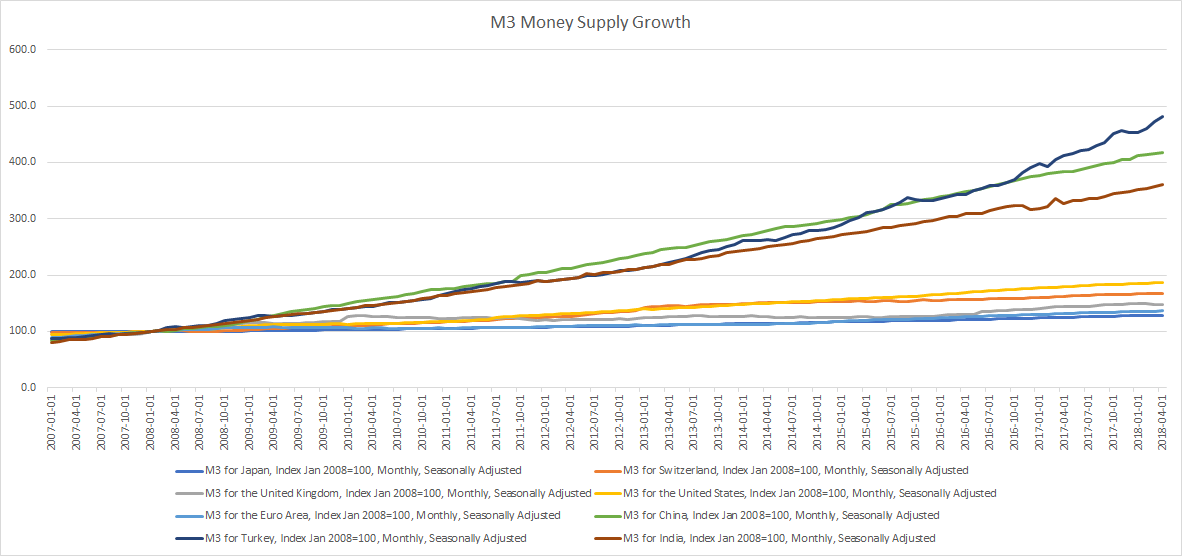

Money supply is simply the total amount of money in circulation in a country. For the U.S. there are several components of the money supply: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest.

Continue reading “Money supply growth for the U.S. has slowed and it isn’t a good sign”