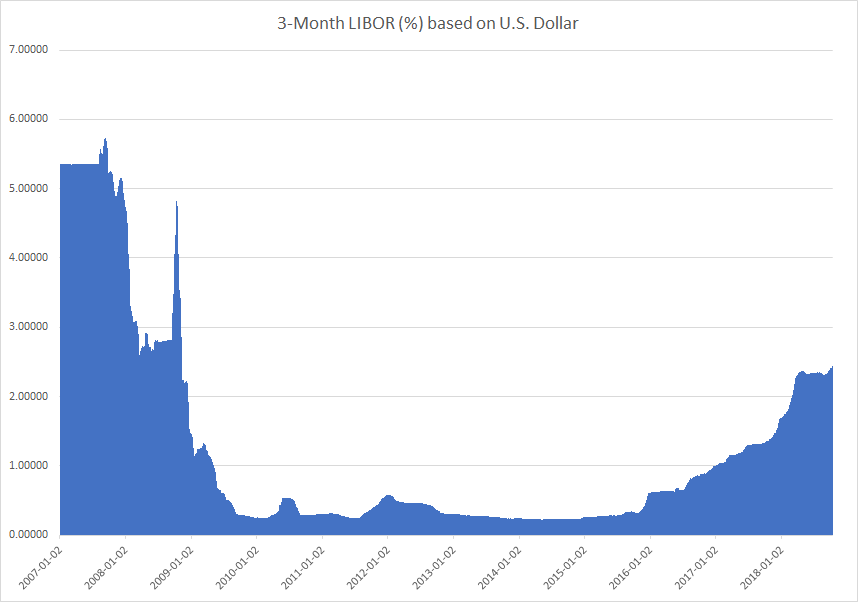

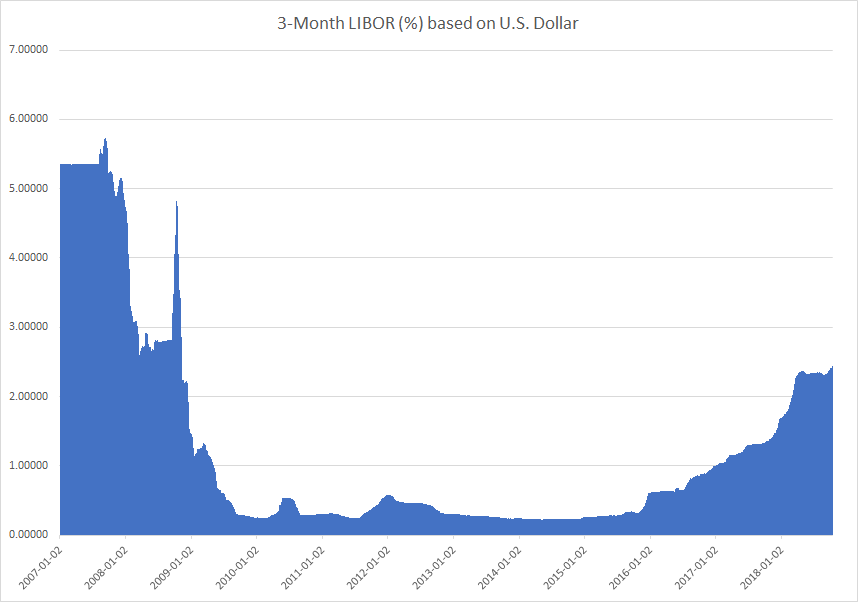

Three-month U.S. Dollar London interbank offered rate (LIBOR) that serves as the basis for trillions of dollars in loans and floating-rate securities globally hit a 10-year high of 2.45%, the highest level since November 2008.

Why wouldn’t it be?

Three-month U.S. Dollar London interbank offered rate (LIBOR) that serves as the basis for trillions of dollars in loans and floating-rate securities globally hit a 10-year high of 2.45%, the highest level since November 2008.

