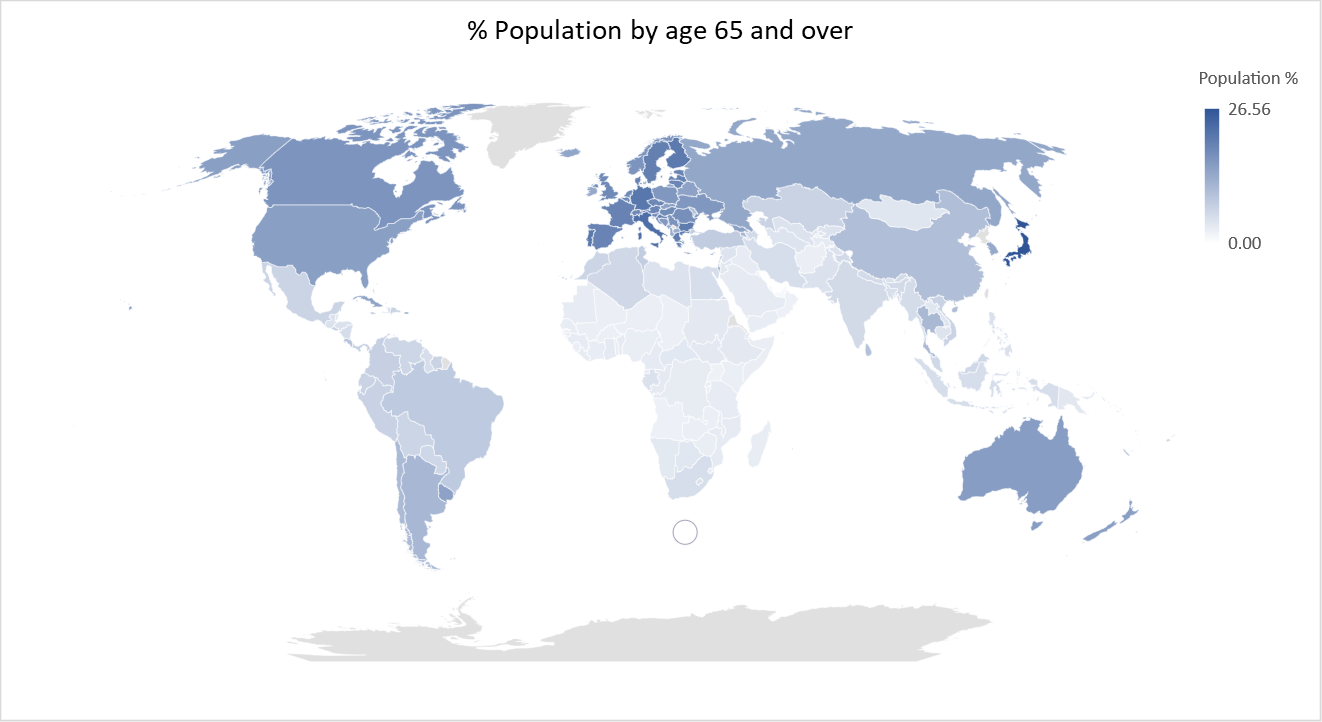

We recently posted about population percentage for each country by age. The data was for 2016 from the World Bank and is the latest set of available data. Here is a map of population percentage for age 65 and above:

