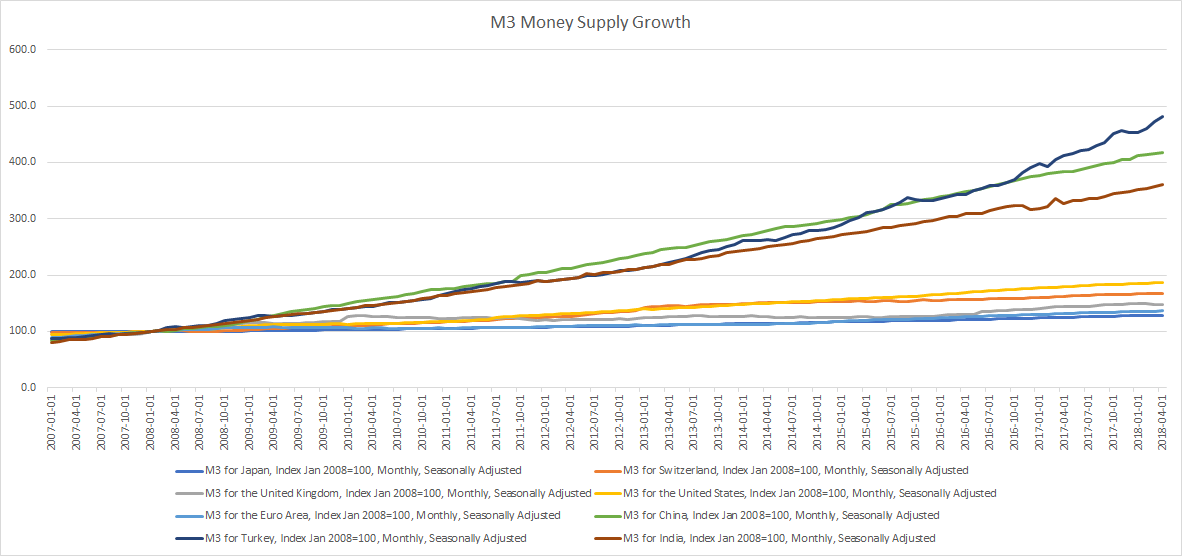

This is not government debt, this is simply Central Bank balance sheet per capita (for every person in that country), and the numbers are staggering …

Continue reading “How much are Central Bank balance sheets per capita (or per person in a country)?”