Is the global economy slowing? We look at four charts – lumber prices, iron ore prices, aluminium prices and the Baltic Dry index.

Continue reading “Is the Global Economy Slowing? Four Commodity Charts”

Why wouldn’t it be?

Is the global economy slowing? We look at four charts – lumber prices, iron ore prices, aluminium prices and the Baltic Dry index.

Continue reading “Is the Global Economy Slowing? Four Commodity Charts”

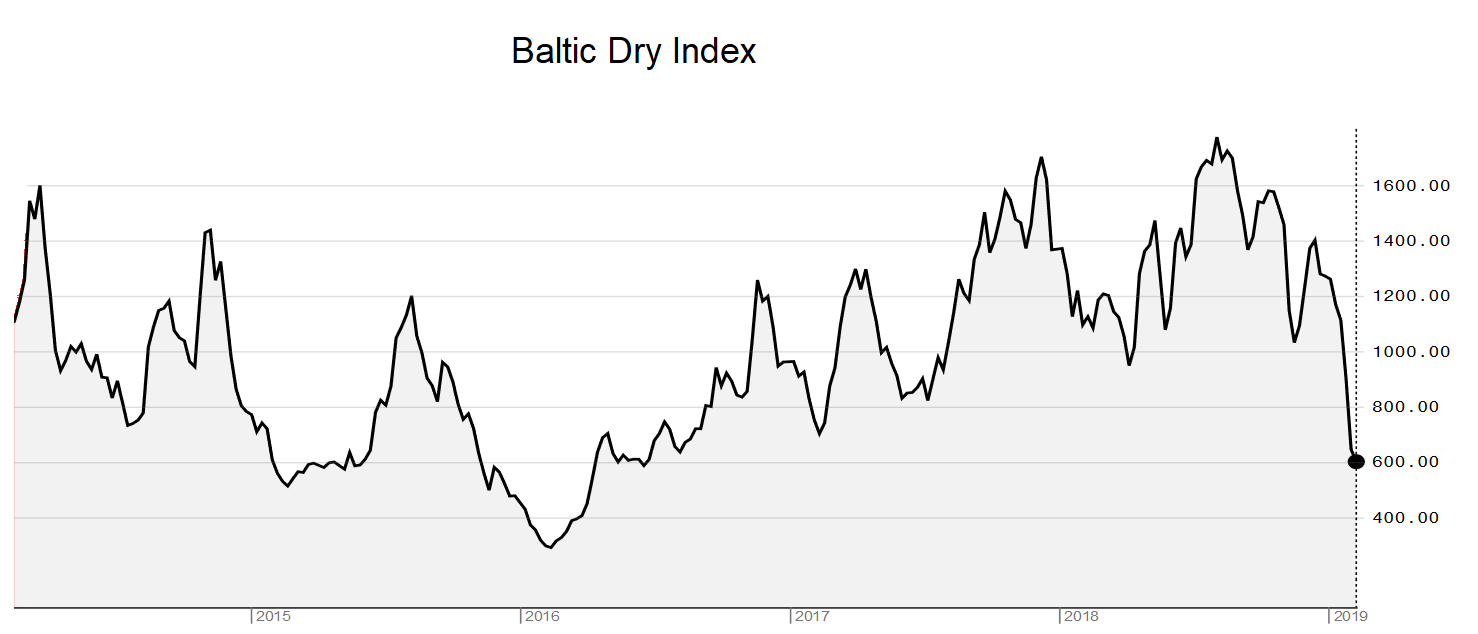

The Baltic Dry Index is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator. The index is based on a daily survey of agents all over the world.

The Baltic Dry Index is down 48% over the past month (and down 47% over the past year). Is this an indicator of more trouble around global growth?

Continue reading “The Baltic Dry Index is down 48% over the past month”

Here is the 1-year change for Equity, Commodity and Bond Markets (all as of end of day December 13, 2018),

Equities

Red almost everywhere with China down 20%, Germany down 16%, South Korea down 15%, U.S. almost flat (Dow Jones and S & P 500 flat with NASDAQ 100 up 6%) and star performer Brazil up 21%

We will write a lot more about the economy over the weekend but in the meanwhile here are two charts,

