Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

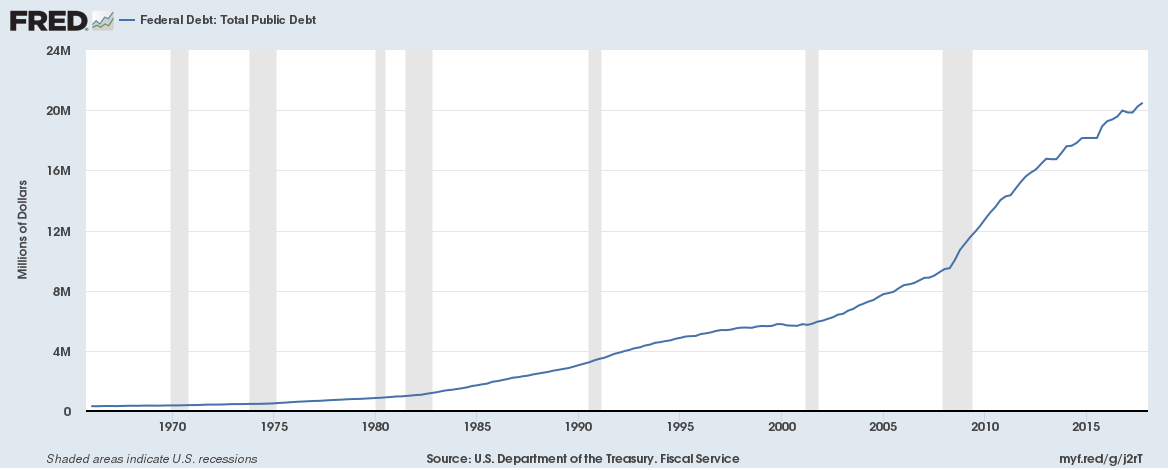

Soaring Government Debt

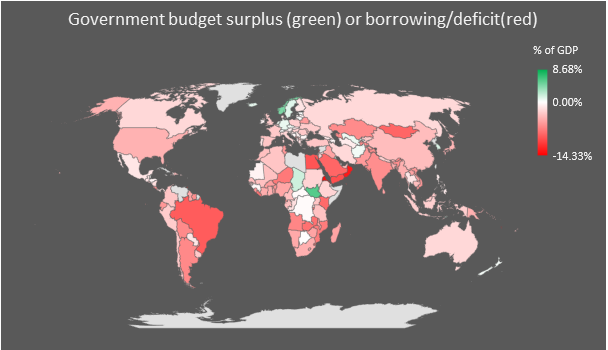

Just 30 out of the 193 countries that report data to the IMF reported a budgetary surplus in 2017. Only 2 of the 20 G20 nations reported a budgetary surplus. These were South Korea (1.21% of GDP) and Germany (0.69% of GDP).

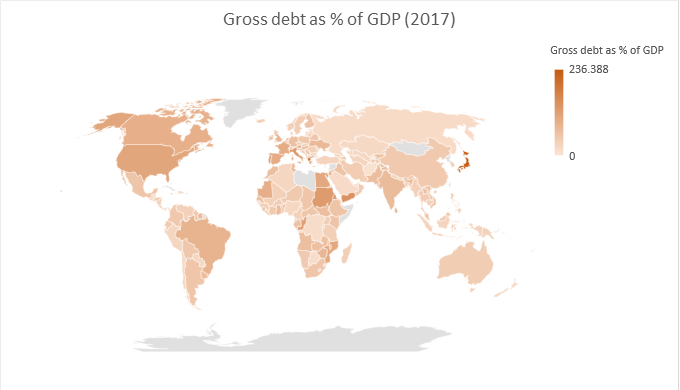

And Gross and Net Debt of countries as percentage of GDP have never been higher in the history of the world.

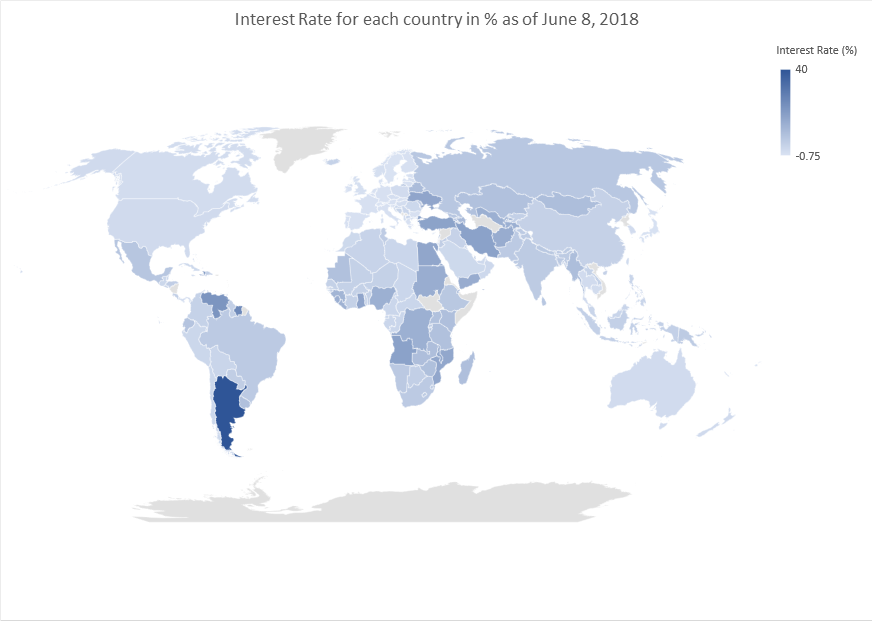

… at a time when Interest Rates around the world have never been lower

Never ever in history has there been a time when 24 nations in the world have had zero or negative interest rates.

