Central Banks have grown their balance sheets significantly in the past 20 years and almost exponentially since the 2008 financial crisis. Here’s how much the balance sheets of the Bank of Japan, the Swiss National Bank, the Federal Reserve and the European Central Bank have grown in the 21st century,

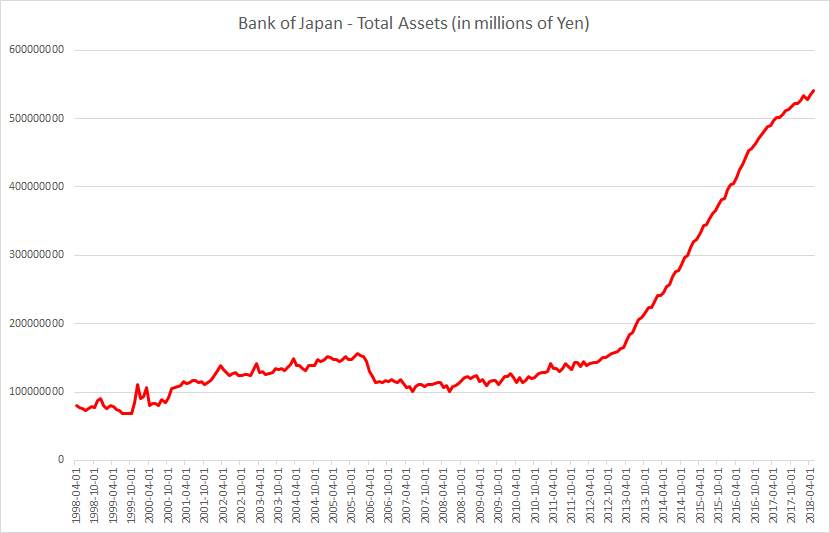

Bank of Japan

Total assets: 540.8036 trillion Yen (JPY) = 4.93 trillion US Dollars (USD)

As of date: May 1, 2018

Asset size as percentage of GDP: 101% of GDP

Interesting information: The Bank of Japan has a target to buy 6 trillion Yen ($54 billion) worth of exchange traded funds a year. It now holds almost 82% of all ETFs in Japan and is indirectly the largest shareholder in many large Japanese companies, almost about half of listed companies in Japan.

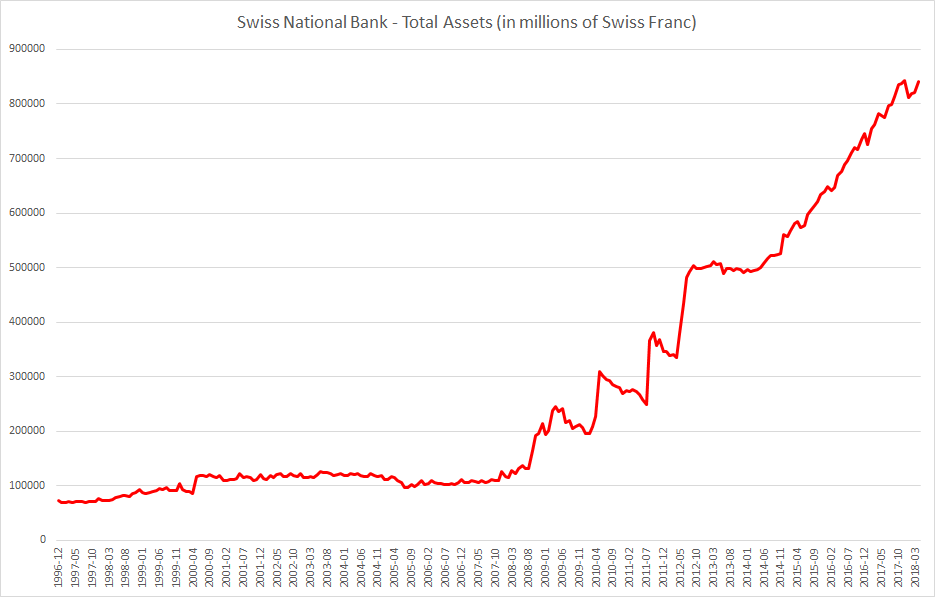

Swiss National Bank

Total assets: 841.38 billion Swiss Franc (CHF) = 853.55 billion US Dollars (USD)

As of date: April 30, 2018

Asset size as percentage of GDP: 125% of GDP

Interesting information: The Swiss National Bank has around $800 billion in foreign currency investments. Amongst its famous holdings are a $3 billion investment in Apple (and it has been buying more shares) and $1.5 billion investment in Facebook. It made a profit of 54 billion Swiss Francs ($55 billion) for the 2017 financial year mainly down to its overseas equities investments.