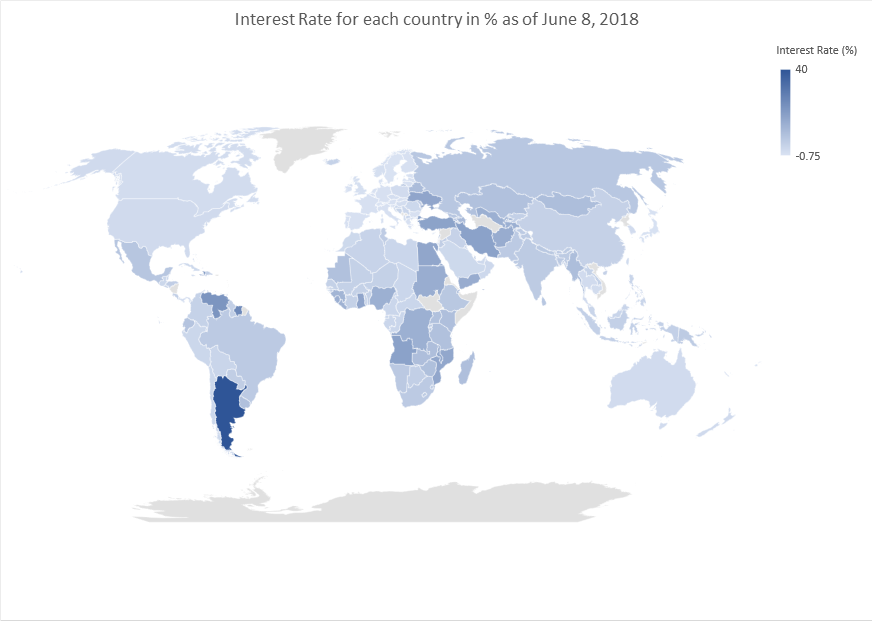

And here is a map of interest rates for each country as of June 8, 2018:

See some correlation – direct or inverse?

