Here is the debt outstanding for all commercial banks in the US (all data as of March 31, 2018),

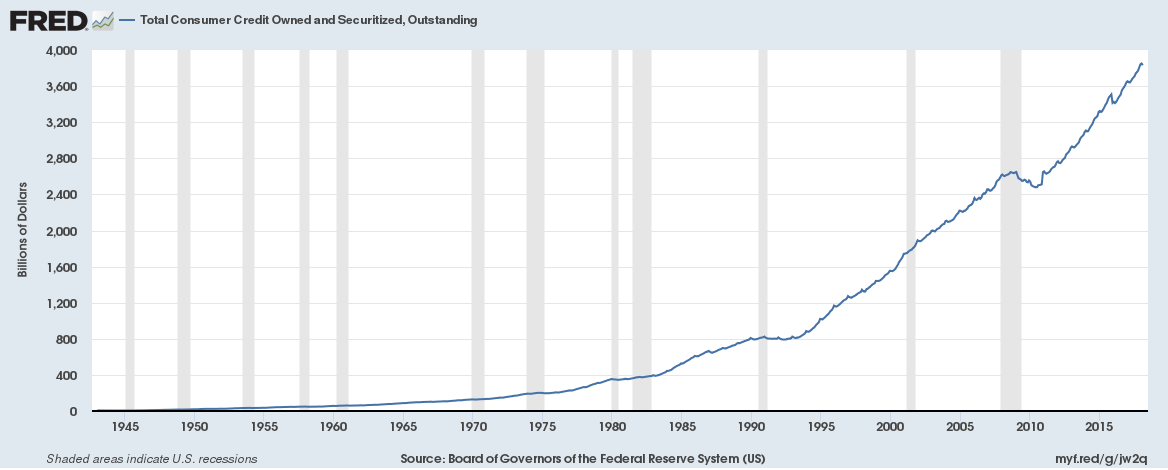

Total consumer credit including student loans $3.9 trillion (up from $2.6 trillion in 2008)

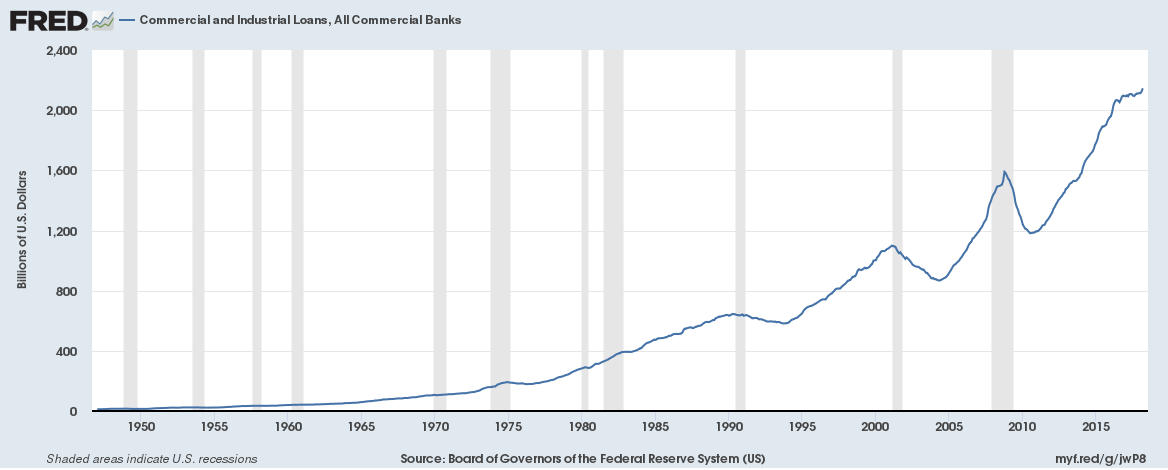

Total commercial and industrial loans $2.15 trillion (up from $1.5 trillion in 2008)

