Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Read Part 1

Read Part 2

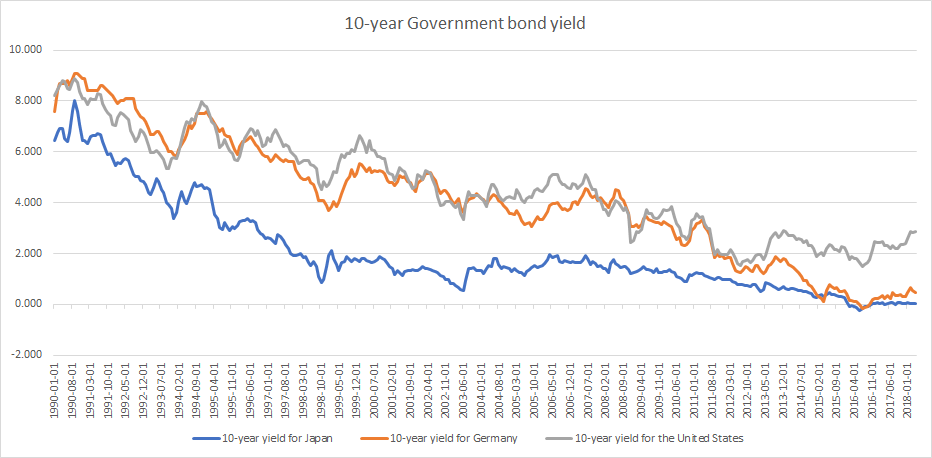

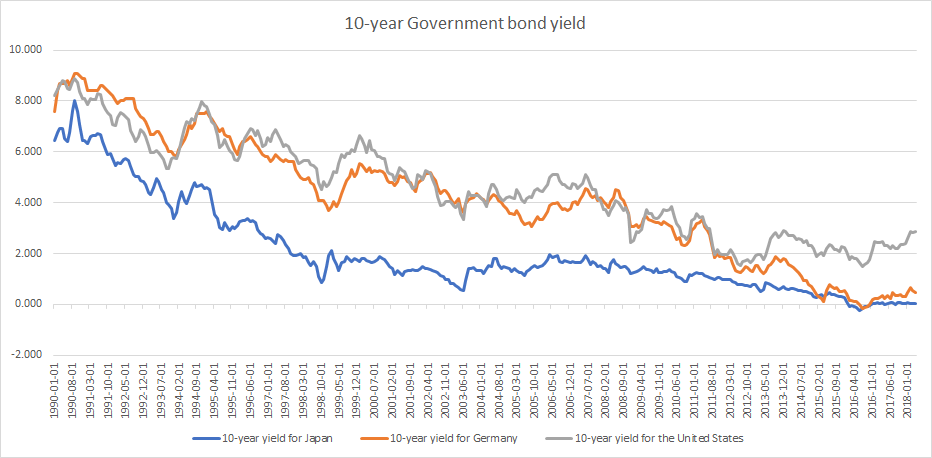

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world .

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

Continue reading “Do economic fundamentals matter anymore? Part 3 of 3”