Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

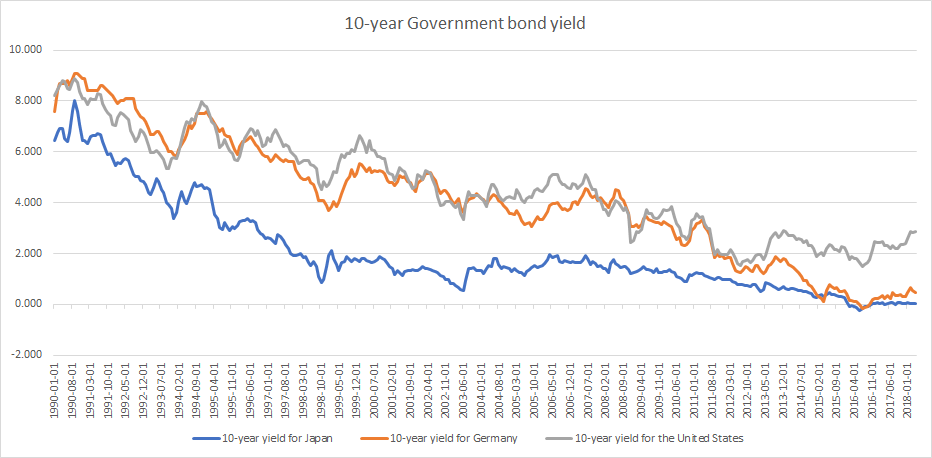

Super low Government bond yields

Government bond yields have never been lower with 2-year yields for most of Europe currently negative. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Even 10-year yields for Japan and Switzerland are barely positive.

Yields on government bonds for all maturities over 3 months have never been lower in the history of the world .

Some 80% of 10-year Japanese government bonds are held by the Bank of Japan. And apparently there are days when no one trades those 10-year bonds because there is no point of trading it. Why? Well, because the Bank of Japan has a policy to control yield curves and since they hold majority of it there are hardly any price movements.

The looming pension crisis

An aging world: Babies born in 2018 can expect to live to over 100. In 2015, there were around 600 million people aged 65 or over and that number is expected to rise to over 2 billion by 2050.

Changing demographics: There are currently 8 workers in employment for every retiree today, that number is likely to reduce to 4 workers in employment for every retiree by 2050.

Underfunding: The UK currently has $6.2 trillion in underfunded government and public-sector employee pensions. For the US that amount is over $25 trillion.

Lower bond yields: Previous funding assumed 7% bond yields, the number has been much closer to 2.5% since 2009 which has caused major deficits.

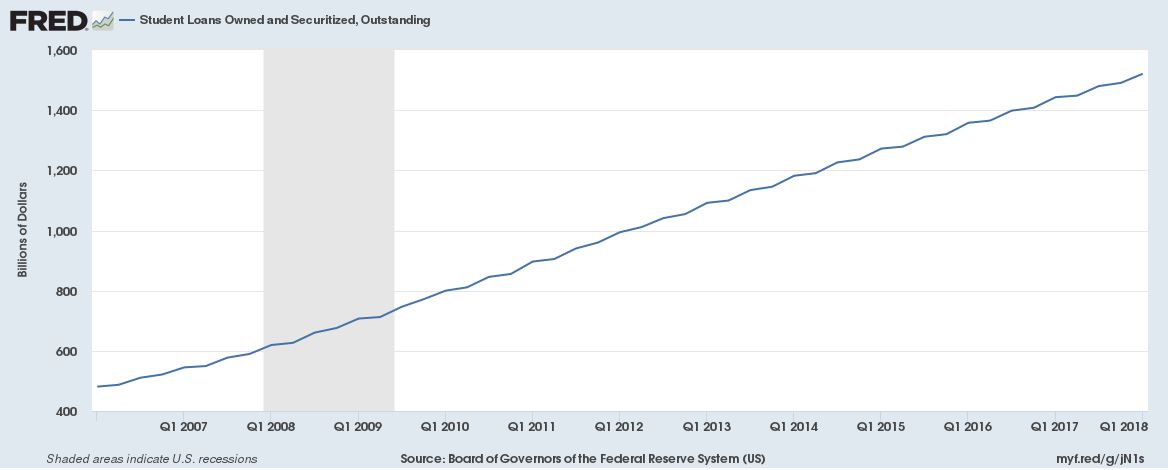

Student loans have never been higher

One way to keep unemployment low is to keep more people in education. Student debt around the world has never been higher.

US Student debt has crossed $1.5 trillion. That is more than the GDP of 185 individual countries and more than individual mortgage debt in the US.

