From the Federal Reserve’s definition of Money Velocity and Money Supply,

Money Velocity

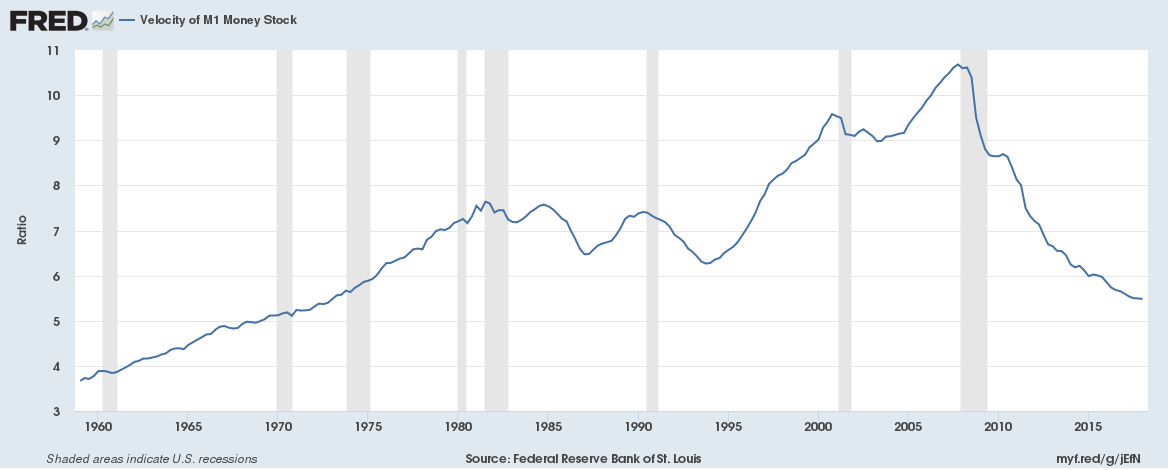

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest.

Money Supply

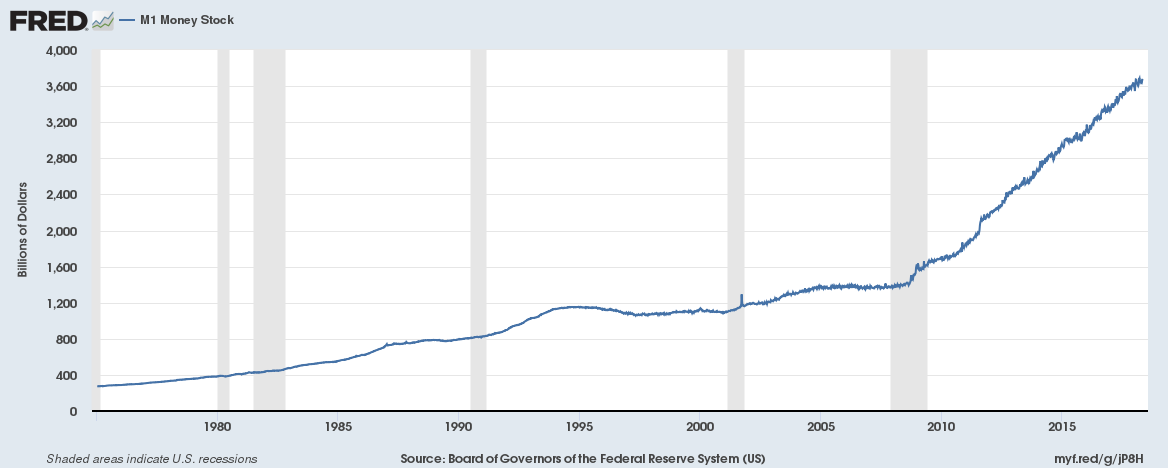

M1 is the money supply of currency in circulation (notes and coins, traveler’s checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

