US bond yields have soared recently with the 10-year bond yield hitting 3% today (up 0.66% over the past year), the highest since January 2014. The 2-year bond yield topped 2.5% (up a massive 1.18% over the past year), the highest since July 2008. Meanwhile, the Greece 10-year bond yield was lower than 4%, closing at 3.99% (down 2.45% over the past year), the lowest since 2005.

Greece 2-year bond yields at 1.44% are down 5.3% over the past year. That is what happens when you have a buyer who will buy all your bond issuances at any price (read here).

To summarize,

US (Moody’s Credit Rating: Aaa)

10-year yield: 3%

2-year yield: 2.5%

Greece (Moody’s Credit Rating: Caa2)

10-year yield: 3.99%

2-year yield: 1.44%

What is driving up US bond yields?

The economy is doing well and expectations are that interest rates will continue rising quickly.

The US conference board consumer confidence index hit 128.7 (up from 127 in March), the highest since June 2008.

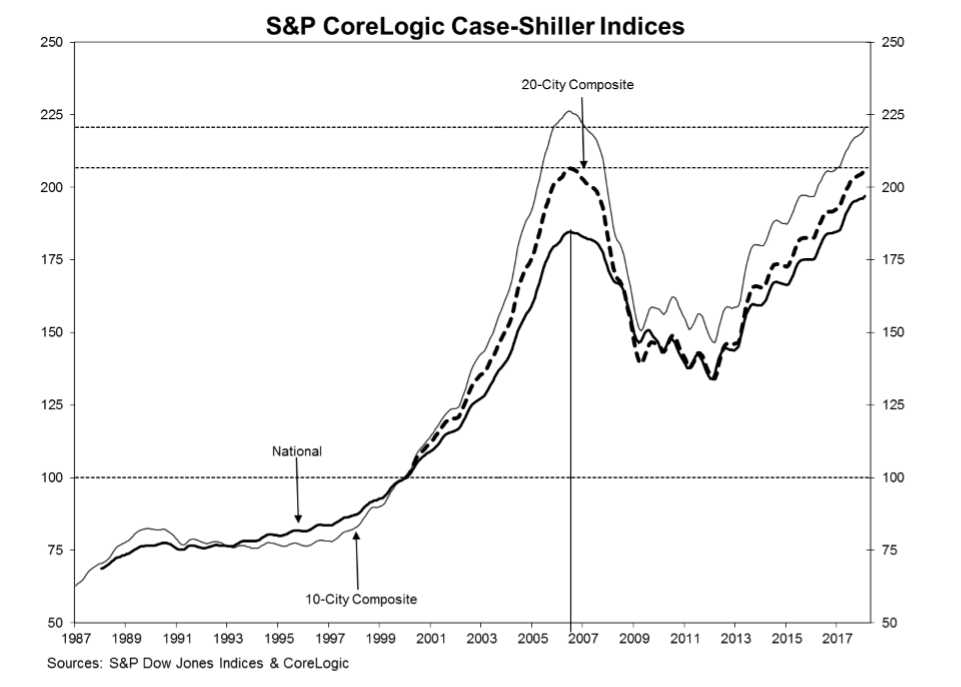

The S&P CoreLogic Case-Shiller Home Price Index jumped 6.3% in February compared to a year ago. The 10-City and 20-City Composites are back to their winter 2007 levels.

Corporate margins for Q1 2018 earnings so far are over 11%, the highest since Q3 2008.

And, amid worker shortages some companies are offering sign up bonuses of up to $25,000 to get employees on board. BNSF Railway and Union Pacific Corporation are offering the bonuses to railway recruits as they are finding it difficult to recruit in a tight job market.