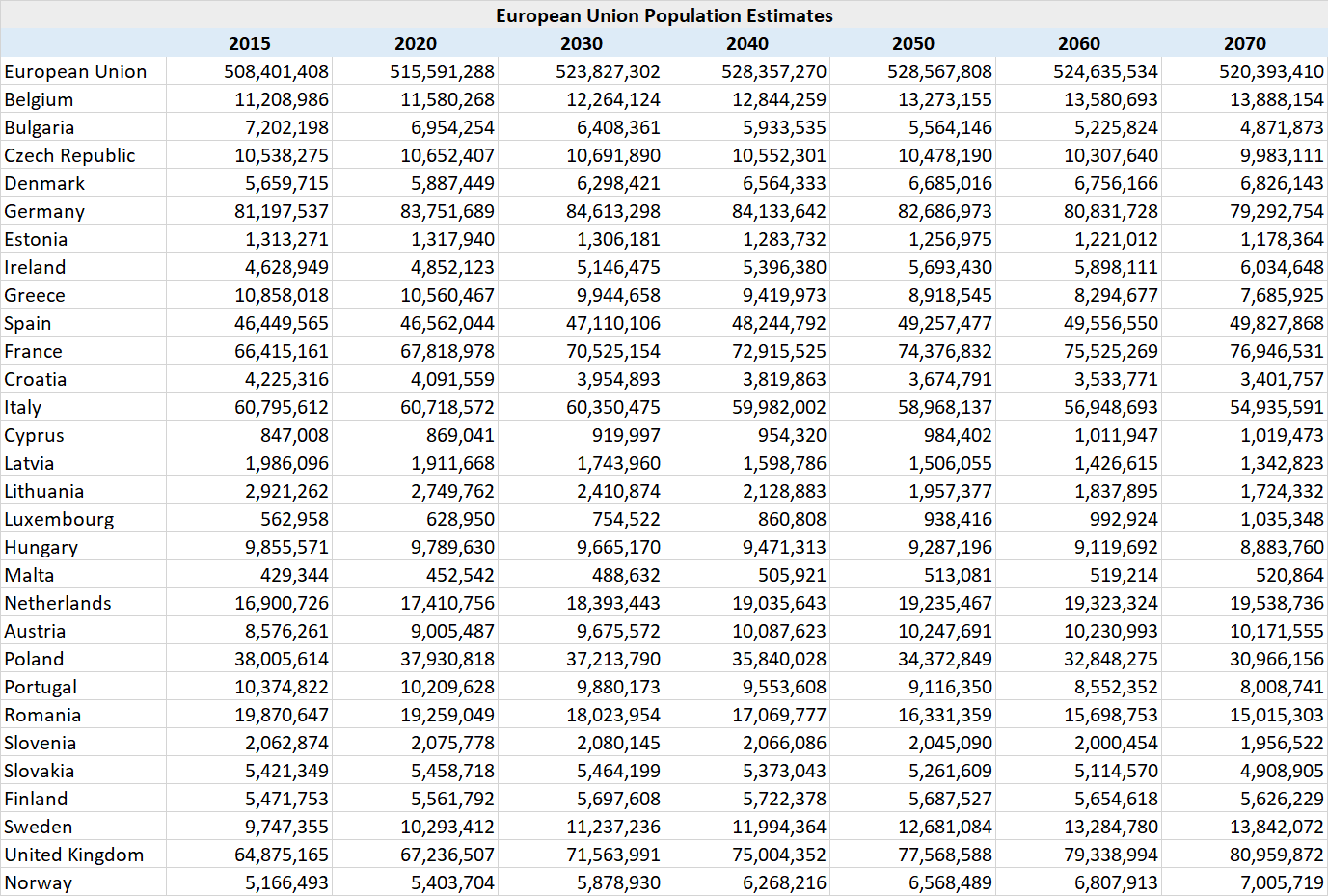

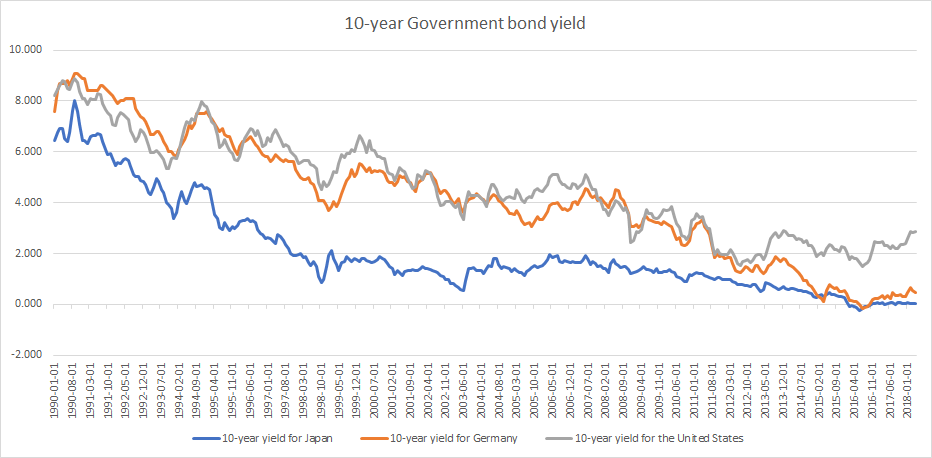

Japan has the highest percentage of over 65s at 26.56%. The other countries that make the top 25 countries for over 65s population are Italy, Germany, Portugal, Finland, Bulgaria, Greece, Sweden, Denmark, France, Croatia, Spain, Estonia, Austria, Malta, Lithuania, Czech Republic, Slovenia, Belgium, Netherlands, United Kingdom, Switzerland and Hungary. All those countries have zero or negative interest rates other than United Kingdom (0.5%), Czech Republic (0.75%) and Hungary (0.9%) who have low interest rates too.

But, hold on, shouldn’t those countries have higher interest rates to support pensions and savings? Well, technically they should. But they don’t. Even government bonds pay close to nothing for those countries, so bond yields aren’t supporting either. The highest interest rates are for countries with a relatively lower average age population.

The world is aging – babies born in 2018 can expect to live to over 100. In 2015, there were around 600 million people aged 65 or over and that number is expected to rise to over 2 billion by 2050. Better living standards, more nutritious diets, access to cleaner drinking water, success in the fight against infectious diseases and advancements in science have all contributed to the increase in life expectancy. That is the good part.

Now for the not so good part – there are currently 8 workers in employment for every retiree today. That number is likely to reduce to 4 workers in employment for every retiree by 2050 which means government or state retirement ages will only rise further. In Japan and Europe that number is likely to be just 2 workers for every retiree by 2050. That is indeed a scary thought on pensions.

