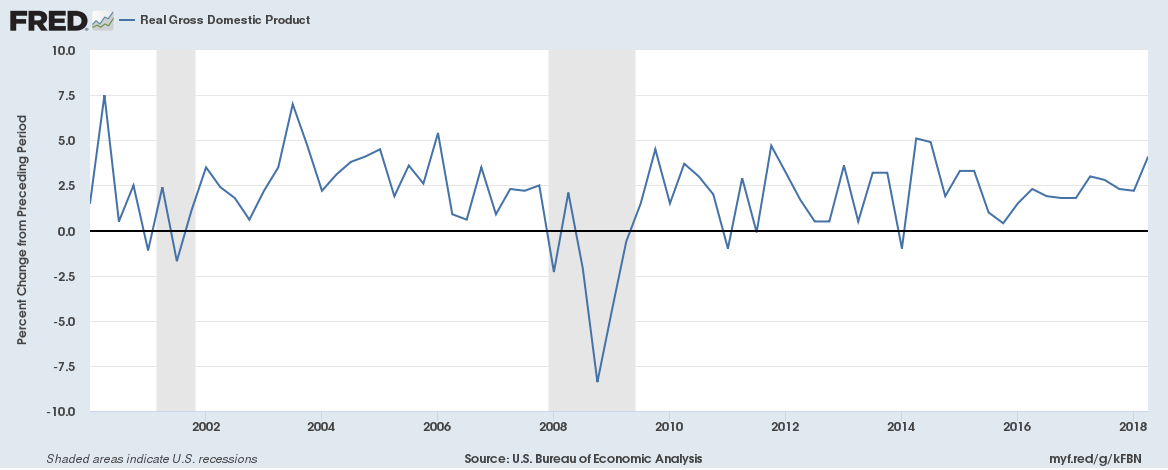

Real gross domestic product for the United States increased at an annual rate of 4.1% in Q2 2018 according to the advance estimate released by the Bureau of Economic Analysis.

