So, the US exits the Iran nuclear deal. The business impact of it?

Not much at all for the US. But a very major impact for Europe.

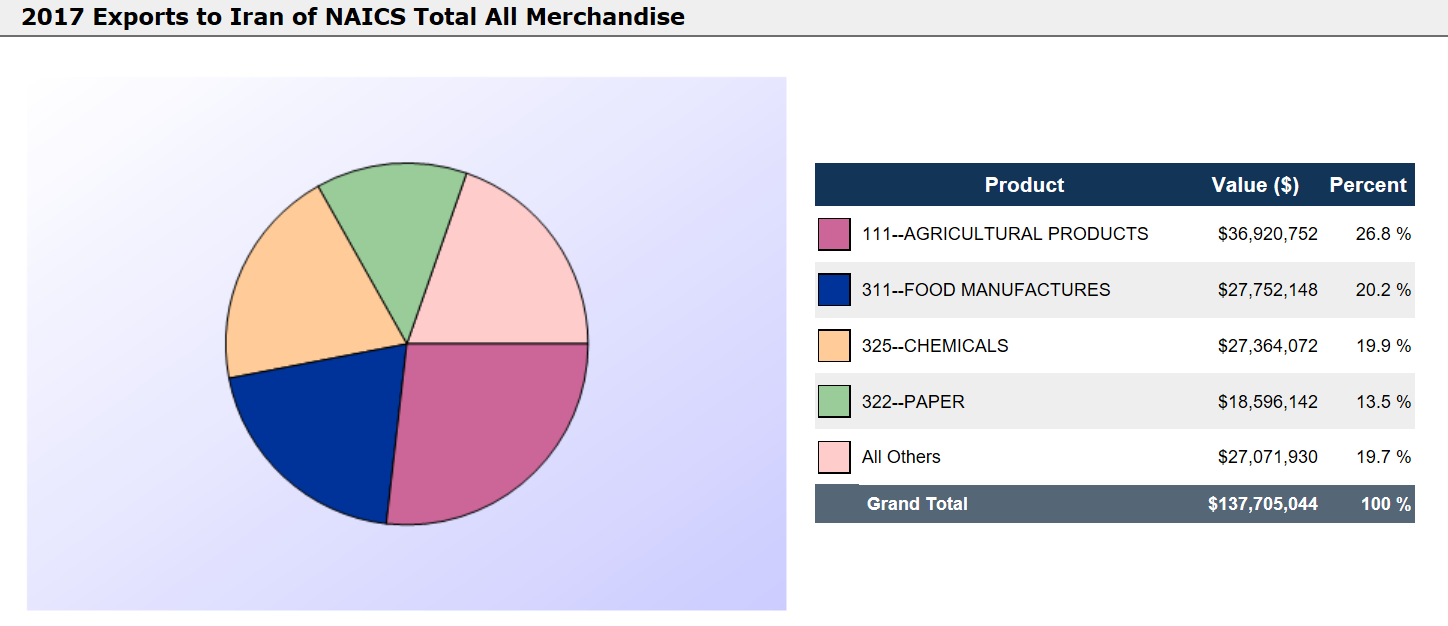

US exports to Iran

2015 exports were $282 million, 2016 were down to $172 million and 2017 were further down to $138 million