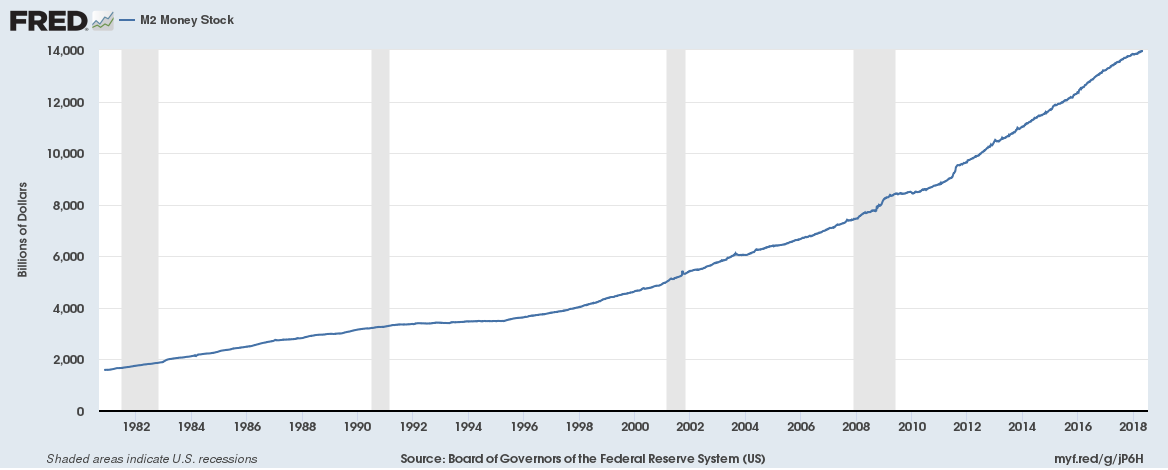

The broader M2 component includes M1 in addition to saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals. Comparing the velocities of M1 and M2 provides some insight into how quickly the economy is spending and how quickly it is saving.

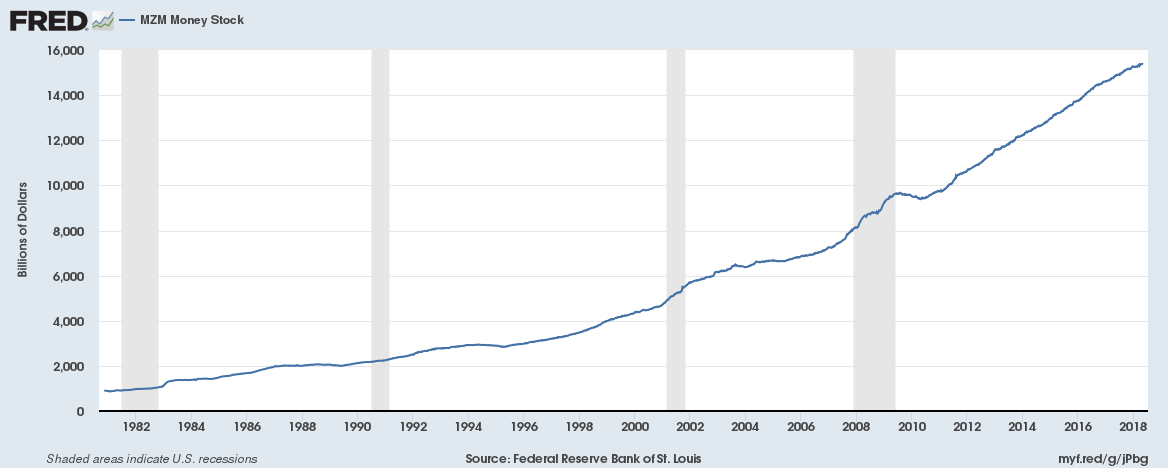

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveler’s checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy.

The Equation of Exchange

MV=PQ

Money Supply (M) * Money Velocity (V) = Price level (P) * Real economic output (Q)