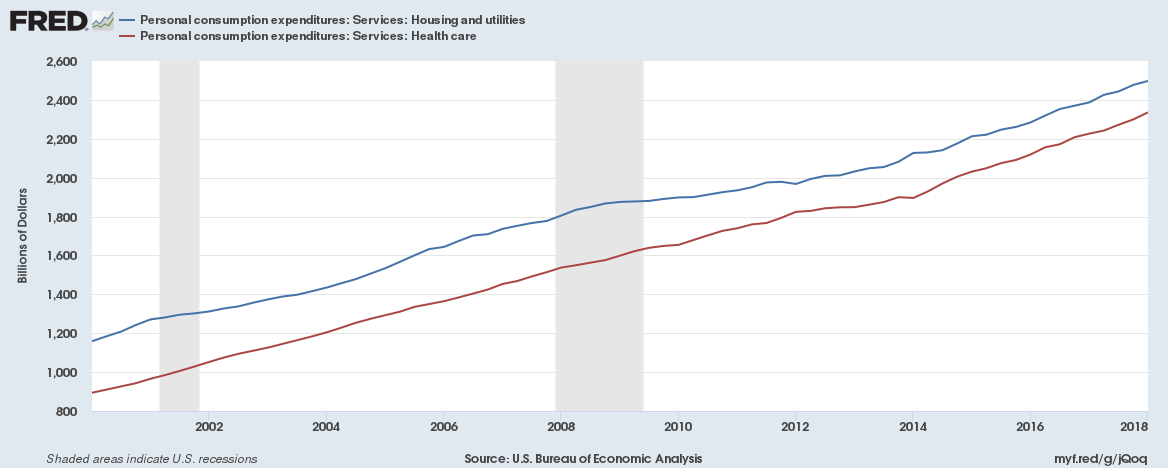

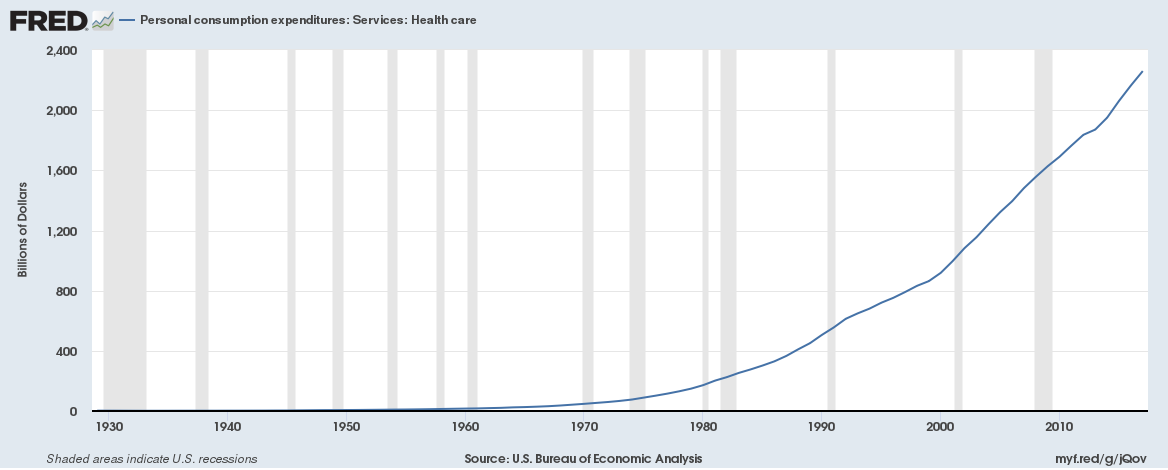

There is the controversial subject of immigration to support healthcare and elder age care jobs and to help fund pensions. We won’t write about the subject of immigration but on to the subject of healthcare – we wrote that Healthcare could soon be the largest expense of households in the U.S. surpassing spend on Housing and Utilities.

Households in the U.S. are likely to spend some $2.45 trillion this year on healthcare.

