We wrote about three slightly different U.S. recession indicators that have been predictive of the past few recessions and have been tracking how near or far are those from being invoked, here’s where we are in September 2018,

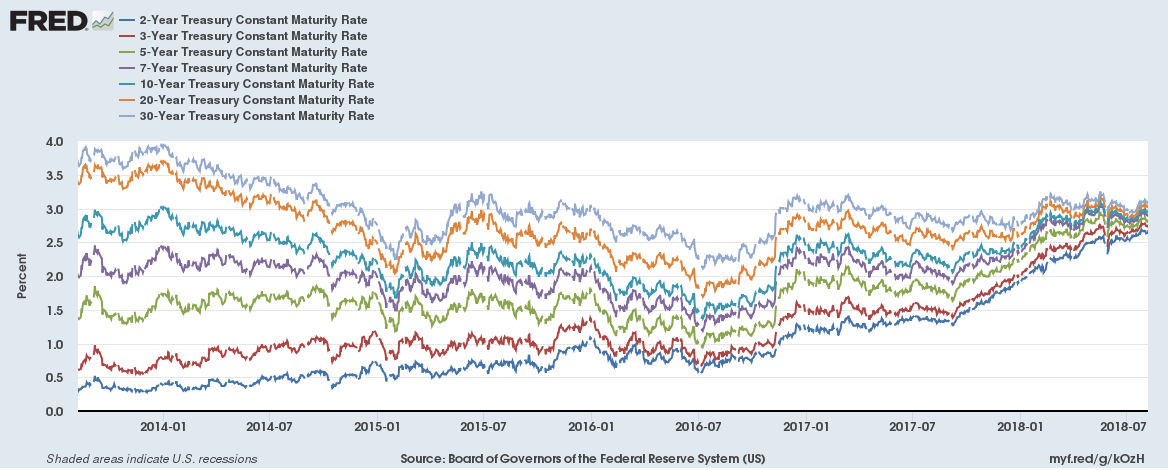

The great U.S. Government bond yield convergence chart

U.S. 2-year, 3-year, 5-year, 7-year, 10-year, 20-year and 30-year yields are all converging. Looks like a beautiful chart, just one thing …

Continue reading “The great U.S. Government bond yield convergence chart”

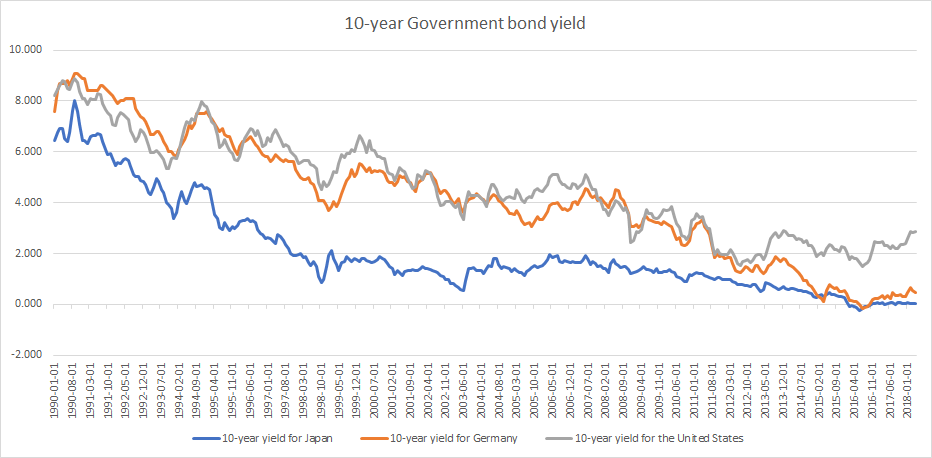

Bond yields globally have fallen over the past year other than in the U.S., Canada and Emerging Markets

We haven’t written about bond yields for some time. Government bond yields have largely been falling despite Central Banks announcing reductions or end to their bond buying programmes.

The only notable countries where yields are still up over the past year are the United States, Canada, Italy and Emerging Markets.