Alternatively, Money Supply * Money Velocity = Nominal GDP

Analysis

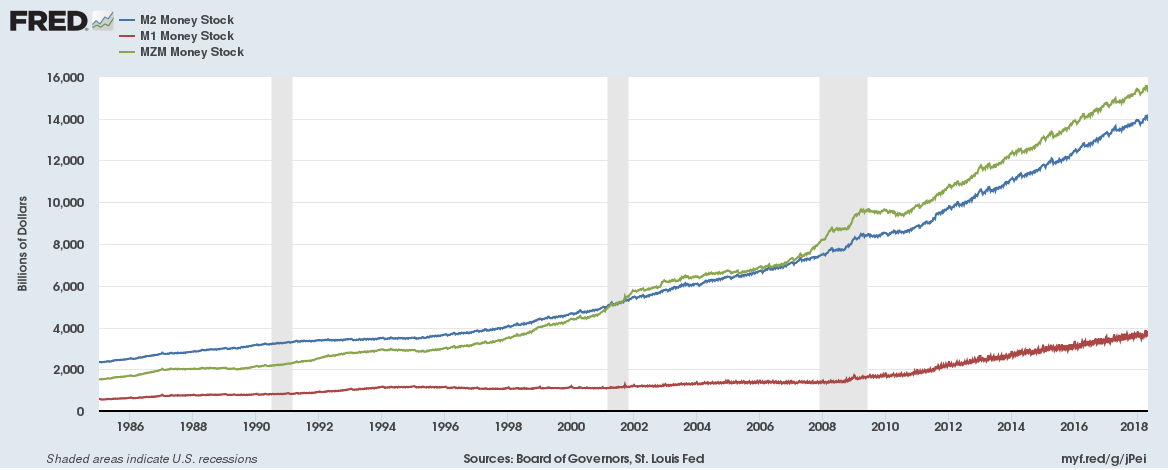

M1 money stock is currently at $3.78 trillion (up from $1.39 trillion in Q2 2008)

M2 money stock is currently at $13.96 trillion (up from $7.67 trillion in Q2 2008)

MZM money stock is currently at $15.36 trillion (up from $8.73 trillion in Q2 2008)