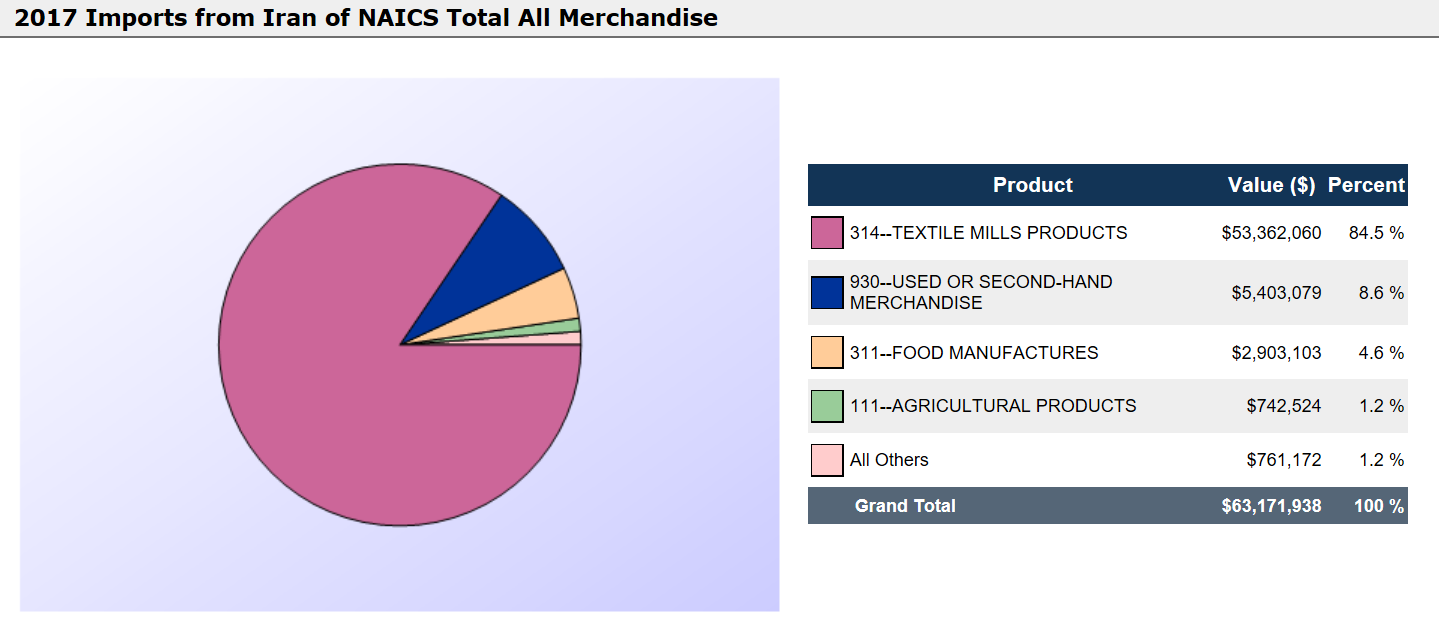

Iran exports to the US

Just $64 million in 2017

European exports to Iran

€10.8 billion ($12.80 billion) in 2017, has grown 10-fold since 2015

Iran exports to Europe

€10.14 billion ($12.02 billion) in 2017, has grown 10-fold since 2015

Here are charts for US – Iran trade,

Iran did sign a $16.6 billion order for 80 aircraft with US based Boeing but that is less than 2% of Boeing’s order book. It was claimed the deal would support 100,000 US aerospace jobs but Boeing hasn’t even started working on the order. On the other hand, Europe based Airbus has delivered 3 of the 118 aircraft as part of the $25 billion deal with work on at least 10 other ordered aircraft in progress.

The bigger issue – US sanctions bar US banks and companies from doing business with Iran. The sanctions also limit foreign companies from dealing with Iran by prohibiting them from using American banks in their operations if they do not sever links with Iran. So, firms must decide between the Iran or the US market.

Companies and countries with commercial deals with Iran would have either 90 or 180 days to wind down those activities and would not be allowed to strike new deals with Iran. Unless of course an exemption can be made.

Little wonder the US and Europe have very different opinions about the Iran deal.

