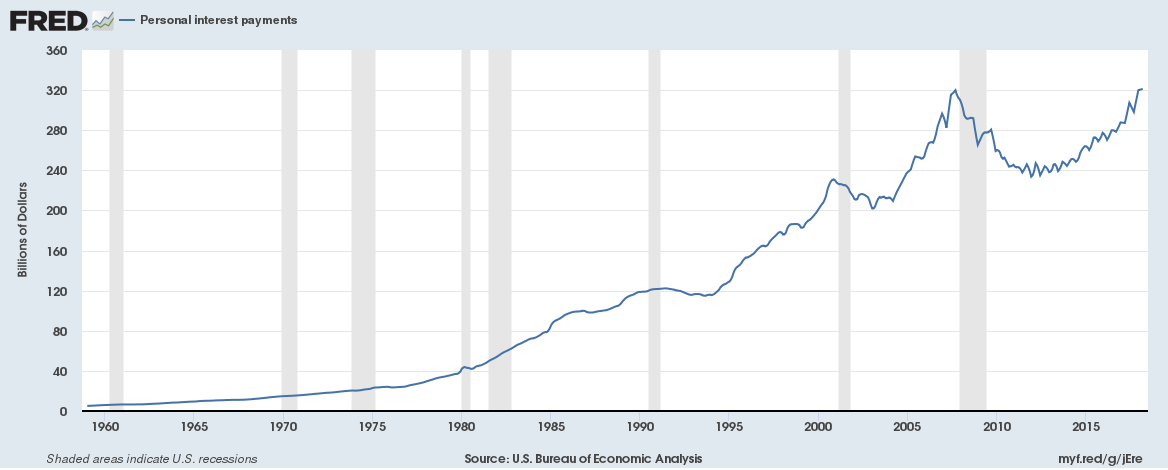

Personal interest payments for households in the United States have hit an all-time high with annualized interest payments now $321 billion, this despite low interest rates currently.

One could attribute this is due to growing household debt which is partially true.

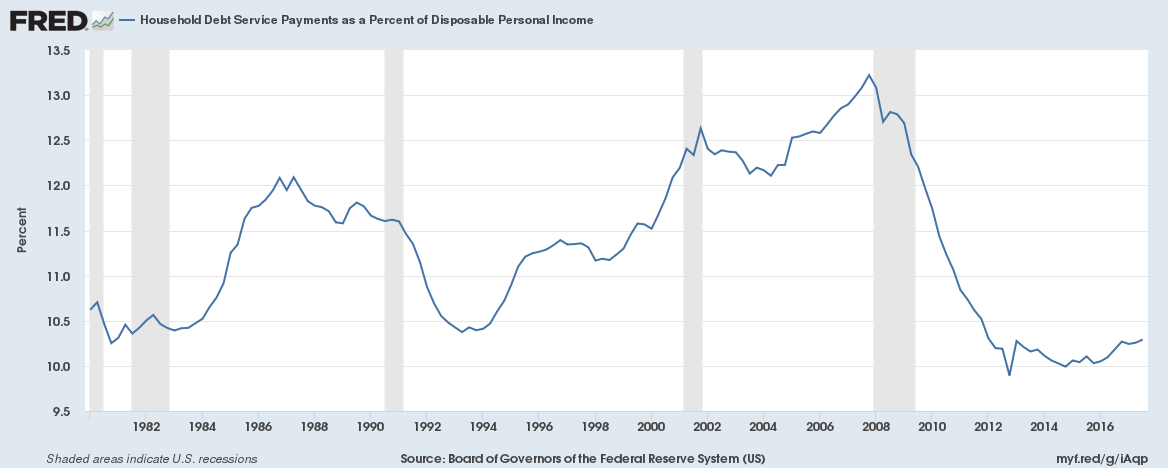

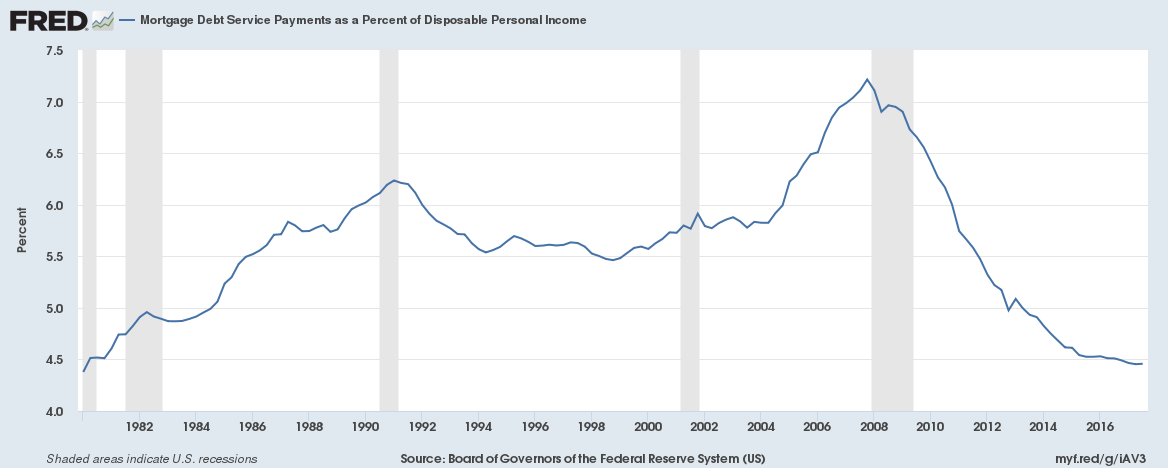

But household debt service payments (for mortgage and total debt) as a percentage of disposable income are at historically low levels.

