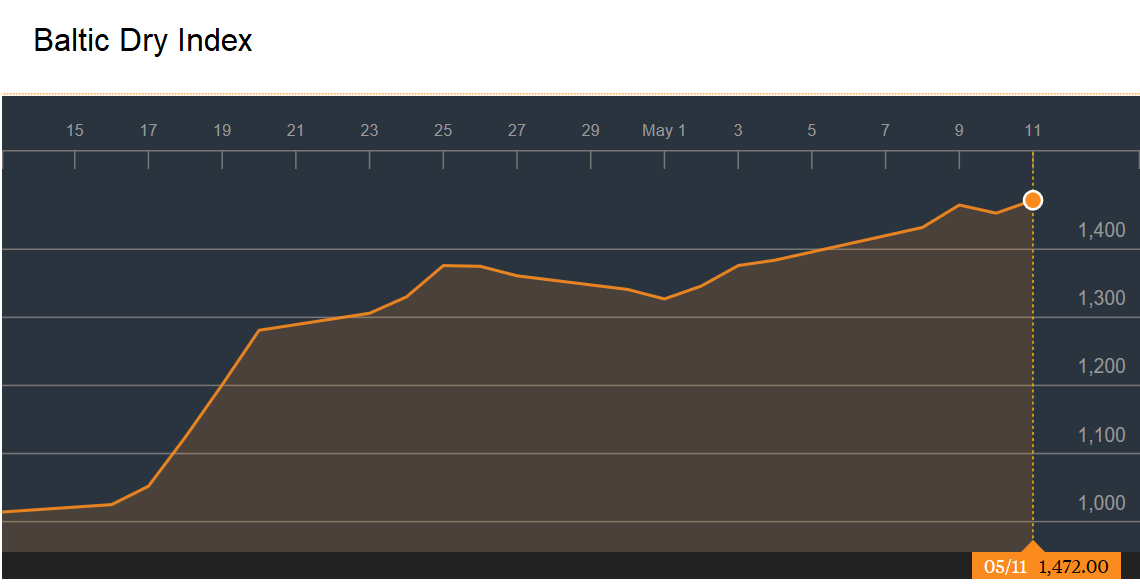

Baltic Dry Index

The Baltic Dry Index is a trade indicator that measures shipping prices of major raw materials and is often seen as a global growth indicator.

Over the past month, it has zoomed 48%. It is up 45% over the past year and is up 8% since the start of the year. This despite weaker US, UK and France Q1 2018 GDP growth. The Baltic Dry index generally falls in the first quarter on back of lower trading activity due to the Chinese New Year but this time it hadn’t recovered until very recently.

Here is a chart of the index over the past month,

Argentina seeks IMF bailout

Argentina is reportedly seeking a financing deal bailout from the International Monetary Fund (IMF) worth $30bn. Argentina severed ties with the IMF in 2006 after paying back a bailout loan. Argentinians generally have a bad opinion of the IMF and many blame its policies of extreme austerity for the economic crisis of 2001.

We reported last week that Argentinian interest rates were hiked to 40% recently.

Here is the recent interest rate history,

April 26: 27.25%

April 27: +3% to 30.25%

May 3: +3% to 33.25%

May 4: +6.75% to 40.00%

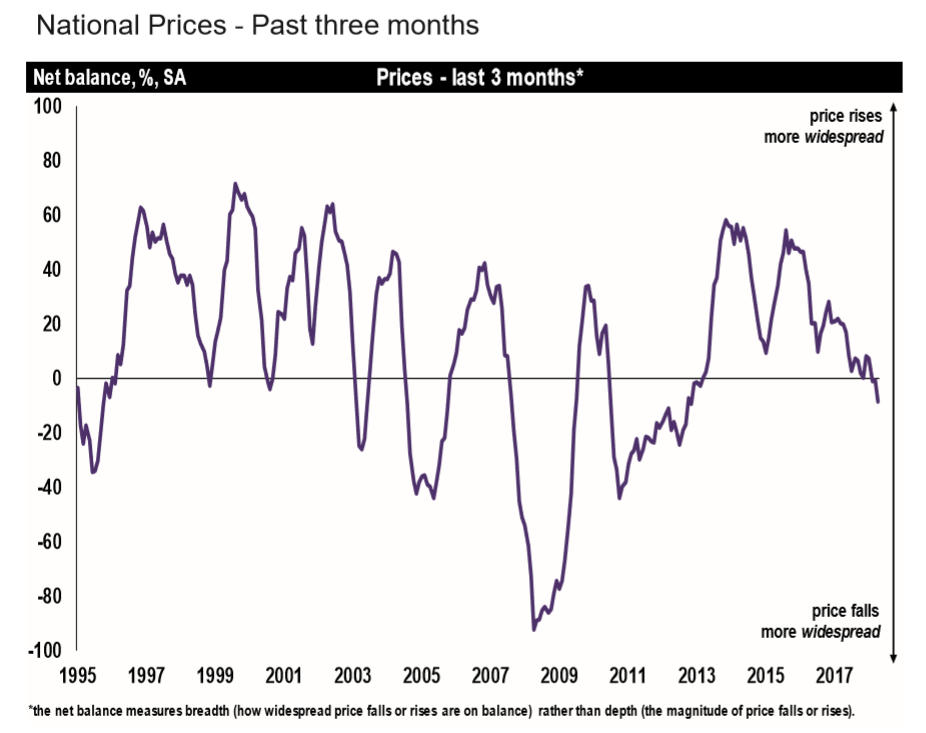

UK House Prices

The Halifax House Price Index that tracks UK house prices reported its biggest monthly fall (of 3.1%) for nearly eight years during April. Halifax is part of the Lloyds Banking Group, the largest mortgage lender in the UK. They also reported lower mortgage approvals and sales this year till date.

Meanwhile, the national Royal Institution of Chartered Surveyors (RICS) price balance slipped to -8% in the latest survey, the most negative figure since November 2012. They reported a massive -65% negative balance for the London Metropolitan area.

Brazil Bond Yields

Brazilian 10-year bond yield topped 10% during the week. The yield at the end of Friday was 10.02%, up 37 bps just during the week.

Coal Prices

Coal prices are soaring again. It is up 8% over the past month and up 36% over the past year.