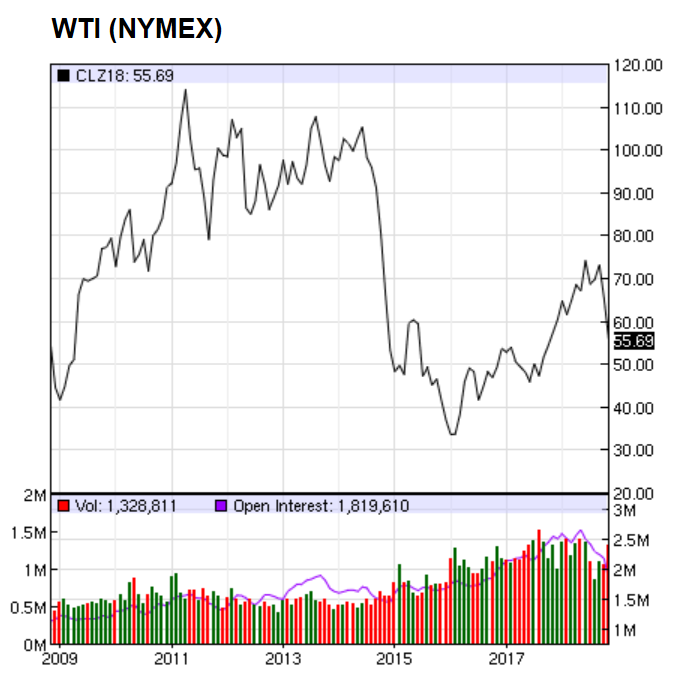

U.S. crude has continued its longest losing streak since it began trading in New York more than three decades ago having plunged more than $20 a barrel since the start of October when it hit a 4-year high. Oil prices fell 8% today. From shortage fears to over-supply concerns …

Continue reading “Just two charts – Oil and the Baltic Dry Index”

Has Gold, U.S. Equities or U.S. Property performed the best? We compare the performance of each and the results are surprising.

Everyone seems to be focussing on the equity markets recently, but equity markets haven’t really moved much over the past one month. Over the past month, major equity markets have lost between 1.5% to 4%.

The real action is in bonds and commodities. And trade seems to be flourishing too.

10-year government bond yields of major economies are lower by 5% to 40% (in relative terms not absolute terms) in just the past month. 10-year German bonds are down 12 bps over the past month. That wouldn’t sound much but they are down 28% from 42 bps to 30 bps. U.K. yields are down 8%, U.S. yields down 5%, Japanese yields down 40%. Even Greek yields are down 20% over just the past month. Does the market anticipate a pause in interest rate rises? It would appear so.

Continue reading “Something strange is happening in the global economy right now”

Investors seek safety

What a difference a week makes, just last week everyone was talking about soaring bond yields. Investors are now seeking safety with developed economies bond yields falling significantly during the week.

Here are some 10-year bond yields, figures in brackets indicate change during the week.

US 2.93% (-15 bps)

UK 1.32% (-21 bps)

Germany 0.41% (-17 bps)

Canada 2.35% (-14 bps)

Switzerland 0.00% (-13 bps)

Netherlands 0.59%% (-15 bps)

Australia 2.79% (-13 bps) Continue reading “Weekly Overview: Investors seek safety as bond yields fall; Crude Oil down 5%; Baltic Dry Index down 15%; Bank of England Governor prepared to cut or freeze interest rates; US E-Commerce Retail sales soaring”

Emerging Markets are being routed with rising oil and a soaring US dollar

Here is the performance of the US dollar against emerging market currencies (figures in brackets are 1-month % change),

USD/MXN – Mexico 19.9450 (+8.17%)

USD/INR – India 67.9850 (+3.23%)

USD/TRY – Turkey 4.4894 (+10.07%)

USD/BRL – Brazil 3.7375 (+10.33%)

USD/ZAR – South Africa 12.7550 (+6.71%) Continue reading “Weekly Overview: Emerging Market Rout; New Italian Government; Japan GDP; Oil surge continues”

Baltic Dry Index

The Baltic Dry Index is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator.

Over the past month, it has zoomed 48%. It is up 45% over the past year and is up 8% since the start of the year. This despite weaker US, UK and France Q1 2018 GDP growth. The Baltic Dry index generally falls in the first quarter on back of lower trading activity due to the Chinese New Year but this time it hadn’t recovered until very recently.

Here is a chart of the index over the past month,

Oil Prices

The price of crude oil crossed $70 per barrel today, the highest since November 2014.

US firm ConocoPhillips has taken over oil inventories and terminals of Venezuelan state-owned PDVSA under court orders to enforce a $2 billion arbitration award by the International Chamber of Commerce. Further, US President Donald Trump said he’d announce his decision on the Iran nuclear deal on Tuesday. Both developments contributed to soaring oil prices. Continue reading “Oil highest since November 2014; Dollar index hits its highest level in 2018; Warren Buffett and Bill Gates on Cryptocurrencies”