COVID-19 cases accelerating

The World Health Organization (WHO) declared COVID-19 a pandemic in March. New cases and fatalities are still growing exponentially. At the end of April there were 3.25 million cases (up from 860,000 at the end of March). The number of fatalities has grown exponentially too to 231,000 at the end of April (up from 42,000 at the end of March).

Strong rebound in stocks

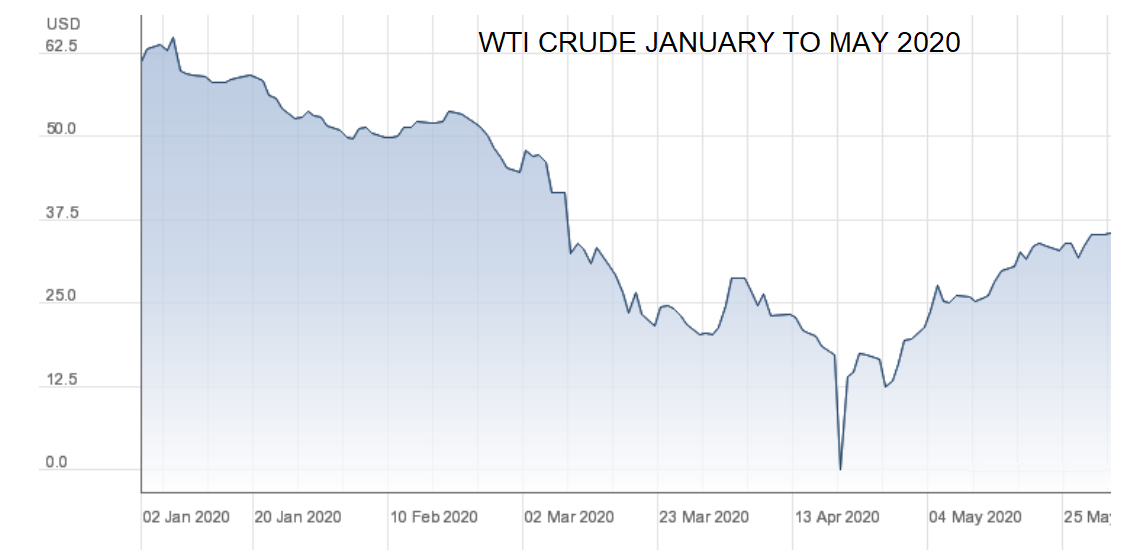

Almost after every crash comes a resounding boom. Continue reading “Highlights from April 2020 – Strong rebound in stocks; Oil prices go negative (for a while); Central Banks announce big bond purchases”