It wouldn’t appear that the market is anticipating interest rate rises in the short term. We will write about that in a few days but in the meanwhile here are 10-year government bond yields as of 14th July 2018 (figure in brackets indicate absolute 1-year change),

Something strange is happening in the global economy right now

Everyone seems to be focussing on the equity markets recently, but equity markets haven’t really moved much over the past one month. Over the past month, major equity markets have lost between 1.5% to 4%.

The real action is in bonds and commodities. And trade seems to be flourishing too.

10-year government bond yields of major economies are lower by 5% to 40% (in relative terms not absolute terms) in just the past month. 10-year German bonds are down 12 bps over the past month. That wouldn’t sound much but they are down 28% from 42 bps to 30 bps. U.K. yields are down 8%, U.S. yields down 5%, Japanese yields down 40%. Even Greek yields are down 20% over just the past month. Does the market anticipate a pause in interest rate rises? It would appear so.

Continue reading “Something strange is happening in the global economy right now”

Those three U.S. recession indicators – how near or far are those from being invoked?

We wrote recently about three slightly different U.S. recession indicators that have been predictive of the past few recessions. How near or far are those from being invoked?

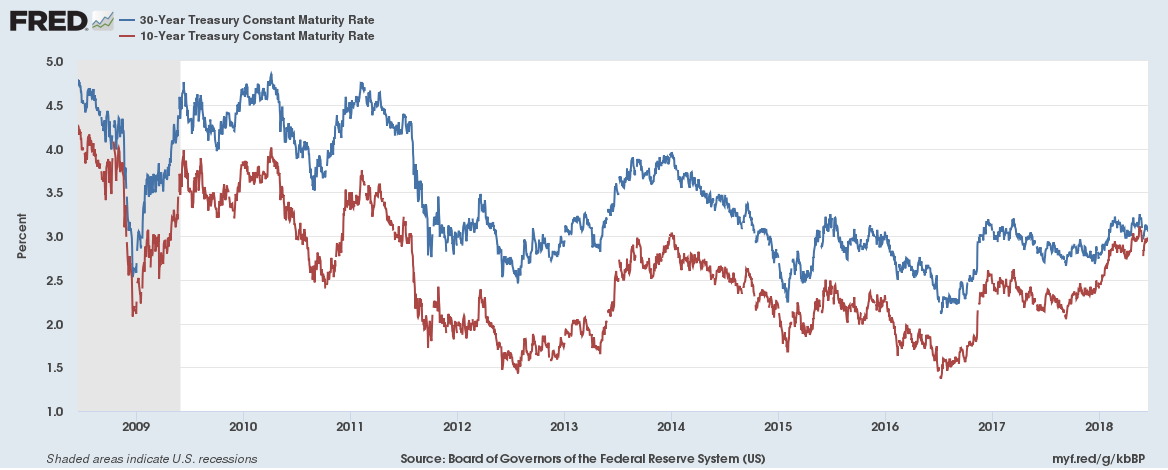

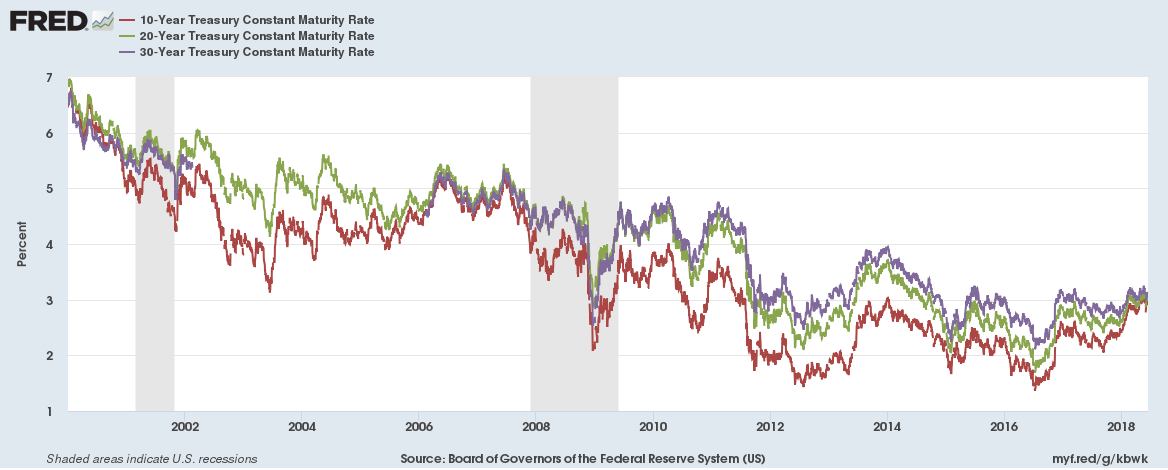

30-year and 10-year Treasury yield

The 10-year Treasury yield has been greater than the 30-year Treasury yield three to six months before each of the past four. Currently the difference is just 19 bps.

And the 30-year, 20-year and 10-year Treasury yields have almost converged three to six months before each of the past five recessions as well. The 20-year yield already 3 bps higher than the 30-year yield, they have been converging for the past two weeks.

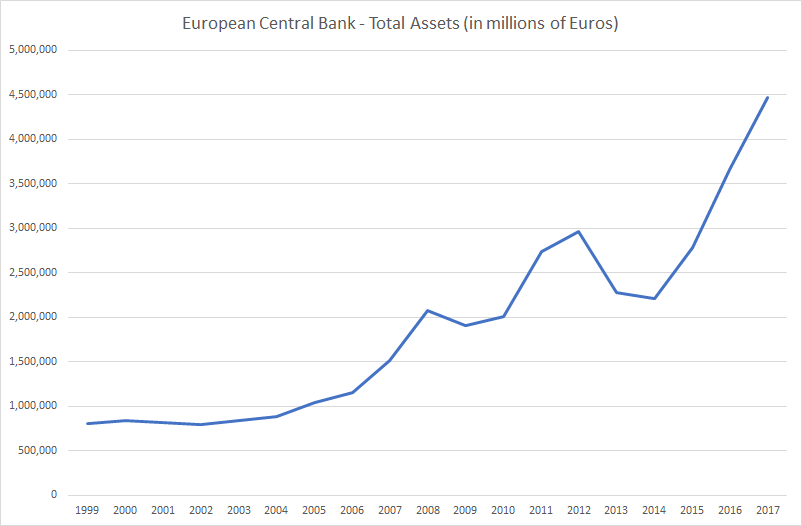

This is what is likely to happen when the European Central Bank ends bond buying

The European Central Bank (ECB) announced on Wednesday that it will halve its bond buys to 15 billion Euros (from the current 30 billion Euros) a month from October then shut the programme at the end of the year.

ECB’s balance sheet has increased by 2 trillion Euros since 2015 when it announced its bond buying programme. 2-year yields for most of the Eurozone countries are currently negative and 10-year yields in most cases are lower than that of the United States. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Continue reading “This is what is likely to happen when the European Central Bank ends bond buying”

Three slightly different US recession indicators

Here are three slightly different US recession indicators that have been predictive of the past few recessions,

