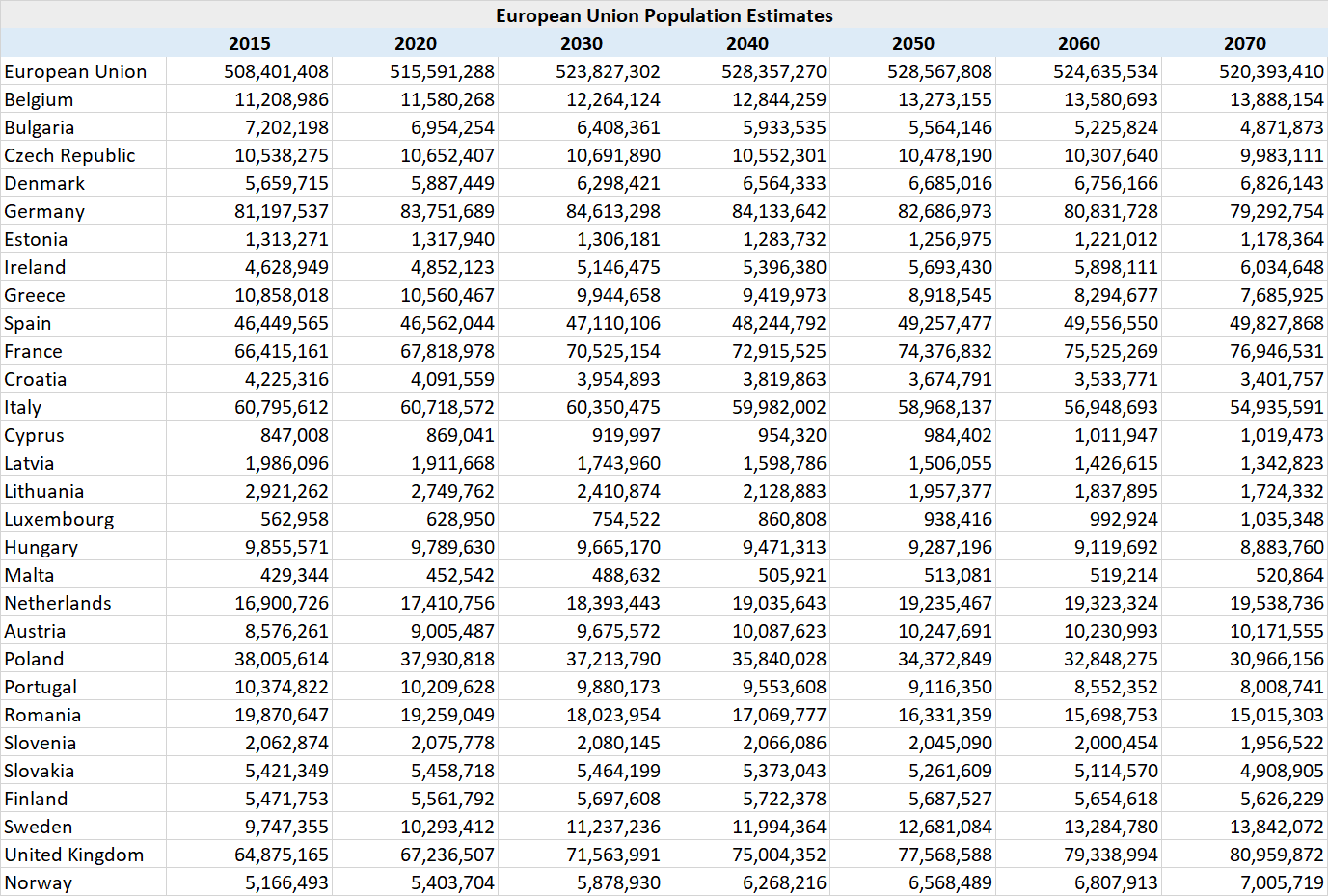

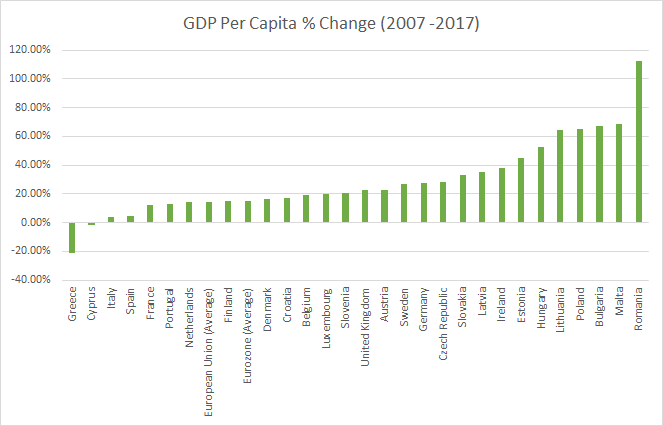

- Parts of the European Union have seen GDP per capita shrink between 2007 and 2017 and the overall compounded annual growth rate for the European Union was just 1.2%

