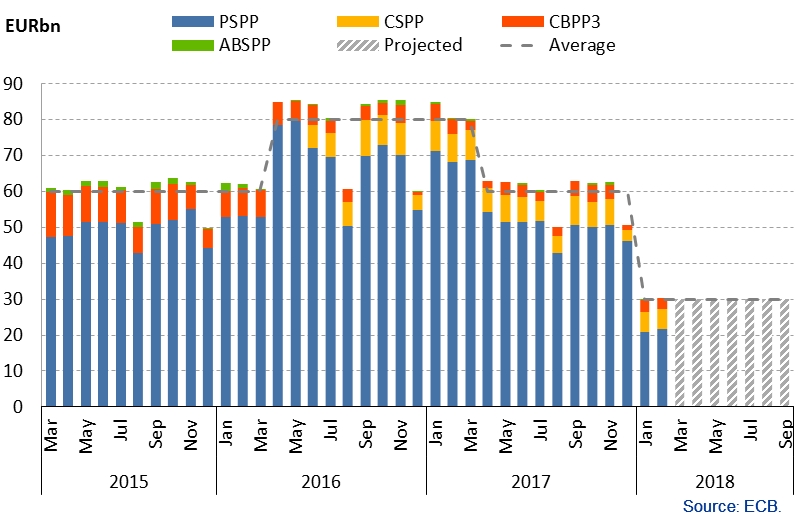

The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (possibly the only) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt.

Bond yields are being held artificially low by the buying programme.

Here are 10-year and 2-year yields,

10-year bond yields, Figures in brackets indicate 1-year changes

Germany 0.50% (0.12%)

France 0.73% (-0.23%)

Netherlands 0.66% (0.02%)

Italy 1.90% (-0.43%)

Spain 1.24% (-0.44%)

Portugal 1.67% (-2.40%)

Greece 4.36% (-2.75%)

USA 2.82% (0.44%)

2-year bond yields, Figures in brackets indicate 1-year changes

Germany -0.59% (0.11%)

France -0.46% (-0.05%)

Netherlands -0.63% (0.05%)

Italy -0.20% (-0.21%)

Spain -0.26% (-0.06%)

Portugal -0.14% (-0.74%)

Greece 1.44% (-6.54%)

USA 2.29% (0.99%)

2-year Eurozone yields are (mostly) negative which is fascinating. Compare that to bond yields of the US.

Everyone is focussing on the balance sheet of the Federal Reserve (which is $4.45 trillion or some 23% of GDP of the US) but it is nothing compared to that of the European Central Bank (which is 4.5 trillion Euros or some 45% of the GDP of the Eurozone).

We can’t see how the Eurozone (and European) credit markets could do with the ECB ending its QE program. Maybe it won’t end in September as it has said it will. Or maybe as the EU keeps saying for everything else – there is a “creative” solution to solve problems! The solution will have to be really creative to work given the Eurozone credit market is virtually just one player.