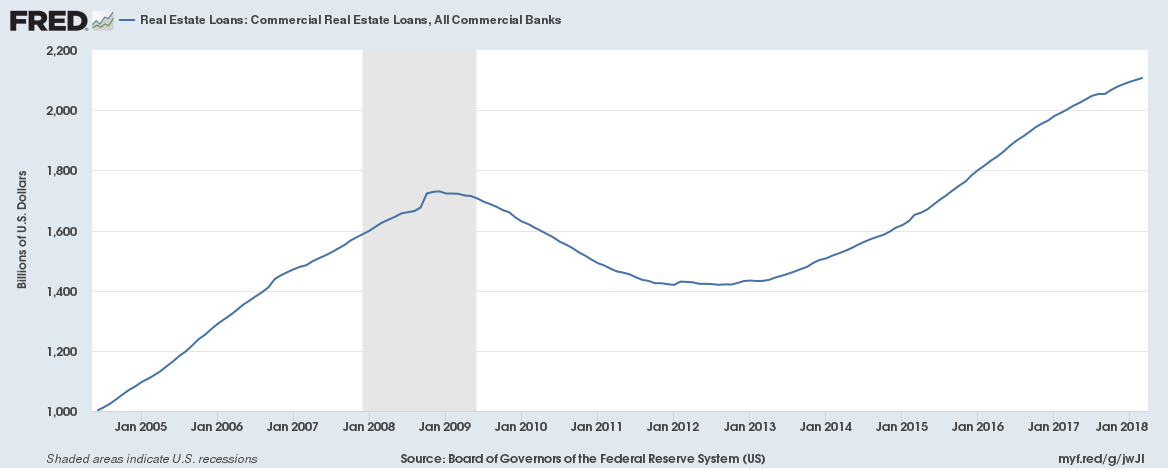

Commercial real estate loans $2.1 trillion (up from $1.6 trillion in 2008)

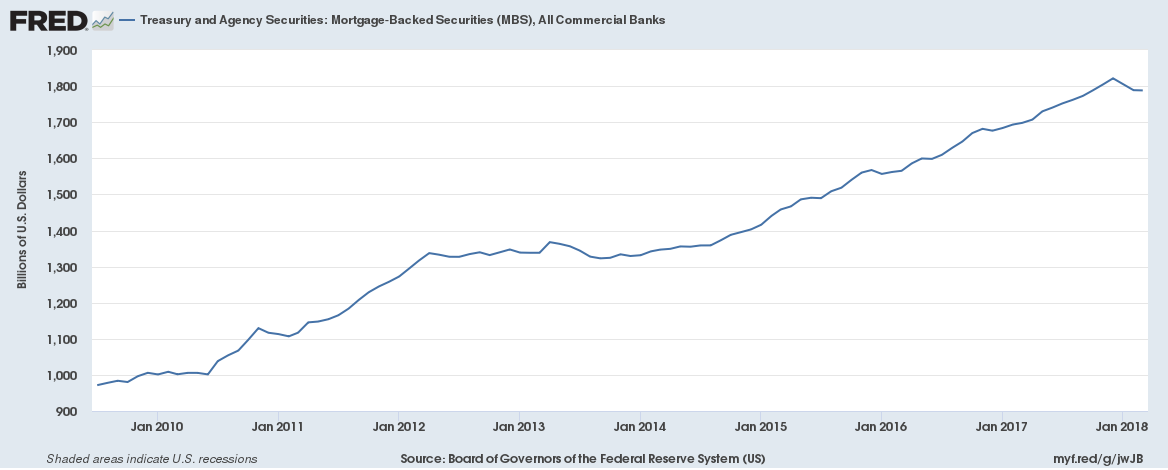

Mortgage Backed Securities $1.76 trillion (up from $800 billion in 2009)

