2019 was a historic year for many reasons. Record returns on stocks, bonds and other assets. 2019 – this time it was different. And 2020? This time it will again be different, very different.

Highlights from August 2019 – Big Swings in Stock Markets; The Yield Curve inversion and the Bond market yield collapse

The Stock Markets made big swings in August thanks to trade tensions heating (and then cooling) between the U.S. and China and the yield curve inverting.

Is the U.S. yield curve inversion an economic warning?

So, longer-term U.S. government bonds are now yielding lower than short-term bonds. Is this really a big economic warning?

Continue reading “Is the U.S. yield curve inversion an economic warning?”

Interest rates are headed downwards as global bond yields are falling quickly again

At the start of 2019 we wrote that 2019 will be a year that will be different with interest rate hikes slowing or interest rates even reversing.

Earlier this month the European Central Bank said interest rates would remain at record lows at least until the end of the year and then last week this was followed by the Federal Reserve saying that it does not expect an interest rate rise for the U.S. for the rest of 2019.

Government bond yields have been falling globally

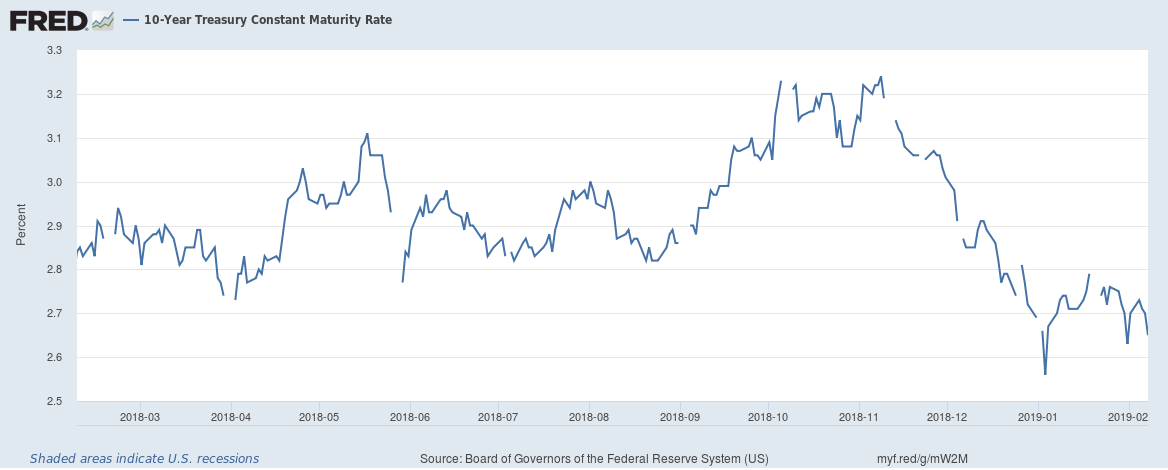

We haven’t written about government bond yields recently but there has been a lot of action in the bond market. Government bond yields have been falling globally which are an indicator that markets are expecting stagnant or falling interest rates. 10-year government bonds are the most tracked and traded and yields have mostly fallen compared to a year ago.

The U.S. 10-year Treasury bond yield is now at 2.65%, down 19 bps from a year ago.

Continue reading “Government bond yields have been falling globally”

Those three U.S. recession indicators – how near or far are those from being invoked? End of 2018 edition

We wrote about three slightly different U.S. recession indicators that have been predictive of the past few recessions and have been tracking how near or far are those from being invoked, here’s where we are at the end of 2018,

Red everywhere – Here’s how Equity, Commodity and Bond Markets have performed over the past year

Here is the 1-year change for Equity, Commodity and Bond Markets (all as of end of day December 13, 2018),

Equities

Red almost everywhere with China down 20%, Germany down 16%, South Korea down 15%, U.S. almost flat (Dow Jones and S & P 500 flat with NASDAQ 100 up 6%) and star performer Brazil up 21%

The yield curve inversion plus why banks and banking stocks are impacted by it

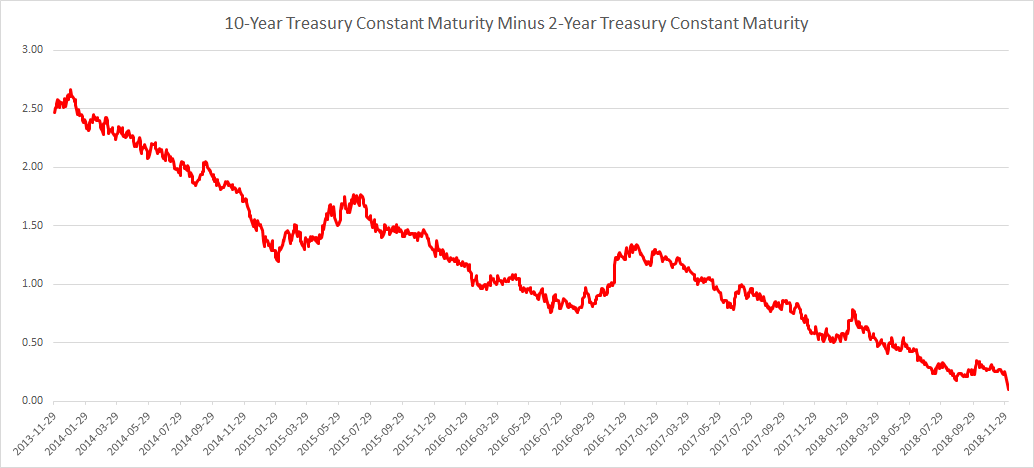

The U.S. 10-year Treasury constant maturity yield minus the 2-year Treasury constant maturity yield spread has been a good indicator of past recessions. Yield curve inversion which happens when the spread turns negative and has preceded the last seven straight recessions. The 10-year Treasury constant maturity yield minus the 2-year Treasury constant maturity yield is the lowest since the last recession at only 10 bps.

Continue reading “The yield curve inversion plus why banks and banking stocks are impacted by it”

Here’s why the Federal Reserve increasing interest rates could be a problem

The reasons aren’t what you think …

Continue reading “Here’s why the Federal Reserve increasing interest rates could be a problem”