- GDP growth for the European Union between 2007 and 2017 adjusted for inflation was negative

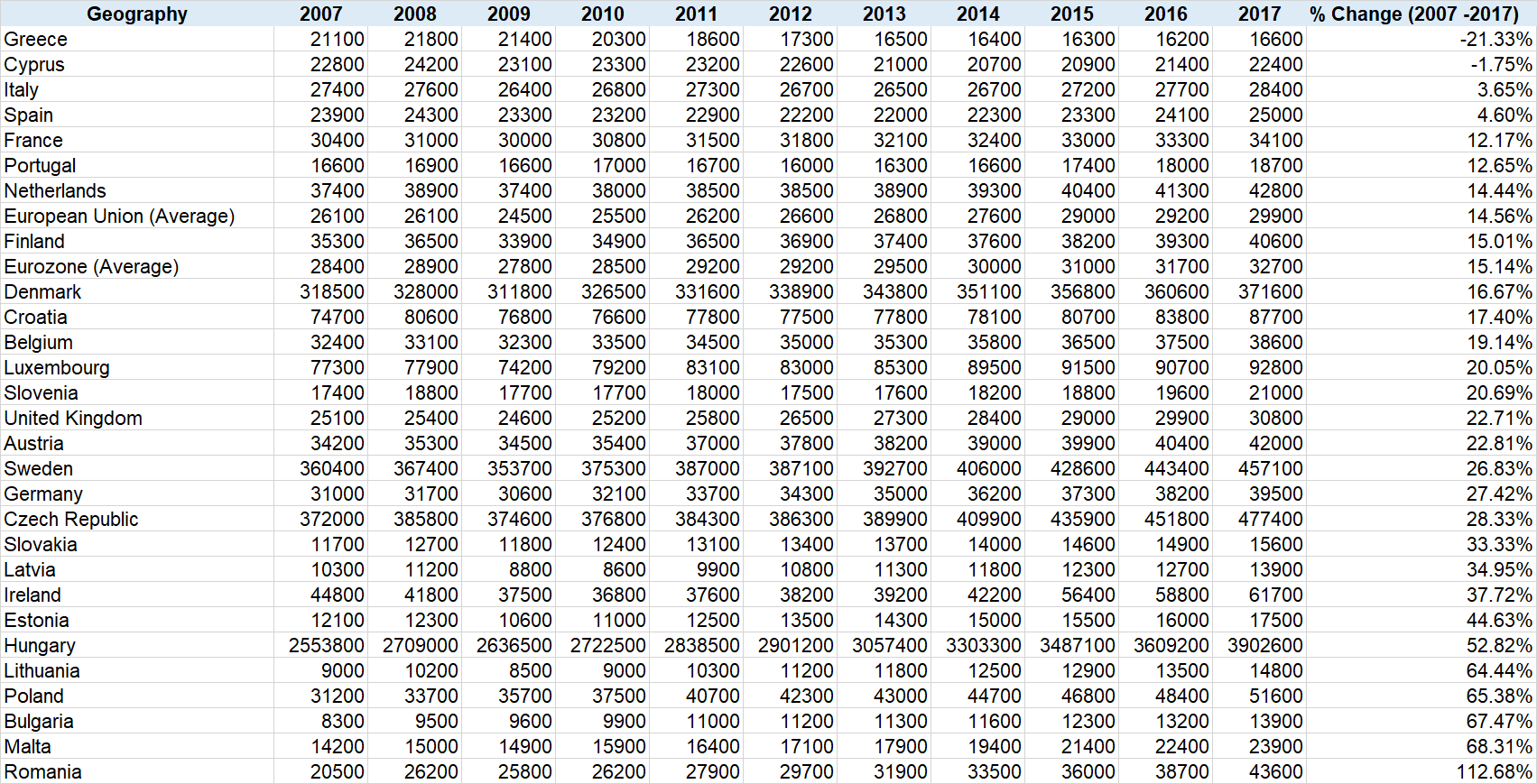

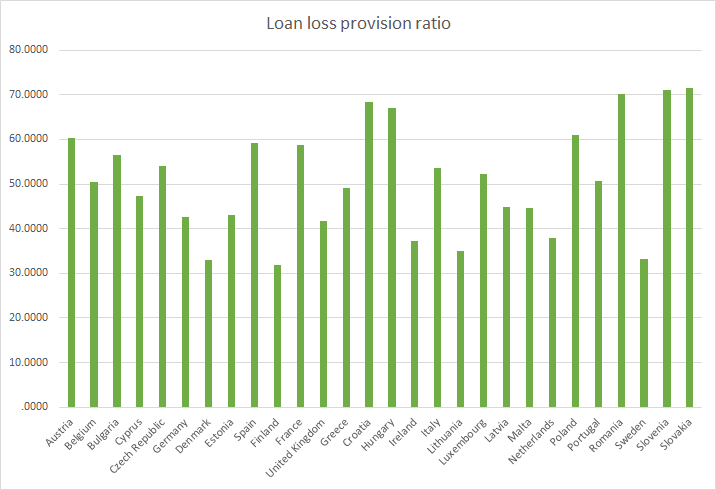

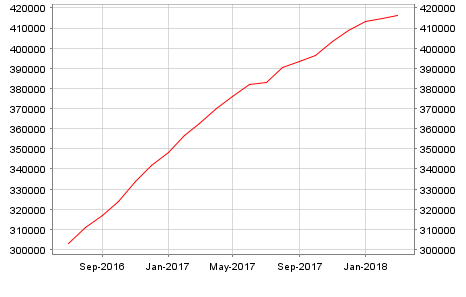

- Banks in Greece, Cyprus, Portugal and Italy have a non-performing loan ratio of over 10% a decade on from the financial crisis and have only provisioned around 50% of the losses