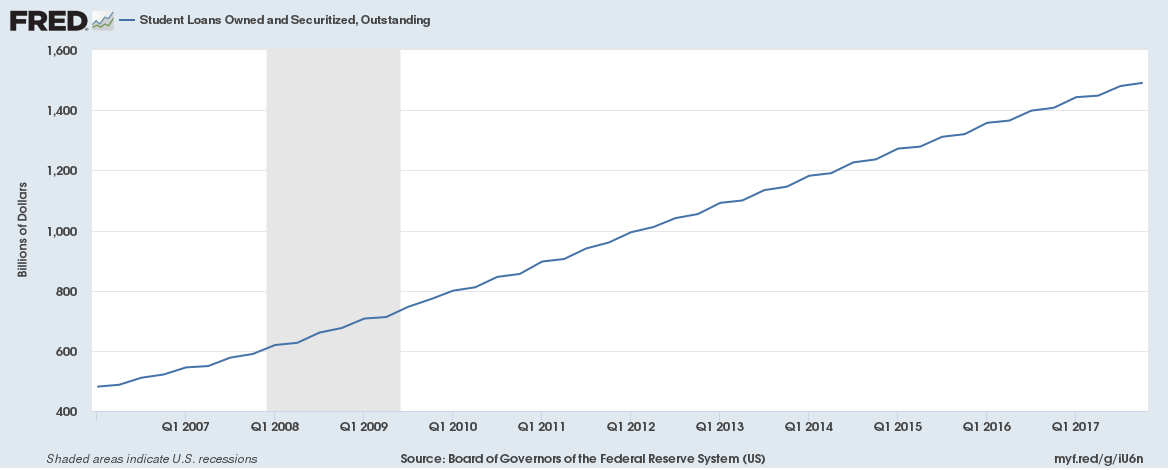

Student loans $1.5 trillion (up from $500 billion in 2008)

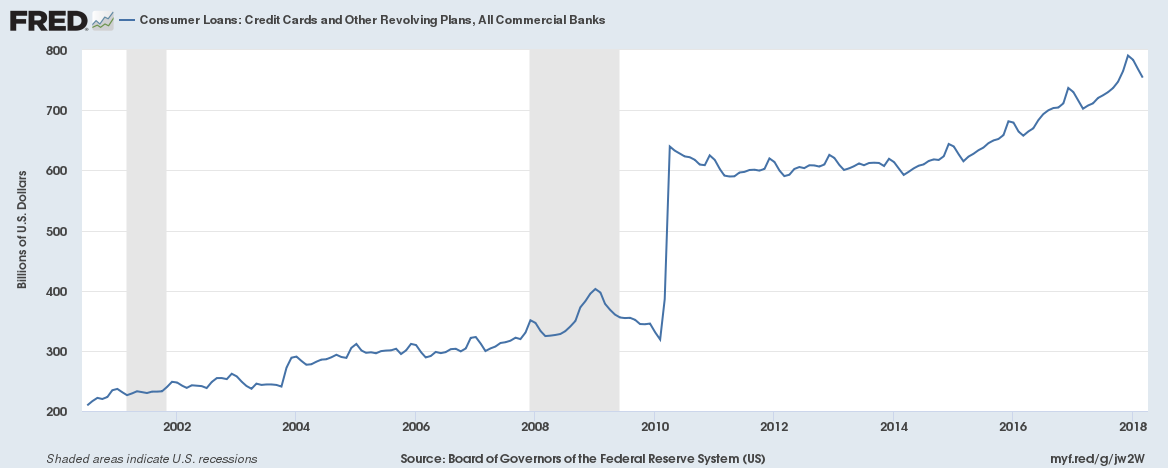

Consumer credit cards and other revolving credit $775 billion (up from $400 billion in 2008)

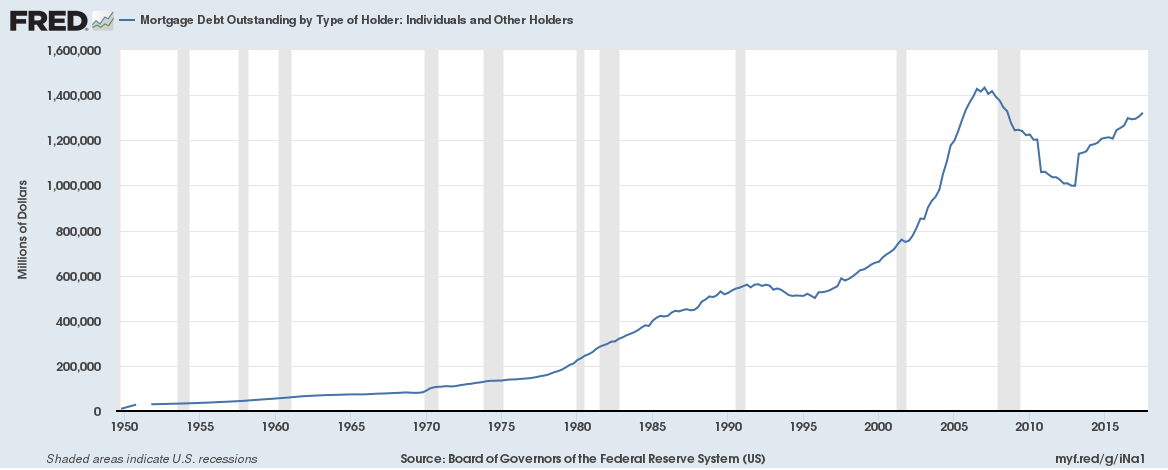

Mortgage debt $1.32 trillion (down from $1.42 trillion in 2008)