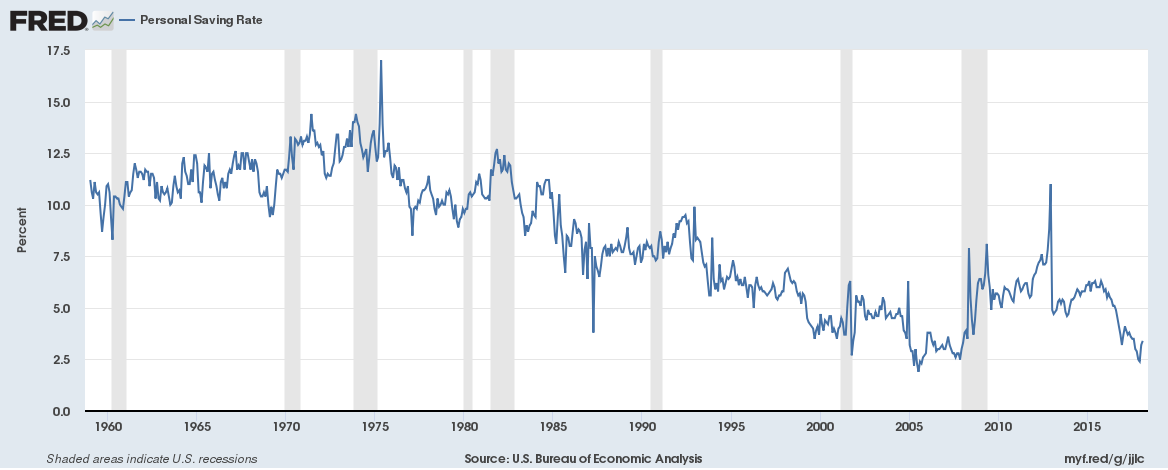

And personal saving rates are close to multiyear lows.

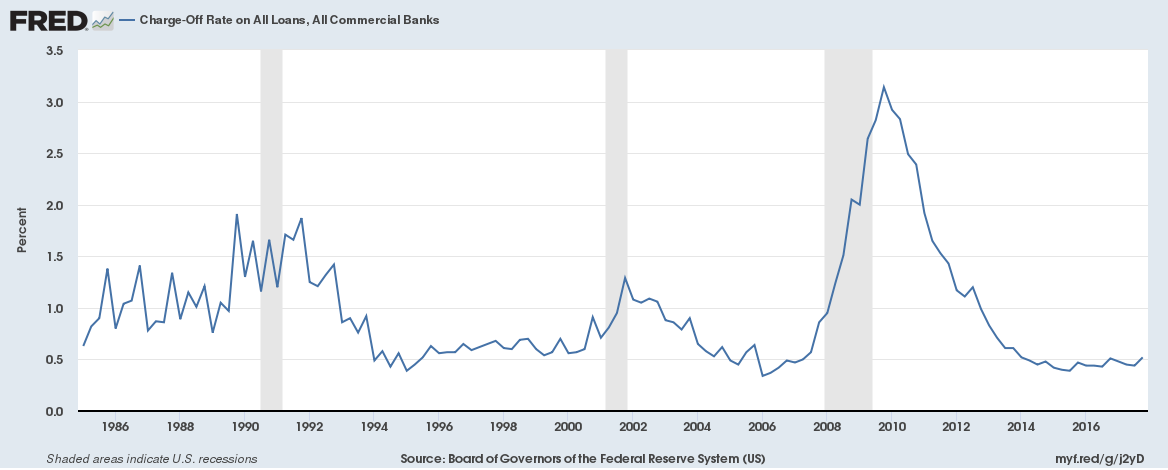

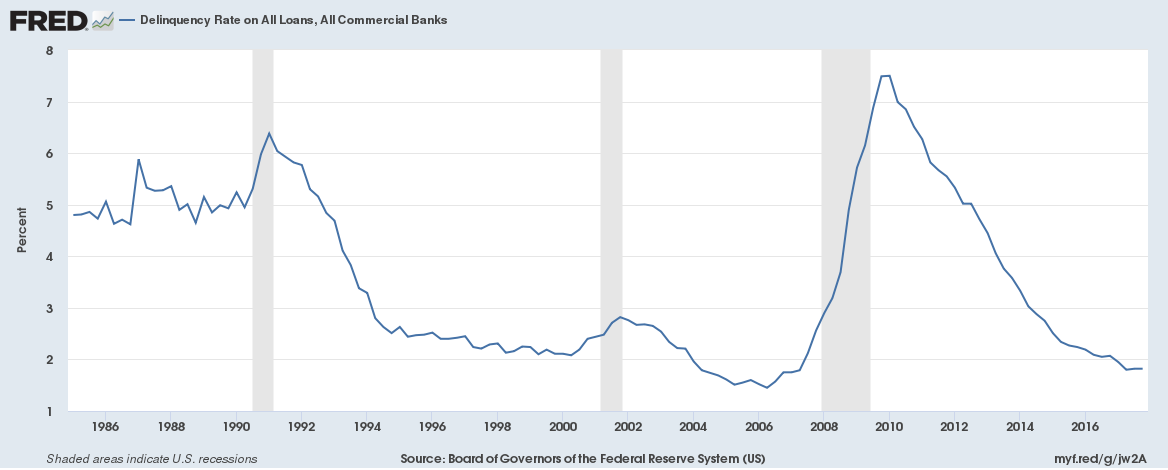

Charge-off and delinquency rates remain at low levels too.

All this just means one thing – if interest rates are to rise significantly or quickly or both then households on variable rate credit products and those seeking new credit could face issues.