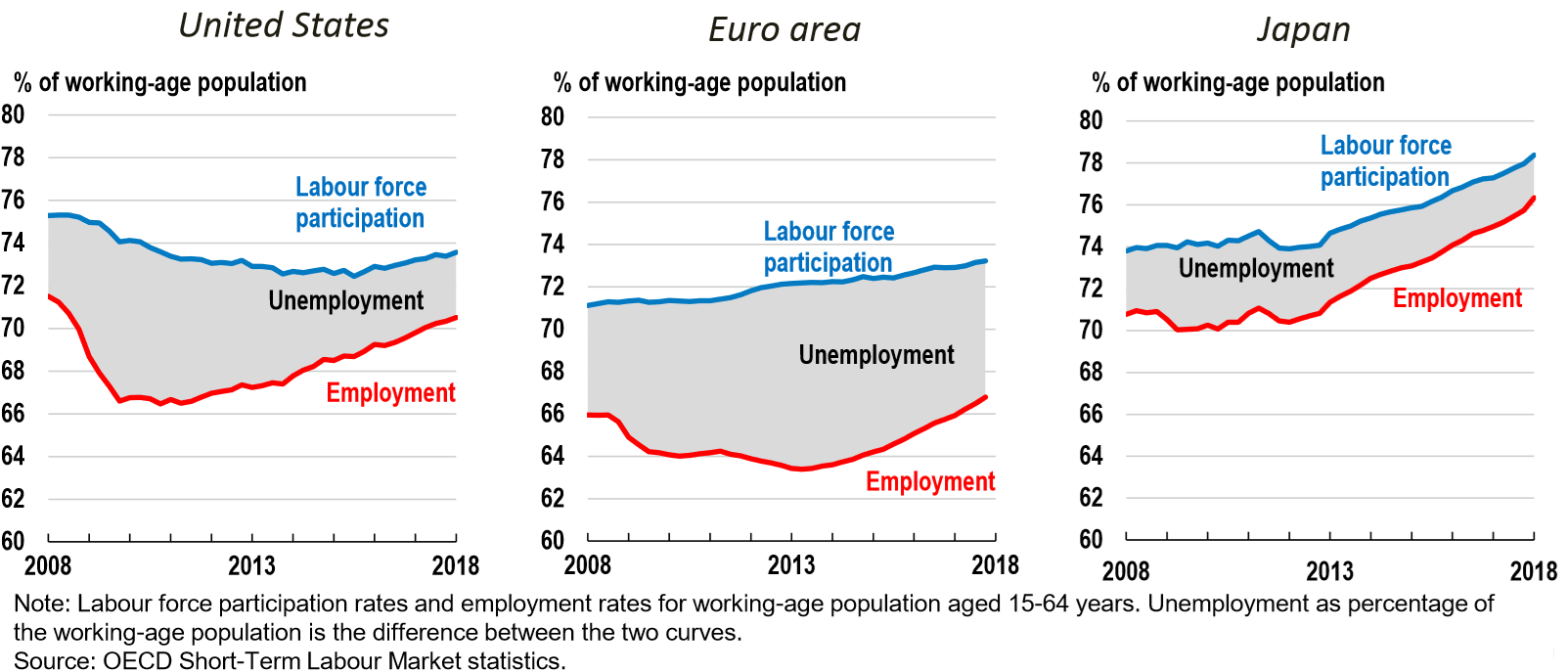

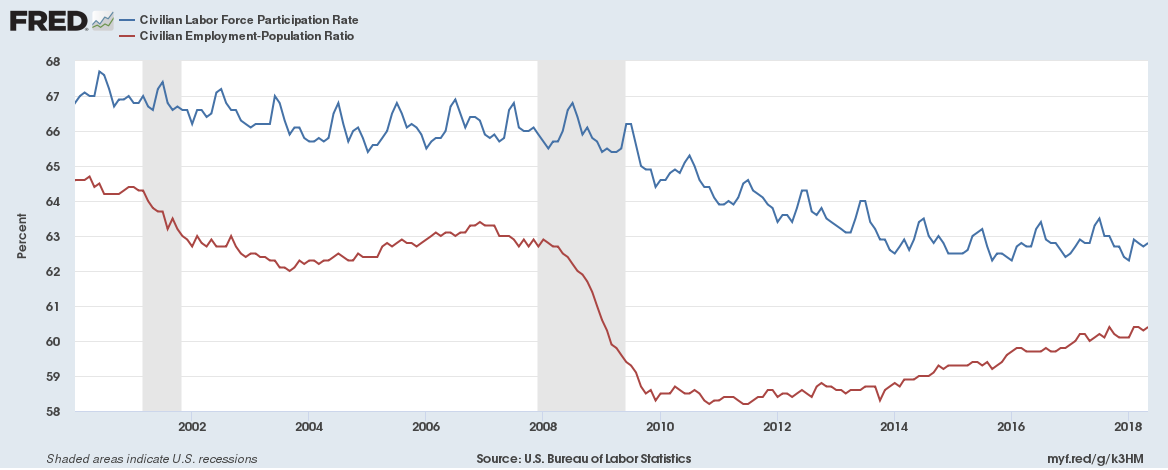

Real unemployment

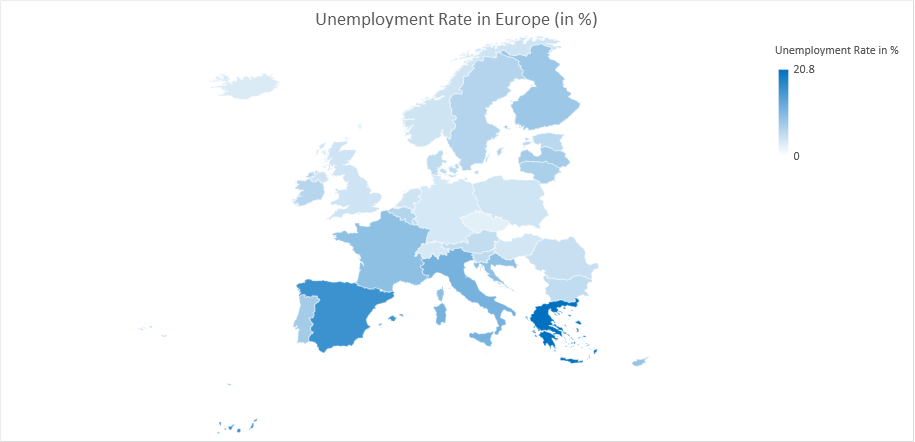

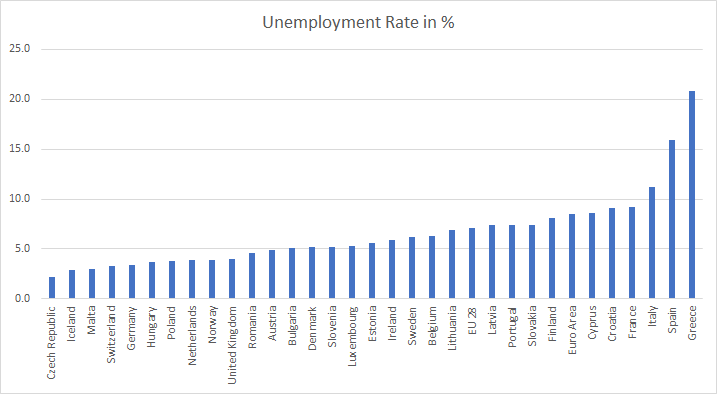

Unemployment in Europe is lowest since 2008 but is still twice that of the United States.

The Euro Area unemployment rate was 8.5% in April 2018, down from 8.6% in March 2018 and from 9.2% in April 2017. This is the lowest since December 2008 but still more than double of the US unemployment rate of 3.9% reported in April (the US unemployment rate further fell to 3.8% in May).