Total Consumer Credit Outstanding:

Commercial and Industrial Loans Outstanding:

Mortgage Debt Outstanding:

Credit Card and Other Revolving Plans Debt Outstanding:

Student Loans Outstanding:

Commercial Real Estate Loans Outstanding:

Mortgage Backed Securities:

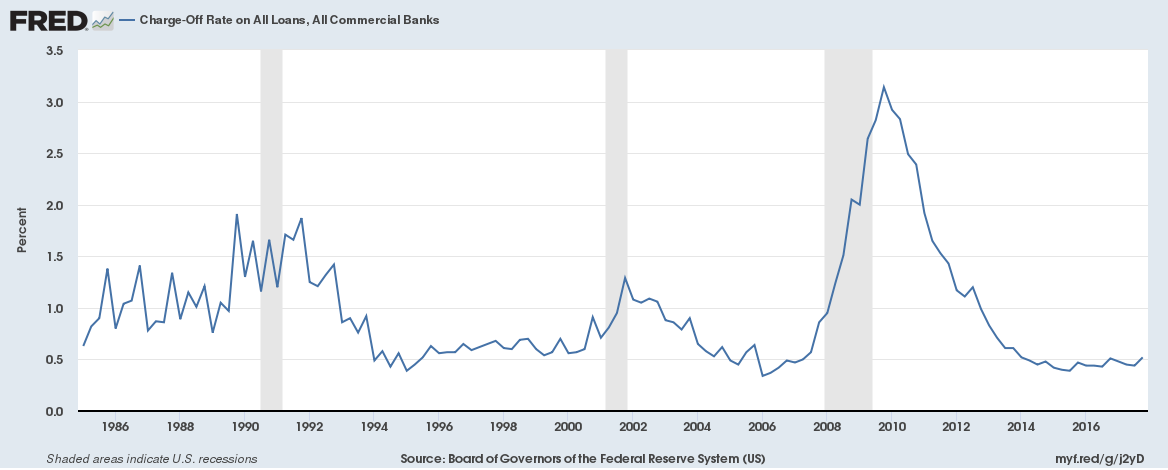

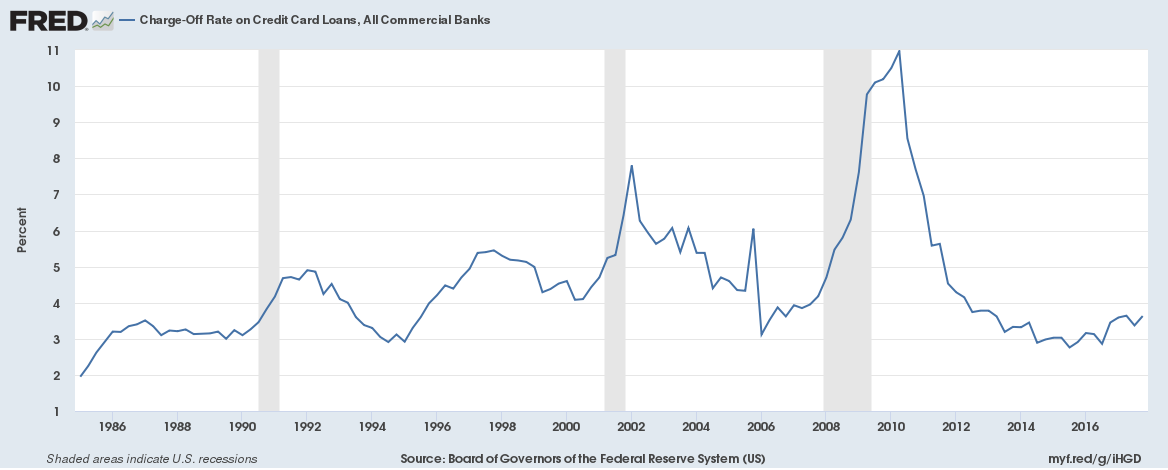

Charge-off Rates

Charge-off rates for any category of loan are defined as the flow of a bank’s net charge-offs (gross charge-offs minus recoveries) during a quarter divided by the average level of its loans outstanding over that quarter.