M1 money velocity is currently at 5.48, almost the lowest on record

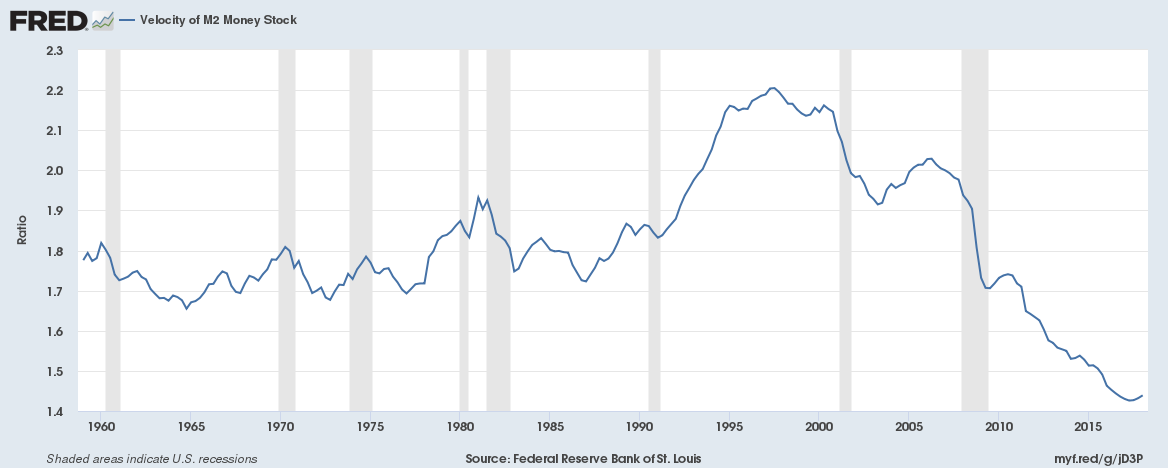

M2 money velocity is currently at 1.44, almost the lowest on record

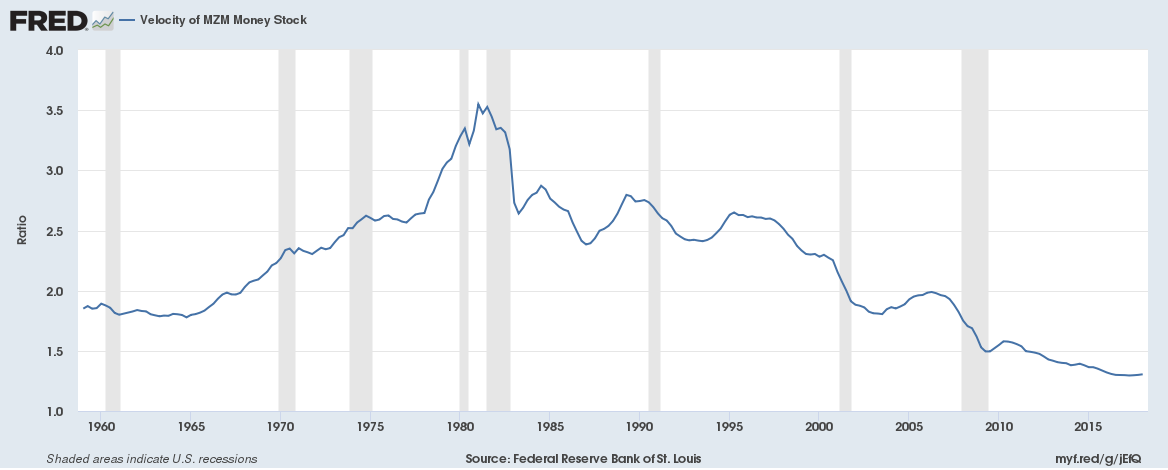

MZM money velocity is currently at 1.31, almost the lowest on record

Years of QE has caused money supply to grow at an unprecedented pace and there is ample liquidity in the financial system.

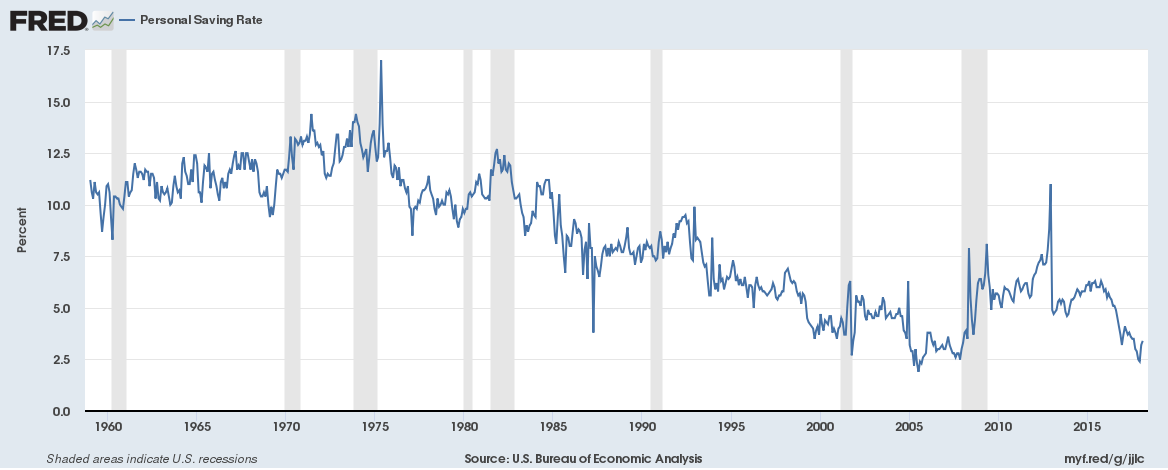

One could claim individuals and businesses/private sector are hoarding money instead of spending it. Well on the individual or household side of things we know the savings rate is now close to record lows.