Never ever in history have interest rates around the world been lower.

The average interest rate in the world is 5.75% today, the lowest on record.

Here are countries with zero or negative interest rates,

Switzerland -0.75%

Denmark -0.65%

Sweden -0.5%

Japan -0.1%

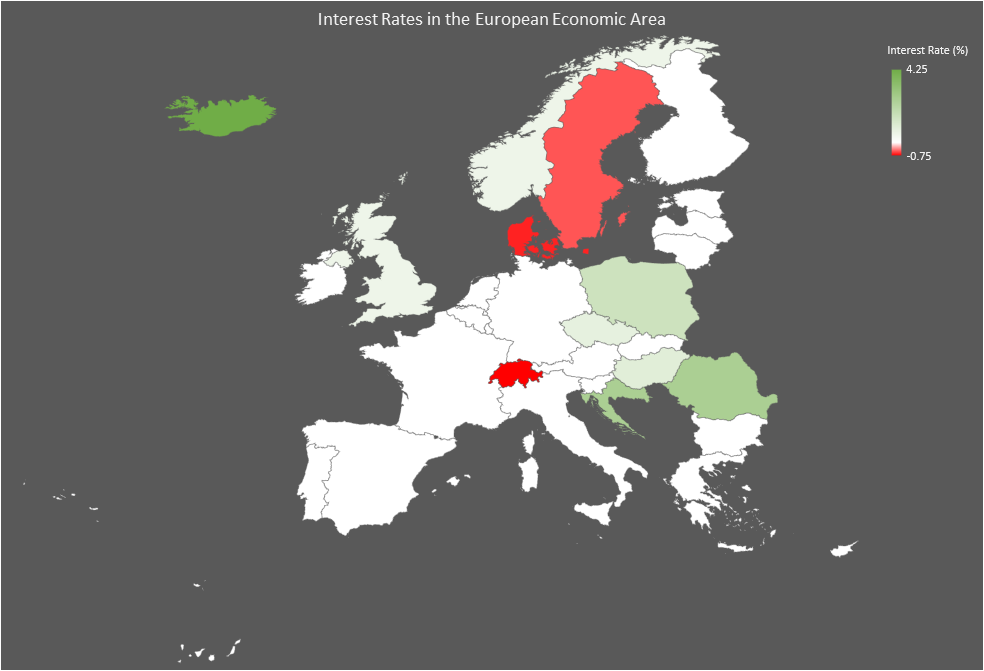

Austria 0%

Belgium 0%

Bulgaria 0%

Cyprus 0%

Estonia 0%

Finland 0%

France 0%

Germany 0%

Greece 0%

Ireland 0%

Italy 0%

Latvia 0%

Lithuania 0%

Luxembourg 0%

Malta 0%

Netherlands 0%

Portugal 0%

Slovakia 0%

Slovenia 0%

Spain 0%

European interest rates have never been lower. You could get a mortgage in parts of Europe that pays you interest for borrowing money!

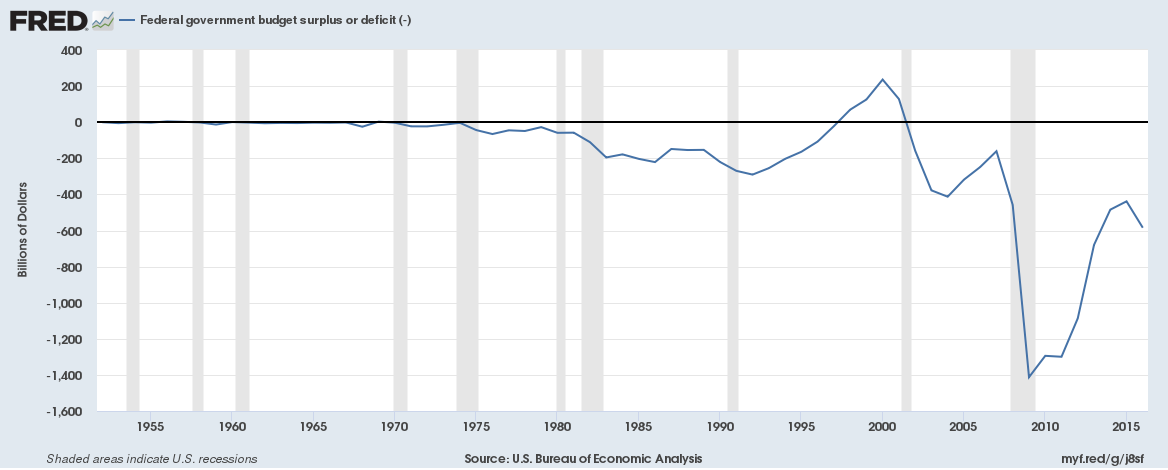

The US has an AAA credit rating despite growing debt, a rising budget deficit and soaring interest costs

The US last had a budgetary surplus in 2001 and is now projected to run a surplus next in 2035.

