At the start of 2019 we wrote that 2019 will be a year that will be different with interest rate hikes slowing or interest rates even reversing.

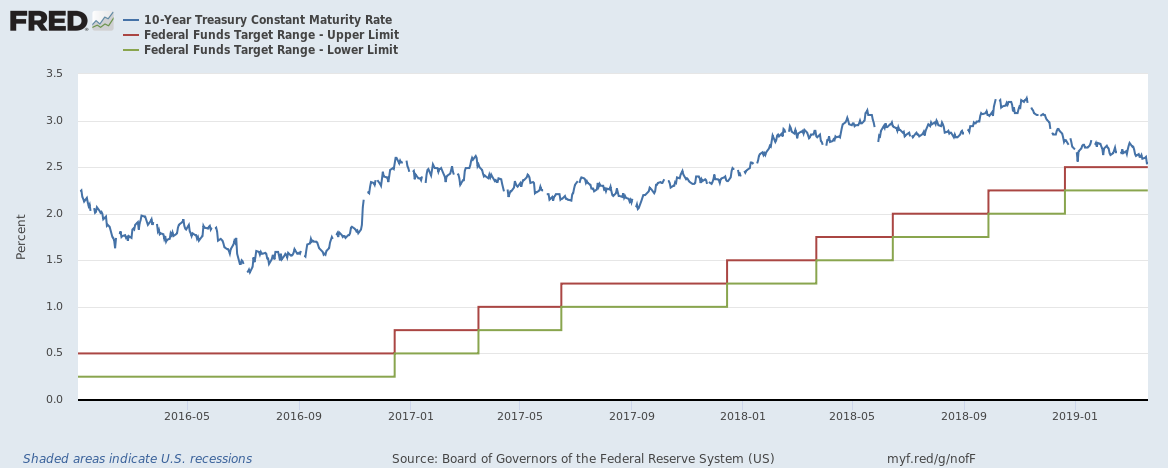

Earlier this month the European Central Bank said interest rates would remain at record lows at least until the end of the year and then last week this was followed by the Federal Reserve saying that it does not expect an interest rate rise for the U.S. for the rest of 2019.

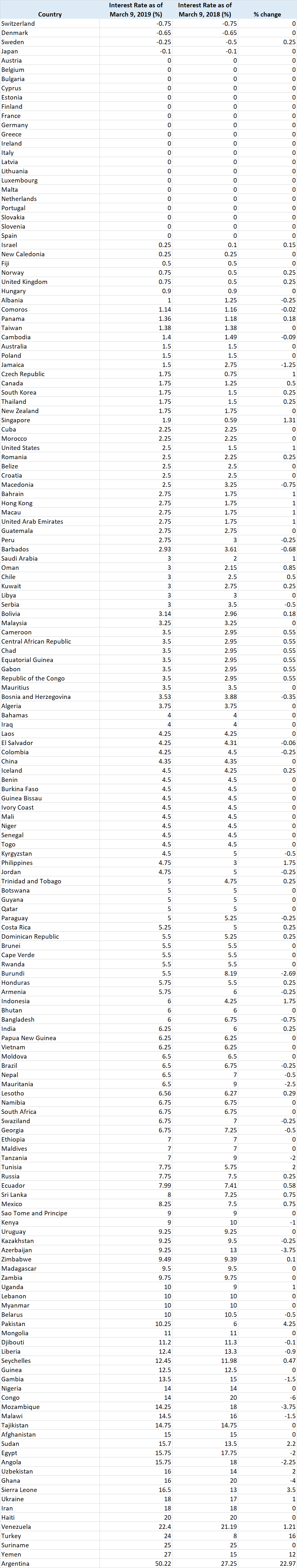

We wrote earlier this month that the average global central bank interest rate had barely changed over the past year.

Bond yields – a lead indicator of interest rate changes are now definitely signalling a fall in interest rates going forward. We had written in February that Government bond yields had been falling globally. This has further accelerated breaking records.

German 10-year government bond yield is now -0.03%, down 55 bps over the past year. This is the first time since 2016 that German government bond yield has turned negative.

Australian 10-year bond yield is now 1.77%, the lowest level ever on record and down 90 bps over the past year.

Japanese 10-year yield is at -0.08%, down 8 bps over the past year.

Switzerland 10-year yield is at -0.50%, down 60 bps over the past year.

U.S. 10-year yield is at 2.46%, down 41 bps over the past year. And we are close to multiple yield curve inversions. (Related: The yield curve inversion plus why banks and banking stocks are impacted by it)

UK 10-year yield is at 1.02%, down 46 bps over the past year.

Elsewhere French, Spanish, Portuguese, Brazilian and Indian 10-year government bond yields have all fallen over the past year.

The zero or negative interest policy continues across Europe and Japan. Well, it worked tackling a slowing economy post the economic crisis of 2008 and with the global economy slowing down again, why not just continue keeping interest rates at record lows or drop them further.

There is a big risk though – Central Banks had a big tool to fight a recession in the form of cutting interest rates. There is little room to that now, other than for the United States. Quantitative tightening in the form of reducing Treasury holdings for the Federal Reserve has been slowed down in last week’s announcement and the European Central Bank has announced new monetary stimulus in the form of TLTRO-III. Central Banks don’t have many tools left to fight another recession.