Is the global economy slowing? We look at four charts – lumber prices, iron ore prices, aluminium prices and the Baltic Dry index.

Continue reading “Is the Global Economy Slowing? Four Commodity Charts”

Why wouldn’t it be?

Is the global economy slowing? We look at four charts – lumber prices, iron ore prices, aluminium prices and the Baltic Dry index.

Continue reading “Is the Global Economy Slowing? Four Commodity Charts”

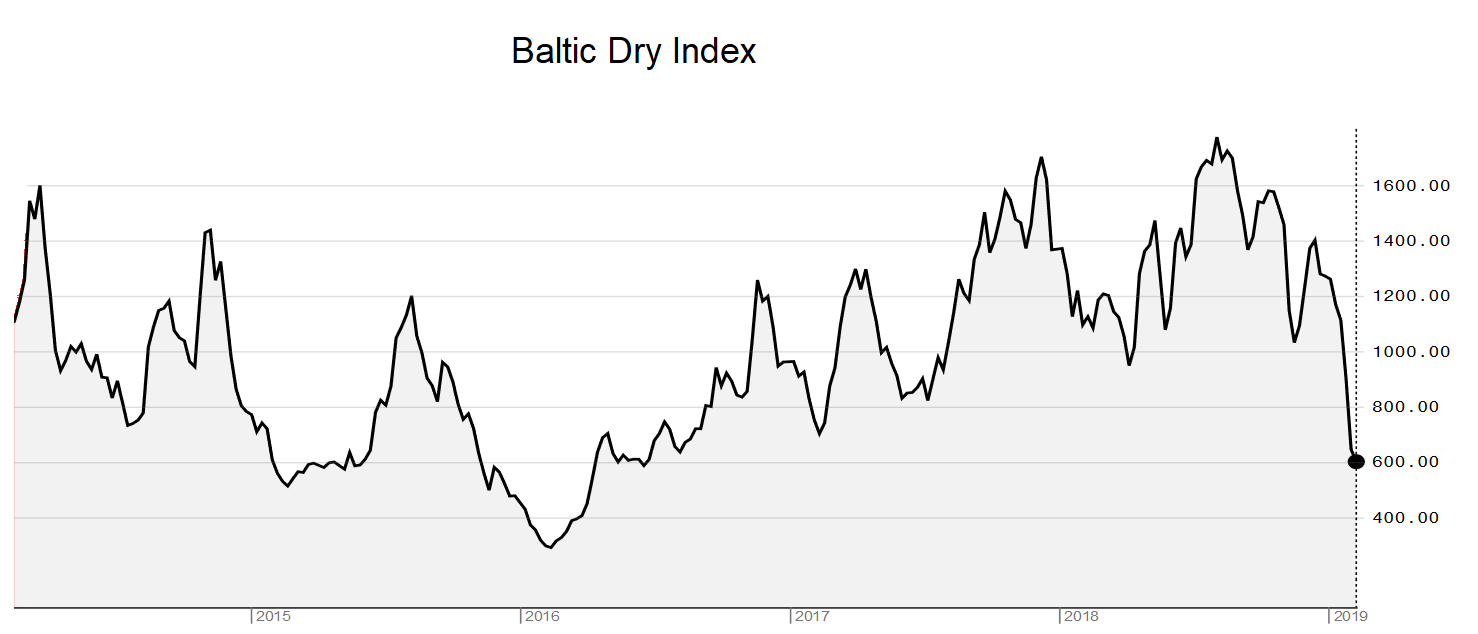

The Baltic Dry Index is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator. The index is based on a daily survey of agents all over the world.

The Baltic Dry Index is down 48% over the past month (and down 47% over the past year). Is this an indicator of more trouble around global growth?

Continue reading “The Baltic Dry Index is down 48% over the past month”

We will write a lot more about the economy over the weekend but in the meanwhile here are two charts,

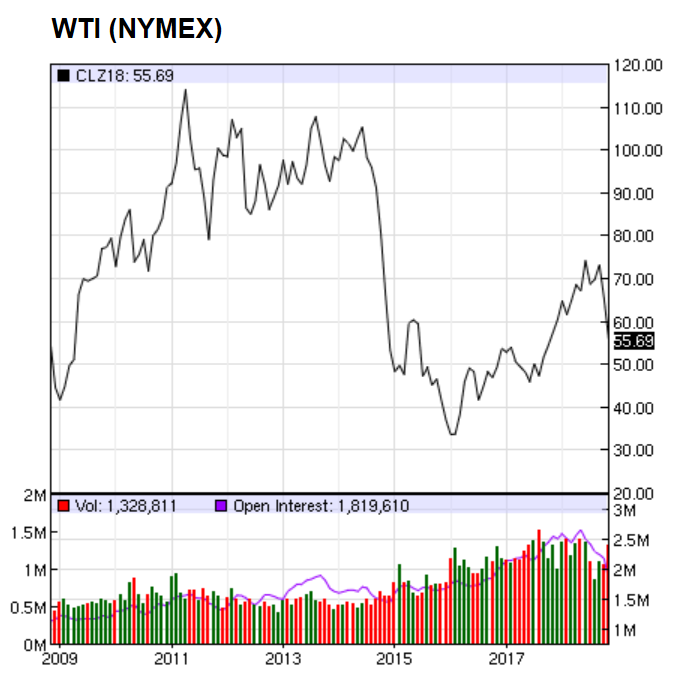

U.S. crude has continued its longest losing streak since it began trading in New York more than three decades ago having plunged more than $20 a barrel since the start of October when it hit a 4-year high. Oil prices fell 8% today. From shortage fears to over-supply concerns …

Continue reading “Just two charts – Oil and the Baltic Dry Index”

Everyone seems to be focussing on the equity markets recently, but equity markets haven’t really moved much over the past one month. Over the past month, major equity markets have lost between 1.5% to 4%.

The real action is in bonds and commodities. And trade seems to be flourishing too.

10-year government bond yields of major economies are lower by 5% to 40% (in relative terms not absolute terms) in just the past month. 10-year German bonds are down 12 bps over the past month. That wouldn’t sound much but they are down 28% from 42 bps to 30 bps. U.K. yields are down 8%, U.S. yields down 5%, Japanese yields down 40%. Even Greek yields are down 20% over just the past month. Does the market anticipate a pause in interest rate rises? It would appear so.

Continue reading “Something strange is happening in the global economy right now”

Investors seek safety

What a difference a week makes, just last week everyone was talking about soaring bond yields. Investors are now seeking safety with developed economies bond yields falling significantly during the week.

Here are some 10-year bond yields, figures in brackets indicate change during the week.

US 2.93% (-15 bps)

UK 1.32% (-21 bps)

Germany 0.41% (-17 bps)

Canada 2.35% (-14 bps)

Switzerland 0.00% (-13 bps)

Netherlands 0.59%% (-15 bps)

Australia 2.79% (-13 bps) Continue reading “Weekly Overview: Investors seek safety as bond yields fall; Crude Oil down 5%; Baltic Dry Index down 15%; Bank of England Governor prepared to cut or freeze interest rates; US E-Commerce Retail sales soaring”