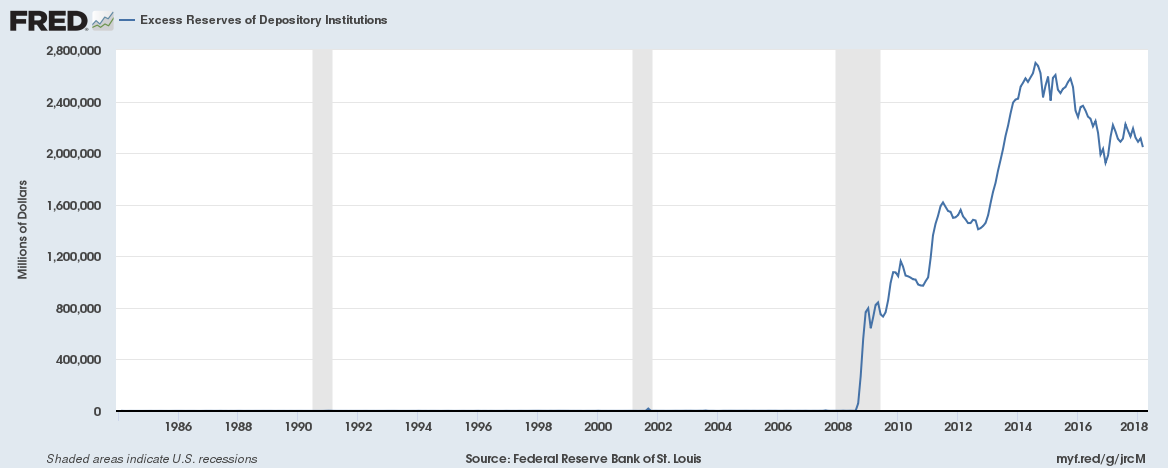

We know banks in the U.S. currently hold close to $2 trillion in excess reserves with the Federal Reserve earning over $25 billion in 2017 (read more here). This means they are being conservative with lending money.