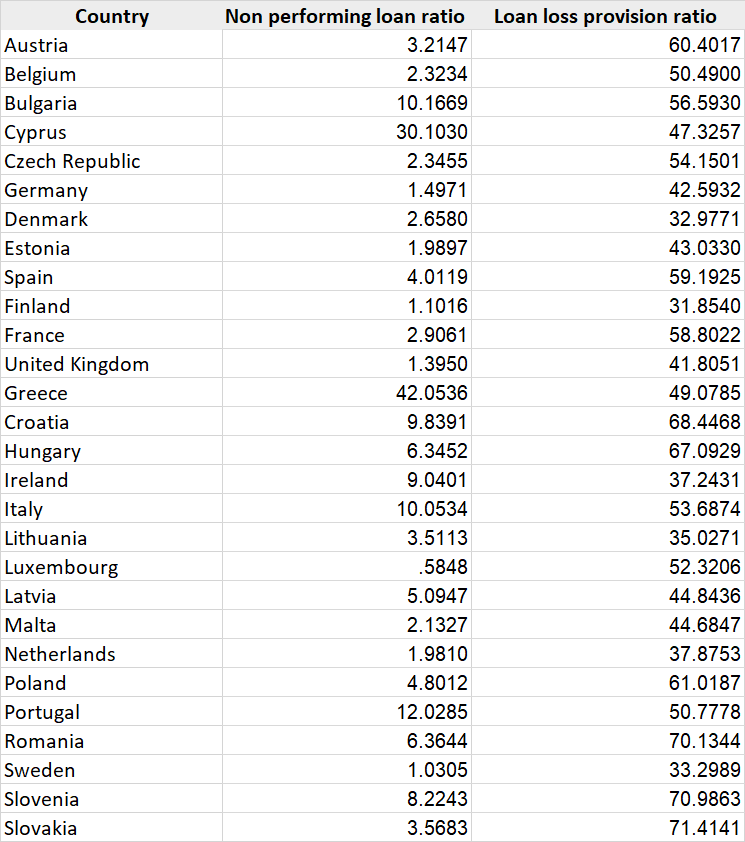

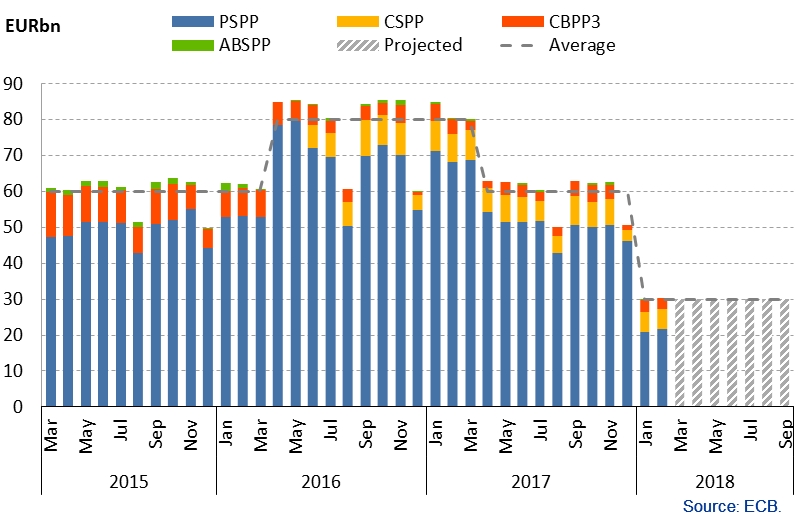

- The European Central Bank (ECB) is by far the biggest holder of European bonds and has a balance sheet of €4.5 trillion or some 45% of the GDP of the Eurozone

