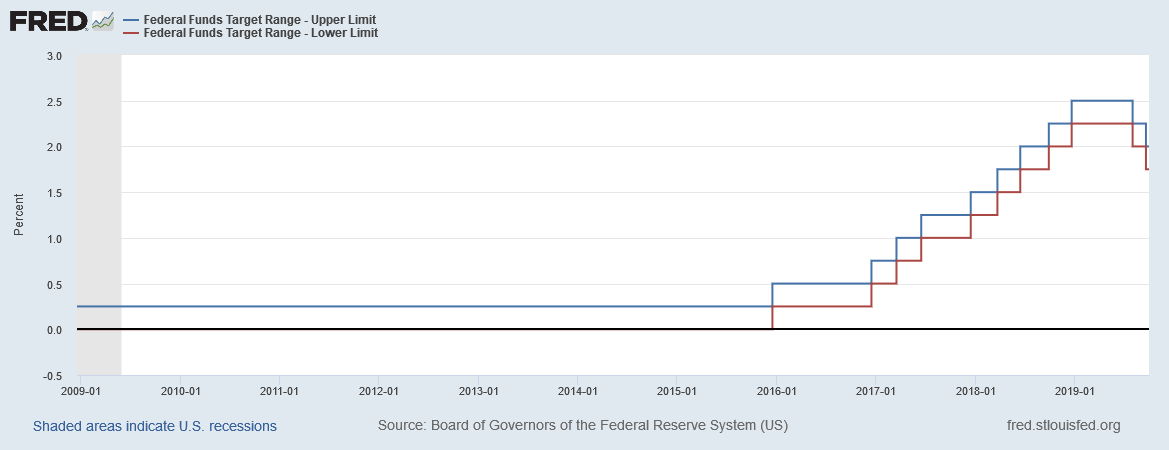

The Federal Reserve cut interest rates for again (the second time this year). Will Central Banks elsewhere follow?

As widely (again) expected by the markets, the Federal Open Market Committee (FOMC) cut the target range for federal funds by 25 bps to a range of 1.75% to 2%. This is the second cut of the year after a cut earlier in July.

Chances of a third cut this year? Apparently, five members of the Fed thought the FOMC should have held its previous range of interest rates (which was 2% to 2.25%), five thought a 25 bps cut was right but wanted no further rates cuts for the rest of 2019, and seven favoured this cut and another in 2019. Our take? One more rate cut in 2019 and three in 2020. Our target? 0.75% to 1% by the end of 2020.

The Federal Reserve also cut the interest it pays on excess reserves by 30 bps, greater than the funds rate cut. Lesser free money for banks. (Read More: Here’s how banks in the US earned over $25 billion in 2017 by lending money to the Federal Reserve)

Winter is coming Negative interest rates are coming

Meanwhile, in Denmark, Nordea and Jyske will now pay you interest if you take out a mortgage.

Negative interest rates are here to stay. But don’t think of making that move to Denmark (yet), negative interest rates are coming elsewhere too. Swiss nationals pay them on all savings. German corporates pay interest for holding money with banks.

By 2020, we reckon most corporates will pay for holding money with banks in mainland Europe.And coming to retail customers in mainland Europe (especially Germany) in 2020 – a penalty for holding savings. This time it is different, why wouldn’t it be?