What happened in October: The S&P 500 hit an all-time high as trade tensions eased. The Fed cut interest rates again. Meanwhile, China GDP growth was slowest in three decades. The British Pound soared in October and signs are that the Eurozone economy is faltering more than expected.

Stock Markets globally hit new records

As trade tensions eased, global stock markets hit record highs. The S&P 500 hit 3050 at the end of October as markets elsewhere soared too. Emerging markets were the stars in October with the MSCI Emerging Markets index gaining 4.2% for October.

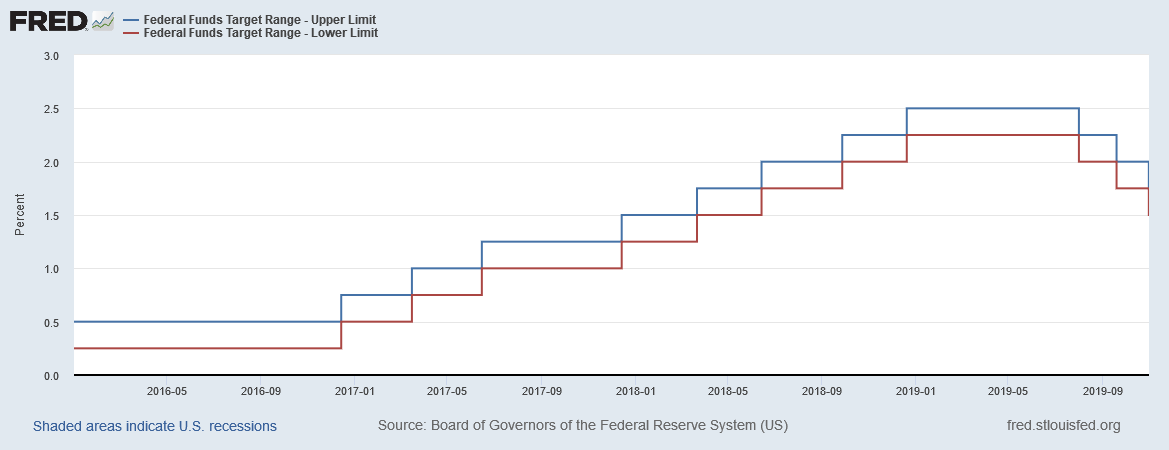

Fed Rate Cut

The Federal Open Market Committee (FOMC) cut the target range for federal funds by 25 bps to a range of 1.5% to 1.75%. This is the third cut of the year after previous ones in July and September. Will the Fed cut rates again in 2019? We reiterate our expectation from September, which is no further rate cut in 2019 but we expect three rate cuts in 2020.

China Growth

China reported Q3 2019 GDP growth of 6%, the slowest in 28 years. Trade War impact? Yes, but also slowing domestic consumption. Stimulus ahead? Most probably.

UK Pound

The British Pound (GBP) rallied about 5% against the U.S. dollar (USD) as it is expected that an election in December will help resolve Brexit. We don’t discuss politics on this site, but we do think Brexit will happen shortly after the election because frankly people are bored, they will vote for the option offering implementation of the Brexit vote.

Eurozone faltering

Manufacturing PMIs across the Eurozone fell significantly during the month. Confidence in services wasn’t great either (but was just about growing). The European Central Bank (ECB) is re-starting quantitative easing. It will buy €20bn of debt a month from November.