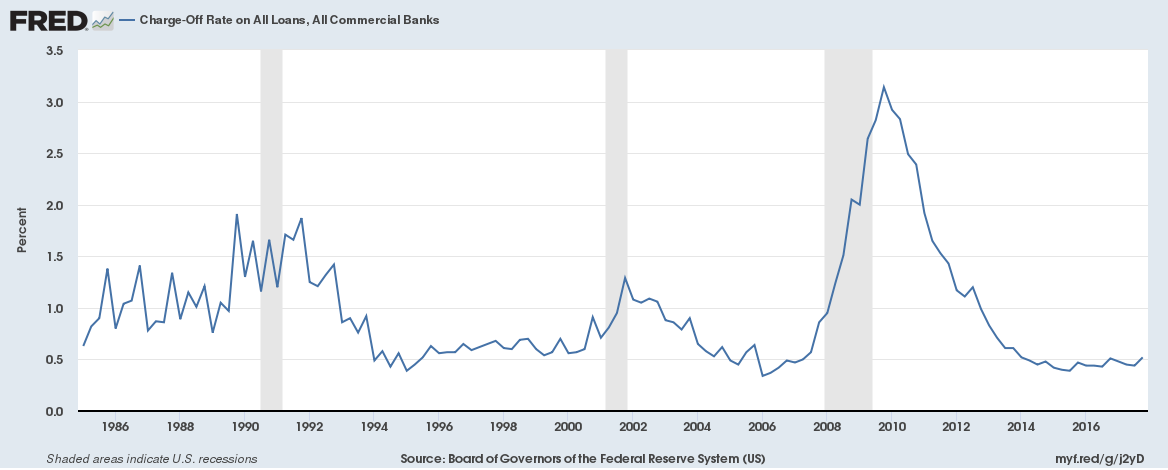

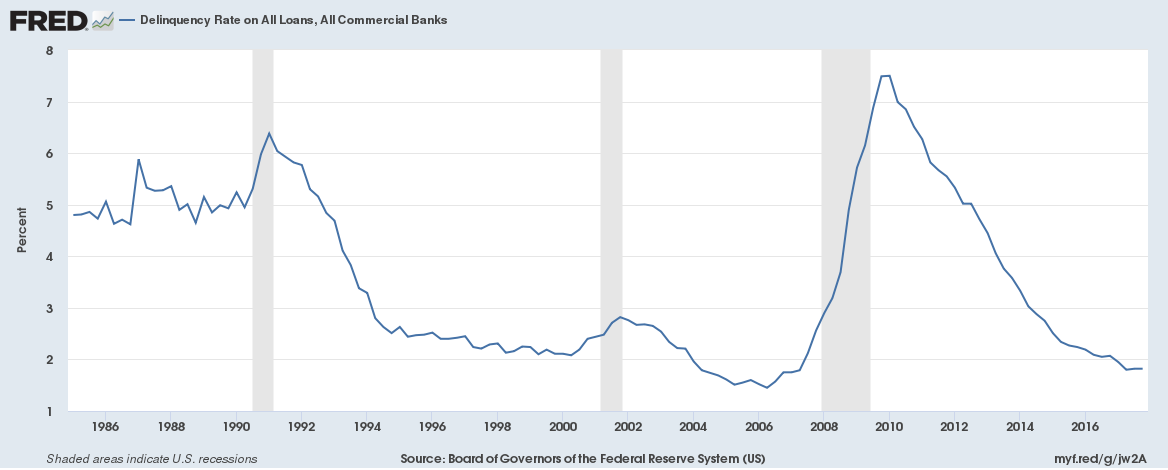

Being conservative in lending means charge-off and delinquency rates remain close to record low levels (read more here).

What does all this mean

Firstly, the general inference that an increase in money velocity is indicative of a strong real economy and a decline in money velocity is an indication of a weak real economy is not true.

Money velocity has declined due to a massive increase in money supply.

Either banks are still being very conservative in lending or there isn’t genuinely much demand for new credit.

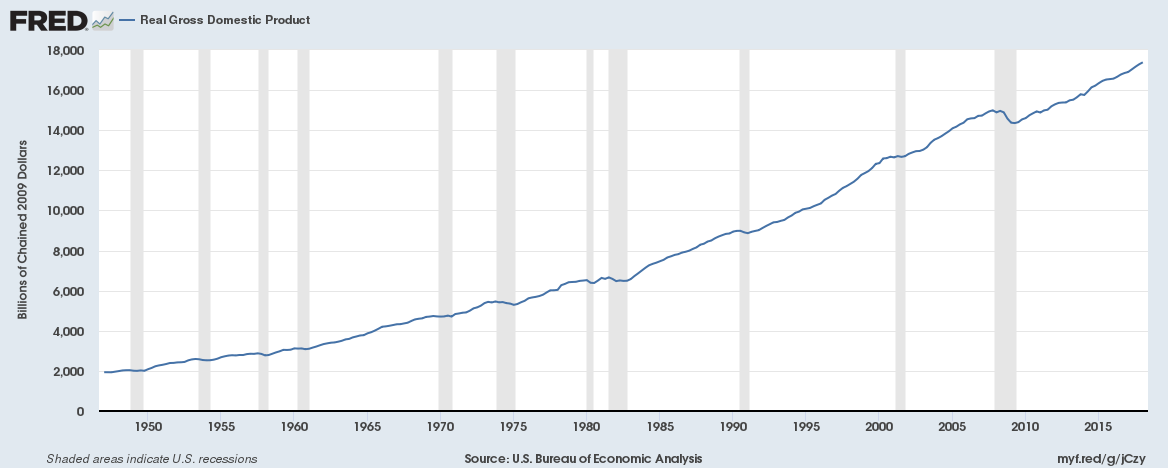

More money supply is required to fuel GDP growth with low levels of money velocity. [That equation: Money Supply * Money Velocity = Nominal GDP]

Money velocity is gradually beginning to increase and at the same time the U.S. government is pumping trillions into the economy to stimulate it further, either this must result in higher price levels (inflation) or significant increase in real economic output [Money Supply (M) * Money Velocity (V) = Price level (P) * Real economic output (Q)].

