We wrote about the average import tariffs or custom duties per country recently. That data set was sourced from the World Trade Organization (WTO) and it showed that the average import tariff or custom duty for the United States is currently 3.48%. We did mention that the WTO number is averaged across all products; the actual tariffs could be different based on the product mix of imports as well as any special trade deals the country may be part of.

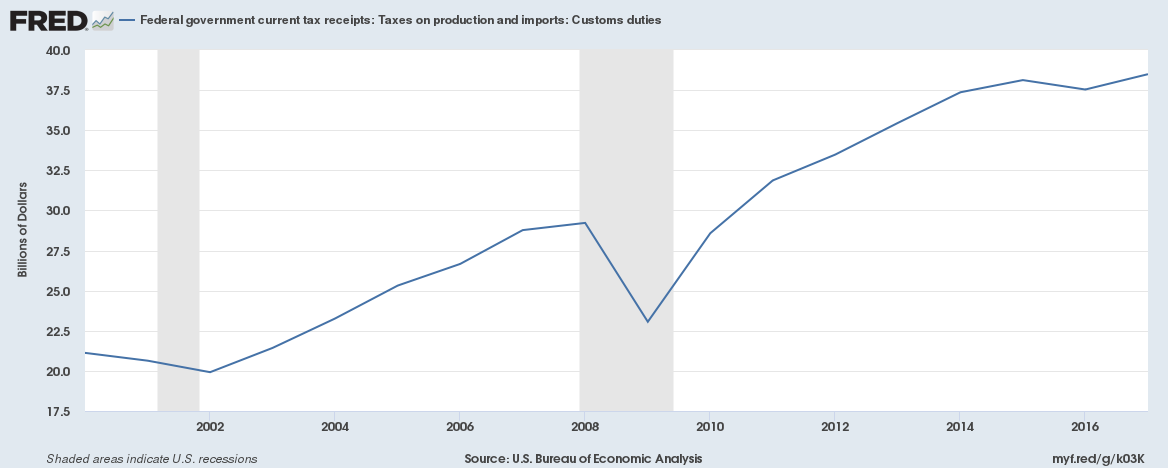

In the case of the U.S., the actual import tariff or custom duty was just $38.49 billion or 1.65% of the value of $2.34 trillion in imports in 2017.

U.S. Companies likely paid far more in tariffs on exports. We couldn’t find an official number on tariffs paid by U.S. companies on exports to other countries but did calculate the import and export tariffs on trade with China.

U.S. companies would have likely paid far more than 1.65% based on the WTO tariffs and the country and product mix of exports.

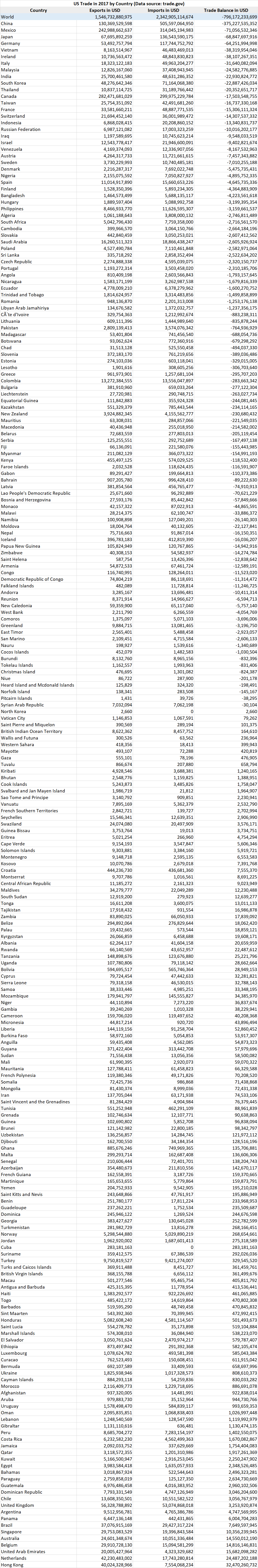

Given below are statistics of trade by each country for the U.S. in 2017,

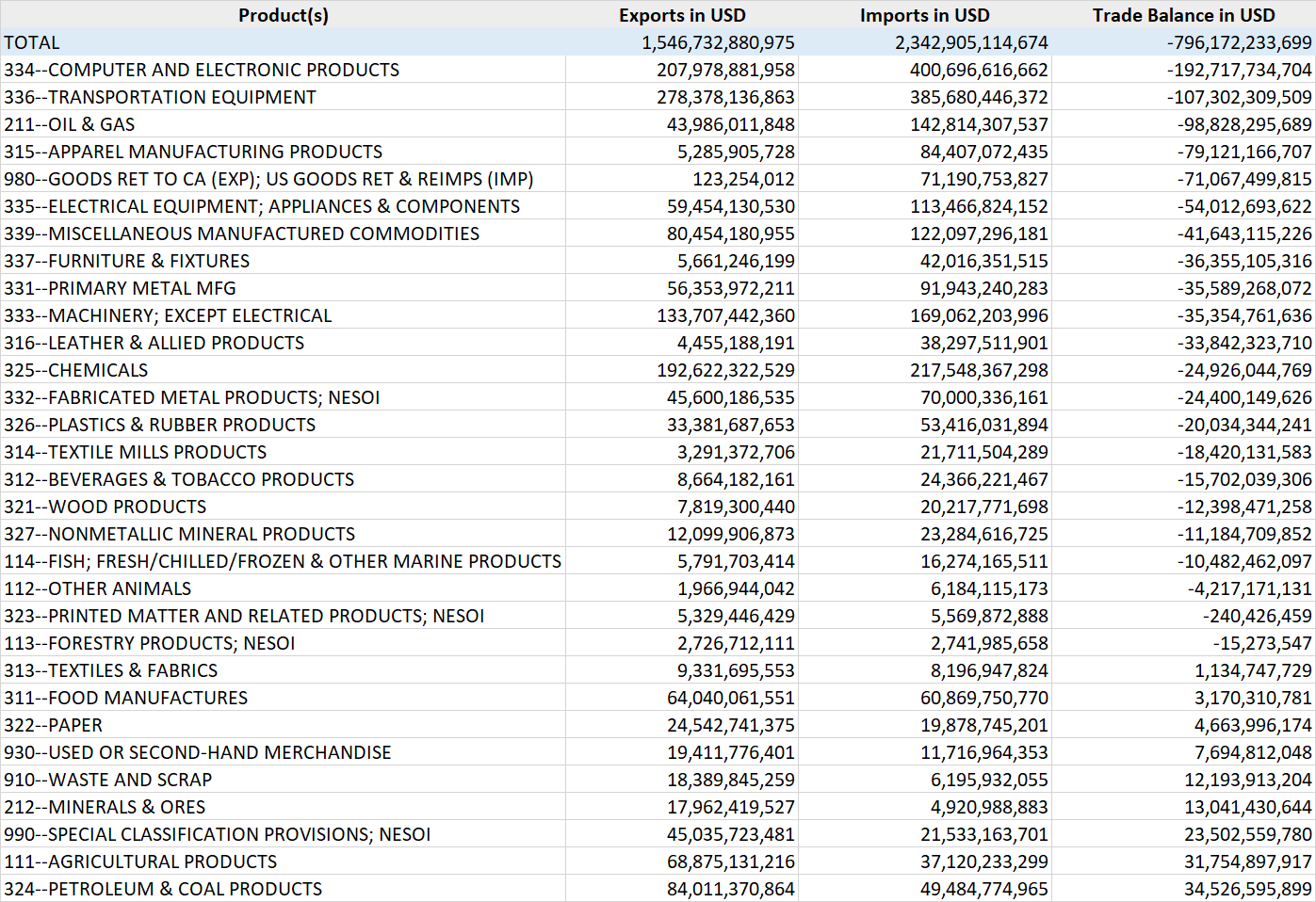

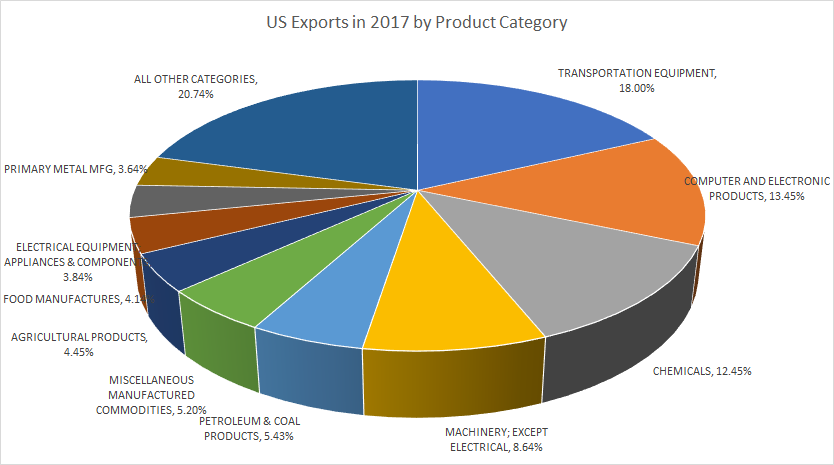

And the trade by each product is represented in the table and charts below,

As mentioned previously, we did calculate the approximate tariffs for trade with China.

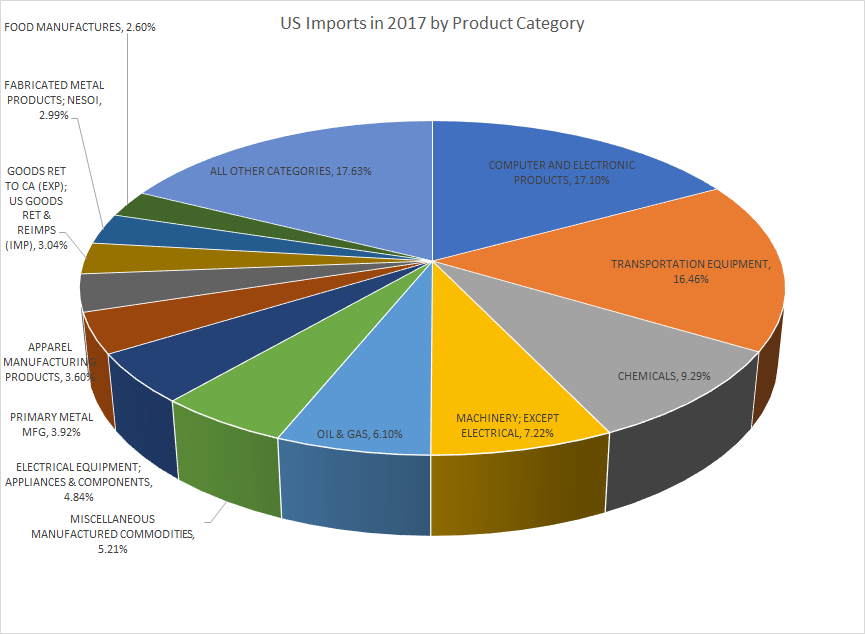

Firstly, here are the statistics for trade with China by product in 2017,

Purely based on WTO tariffs by product, our calculations show that Chinese companies paid an average of 2.5% (or $12.54 billion on exports of $505.60 billion) in tariffs on exports to the United States.

U.S. companies paid an average of 7.9% (or $10.29 billion on exports of $130.37 billion) in tariffs on exports to China.