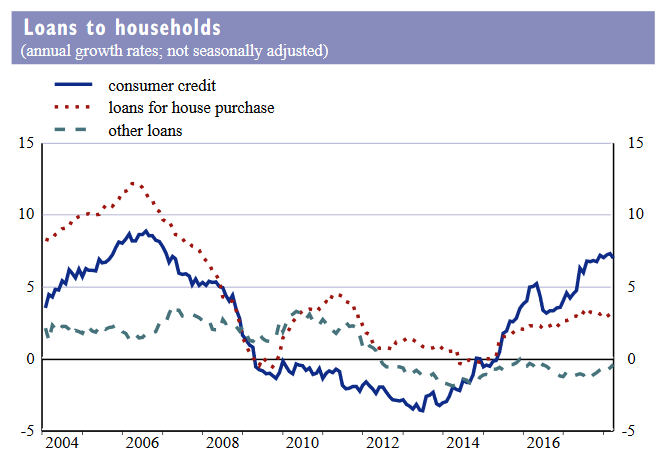

Euro area consumer credit

Euro area consumer credit is now growing at the fastest pace since 2007. That at a time when the non-performing loan ratio remains high. What could possibly go wrong?

Almost 3% coupon on 10-year Treasury bond

The Treasury 10-year bond auction today priced at a yield of 2.995% but as the coupon is the lower multiple of 0.125%, the coupon will be 2.875%. A 3% coupon on the 10-year bond can’t be far now.

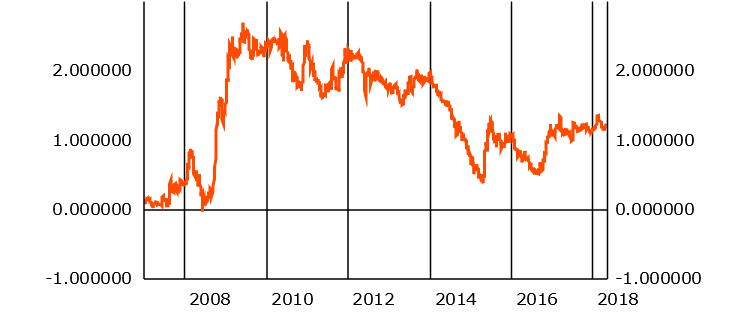

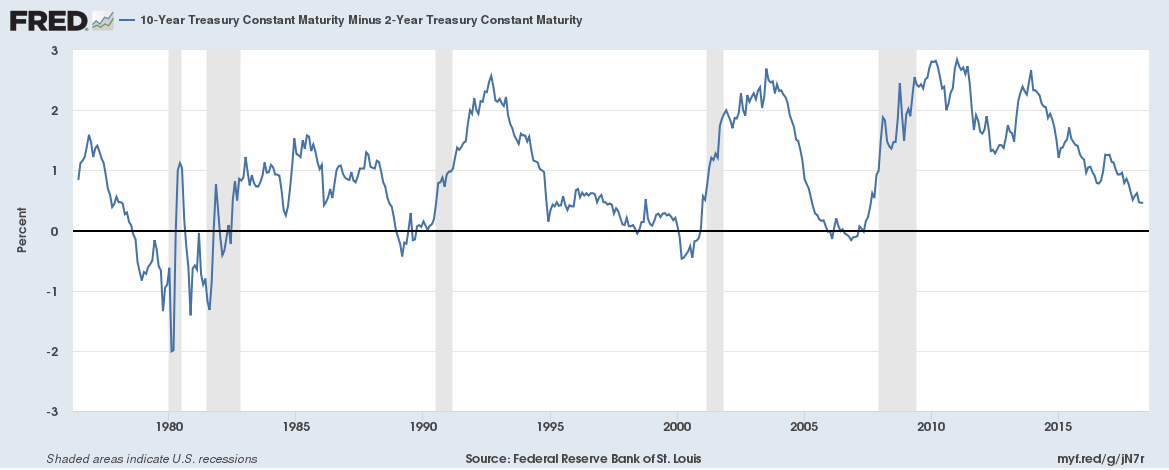

US yield curve inversion vs Euro area curve yield inversion

The US 10-year Treasury constant maturity yield minus 2-year Treasury constant maturity yield is now just 44 bps. Yield curve inversion which happens when the spread turns negative has preceded the last seven straight recessions. The market is worried.

Meanwhile for the Euro area, the spread is represented in the chart below, the Euro is not an old currency yet, but a very brief inversion did happen before the 2008 recession.