Money supply is simply the total amount of money in circulation in a country. For the U.S. there are several components of the money supply: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest.

M1 is the money supply of currency in circulation (notes and coins, traveller’s checks [non-bank issuers], demand deposits, and checkable deposits).

The broader M2 component includes M1 in addition to saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals.

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveller’s checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds.

Slowing money supply growth

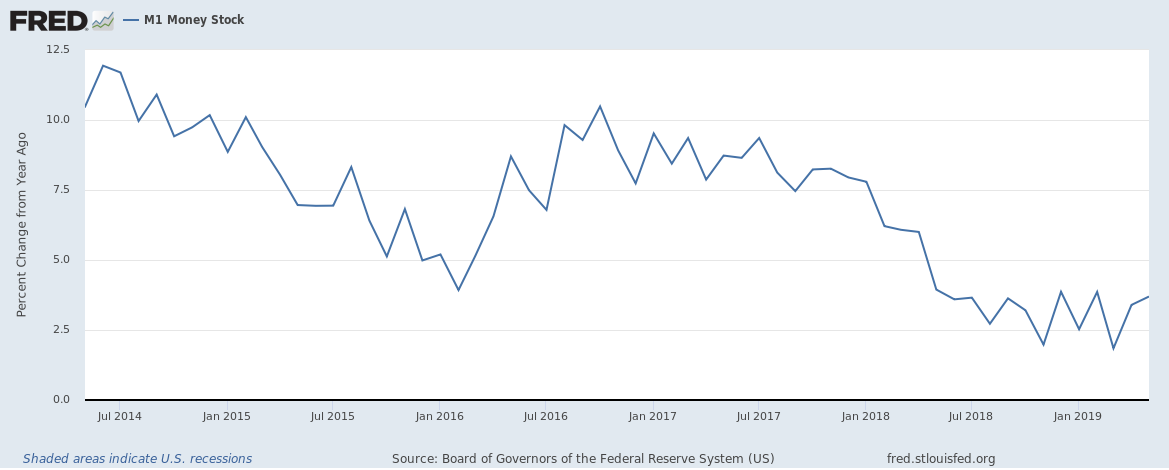

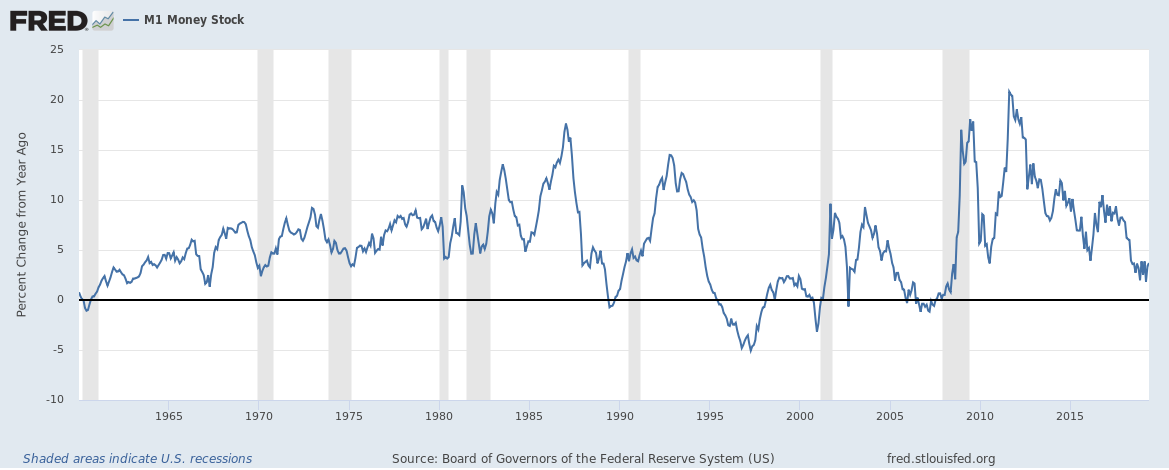

M1 money supply growth has slowed to around 3.5%. Charts for the last 5 years and for a longer timescale are below:

