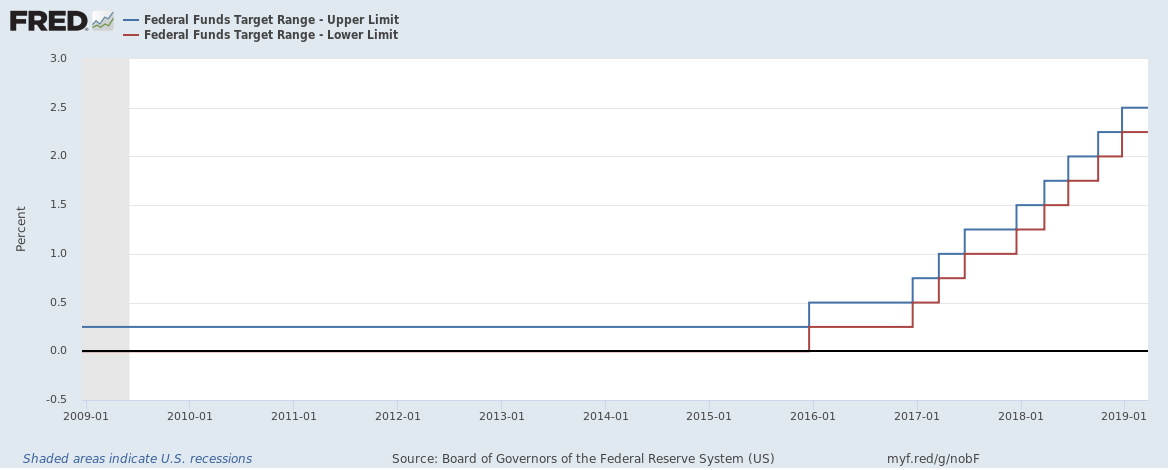

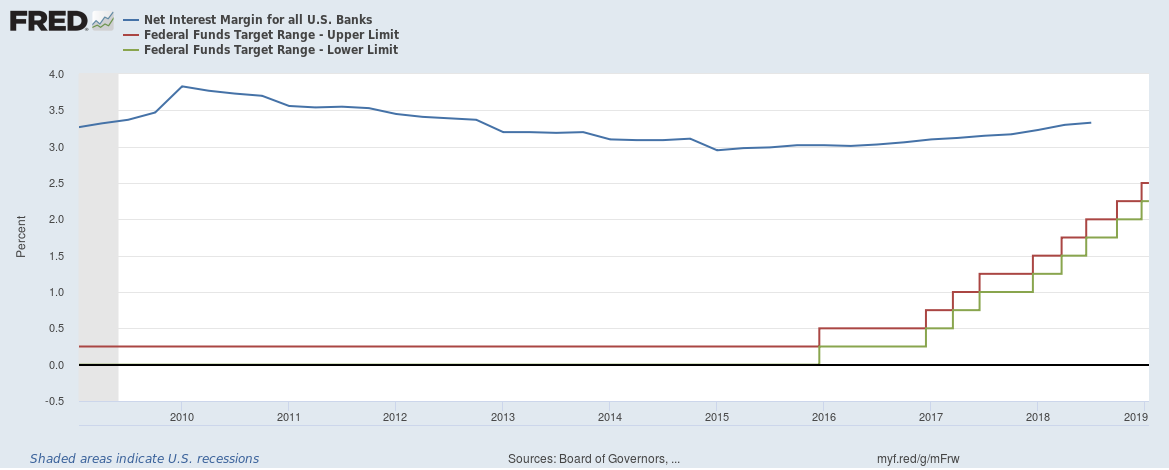

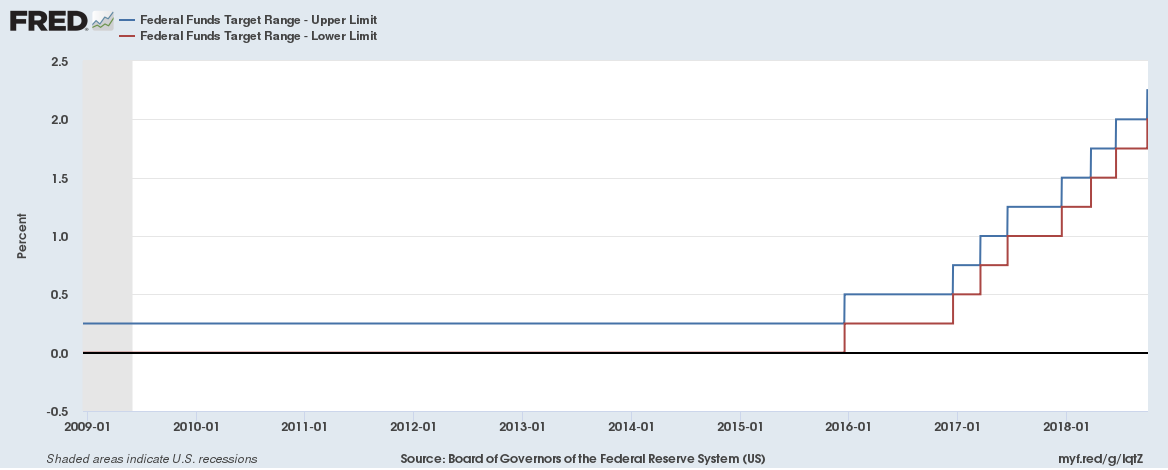

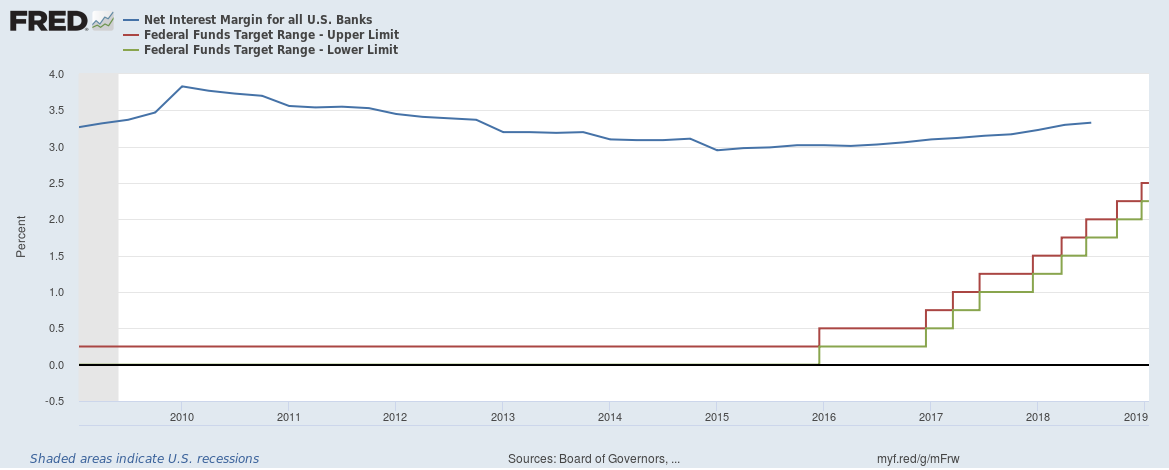

The Federal Reserve increased the target for the bank’s benchmark rate by 0.25% (to a range of 2.25% to 2.5%) at the end of December, the ninth rate rise since 2015. Rising benchmark interest rates are having little impact on mortgage and saving rates or interest margin of banks.

Interest Margin of Banks in the United States stood at 3.33% at the end of Q3 2018, up just 0.03% from Q2 2018 (3.3%) and up just 0.18% from Q3 2017 (3.15%).

Continue reading “Rising benchmark interest rates in the United States are having little impact on mortgage and saving interest rates as well as interest margin of banks”