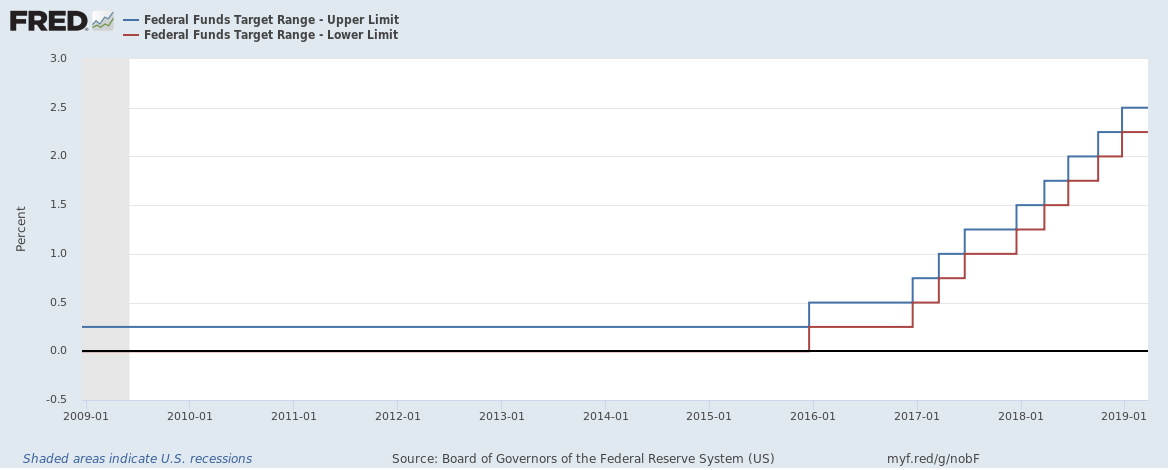

The Federal Open Market Committee (FOMC) announced during the week that it had decided to maintain the target range for the federal funds between 2.25% to 2.5%.

The FOMC said that labour market remains strong, but that growth of economic activity has slowed from its solid rate in the fourth quarter. Payroll employment were little changed in February, but job gains had been solid, on average, in recent months, and the unemployment rate has remained low.

It also added that recent indicators point to slower growth of household spending and business fixed investment in the first quarter.

The FOMC changed their outlook for 2019 from the two increases predicted in December to no movement.

Balance Sheet Changes

To ensure a smooth transition to the longer-run level of reserves consistent with efficient and effective policy implementation, the FOMC intends to slow the pace of the decline in reserves over coming quarters provided that the economy and money market conditions evolve about as expected.

The FOMC intends to slow the reduction of its holdings of Treasury securities by reducing the cap on monthly redemptions from the current level of $30 billion to $15 billion beginning in May 2019.

The FOMC also intends to conclude the reduction of its aggregate securities holdings in the System Open Market Account (SOMA) at the end of September 2019.

The FOMC intends to continue to allow its holdings of agency debt and agency mortgage-backed securities (MBS) to decline, consistent with the aim of holding primarily Treasury securities in the longer run.

Related:

The Federal Reserve is unwinding its balance sheet, here’s why and how it is doing it