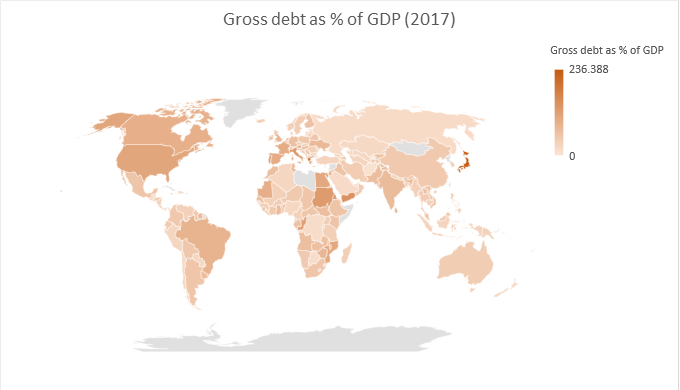

Here is the gross debt of every country as percentage of GDP for 2017 (source: International Monetary Fund),

All countries have at least some gross debt and 10 countries have no net debt.

Japan has both the highest gross and net debt as percentage of GDP.

Here is the data set (negative values for net debt as % of GDP indicate that the country has no debt); G20 countries are highlighted in bold,

(Country; Gross debt as percentage of GDP; Net debt as percentage of GDP)