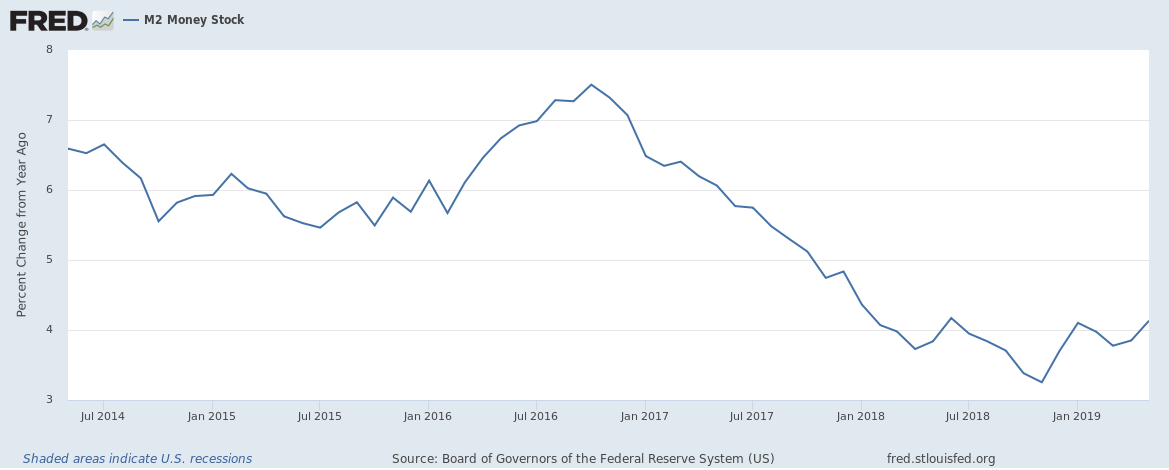

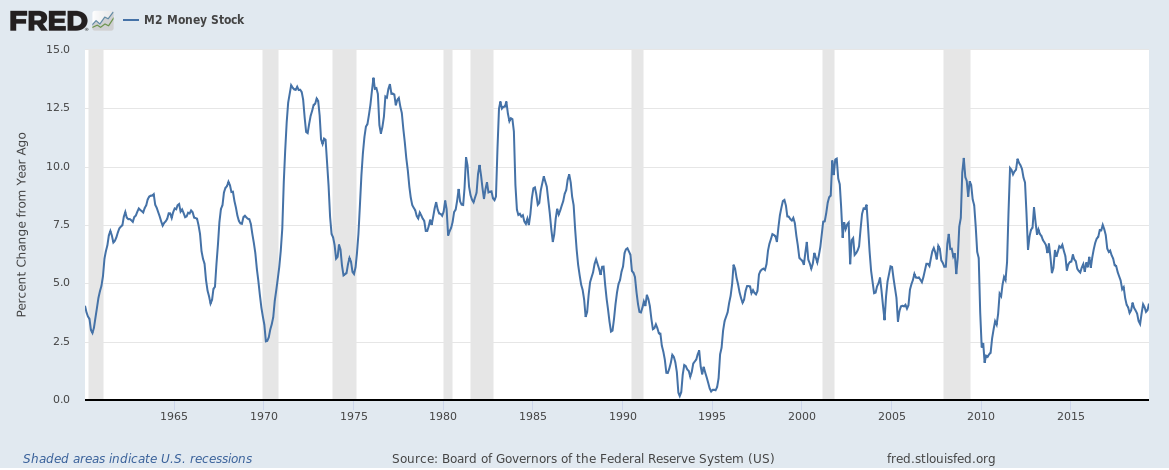

M2 money supply growth has slowed to around 4%. Charts for the last 5 years and for a longer timescale are below:

