reflected a decrease in services, led by health care as well as food services and accommodations. The decrease in private inventory investment was mainly in nondurable goods manufacturing, led by petroleum and coal products. The decrease in non-residential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

Q2 2020 will be far worse

Economic activity in Q1 2020 as impacted for about 10 working days, Q2 2020 should see significantly lower economic activity due to extended lockdowns and a large contraction in GDP. Biggest fall on record? Probably

Related: U.S. Q4 2019 GDP growth at 2.1% (QoQ), 3.9% (YoY); 2019 GDP growth at 4.1% (YoY)