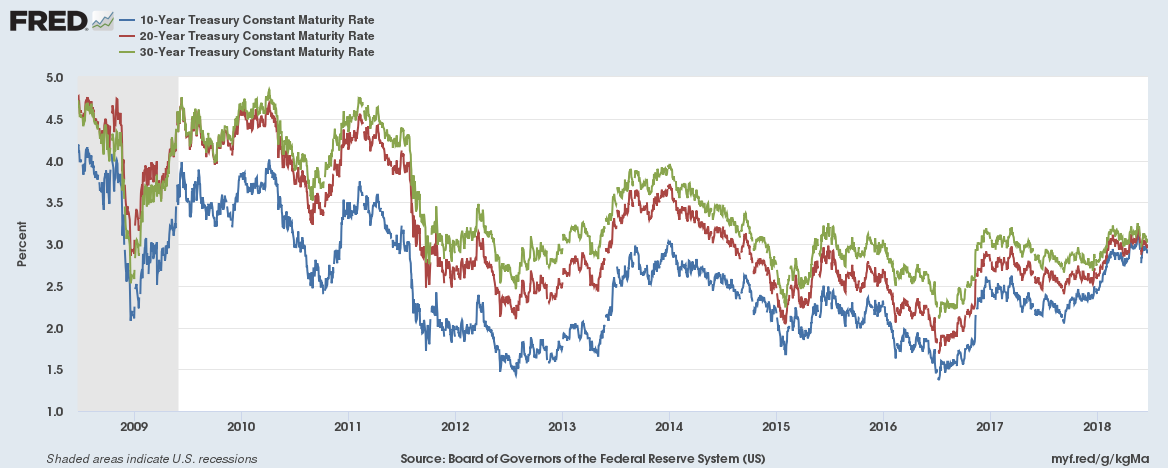

30-year and 10-year Treasury yield

The 10-year Treasury yield has been greater than the 30-year Treasury yield three to six months before each of the past four recessions. Graph below for the past decade, the shaded areas indicate recessions,

And the 30-year, 20-year and 10-year Treasury yields have almost converged three to six months before each of the past five recessions as well. Graph below, the shaded areas indicate recessions,

Continue reading “Three slightly different US recession indicators”

Do economic fundamentals matter anymore? Part 3 of 3

Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world .

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

Continue reading “Do economic fundamentals matter anymore? Part 3 of 3”

Weekly Overview: Investors seek safety as bond yields fall; Crude Oil down 5%; Baltic Dry Index down 15%; Bank of England Governor prepared to cut or freeze interest rates; US E-Commerce Retail sales soaring

Investors seek safety

What a difference a week makes, just last week everyone was talking about soaring bond yields. Investors are now seeking safety with developed economies bond yields falling significantly during the week.

Here are some 10-year bond yields, figures in brackets indicate change during the week.

US 2.93% (-15 bps)

UK 1.32% (-21 bps)

Germany 0.41% (-17 bps)

Canada 2.35% (-14 bps)

Switzerland 0.00% (-13 bps)

Netherlands 0.59%% (-15 bps)

Australia 2.79% (-13 bps) Continue reading “Weekly Overview: Investors seek safety as bond yields fall; Crude Oil down 5%; Baltic Dry Index down 15%; Bank of England Governor prepared to cut or freeze interest rates; US E-Commerce Retail sales soaring”

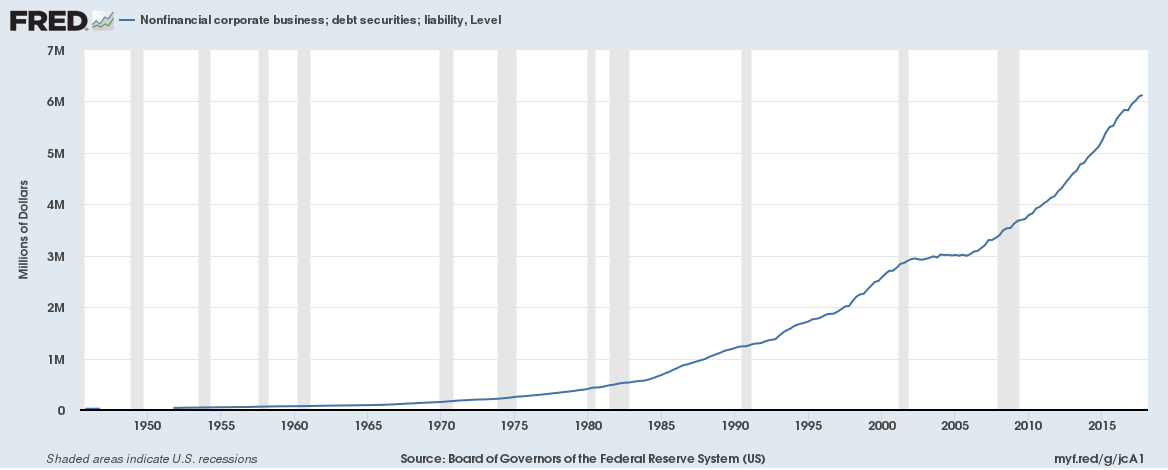

Corporate debt is soaring in the U.S. even as corporate bond yields are rising

Corporations (non-financial) in the United States have $6.2 trillion in debt and debt has doubled in the past decade,

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”