Investors seek safety

What a difference a week makes, just last week everyone was talking about soaring bond yields. Investors are now seeking safety with developed economies bond yields falling significantly during the week.

Here are some 10-year bond yields, figures in brackets indicate change during the week.

US 2.93% (-15 bps)

UK 1.32% (-21 bps)

Germany 0.41% (-17 bps)

Canada 2.35% (-14 bps)

Switzerland 0.00% (-13 bps)

Netherlands 0.59%% (-15 bps)

Australia 2.79% (-13 bps)

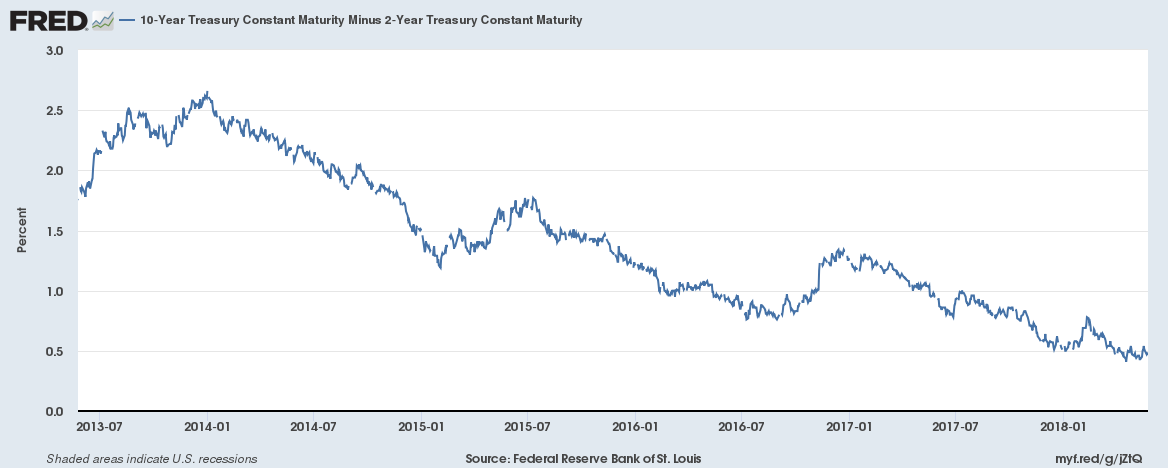

And, the falling U.S. 10-year yield means that the 10-year Treasury constant maturity yield minus 2-year Treasury constant maturity yield is now just 48 bps. Yield curve inversion which happens when the spread turns negative has preceded the last seven straight recessions.

Crude oil price falls 5% during the week

Crude oil fell 5% during the week to $67.89 on news that OPEC and Russia are considering easing output caps. Just last week the national average for regular gasoline in the United States had risen to nearly $3 a gallon, the highest level since 2014.

Baltic Dry Index falls 15% during the week

The Baltic Dry Index which is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator fell 15% during the week. It was the biggest fall this year and geopolitical risks have played a major part in the sentiment.

Bank of England governor on interest rates

Bank of England governor Mark Carney has said that the Bank would be prepared to cut interest rates or freeze them in order to support jobs and economic growth should Britain be plunged into a “disorderly” Brexit.

This after saying earlier in the week that the Brexit vote has left households £900 worse off. He claims the vote to leave the European Union had lowered growth by “up to 2%”.

Giving evidence to the Treasury Committee, Mr Carney said: “Real household incomes are about £900 lower than we forecast in 2016. The question is why and what drove that difference. Some of it is ascribed to Brexit.”

The British Pound (£) has fallen 5% against the U.S. dollar over the past month and interest rate hike expectations are very low for at least the next 5 months.

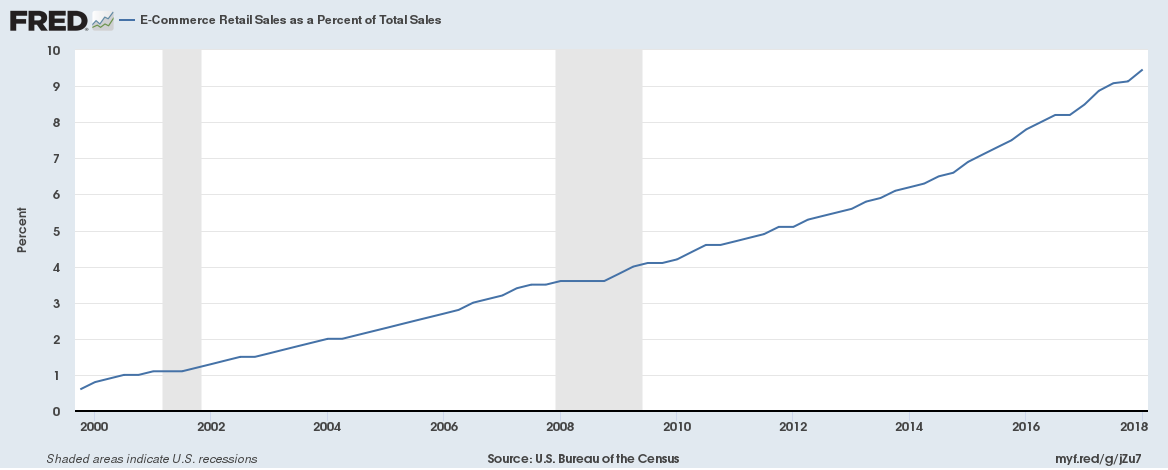

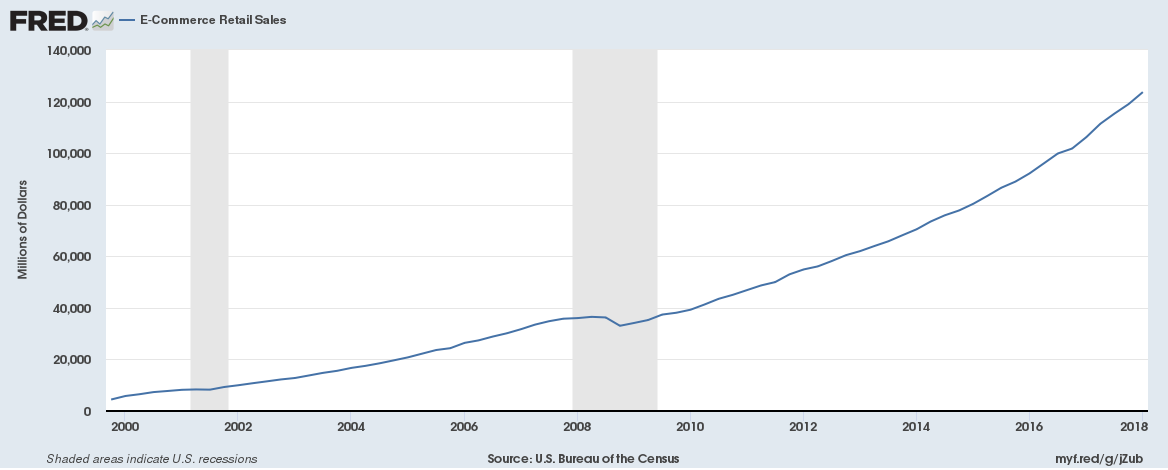

US E-Commerce Retail Sales

US E-Commerce Retail sales as a percent of total sales are soaring at the quickest pace ever as retail store closures are accelerating.