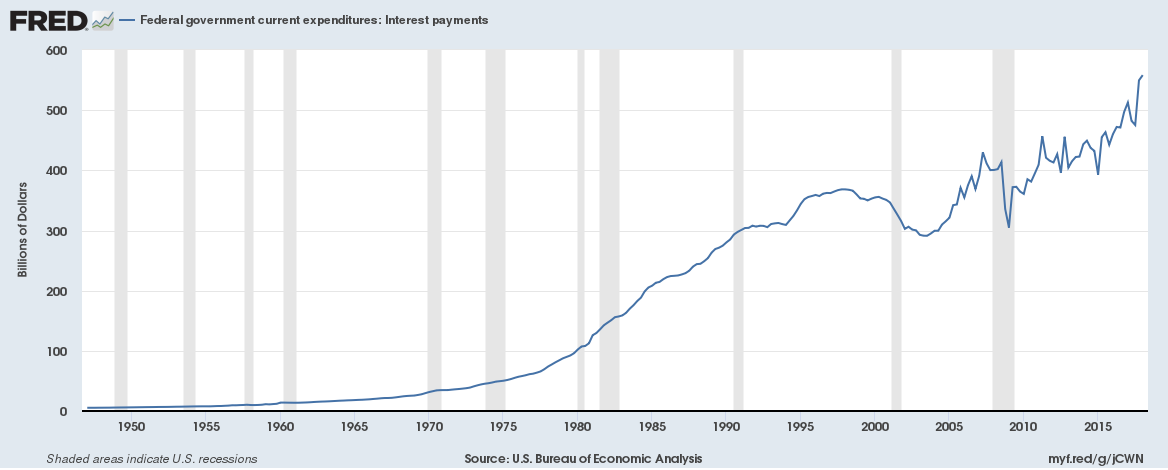

As with rising debt and rising interest rates, expenditure on interest payments has been soaring too. The US pays around $558 billion in interest payments a year.

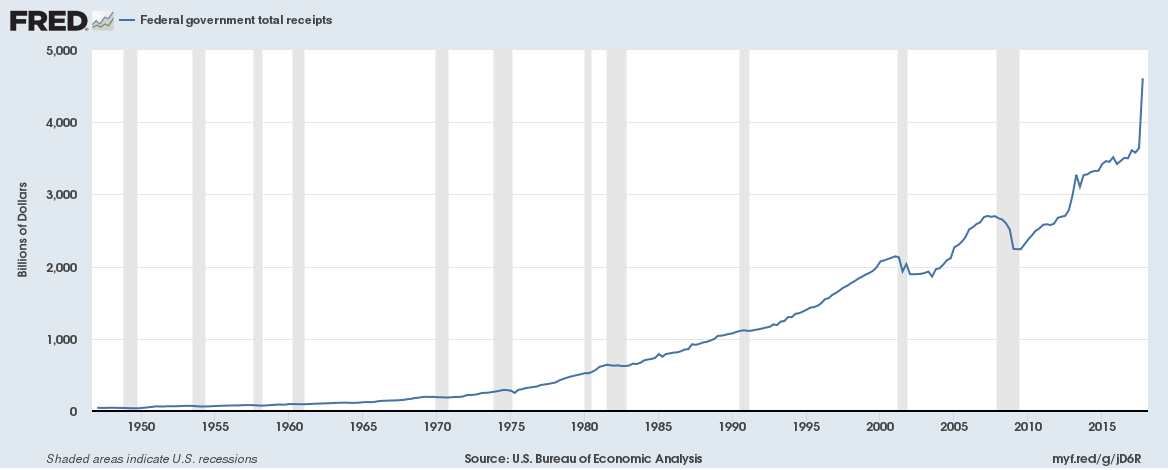

The total federal revenues are around $4.6 trillion (Federal revenue only – state revenues not included) a year, which would mean 12% of all revenues are paid as ongoing interest. But with tax cuts, government finances are going to get worse.

Falling government revenue, rising budget deficit, growing debt, soaring interest costs (due to rising yields) … yet the US has an AAA rating.

Just saying – a day (September 14, 2008) before Lehman Brothers entered Chapter 11 administration (i.e. bankruptcy) Fitch had rated its senior debt A+, and its subordinated debt and preferred stock A. Moody’s had rated its senior long-term rating A1 and its subordinated debt A2. Everything is great until it isn’t.