Afghanistan; 7.346; N/A

Albania; 71.244; 65.472

Algeria; 25.802; 20.487

Angola; 65.266; N/A

Antigua and Barbuda; 86.823; N/A

Argentina; 52.615; N/A

Armenia; 53.467; N/A

Australia; 41.592; 19.094

Austria; 78.833; 54.32

Azerbaijan; 54.702; N/A

The Bahamas; 57.205; N/A

Bahrain; 90.335; N/A

Bangladesh; 32.414; N/A

Barbados; 132.876; 76.284

Belarus; 50.962; N/A

Belgium; 103.184; 90.324

Belize; 99.023; N/A

Benin; 54.597; N/A

Bhutan; 102.398; N/A

Bolivia; 50.86; 35.369

Bosnia and Herzegovina; 40.972; 33.735

Botswana; 15.646; -2.683

Brazil; 83.98; 51.583

Brunei Darussalam; 2.689; N/A

Bulgaria; 23.927; 10.878

Burkina Faso; 38.327; N/A

Burundi; 56.69; N/A

Cabo Verde; 126.029; 116.538

Cambodia; 35.134; N/A

Cameroon; 33.832; 30.418

Canada; 89.688; 27.793

Central African Republic; 53.441; N/A

Chad; 52.533; N/A

Chile; 23.593; 5.257

China; 47.79; N/A

Colombia; 49.414; 41.27

Comoros; 28.381; N/A

Democratic Republic of the Congo; 15.664; N/A

Republic of Congo; 119.073; N/A

Costa Rica; 49.098; N/A

Côte d’Ivoire; 46.391; N/A

Croatia; 78.414; N/A

Cyprus; 99.258; N/A

Czech Republic; 34.663; 22.869

Denmark; 36.413; 16.273

Djibouti; 30.649; 28.101

Dominica; 87.57; N/A

Dominican Republic; 37.743; 28.556

Ecuador; 44.979; N/A

Egypt; 103.261; 94.005

El Salvador; 59.319; N/A

Equatorial Guinea; 42.676; N/A

Eritrea; 131.244; N/A

Estonia; 8.772; -0.572

Ethiopia; 56.223; 52.228

Fiji; 46.623; 42.332

Finland; 61.369; 22.574

France; 96.956; 87.651

Gabon; 61.065; N/A

The Gambia; 123.239; N/A

Georgia; 44.918; N/A

Germany; 64.137; 45.099

Ghana; 71.839; 65.273

Greece; 181.906; N/A

Grenada; 71.448; N/A

Guatemala; 24.375; N/A

Guinea; 39.669; N/A

Guinea-Bissau; 41.971; N/A

Guyana; 50.676; 50.676

Haiti; 31.087; N/A

Honduras; 43.949; N/A

Hong Kong SAR; 0.055; N/A

Hungary; 69.906; 66.413

Iceland; 40.906; 33.344

India; 70.2; N/A

Indonesia; 28.913; 24.802

Islamic Republic of Iran; 40.866; 29.741

Iraq; 57.98; N/A

Ireland; 68.52; 59.829

Israel; 60.971; 57.928

Italy; 131.454; 119.885

Jamaica; 104.074; N/A

Japan; 236.388; 153.04

Jordan; 95.557; 88.489

Kazakhstan; 21.184; -11.784

Kenya; 55.646; 50.364

Kiribati; 26.315; N/A

Korea (Republic of); 39.782; 6.609

Kosovo; 20.94; N/A

Kuwait; 20.641; N/A

Kyrgyz Republic; 59.092; N/A

Lao P.D.R.; 62.769; N/A

Latvia; 34.835; 26.918

Lebanon; 152.846; 147.164

Lesotho; 34.703; -0.944

Liberia; 34.434; 31.997

Libya; N/A; N/A

Lithuania; 36.52; 29.717

Luxembourg; 23.032; -8.284

Macao SAR; 0; N/A

FYR Macedonia; 39.254; 38.446

Madagascar; 37.276; N/A

Malawi; 59.318; N/A

Malaysia; 54.157; N/A

Maldives; 68.051; N/A

Mali; 35.557; 29.866

Malta; 52.622; N/A

Marshall Islands; 27.969; N/A

Mauritania; 91.086; 90.799

Mauritius; 60.15; N/A

Mexico; 54.181; 46.12

Micronesia; 24.489; N/A

Moldova; 37.72; N/A

Mongolia; N/A; N/A

Montenegro; 67.493; N/A

Morocco; 64.407; 64.042

Mozambique; 102.243; N/A

Myanmar; 34.725; N/A

Namibia; 46.103; 43.643

Nauru; 60.147; N/A

Nepal; 27.15; N/A

Netherlands; 56.658; 46.173

New Zealand; 26.428; 4.649

Nicaragua; 33.562; N/A

Niger; 46.528; 40.894

Nigeria; 23.401; 19.608

Norway; 36.655; -90.469

Oman; 44.22; -10.776

Pakistan; 67.173; 61.608

Palau; N/A; N/A

Panama; 38.158; 35.881

Papua New Guinea; 32.609; N/A

Paraguay; 25.566; 20.437

Peru; 25.507; 10.118

Philippines; 37.825; N/A

Poland; 51.382; 46.668

Portugal; 125.619; 108.098

Puerto Rico; 54.573; N/A

Qatar; 53.962; N/A

Romania; 36.878; 28.341

Russia; 17.437; N/A

Rwanda; 40.599; N/A

Samoa; 49.121; N/A

San Marino; 56.569; N/A

São Tomé and Príncipe; 83.3; N/A

Saudi Arabia; 17.289; -7.723

Senegal; 61.152; N/A

Serbia; 61.476; 58.684

Seychelles; 63.315; 48.427

Sierra Leone; 58.428; N/A

Singapore; 110.864; N/A

Slovak Republic; 50.427; N/A

Slovenia; 75.367; N/A

Solomon Islands; 10.011; -1.101

Somalia; N/A; N/A

South Africa; 52.673; 47.896

South Sudan; 66.341; N/A

Spain; 98.364; 86.344

Sri Lanka; 79.424; N/A

St. Kitts and Nevis; 62.378; N/A

St. Lucia; 71.262; N/A

St. Vincent and the Grenadines; 80.813; 77.86

Sudan; 126.022; N/A

Suriname; 72.053; N/A

Swaziland; 29.173; 23.673

Sweden; 40.943; 9.014

Switzerland; 42.779; 23.053

Syria; N/A; N/A

Taiwan Province of China; 35.172; 33.291

Tajikistan; 47.784; N/A

Tanzania; 38.243; N/A

Thailand; 41.882; N/A

Timor-Leste; N/A; N/A

Togo; 78.633; N/A

Tonga; N/A; N/A

Trinidad and Tobago; 41.34; -10.968

Tunisia; 71.275; 21.269

Turkey; 28.482; 22.736

Turkmenistan; 28.82; N/A

Tuvalu; 49.186; N/A

Uganda; 38.955; N/A

Ukraine; 75.602; N/A

United Arab Emirates; 19.471; N/A

United Kingdom; 87.029; 78.166

United States; 107.785; 82.268

Uruguay; 66.19; 32.3

Uzbekistan; 24.539; N/A

Vanuatu; 48.412; N/A

Venezuela; 34.866; N/A

Vietnam; 58.231; N/A

Yemen; 141.014; 139.372

Zambia; 62.209; 56.349

Zimbabwe; 78.36; N/A

General government gross debt (Percent of GDP)

Gross debt consists of all liabilities that require payment or payments of interest and/or principal by the debtor to the creditor at a date or dates in the future. This includes debt liabilities in the form of SDRs, currency and deposits, debt securities, loans, insurance, pensions and standardized guarantee schemes, and other accounts payable. Thus, all liabilities in the GFSM 2001 system are debt, except for equity and investment fund shares and financial derivatives and employee stock options. Debt can be valued at current market, nominal, or face values.

General government net debt (Percent of GDP)

Net debt is calculated as gross debt minus financial assets corresponding to debt instruments. These financial assets are: monetary gold and SDRs, currency and deposits, debt securities, loans, insurance, pension, and standardized guarantee schemes, and other accounts receivable.