The Baltic Dry Index is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator. The index is based on a daily survey of agents all over the world.

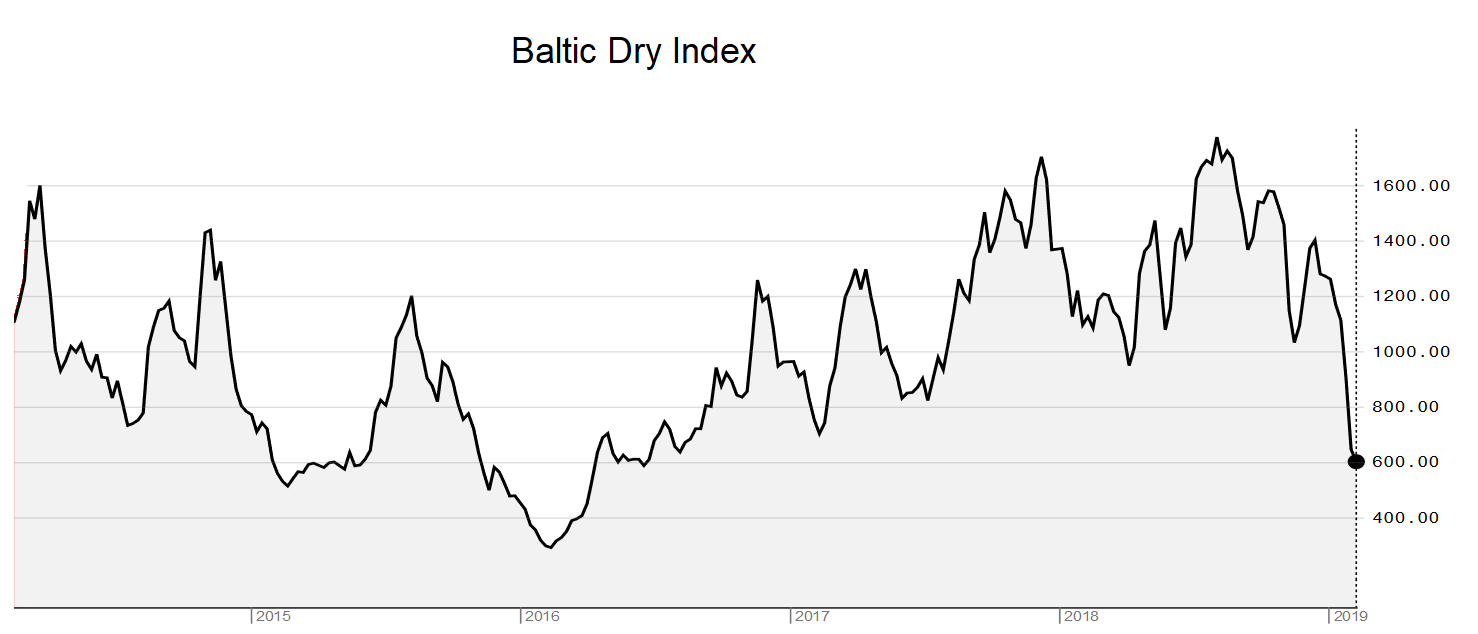

The Baltic Dry Index is down 48% over the past month (and down 47% over the past year). Is this an indicator of more trouble around global growth?

The Baltic Dry Index includes three components – Capesizes, Panamaxes and Supramaxes. These are based on ship sizes,

- Capesize ships are the largest ships with 100,000+ tonnage. They are generally used for transporting industrial goods and minerals such as iron ore. This component of the index has fallen the least thanks to iron ore demand soaring in the past month with prices rising 27% over the past month.

- Panamax ships are medium sized ships which are usually used to transport food grains. Food grain demand and prices have suffered due to the ongoing trade tensions between the U.S. and China.

- Supramaxes are the smallest ships used for transporting a variety of goods.

The Baltic Dry Index hit a peak on the 20th of May 2008, when the index hit 11,793. The lowest level ever reached was on the 10th of February 2016, when the index dropped to 290 points. The index is currently at 595, a 32-month low. We will write about the state of the global economy over the weekend, but the Baltic Dry Index meltdown is very interesting.