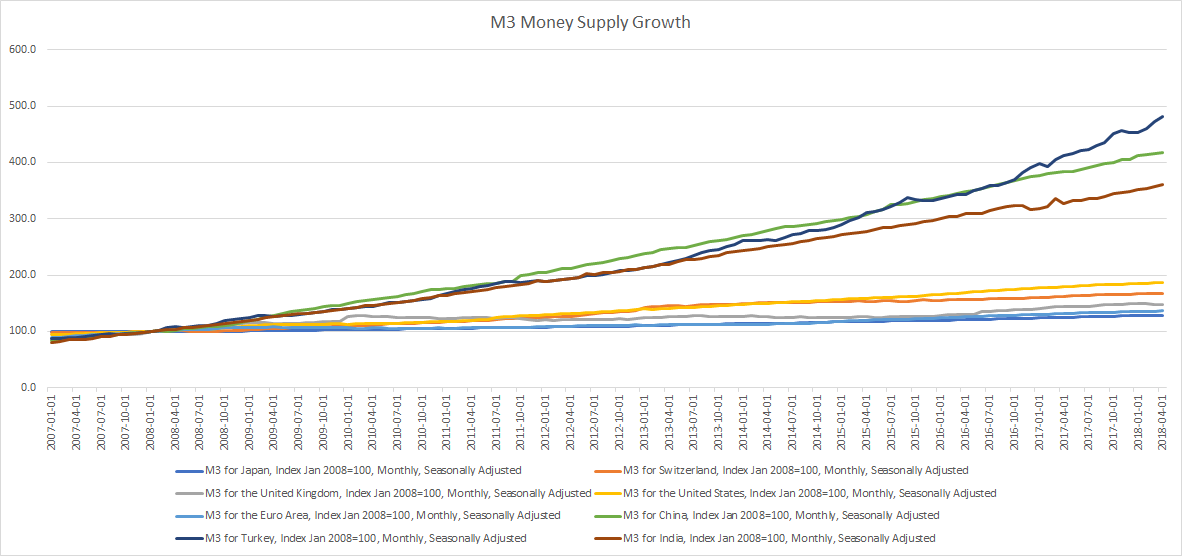

Broad Money M3

Broad money (M3) includes currency, deposits with an agreed maturity of up to two years, deposits redeemable at notice of up to three months and repurchase agreements, money market fund shares/units and debt securities up to two years.

Money Velocity

The velocity of M3 helps determine how often financial assets are switching hands within the economy.

The Equation of Exchange

MV=PQ

Money Supply (M) * Money Velocity (V) = Price level (P) * Real economic output (Q)

Alternatively, Money Supply * Money Velocity = Nominal GDP

Is Inflation as low as the official numbers claim it is or is money velocity super low? (Related: The curious case of low U.S. money velocity)