Charge-off rate for all products for all commercial banks in the US 0.52% (was 3.14% in Q4 2009)

Charge-off rate for real estate mortgages 0.03% (was 2.90% in Q4 2009)

Charge-off rate for consumer credit cards 3.63% (was 10.97% in Q2 2010)

Charge-off rate on All Loans:

Charge-off rate on Credit Cards:

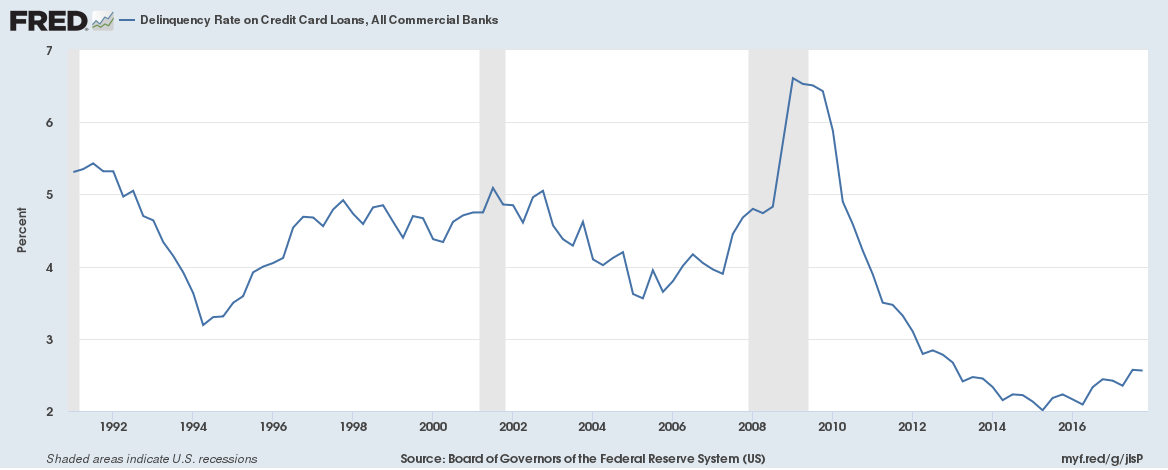

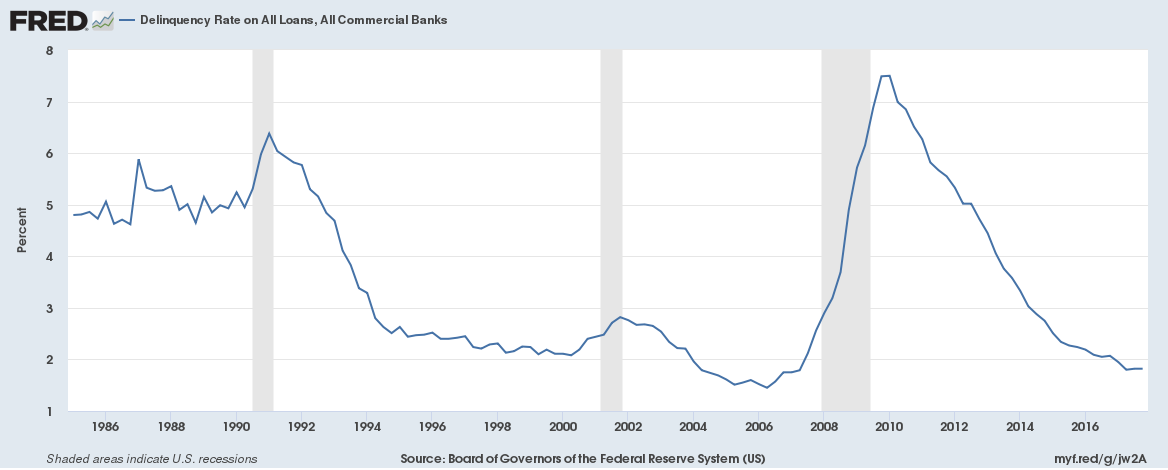

Delinquency Rates

The delinquency rate for any loan category is the ratio of the dollar amount of a bank’s delinquent loans in that category to the dollar amount of total loans outstanding in that category.

Delinquency rate for all products for all commercial banks in the US 1.82% (was 7.5% in Q2 2010)

Delinquency rate for real estate mortgages 2.30% (was 10.23% in Q1 2010)

Delinquency rate for consumer credit cards 2.56% (was 6.61% in Q1 2009)

Delinquency rate on All Loans:

Delinquency Rate on Credit Cards: