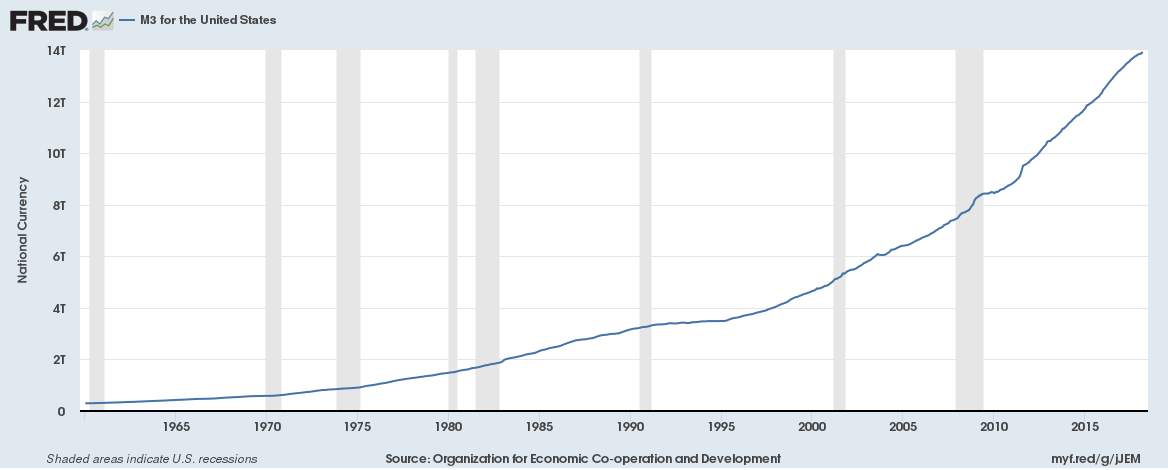

1. Liquidity

Central Banks have created loads of new money with quantitative easing. There is simply too much liquidity in the markets. Here is a chart of the M3 money supply for the US,

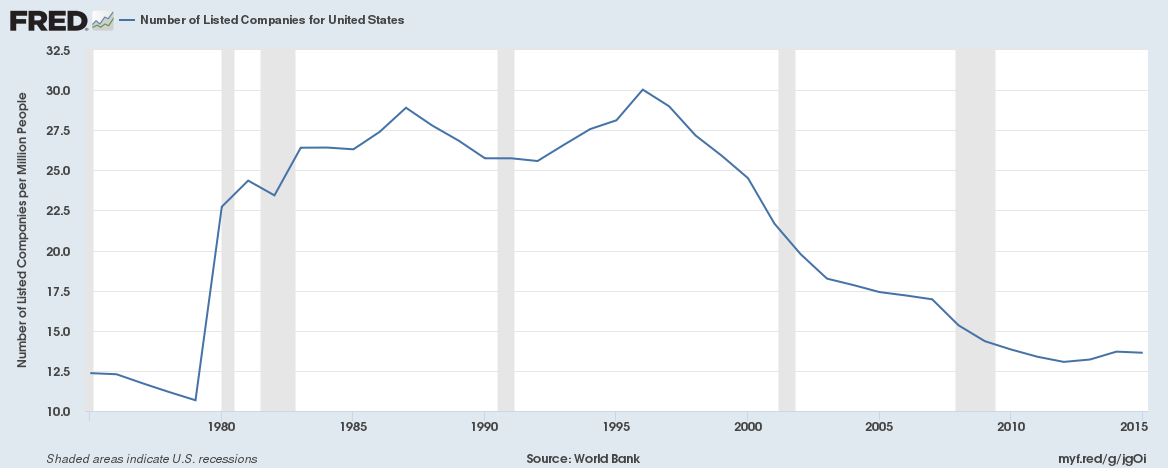

2. Too little choice for stocks

There are far fewer listed companies globally now then there were 20 years ago. 20 years ago, there were over 8000 stock market listed companies in the US, that number has halved by 2018.

3. Merger and Acquisition activity has resulted in profit concentration in a few companies

In the US the top 200 companies (exchange listed and private) account for around 90% of all corporate profits. Again, with very little choice, valuations are soaring especially for the very big listed companies.

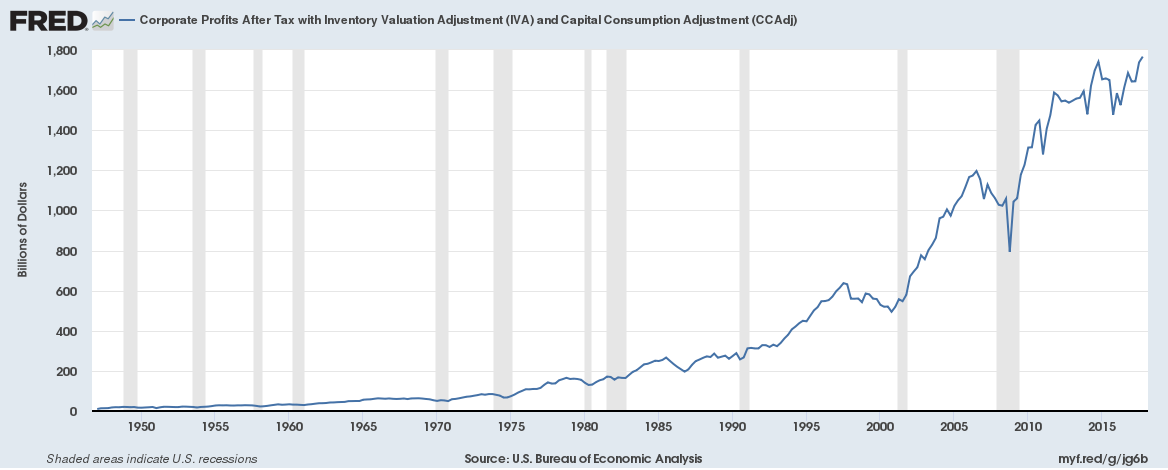

4. Corporate profit margins and profitability have never been bigger

Corporate profit margins for listed companies in the US that have reported Q1 2018 earnings so far has been over 11.3%, the largest margin on record. And profitability is at an all time high too.