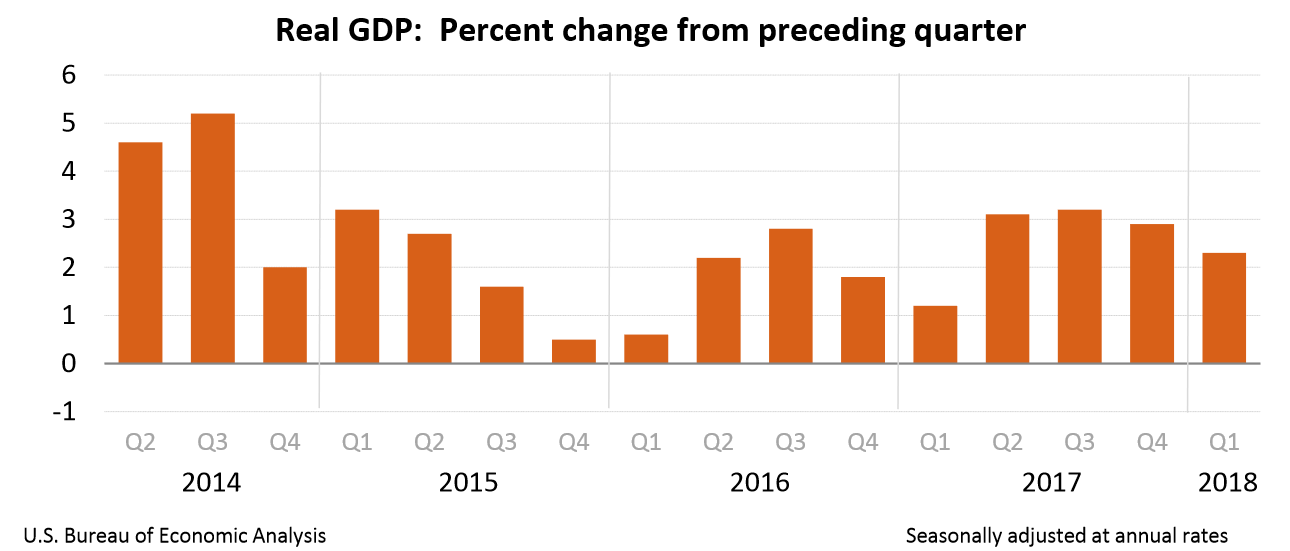

US real GDP increased at an annual rate of 2.3% in the first quarter of 2018 as per an advance estimate released by the Bureau of Economic Analysis.

Components of GDP

Personal consumption expenditures contributed 73 (0.73%) basis points to the GDP growth (the lowest since 2013)

Goods within personal consumption contributed (negative) 24 basis points to the total growth (the lowest since 2012)

Out of which Motor Vehicles contributed (negative) 42 basis points to the total growth (the lowest since 2009)

Out of which Clothing and footwear (negative) 19 basis points to the total growth (the lowest since 2010)

Services within personal consumption contributed (positive) 97 basis points to the total growth

Out of which Healthcare contributed (positive) 33 basis points to the total growth (the highest since Q2 2016)

Out of which Financial Services and Insurance contributed (positive) 34 basis points to the total growth (the highest since 2008)

Gross Private domestic investment contributed 119 basis points to the GDP growth (the highest since Q2 2015)

Change in private inventories contributed 43 basis points to the GDP growth

Net Exports of goods and services contributed 20 basis points to the GDP growth

Personal consumption is collapsing, with vehicle sale falling significantly. Falling sales of Clothing and footwear is a bit of a surprise. If the economy is doing well then why are consumers buying less? Even business inventories are up significantly. Last September General Motors reduced shifts at factories because of growing inventories and Ford yesterday announced that it is almost exiting the car market business in the US.

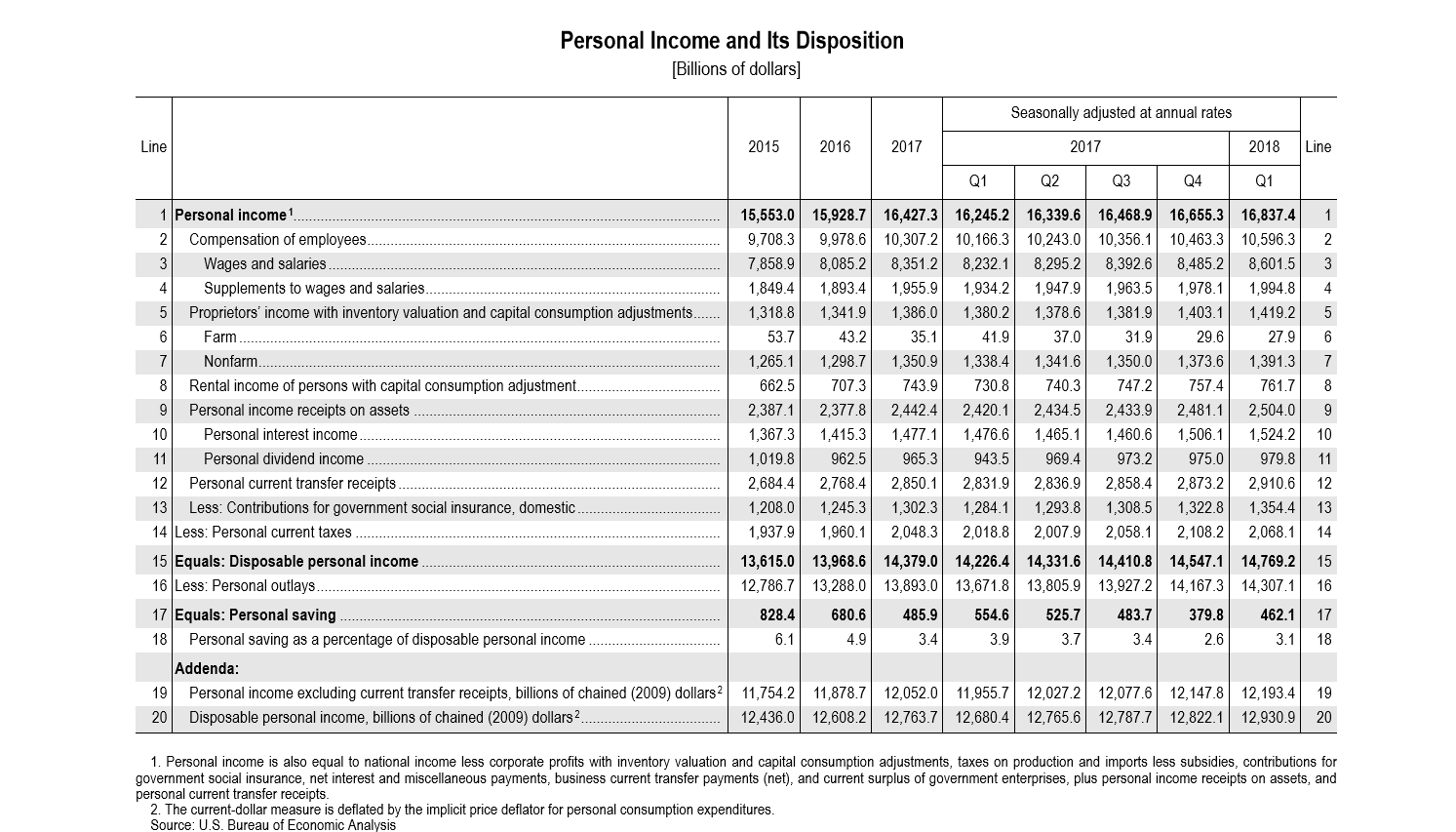

Total employee compensation (which includes wages and benefits) rose 2.7% over past 12 months, up from 2.4% a year ago and the highest since Q3 2008. Wage inflationary pressures will start affecting businesses sooner rather than later. We covered earlier here that Corporate margins for Q1 2018 earnings so far are over 11%, the highest since Q3 2008.

Current-dollar personal income increased $182.1 billion in the first quarter. Decelerations in personal interest income, rental income, and nonfarm proprietors’ income were largely offset by accelerations in wages and salaries and in government social benefits.

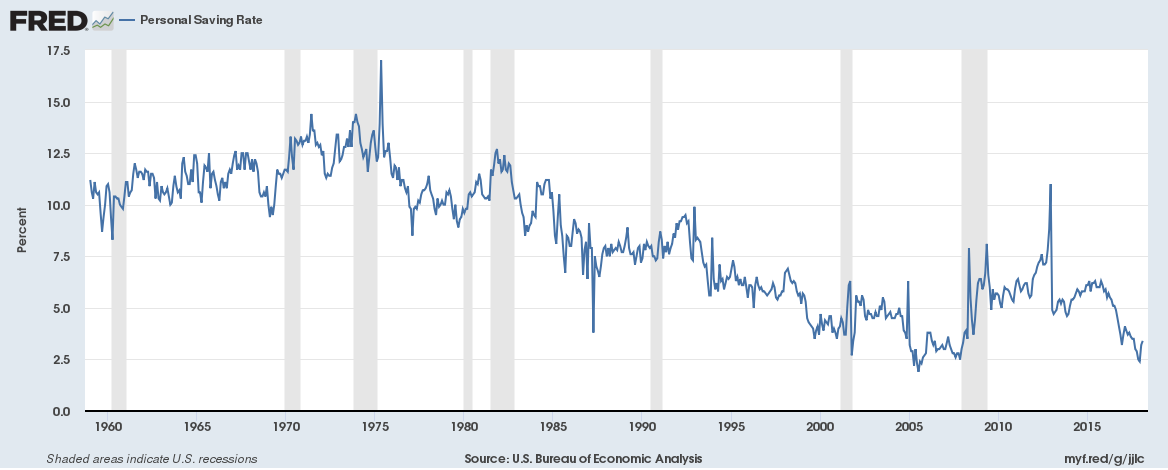

The household savings rate fell to a multi-year low of 3.1%

This means that wages are rising but real inflation is probably rising quicker which is causing the savings rate to collapse. Personal consumption is falling at an alarming rate as inventories are growing significantly. The US economy may not be as strong as everyone believes it is.