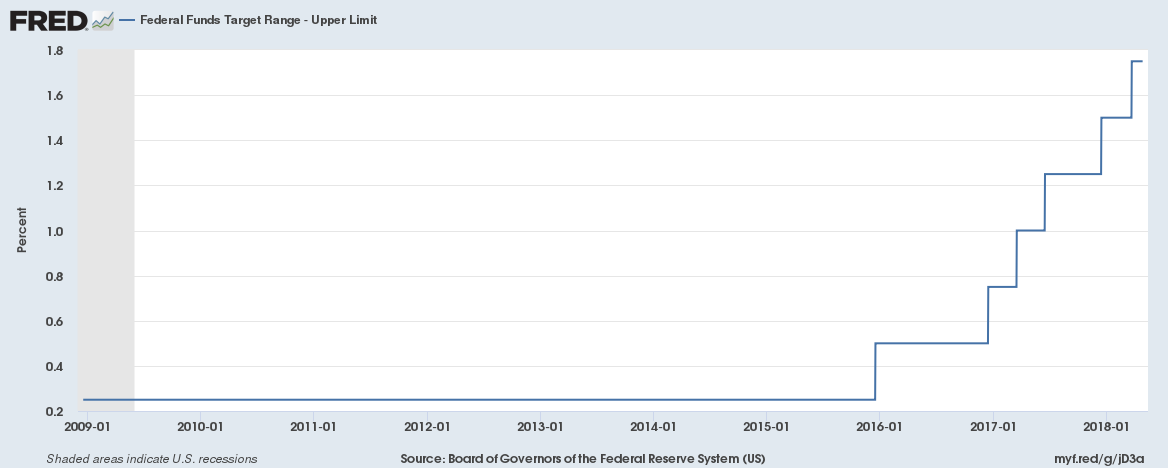

If price levels begin to increase significantly, then Federal Reserve will hike rates at every possible opportunity.

Gosh, you would have the feeling that since roughly 1980, all this money could be going to people who don’t spend it. Now who could that be? Well since 1980, all the money has gone to the top 1%, while the bottom 99% have seen wages flat or even fall slightly. Maybe a rich person will do something a bit different with an extra C note than a poor person. JFC, is this not obvious?

Ditto. Poor person gets a dollar, she spends it and borrows a dollar more. Rich person gets a dollar, she puts it in her bond fund. Simple and sad portrait of our broken system that benefits the few.

Not measuring the money earned illegally by illegal immigrants

that send billions out of the country. So the money sent out of

the country could not be spent in the U S A and the velocity of

money would be effected.

Really?

1. Money leaves the U.S. all the time, and not just from illegal immigrants. And, money flows back into the U.S. from other countries too. So, there would have to me a very large *change* to that in-flow and out-flow to have an effect.

2. Money flow *changes* occur on the scale of billions. The velocity of money is not going to be affected by changes on the order of billions. The current M2 money supply is about $15 trillion dollars. To have a significant effect on velocity, you have to be dealing with multiple trillions of dollars.

3. Excess bank reserves are at about $2T. These reserves were amassed after the Great Recession. Also, the Federal Reserve is sitting on about $4T in QE assets. And corporations have about $2T in cash and short term liquid investments. These are the kinds of assets and numbers that could affect M2 velocity.

Mr Fuller up there is exactly right.

How does the Fed inject money? Well, it buys bonds or similar stuff from people and gives them money instead. Who are the “people” (or banks) that have these bonds? Not poor people. And when you were getting near 0% interest with your bonds, maybe along with even with a little credit risk, you might as well just hold the cash instead.

Income velocity, VI, is a contrivance. Transactions velocity, money physically exchanging counterparties, is the principal economic driver. Vt has been compromised because of the impoundment and ensconcing of monetary savings (income not spent). All commercial bank held savings are unused and unspent, lost to both consumption and investment (because the DFIs always create new money whenever they lend/invests with the nonbank public).

George Garvy: “Ideally, only balances subject to check or, even better, balances shown on checkbook stubs of depositors should be used to compute velocity rates.”

This is analogous to Dr. Richard G. Anderson’s, Ph.D. Economics, Massachusetts Institute of Technology (the world’s leading guru on bank reserves) explanative: “legal reserves are driven by payments”, payments being “total checkable deposits”.

See: Dr. Philip George (where a proportion of cash is commonly represented as { k }, a portion of nominal income), as in Alfred Marshall’s “cash balance” approach)

“The velocity of money is a function of interest rates”

“Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits.”

“When the interest rate is zero the velocity of money will tend to zero. This is because there is no incentive to move their accumulated savings out of demand deposits.”

“When interest rates go up, flows into savings and time deposits increase.”

“Holding interest rates down does nothing to boost investment because the problem is falling consumption.”