Here are charts for each country,

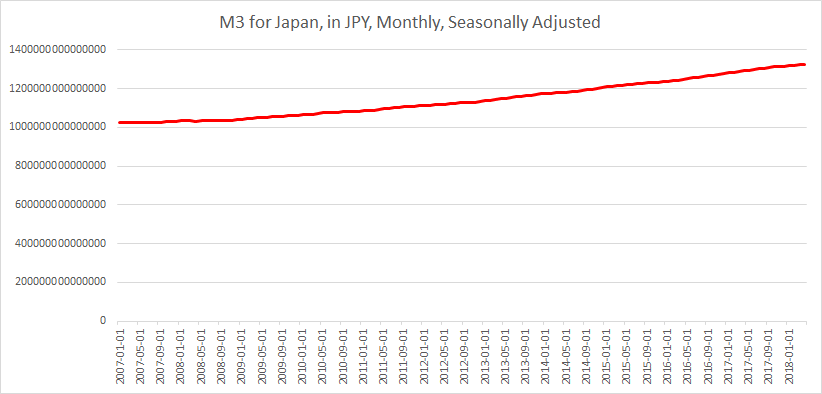

Japan

Growth since January 1, 2008: 28.4%

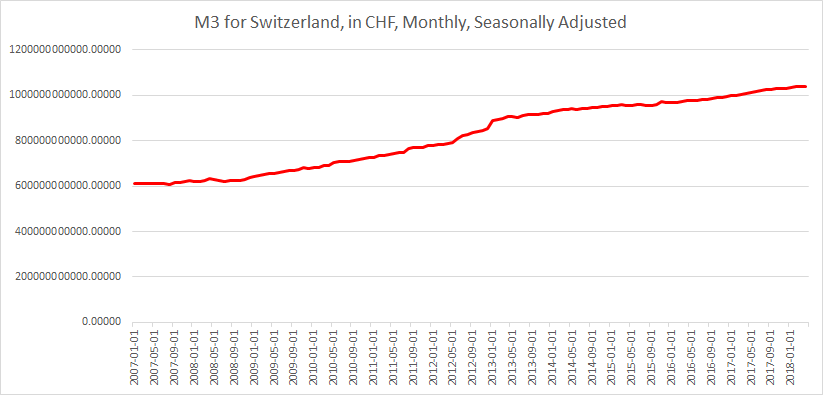

Switzerland

Growth since January 1, 2008: 67.3%

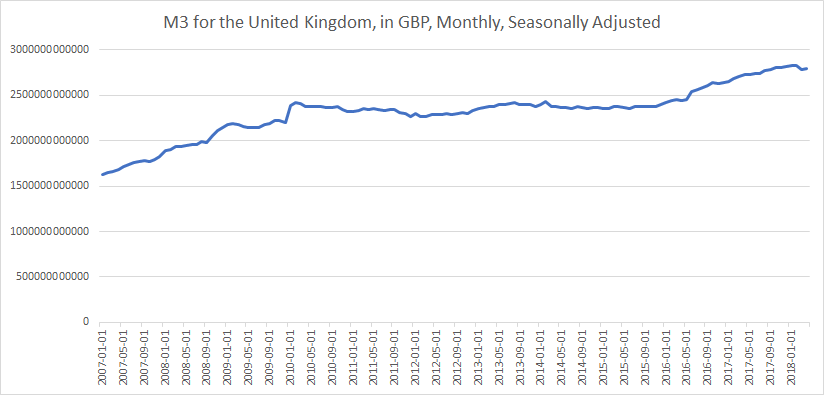

United Kingdom

Growth since January 1, 2008: 48.2%

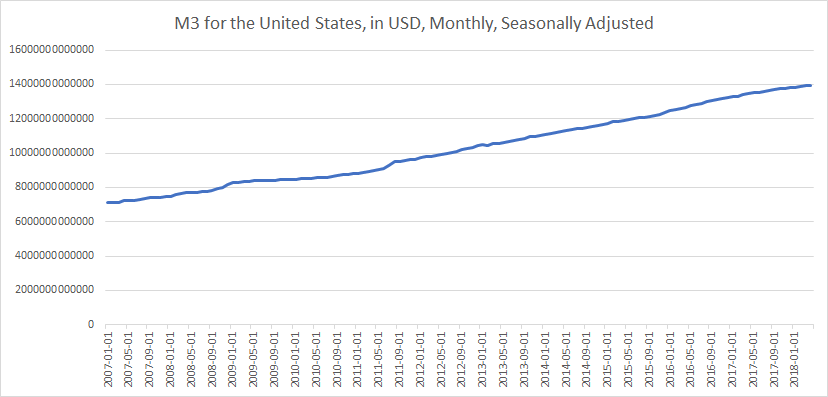

United States