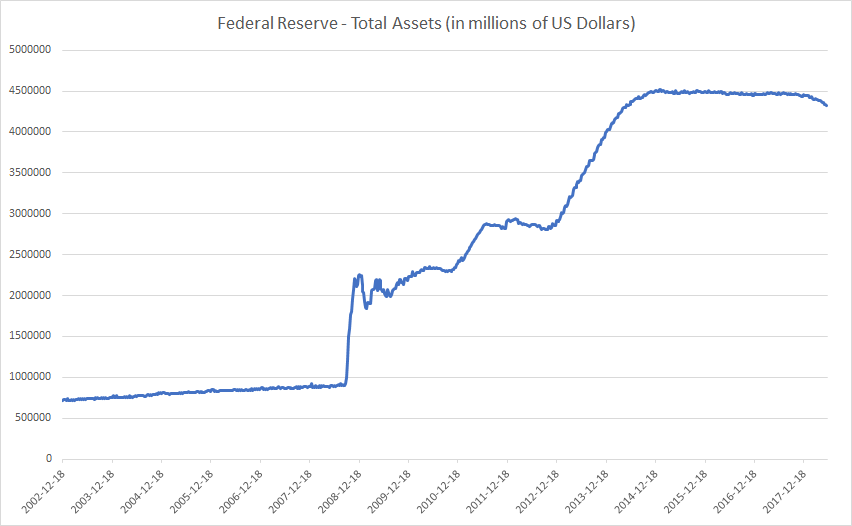

Federal Reserve

Total assets: 4.32 trillion US Dollars (USD)

As of date: June 6, 2018

Asset size as percentage of GDP: 22% of GDP

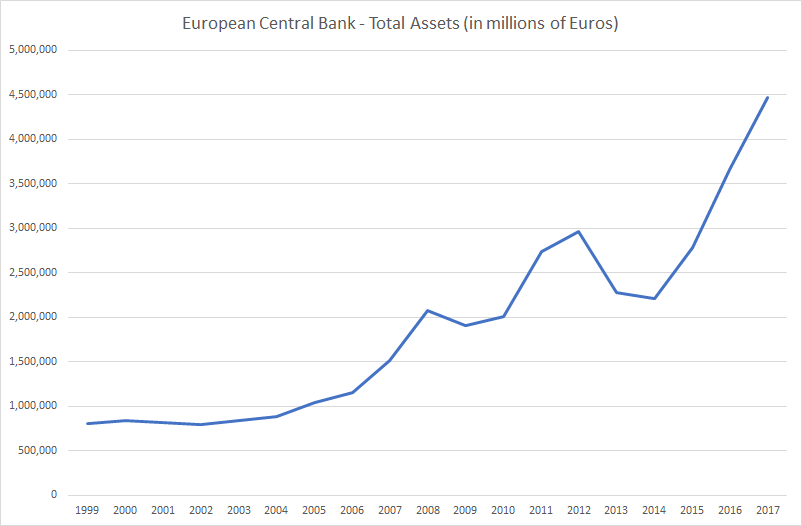

European Central Bank

Total assets: 4.47 trillion Euro (EUR) = 5.25 trillion US Dollars (USD)

As of date: December 31, 2017

Asset size as percentage of GDP: 45% of Eurozone GDP

Interesting information: The European Central Bank balance sheet has increased by 2 trillion Euros since 2015 when it announced its bond buying programme. The European Central Bank invests in corporate bonds amongst other things. It has about 112 billion Euros of corporate bonds and recently is alleged to have lost around 200 million Euros (or 55% of its investment it made via the Finnish Central Bank) in scandal hit Steinhoff.