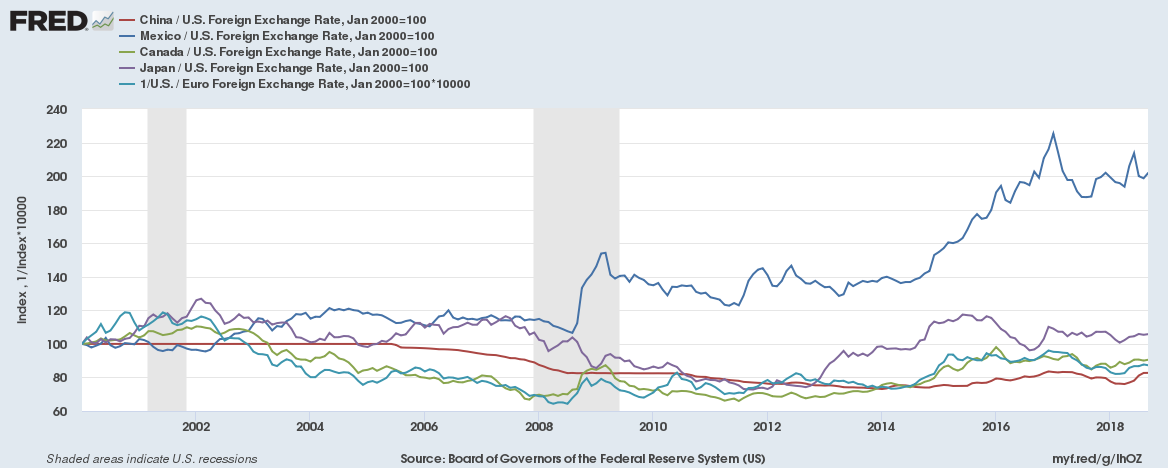

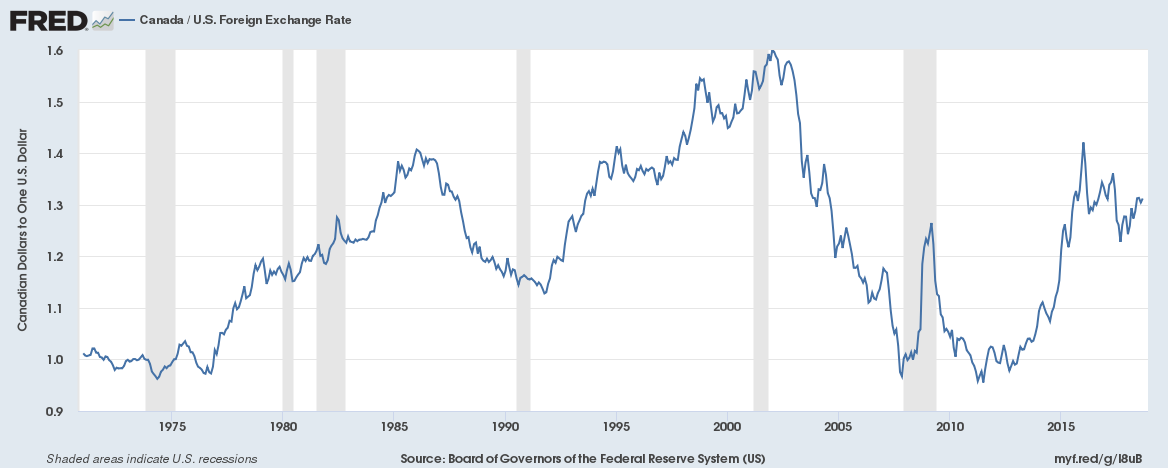

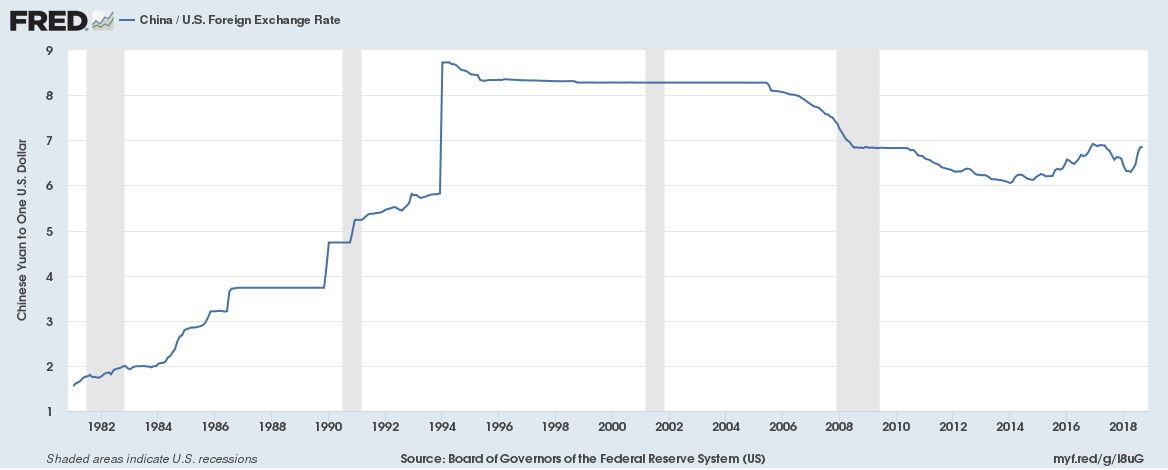

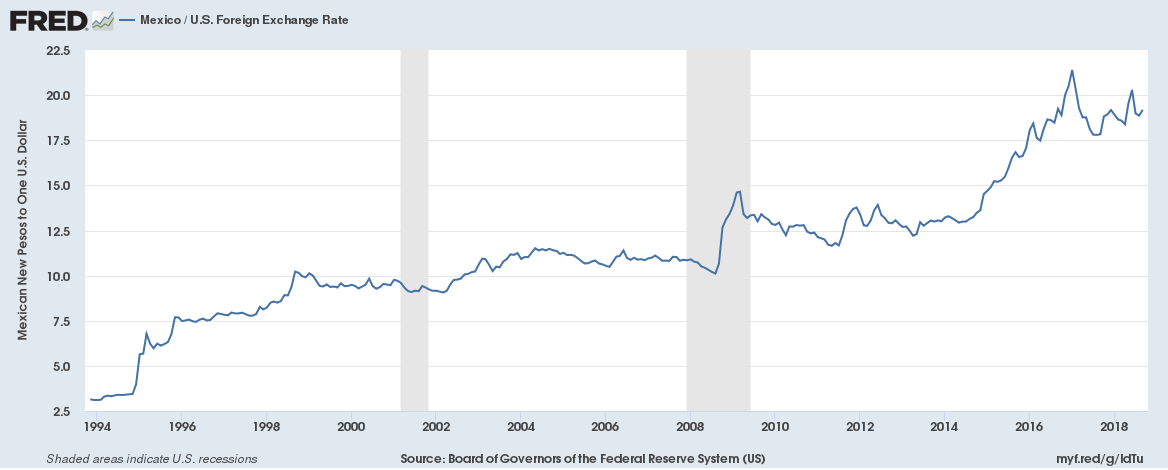

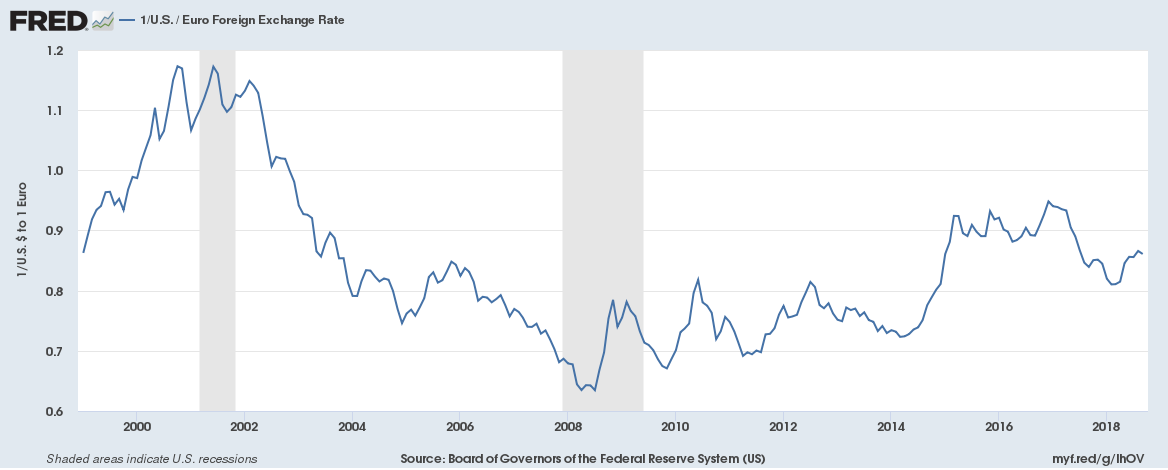

The Euro Area, China, Canada, Mexico and Japan together account for over 70% of U.S. trade. Have these countries (including the Euro Area group of countries) manipulated their currencies to boost exports? In this century (2000 onwards) the Chinese Yuan, the Canadian Dollar and the Euro have appreciated against the dollar. The Japanese Yen has been largely unchanged against the U.S. dollar since the start of this century and only the Mexican Peso has weakened against the dollar.