Growth since January 1, 2008: 86.3%

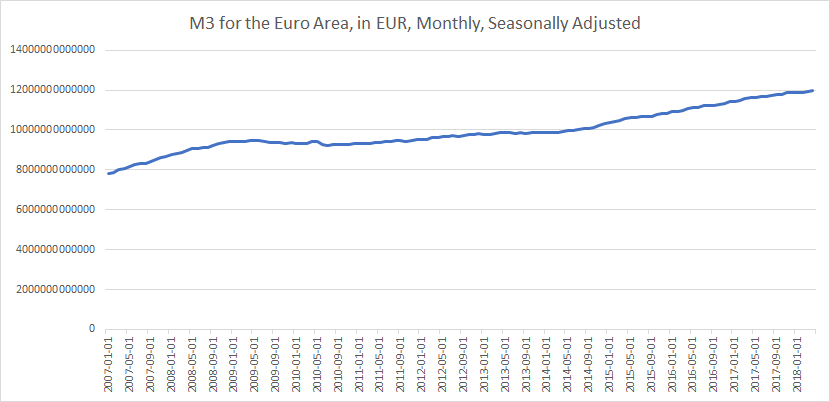

Euro Area

Growth since January 1, 2008: 36.5%

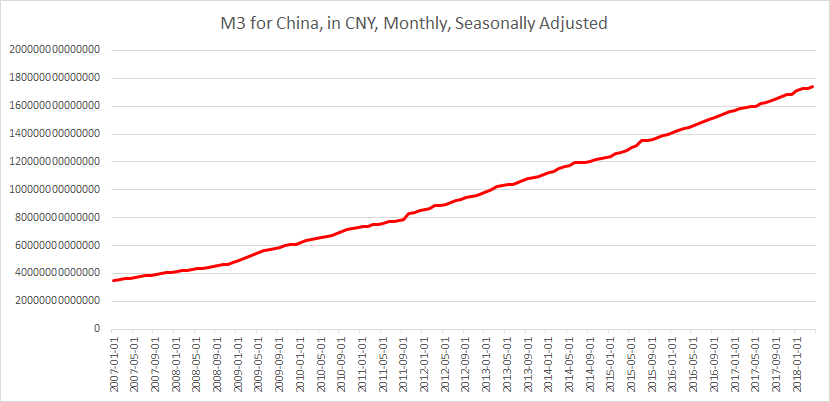

China

Growth since January 1, 2008: 318.4%

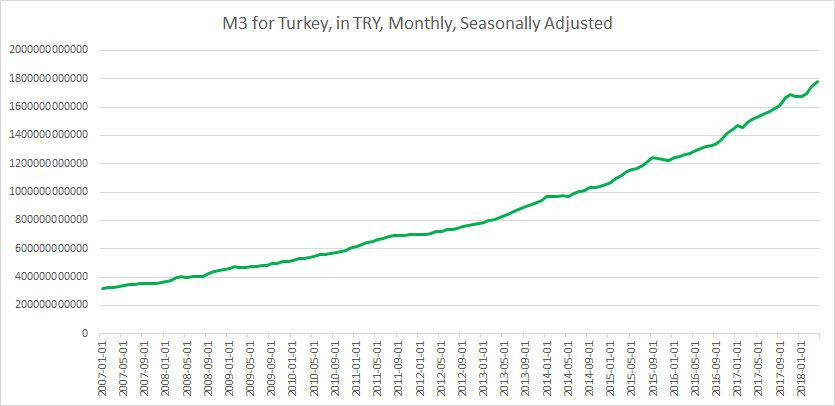

Turkey

Growth since January 1, 2008: 381.8%

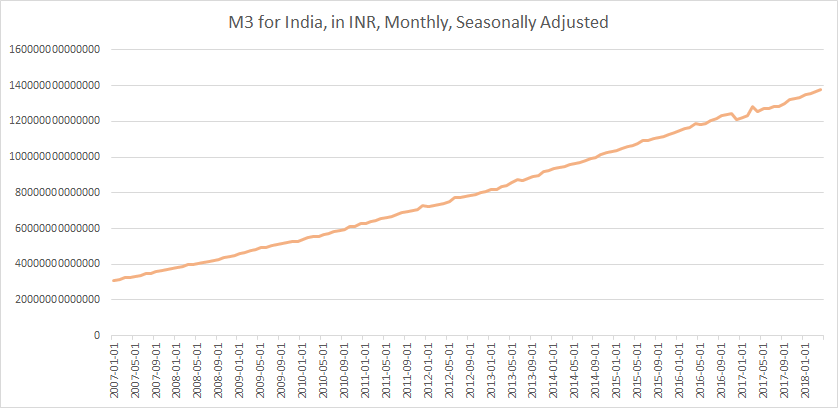

India

Growth since January 1, 2008: 260.4%

Related: