1. The U.S. has the 13th lowest average tariffs in the world as per the World Trade Organisation

We wrote about average import tariffs or custom duties per country, the United States has the 13th lowest tariffs in the world (out of the 165 members of the World Trade Organization) at only 3.48%.

2. … but the U.S. only charged 1.65% in tariffs in 2017

The WTO number is averaged across all products; the actual tariffs could be different based on the product mix of imports as well as any special trade deals the country may be part of.

In the case of the U.S., the actual import tariff or custom duty was just $38.49 billion or 1.65% of the value of $2.34 trillion in imports in 2017.

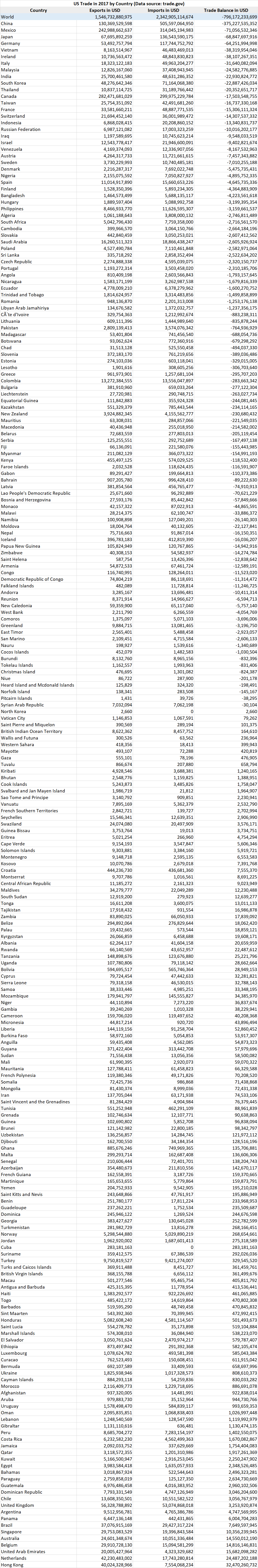

3. The U.S. did have a Trade deficit with Canada in 2017

Canada was the largest export market with exports of $282.47 billion in 2017. Canada was also the third largest market for imports behind only China and Mexico with total imports of $299.98 billion and a trade deficit of $17.5 billion. The trade deficit itself with Canada was the 12th largest for the U.S. in 2017.

4. All constituent countries taken together, the European Union was the largest export market for the U.S. in 2017

The U.S. had exports worth $284 billion to the 28 European Union Countries in 2017, beating Canada with $282.5 billion of exports in 2017.

5. … and the European Union was also the 2nd largest import market for the U.S. in 2017

The U.S. had imports worth $435 billion from the 28 European Union Countries in 2017, the total trade deficit for the U.S. with the European Union was $150 billion, second only to China.

6. The U.S. has a $97 billion deficit with China on Nuclear Reactors and associated equipment, this is only second to Electrical equipment where the deficit is $135 billion

If security is indeed the concern, then why not charge China tariffs on Nuclear Reactors and associated equipment?

7. Chinese companies just paid an average of 2.5% (or $12.54 billion on exports of $505.60 billion) in tariffs on exports to the United States in 2017 while U.S. companies paid 7.9% in tariffs on exports to China in 2017

8. The 25% steel tariff is intended to increase domestic steel production capacity the U.S. by just 7%

The steel tariff is intended to increase domestic steel production from its present 73% of capacity to approximately an 80% operating rate, which isn’t much.

9. … on the other hand – the 10% tariff on aluminium is likely to increase domestic aluminium production capacity by 32%

The aluminium tariff is intended to raise production of from the present 48% average capacity to 80% which could turn out to be quite good for the United States.

10. Canada accounted for the largest share of U.S. steel imports by country in 2017

Canada accounted for the largest share of U.S. steel imports by source country at 16 percent (4.3 mmt), followed by Brazil at 13 percent (3.6 mmt), South Korea at 10 percent (2.7 mmt) in 2017.

11. There is a section 232 investigation ongoing on automobile and automotive parts into the United States

U.S. Secretary of Commerce Wilbur Ross has initiated an investigation under Section 232 of the Trade Expansion Act of 1962. The investigation will determine whether imports of automobiles, including SUVs, vans and light trucks, and automotive parts into the United States threaten to impair the national security as defined in Section 232.

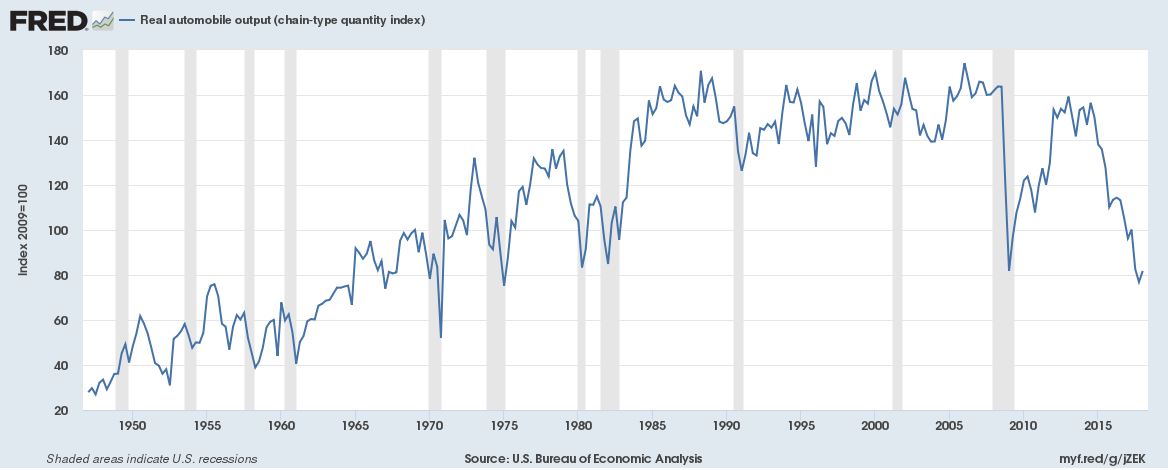

12. … at the same time when new car output in the United States is close to a 43-year low

New car output in the United States is close to a 43-year low as Americans are buying fewer new cars and factories in the U.S. are producing fewer cars.

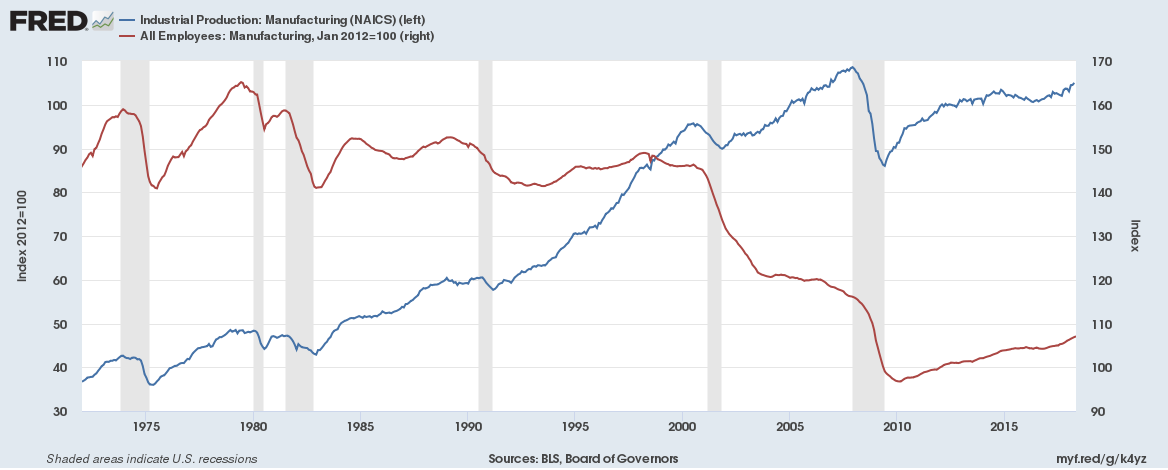

13. … and also at a time when manufacturing output is growing in the United States, but it isn’t generating too many jobs

U.S. manufacturing has been growing but it isn’t generating too many new jobs.

The reasons are simple:

- Increase in productivity

- Increase in automation

- Shift towards higher value goods (like aircrafts or high-end electronics)

14. The Steel and Aluminium tariffs tell us something

Firstly, that President Trump is doing what he promised on trade, whether that is good or bad is debatable.

Secondly, the recommendations of the Department of Commerce on trade tariffs are largely being implemented. The Steel and Aluminium tariffs are a good reference point.

Thirdly, tariffs might force manufactures to change strategy and move at least some manufacturing to the United States. And not just because the tariffs hurt financially but the talk of tariffs invokes uncertainty. And businesses hate uncertainty.

All related posts

The U.S. only charged 1.65% in import tariffs in 2017

Average import tariffs or custom duties per country

All you wanted to know about US trade in 2017 and why China matters so much

The economics behind the 25% tariff on Steel imports and 10% tariff on Aluminium imports to the US

Manufacturing is growing in the United States, but it isn’t generating too many jobs

New car output in the United States is close to a 43-year low