The Euro Area, China, Canada, Mexico and Japan together account for over 70% of U.S. trade. Have these countries (including the Euro Area group of countries) manipulated their currencies to boost exports? In this century (2000 onwards) the Chinese Yuan, the Canadian Dollar and the Euro have appreciated against the dollar. The Japanese Yen has been largely unchanged against the U.S. dollar since the start of this century and only the Mexican Peso has weakened against the dollar.

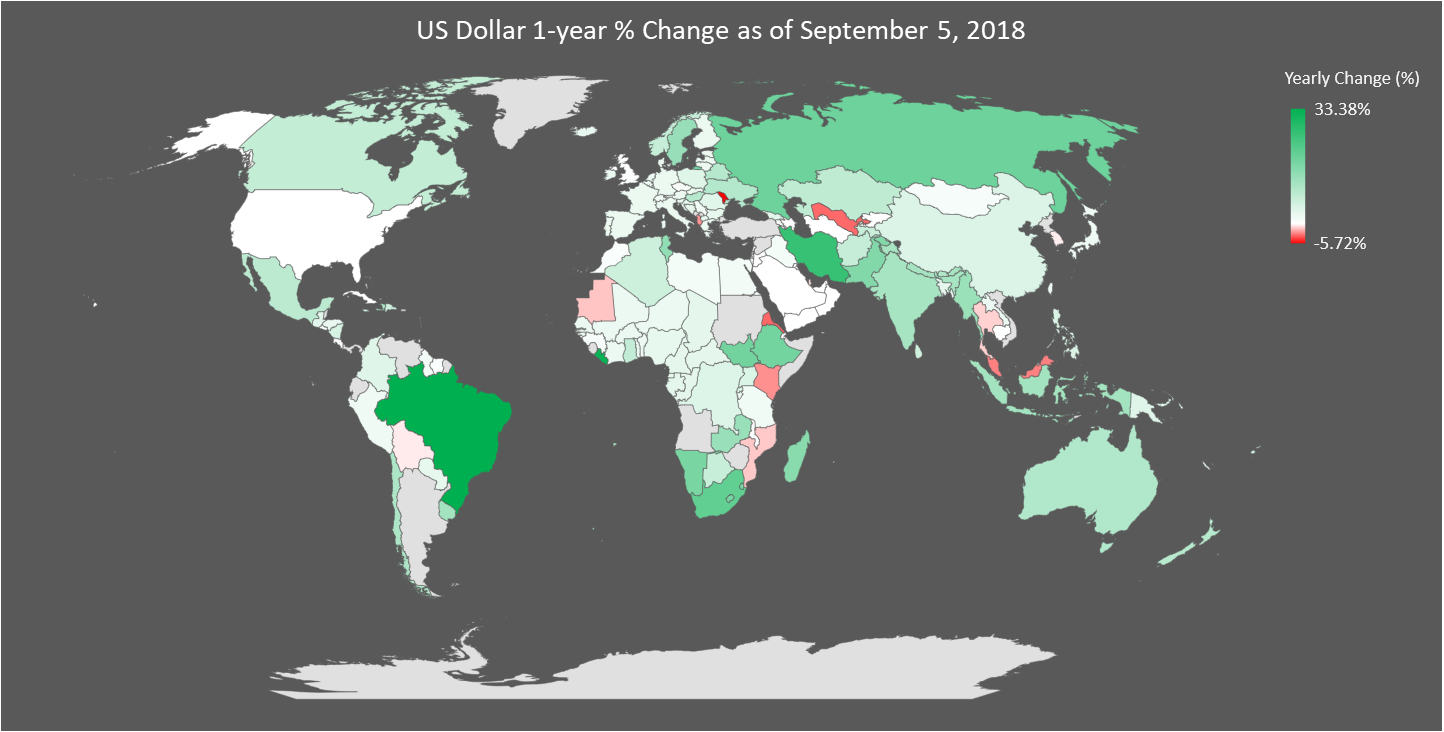

What a difference six months makes, here’s the performance of the US dollar against each currency as of the 5th of September 2018,

Notes: 1. We have excluded the performance of Angola, Sudan, Argentina, Turkey and Venezuela on the map because they are major outliers. They are included in the data set below. 2. Currency price data updated 05-September-2018

The U.S. economy is doing great and is set to contribute 25% of global Gross Domestic Product (GDP) this year, its highest share since 2007. The rise of the U.S. dollar and increases in interest rates are squeezing emerging economics at an unprecedent pace. But it isn’t just emerging economies that are feeling the squeeze, Europe has its problems with Italian debt (and yields), the Australian dollar which has long been considered a growth asset has been falling this year and elsewhere trade worries and rising oil prices are having a big impact on other nations. Even German factory orders are the weakest in years as the U.S. is truly taking back economic leadership.

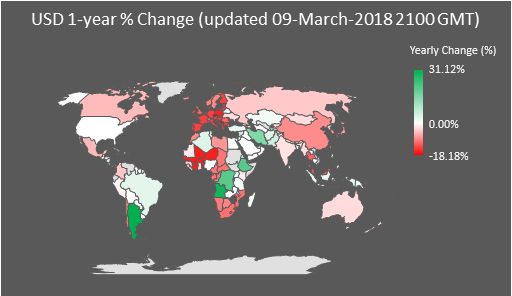

We wrote earlier this year on the downsides of synchronised global growth. We wrote that when global synchronised growth begins to end the U.S. dollar strengthens, investors run away from emerging markets, interest rates continue to rise to tame inflation and bad debt becomes an issue. All of this is happening now, first the US Dollar, here is the 1-year performance of the U.S. Dollar mapped,

Oil Prices

The price of crude oil crossed $70 per barrel today, the highest since November 2014.

US firm ConocoPhillips has taken over oil inventories and terminals of Venezuelan state-owned PDVSA under court orders to enforce a $2 billion arbitration award by the International Chamber of Commerce. Further, US President Donald Trump said he’d announce his decision on the Iran nuclear deal on Tuesday. Both developments contributed to soaring oil prices. Continue reading “Oil highest since November 2014; Dollar index hits its highest level in 2018; Warren Buffett and Bill Gates on Cryptocurrencies”

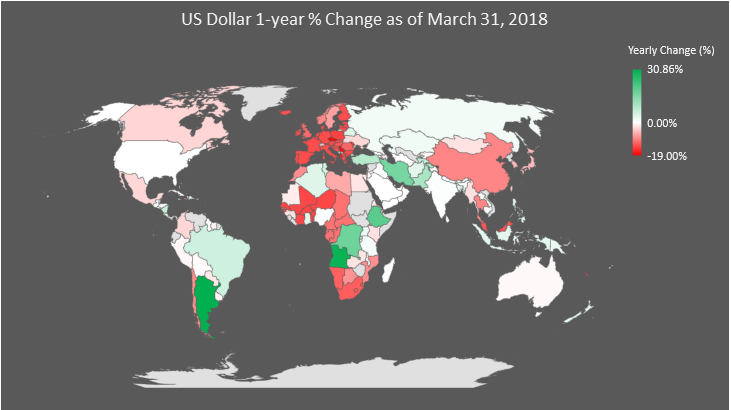

Here is the performance (1-year % change) of the US Dollar (USD) mapped against currencies and countries around the world (the data set is after the map),

Here is the performance (1-year % change) of the US Dollar (USD) mapped against currencies and countries around the world,

The US dollar has lost significantly against a basket of currencies in both 2017 and 2018 (so far), details here.

In fact, the US dollar has lost over 10% against 29 currencies (for 56 countries) over the past year, details here. Continue reading “When does a weak US dollar become a headache for the Federal Reserve?”

Here are the currencies against whom the US Dollar (USD) has lost 10% or more over the past year, Continue reading “Here are the currencies against whom the US Dollar has lost 10% or more over the past year”