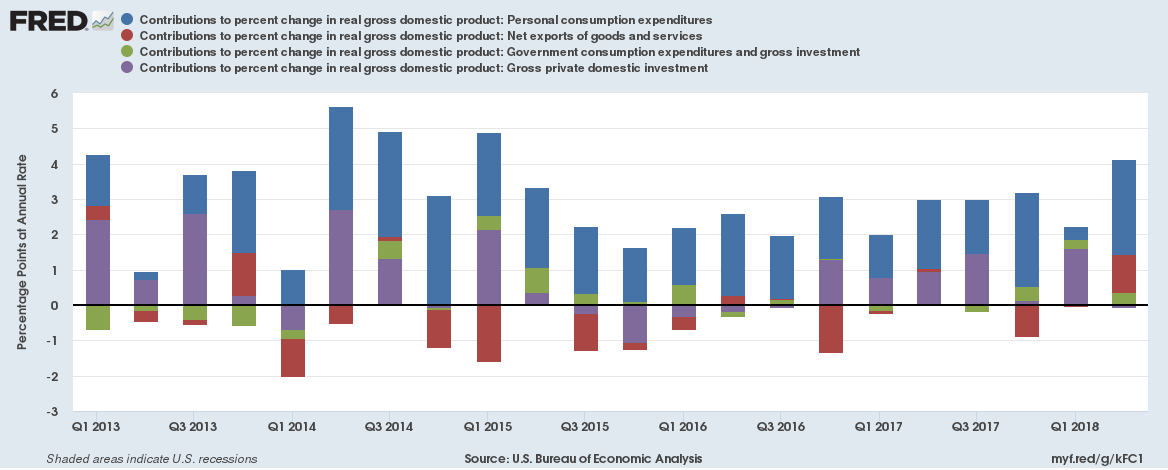

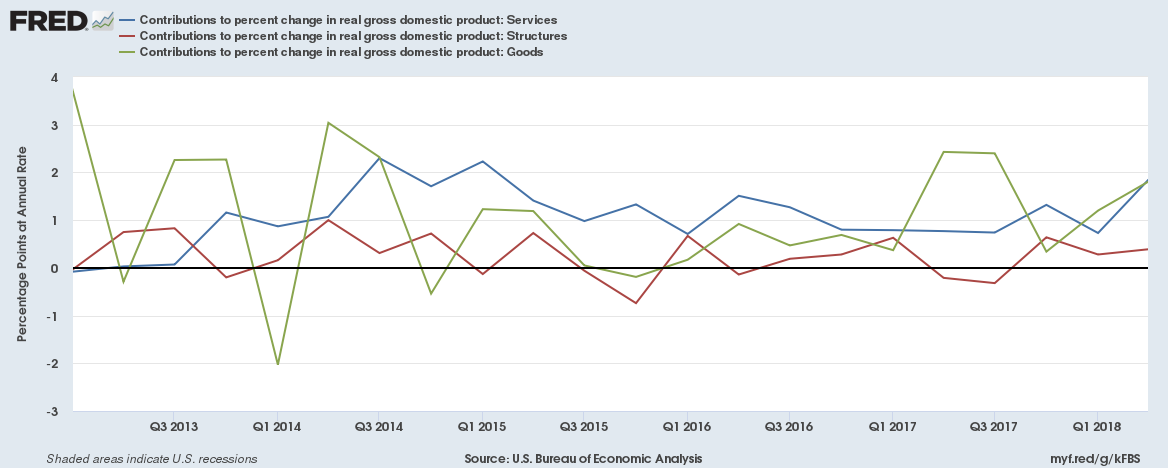

The acceleration in real GDP growth in the second quarter was down to accelerations in Personal Consumption Expenditures and in exports, a smaller decrease in residential fixed investment, and accelerations in federal government spending and in state and local spending. These movements were partly offset by a downturn in private inventory investment and a deceleration in non-residential fixed investment. Imports decelerated too.

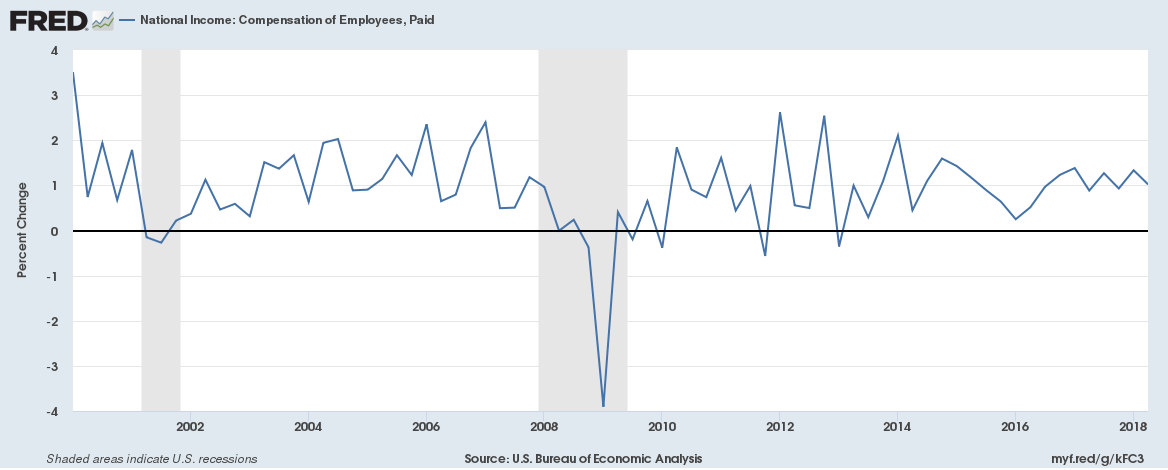

Current-dollar personal income increased $183.7 billion in the second quarter, compared with an increase of $215.8 billion in the first quarter.

