The U.S. economy is doing great and is set to contribute 25% of global Gross Domestic Product (GDP) this year, its highest share since 2007. The rise of the U.S. dollar and increases in interest rates are squeezing emerging economics at an unprecedent pace. But it isn’t just emerging economies that are feeling the squeeze, Europe has its problems with Italian debt (and yields), the Australian dollar which has long been considered a growth asset has been falling this year and elsewhere trade worries and rising oil prices are having a big impact on other nations. Even German factory orders are the weakest in years as the U.S. is truly taking back economic leadership.

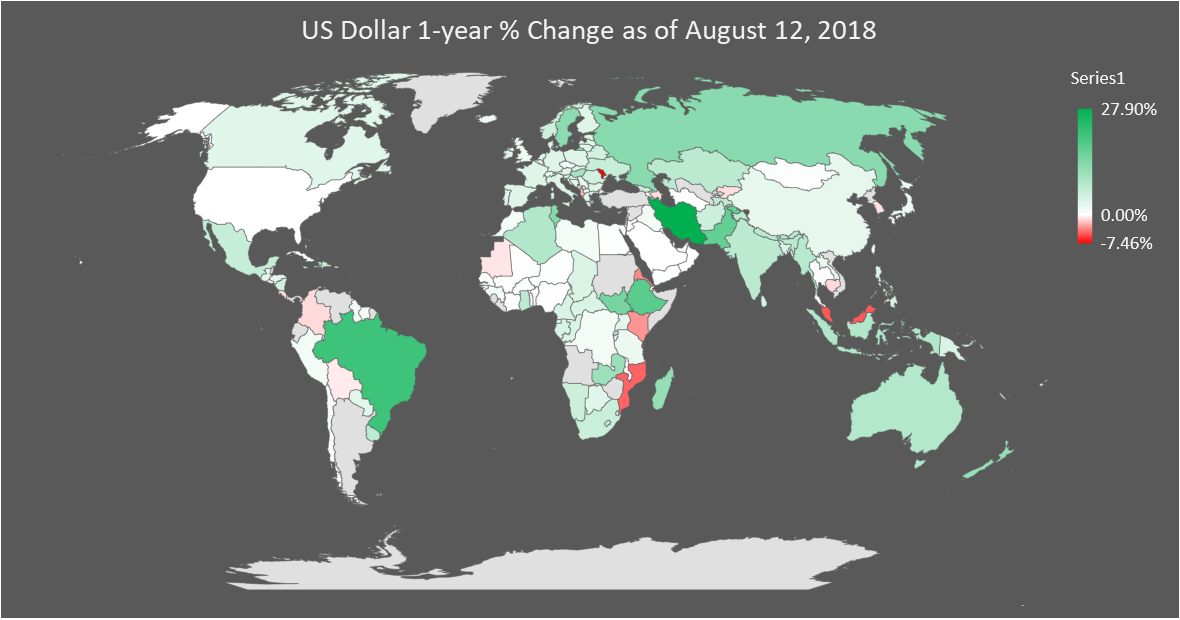

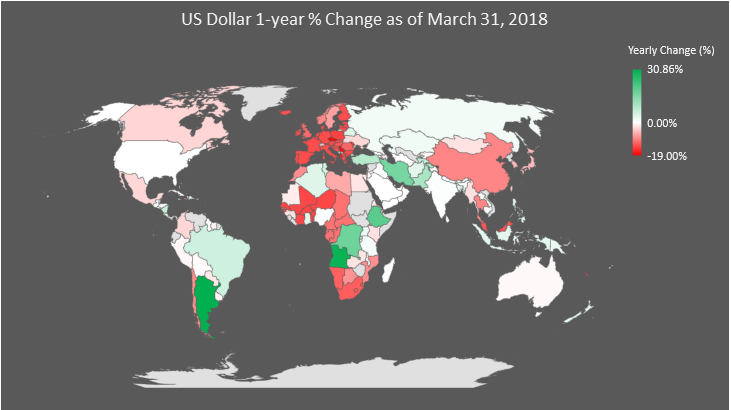

We wrote that when global synchronised growth begins to end the U.S. dollar strengthens, investors run away from emerging markets, interest rates continue to rise to tame inflation and bad debt becomes an issue. All of this is happening now. The US dollar index (DXY) which is a trade-weighted index is up around 6.5% this year. And the dollar is increasing against most currencies, compare that to the performance six months ago,

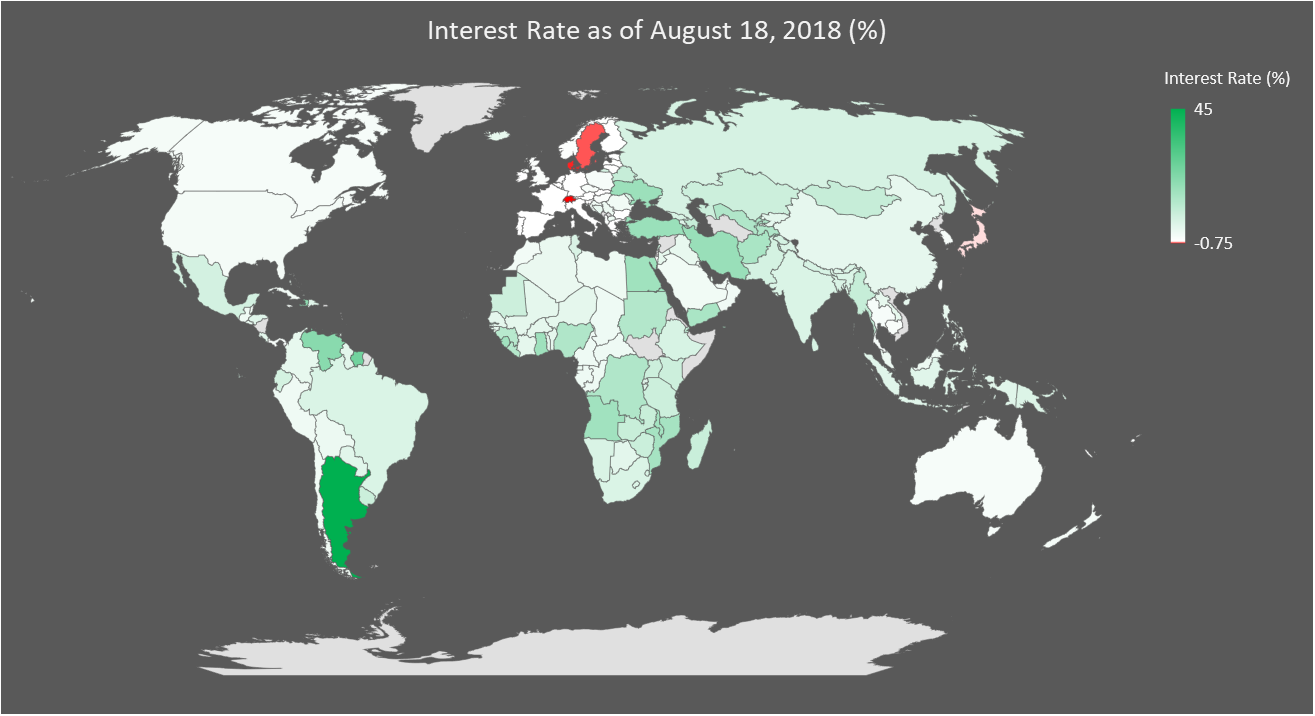

The Federal Reserve’s two interest-rate hikes of 2018 have squeezed the dollar funding for emerging markets.

Within the G-7 or for that matter the G-20, the United States is only economy that is expected to see an acceleration in growth this year. Growth in the second half of 2018 is estimated at 3.2%, while that would be slower than the second quarter’s 4.1% pace, it would be enough to make the entire year’s performance the best since 2005, when GDP climbed 3.5%.

The rest of the global economy is feeling the pain

Emerging economies like Turkey and Brazil are facing an unprecedented crisis with their currencies. Argentina and Venezuela have raised rates to fight record breaking (hyper) inflation. China credit growth is falling. German factory orders are the lowest in years. Italian bond yields are rising with significant cost implications for servicing its debt. A combination of higher oil prices and stronger dollar has put the aviation industry in India in record losses. India is the fastest growing aviation market in the world with the largest outstanding order book for new aircraft. Elsewhere political crisis in South Africa and sanctions in Russia are causing a slow down there. Saudi Arabian unemployment is at an 18-year high. And then there is the uncertainty of trade tariffs and of the United Kingdom’s departure (Brexit) from the European Union.

Americans and American corporates are benefiting from tax cuts, a strong job market and rising household wealth given a buoyant stock market and rising property prices. There is the issue of a growing government budget deficit, yet there is no arguing that the U.S. economy is extremely strong.

In many ways, making the American economy great again isn’t great news for the rest of the world.