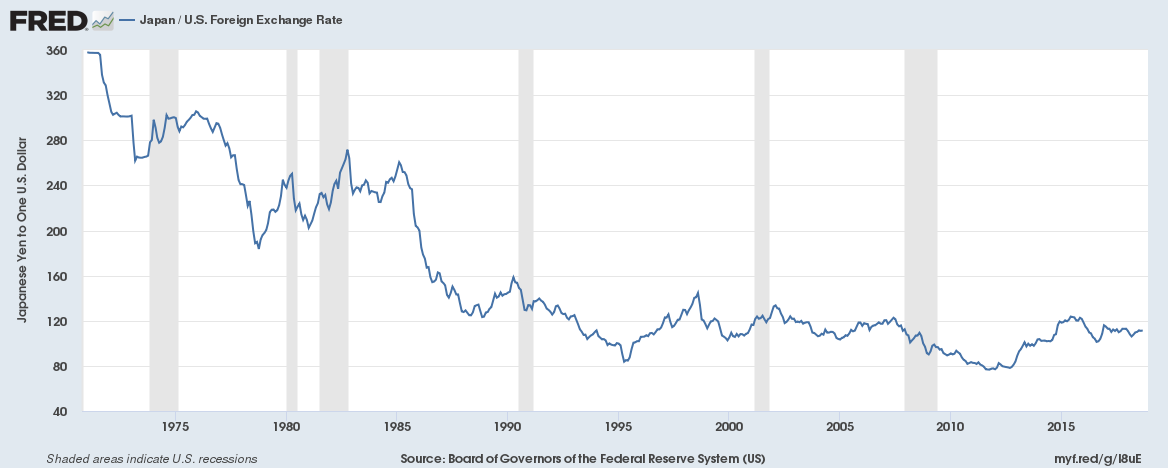

Here are some graphs,

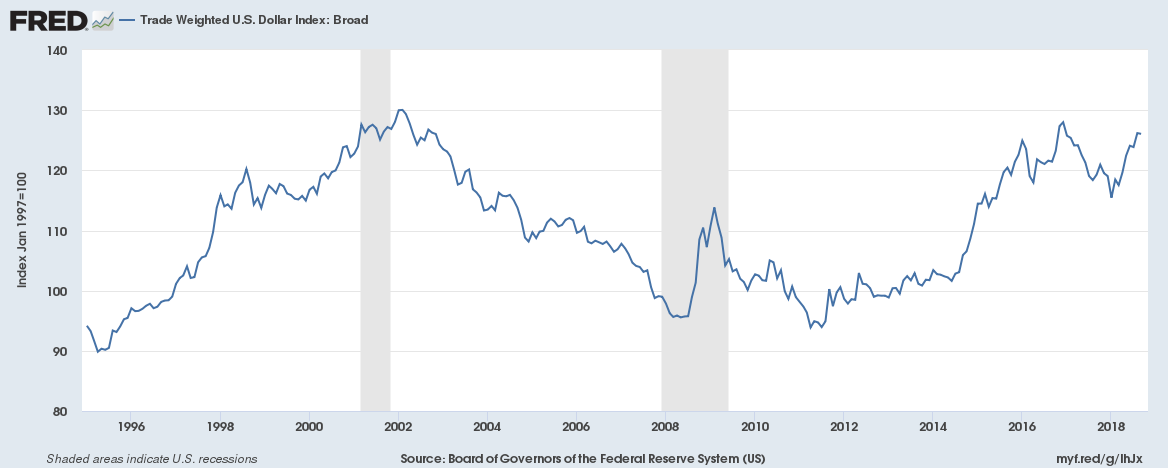

Trade Weighted U.S. dollar Index,

A chart covering the five major currencies (the Chinese Yuan, the Canadian Dollar, the Euro, the Mexican Peso and the Japanese Yen) against the dollar. Values under 100 means the currency has appreciated against the U.S. dollar and values over 100 means the currency has depreciated against the dollar,

Canadian Dollar (CAD)/USD performance,

Chinese Yuan (CHY)/USD performance,

Japanese Yen (JPY)/USD performance,

Mexican Peso (MXN)/USD performance,

Euro (EUR)/USD performance,

Related:

All you wanted to know about US trade in 2017 and why China matters so much

14 very interesting things about U.S. trade and trade tariffs

The U.S. only charged 1.65% in import tariffs in 2017

Average import tariffs or custom duties per country