Greece with unemployment at 20.8%, Spain with unemployment at 15.9% and Italy with unemployment at 11.2% remain the three countries with the highest unemployment in Europe.

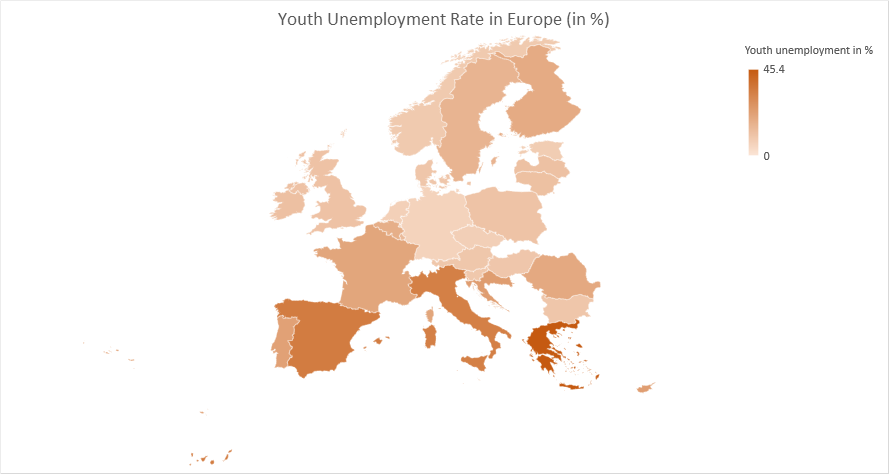

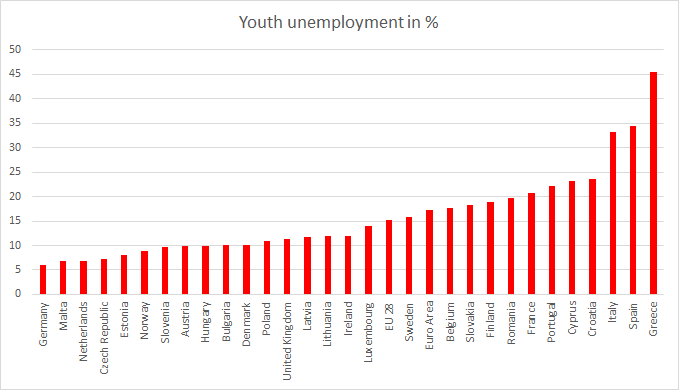

What is more intriguing is youth unemployment at 15.3% for the EU28 and 17.2% for Euro Area. Portugal, Cyprus, Croatia, France, Italy, Spain and Greece all have youth unemployment of more than 20%.

So, is the US doing great with regards to employment or is Europe doing badly? This chart from the OECD tells it all,