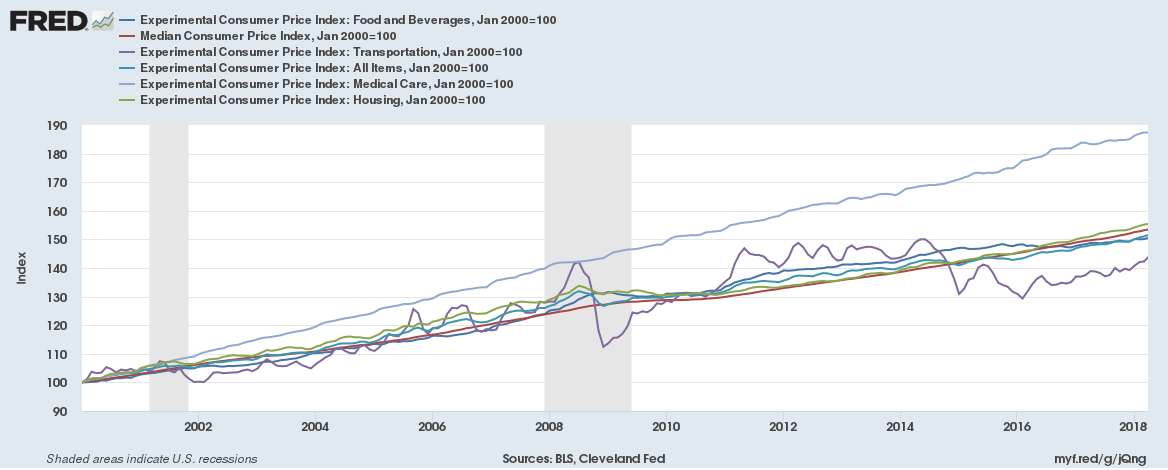

One could blame the increased spend on an aging population and unhealthy living but the main reason for the increased spend is Healthcare price inflation which is growing faster than any other inflation measured component. And it isn’t just the U.S. where healthcare inflation is soaring, it is happening globally.

As life expectancy increases, people will inevitably spend more on healthcare.

There is another aspect to an aging population. As costs soar, people will chase higher returns – which only means more money flowing into higher risk assets. There is also a greater risk of mis-selling and financial fraud.

Another thing – Since the financial crisis of 2008, economic uncertainty has seen falling fertility rates for the European Union with population now set to fall over the coming decades. Japan’s fertility rate has been in decline since the past three decades. Economic uncertainty is going to impact the future in more ways than one.

Poor forecasting isn’t going to help the economic future of an aging population. Previous pension funding assumed 7% bond yields, the number has been much closer to 2.5% since 2009 which has caused major deficits.

The United Kingdom currently has $6.2 trillion in underfunded government and public-sector employee pensions. For the United States that amount is over $25 trillion. If an aging population isn’t sure of their future income, they will not spend, if they do not spend there will be more economic uncertainty for the younger generations and fertility rates will continue to fall only producing more challenging conditions for future generations.

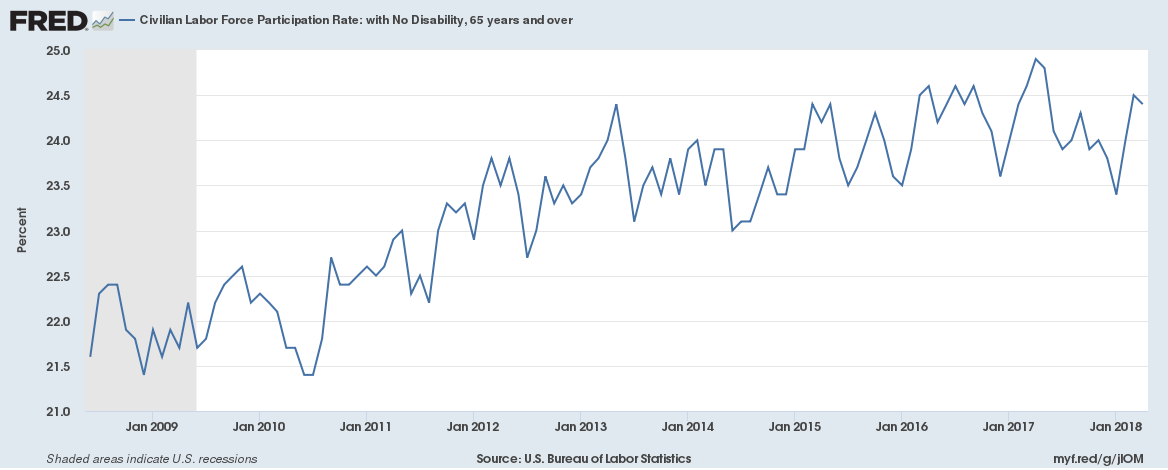

Today, 20% of those aged 65 or over are still working in the United Kingdom and that number is rising and in the United States a greater proportion of those aged 65 and over are seeking employment.

May be people will have to work longer but with machines set to take over several jobs would that be possible?

We have only touched upon some aspects of the business of aging. We will also publish another piece titled “The youth economic dividend” in the next few days.