Do economic fundamentals matter today? We look at the strange market conditions today. We are living in truly interesting times …

Stock Market Valuations

Equities globally have never been more valuable with market capitalization hitting $90 trillion.

Amazon trades at what a Price to Earnings ratio of some 200. Apple is worth some $900 billion. Even Tesla which makes no profit and is unlikely to make any profit any time soon is worth some $55 billion, more than Ford or General Motors.

Netflix is valued at $159 billion (13.6 times revenues of $11.7 billion) with 110 million paid (and 117 million total) subscribers. Netflix trades at a price to earnings ratio of 220. The company expects free cash flow of -$3 to -$4 billion in 2018 (yes, that is negative cash flow). Yet Netflix’s market cap is now greater than Disney’s and Comcast’s.

Don’t mention fundamentals …

Central Banks printing money and buying equities

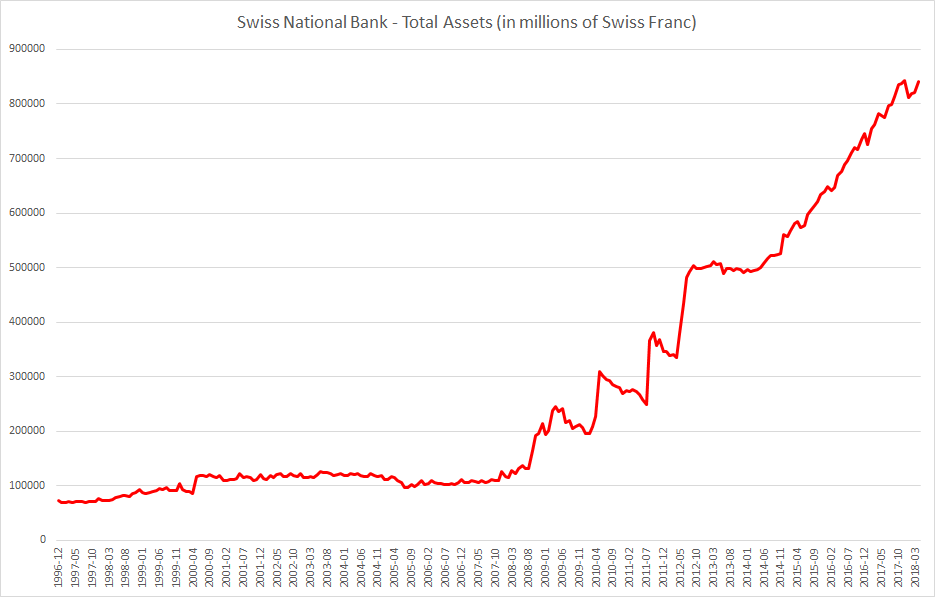

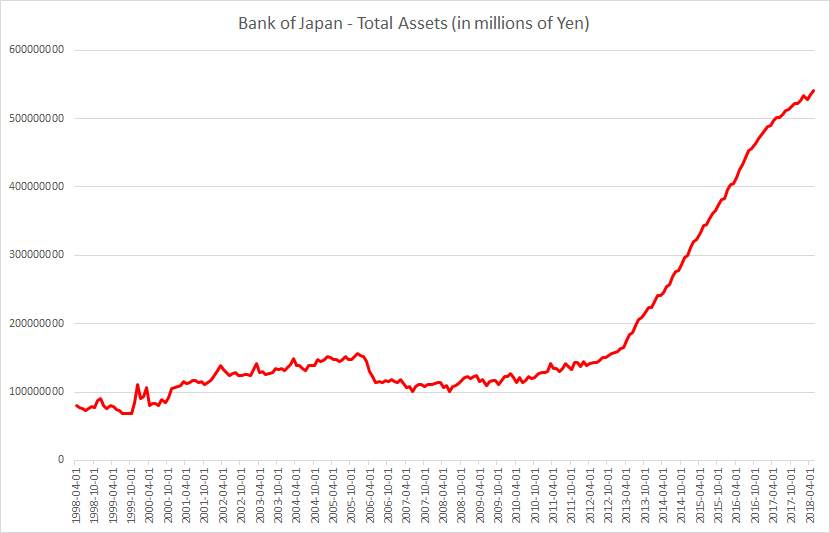

Both the Swiss National Bank and the Bank of Japan have negative interest rates (-0.75% for Switzerland and -0.10% for Japan) and have done a lot of Quantitative Easing in the last 5 years. Both have a balance sheet greater than the GDP of their respective countries with Bank of Japan’s balance sheet 101% of GDP of Japan and the Swiss National Bank with a balance sheet of 125% of GDP of Switzerland. What do they do with freshly printed money?

The Swiss National Bank has around $800 billion in foreign currency investments. Amongst its famous holdings are a $3 billion investment in Apple (and it has been buying more shares) and $1.5 billion investment in Facebook. It made a profit of 54 billion Swiss Francs ($55 billion) for the 2017 financial year mainly down to its overseas equities investments.

The Bank of Japan has a target to buy 6 trillion Yen ($54 billion) worth of exchange traded funds a year. It now holds almost 82% of all ETFs in Japan and is indirectly the largest shareholder in many large Japanese companies, almost about half of listed companies.

Central Banks don’t just manage monetary policy now, they are also major shareholders in private corporations.