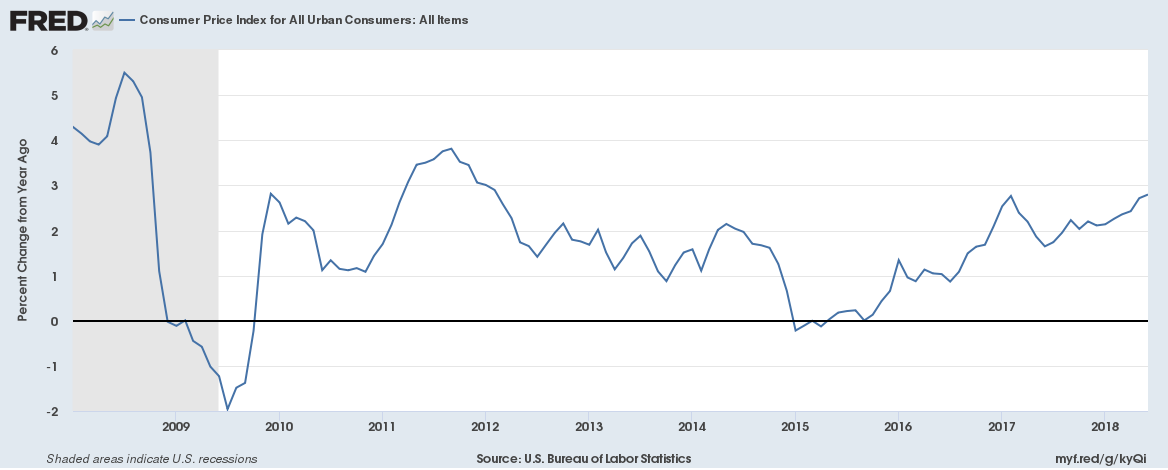

Decelerations in wages and salaries, government social benefits, personal interest income, and nonfarm proprietors’ income were partly offset by accelerations in personal dividend income and rental income, a deceleration in contributions for government social insurance (a subtraction in the calculation of personal income), and an upturn in farm proprietors’ income. Wage growth was a mere 1.1% at a time inflation (urban CPI) is running at 2.8%.

Disposable personal income increased $167.5 billion, or 4.5 percent, in the second quarter, compared with an increase of $256.7 billion, or 7.0 percent, in the first quarter. Real disposable personal income increased 2.6%, compared with an increase of 4.4%.

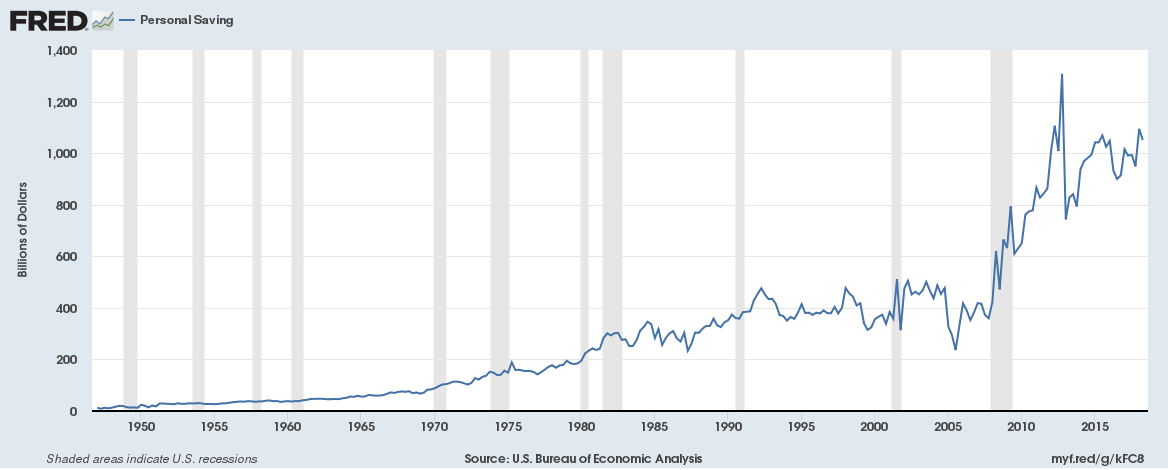

Personal saving was $1,051.1 billion in the second quarter, compared with $1094.1 billion in the first quarter. The personal saving rate (personal saving as a percentage of disposable personal income) was 6.8% in the second quarter, compared with 7.2%in the first quarter.

This contrasts with Q1 2018 when personal consumption collapsed but wage growth was the highest in a decade. (Related: U.S. Q1 2018 GDP estimated at 2.3% as personal consumption collapses; wage growth highest in a decade; personal saving rate falls)