Low velocity is caused by an imbalance of savings in the world. China’s state capitalism accumulates massive trade surpluses (savings) by surpassing wages and their domestic sector. Same for other repressive governments modeled on state capitalism.

The lending of excess savings by China and others, has flooded the world market with cheap money which lowers velocity. If China were to reverse it’s state capitalism and allow open markets to raise wages there, the increase in world demand would increase the velocity of money.

So I was reading James Rickards new Book “AfterMath” and was inspired to Google: “Velocity of Money Low Why.” I found this article with recent comments as of today and figured I would contribute as well. Thanks, Everyone for Posting, found the right page.

As I was reading Rickard’s book, I had this theory that the velocity of money was low. I believe all the money is being hoarded by the Forbes 500, aka 1 %, just like others have stated previously in their post. Which means, Money Printing by our Government, based on all the readings I have read, should have caused inflation but it did not why? (I am no economist by the way)

Moreover, money velocity has dropped. Why? The only logical answer is that it is being saved. By whom? The people on the Forbes list who keep getting richer and richer; and keep sucking the liquidity out of the system. I am a capitalist but want to understand why this is happening to position myself better. Which means that until the rich have a reason to dump their liquidity for something more meaningful than the Forbes list, they will keep accumulating money, and the velocity of money will continue to stay low. The Government can then keep printing money without the worry of inflation. So the question would be…what would make the rich want to transition out of the dollar to something else? Cause when they do, I believe that will be the catalyst for velocity and inflation.

One word… Gold

Re: “Why?”

The stagflationary era was characterized by the “monetization” of time deposits in the payment’s System (catallactics which vastly accelerated money velocity). The “saturation” in deposit innovation occurred in the 1st qtr. of 1981 with the widespread introduction of ATS, NOW, and MMDA accounts.

The passage of the DIDMCA of March 31st 1980 permanently destroyed money velocity by turning 38,000 intermediaries (the MSBs, CUs, and S&Ls) into commercial banks, DFIs. It caused the S&L crisis.

New money substitutes were propagated by Alan Greenspan reducing legal reserves by 40 percent and the repeal of the Glass Steagall Act. The Gramm–Leach–Bliley Act encouraged lending with no skin in the game.

Then Bankrupt-u-Bernanke destroyed America by remunerating interbank demand deposits.

The remuneration rate functions like the old Regulation Q ceilings between the banks and the nonbanks. It determines money velocity.

https://fred.stlouisfed.org/graph/?g=oFZw

Low interest rates reflect the bottling up of savings in the payment’s system. I.e., all DFI savings are unused and unspent.

This is a self-reinforcing process. The more savings which are frozen in the payment’s system, the greater the reduction in the velocity of circulation. As money velocity is destroyed, future income streams are lessened. As N-gDp falls, creating an excess of savings over investment outlets…more savings end up in the payment’s system.

In Q1 of 2020 the velocity of money further decreased. Probably due to the economic COVID-19 fallout. The central banks are already increasing the money stock, but the demand for lending is still very low. Who wants to buy a new car, open an new business or build a new factory in these uncertain times?

“Money velocity has declined due to a massive increase in money supply.”

If this conclusion is right, then the COVID-19 stimulus packages will slow the velocity of money even further.

Money velocity is at all-time lows given the unprecedented increase in money supply, we will write about money velocity changes globally shortly.

And the curious aspect about this is it does support the stock market since the cash is chasing fewer stocks. Which does increase wealth at the top. If this cash was deployed in actual investment of business and jobs, it would increase wealth on the lower end. For example:

If the US dollar devalued, which it could if it was not the defacto reserve currency, this could make a difference. The Top 1% invest in cheaper assets overseas – factories for example. The dollar is worth more and investing in USA where the strong dollar drives up your cost does not make sense. Now, if the dollar devalued, the Top 1% would have less investment power overseas. They would not be as compelled to invest there as much. Plus, the lower dollar would make many aspects of economy based in USA more competitive with the world. Which should reallocate these dollars to investment back in USA. There should then be a corresponding increase in money velocity two ways: 1) Business investment 2) Employee investment as they feel better about future and have more money to spend. Business investment has been in he dumps for years – but it is not in the dumps overseas