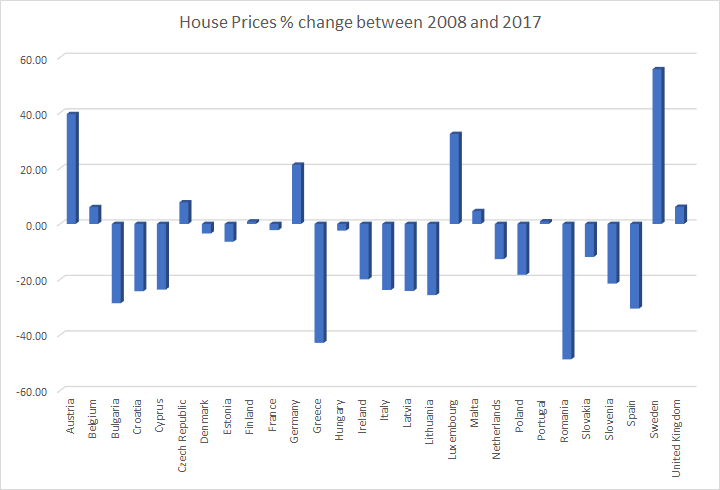

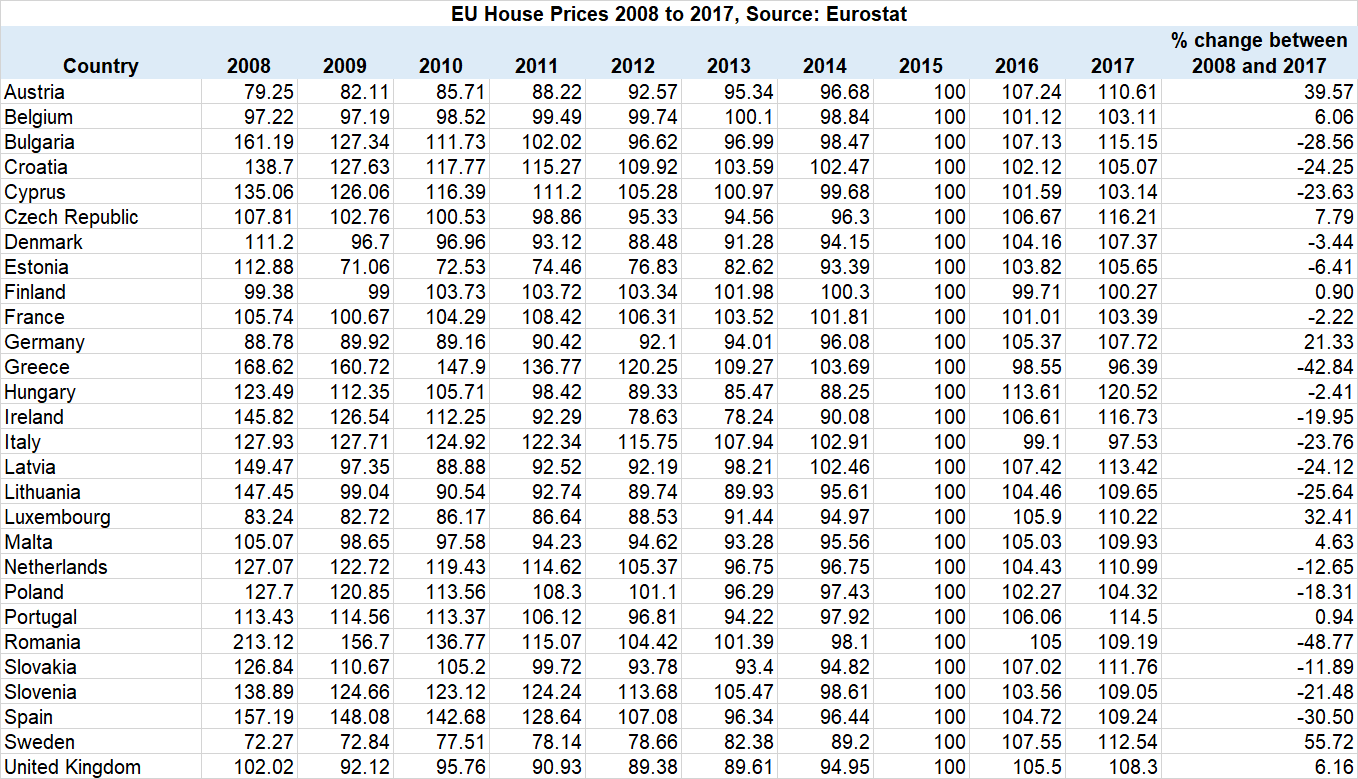

- 18 of the 28 countries that are part of the European Union have seen house prices fall between 2008 and 2017

- Greece has been the worst affected country, with its stock market down 85% since 2007, GDP per capita down 22% since 2007, house prices down 43% since 2008 and banks in Greece currently have a non-performing loan ratio of 42%

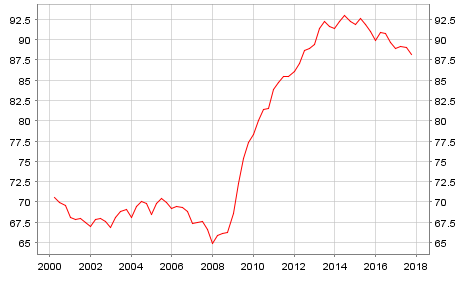

- Eurozone Debt as % of GDP is gradually falling but is still historically high

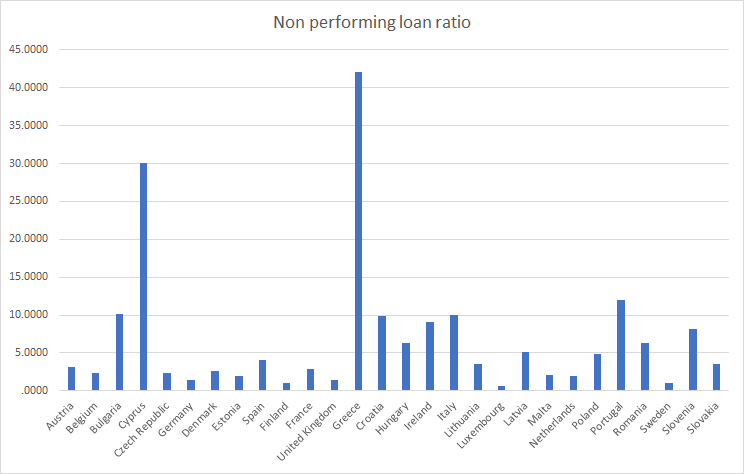

- Since the financial crisis of 2008, economic uncertainty has seen falling fertility rates for the European Union with population now set to fall over the coming decades

GDP per capita (Read more here)

Non-performing loans (Read more here)

ECB Balance Sheet (Read more here)

European House prices (Read more here)

Greece

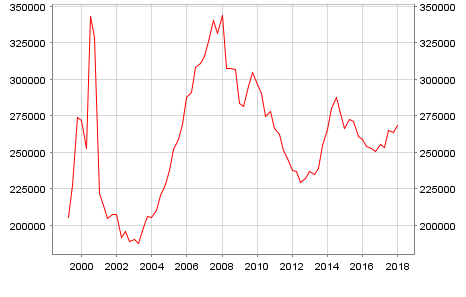

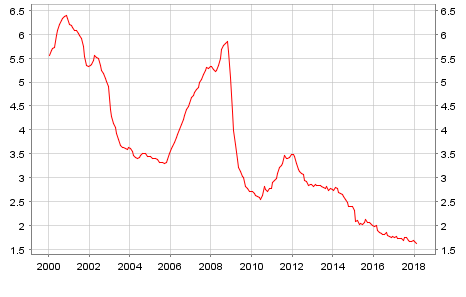

Eurozone Mortgage Rates

Eurozone Debt as % of GDP (Read more here)

Population Estimates