Residential Mortgage Debt greater than the GDP of a country

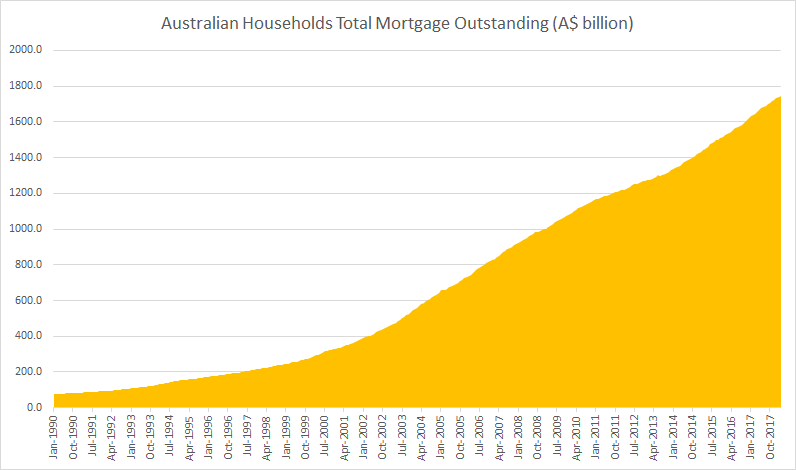

Take Australia for instance.

Total Residential Mortgage Debt Outstanding: A$1.75 trillion (Up 67% since September 2008), 96% of GDP (2017)

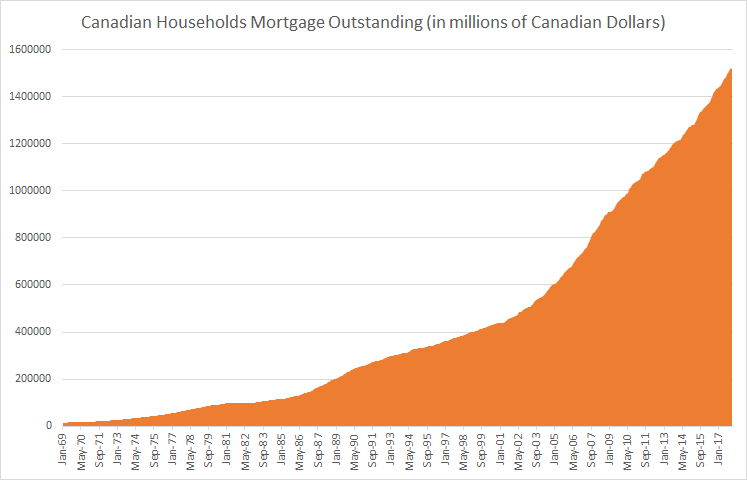

Or Canada

Total Residential Mortgage Debt Outstanding: C$1.53 trillion (Up 70% since September 2008), 102% of GDP (2017)

The Banking Crisis

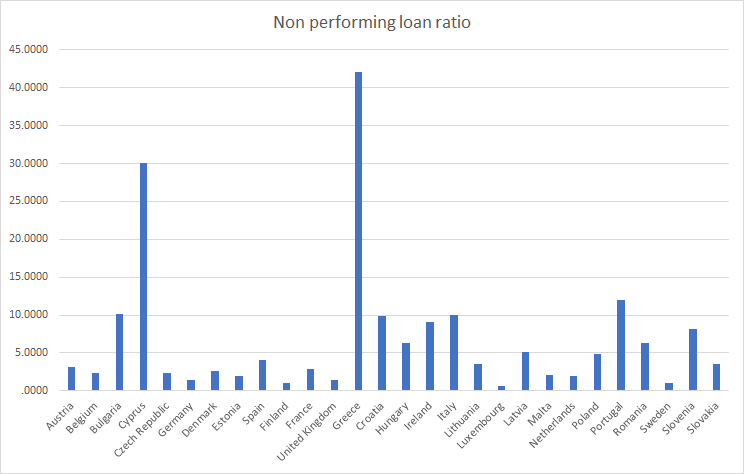

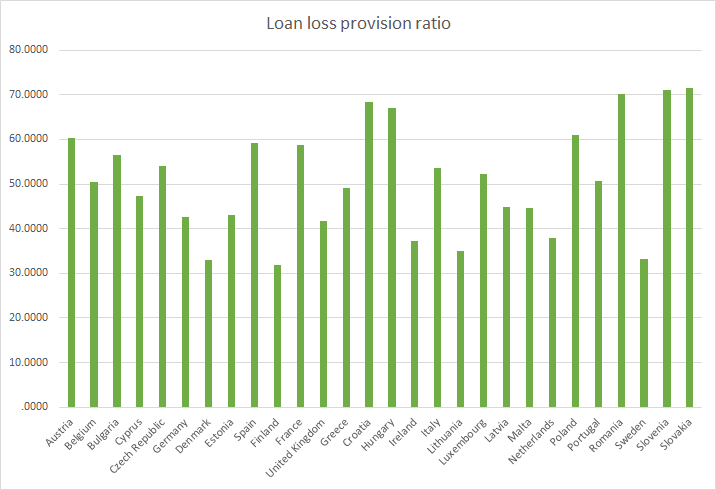

Banks in Greece, Cyprus, Portugal and Italy have a non-performing loan ratio of over 10% a decade on from the financial crisis and have only provisioned around 50% of the losses. The European Banking Crisis is far from over.

2018 feels just like 2008 for European Banks …