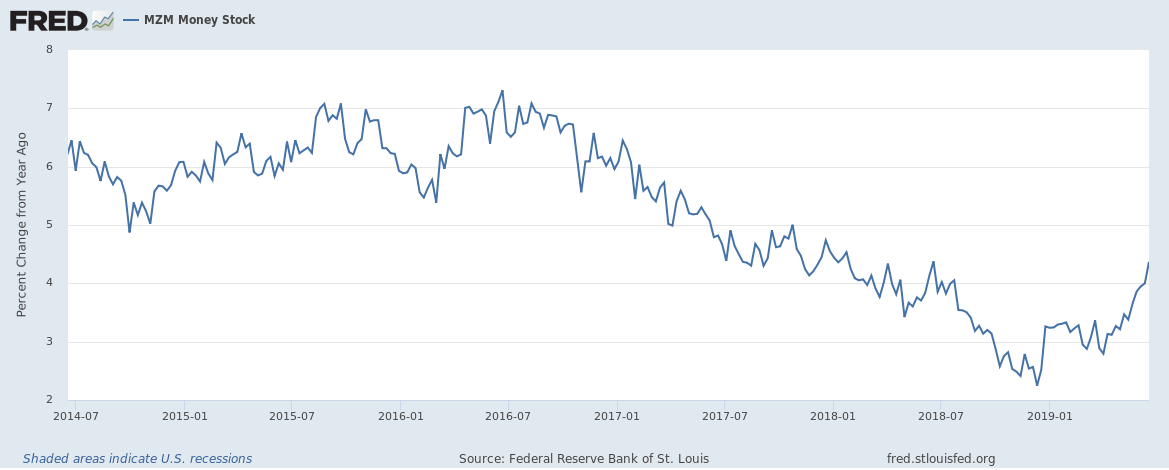

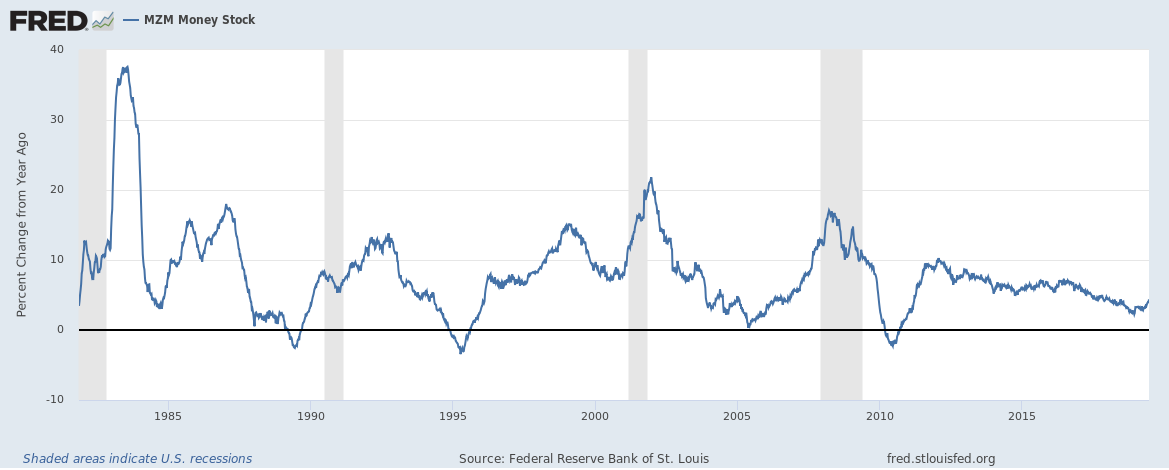

MZM money supply growth has slowed to around 4.4%. Charts for the last 5 years and for a longer timescale are below:

Is slowing growth an issue?

Money supply growth is an indicator of general economic activity. During good economic times, money supply tends to grow quickly as banks lend more money.

But as the charts above show recessions tend to be preceded by periods of falling money-supply growth. The Federal Reserve will surely be tempted to cut rates now …

The whole concept that banks lending money thereby adds money to circulation is a scam by the Federal Reserve who have been destroying America with their FIAT currency for 50 years. The fact most Americans have never heard of Executive Order 6102 or don’t even know that the Federal Reserve is a privately owned company by the Banking Cartel… is more than enough information to question what is going on.